Aarp Insurance Quote

AARP, the powerful force behind a leading non-profit organization in the United States, has long been renowned for its commitment to empowering and safeguarding the well-being of older adults. Among its extensive suite of offerings, AARP Insurance stands out as a cornerstone, providing a robust array of insurance products designed specifically to meet the unique needs of its members. With an unwavering dedication to affordability, accessibility, and comprehensive coverage, AARP Insurance has established itself as a trusted partner for millions of Americans navigating the complexities of retirement and aging.

Unveiling the Comprehensive AARP Insurance Portfolio

AARP Insurance offers an extensive range of coverage options tailored to address the diverse requirements of its members. At the forefront of its offerings is AARP Medicare Supplement Insurance, a crucial component in ensuring that members receive the medical care they need without financial strain. This insurance plan fills the gaps left by original Medicare, covering expenses such as deductibles, co-payments, and co-insurance, thereby providing a vital safety net during retirement.

In addition to Medicare Supplement Insurance, AARP Insurance also extends its protective umbrella to include AARP Dental Insurance, Vision Insurance, and Hearing Care Insurance. These plans are designed to maintain and enhance the overall health and well-being of AARP members, offering comprehensive coverage for dental procedures, vision care, and hearing aids. By addressing these essential aspects of healthcare, AARP Insurance ensures that its members can access the necessary treatments and services without compromising their financial stability.

Furthermore, AARP Insurance recognizes the importance of safeguarding one's home and personal belongings. As such, it offers Homeowners Insurance and Renters Insurance plans, providing coverage for a wide range of potential risks, including theft, fire, and natural disasters. These policies are tailored to meet the unique needs of AARP members, offering peace of mind and financial protection during challenging times.

For those seeking protection on the open road, AARP Insurance also provides Auto Insurance plans. These policies offer comprehensive coverage for vehicles, including liability, collision, and comprehensive protection. By partnering with leading insurance carriers, AARP Insurance ensures that its members receive competitive rates and superior service, making it easier and more affordable to stay protected while on the move.

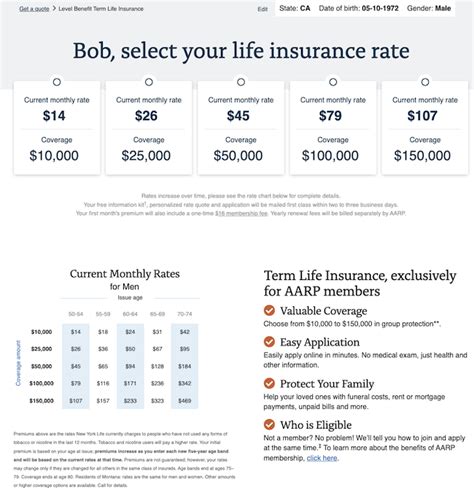

In an era where unexpected events can have devastating financial consequences, AARP Insurance also offers Life Insurance plans. These policies provide a vital safety net for members and their loved ones, offering financial support during difficult times. With AARP Life Insurance, members can choose from a range of coverage options, including term life insurance, permanent life insurance, and burial insurance, ensuring that their legacy and financial responsibilities are secured.

The Advantages of AARP Insurance: A Deep Dive

The allure of AARP Insurance extends beyond its comprehensive coverage options. One of the key advantages is its competitive pricing. AARP Insurance is renowned for offering some of the most competitive rates in the market, making it an affordable choice for its members. By leveraging its vast membership base and negotiating power, AARP Insurance is able to secure favorable terms and rates from leading insurance carriers, passing these savings directly to its members.

In addition to competitive pricing, AARP Insurance is also highly regarded for its exceptional customer service. The organization prides itself on its commitment to providing a superior level of service to its members. This includes offering dedicated support and guidance throughout the insurance process, from policy selection and enrollment to claims management and resolution. With a team of experienced and knowledgeable professionals, AARP Insurance ensures that its members receive the personalized attention and support they deserve.

Another significant advantage of AARP Insurance is its easy enrollment process. Recognizing that retirement should be a time of relaxation and enjoyment, AARP Insurance has streamlined its enrollment process to be as straightforward and hassle-free as possible. Members can easily compare and select the insurance plans that best suit their needs online or over the phone, with clear and concise information provided to ensure an informed decision. This user-friendly approach to enrollment makes AARP Insurance a convenient and accessible choice for its members.

| Insurance Type | Key Benefits |

|---|---|

| Medicare Supplement Insurance | Covers gaps in original Medicare, providing financial protection for medical expenses. |

| Dental, Vision, and Hearing Care Insurance | Comprehensive coverage for essential healthcare needs, ensuring access to necessary treatments. |

| Homeowners and Renters Insurance | Protection for homes and personal belongings against various risks, including theft and natural disasters. |

| Auto Insurance | Comprehensive vehicle coverage, including liability, collision, and comprehensive protection, with competitive rates. |

| Life Insurance | Provides financial support for members and their loved ones, offering a range of coverage options. |

Empowering Retirement: The Impact of AARP Insurance

The impact of AARP Insurance extends far beyond the policies it offers. By providing comprehensive coverage and financial protection, AARP Insurance empowers its members to navigate retirement with confidence and peace of mind. With the knowledge that they are protected against unforeseen events and have access to essential healthcare services, AARP members can focus on enjoying their golden years and pursuing their passions.

AARP Insurance also plays a crucial role in promoting financial stability and security among its members. By offering competitive rates and tailored coverage options, AARP Insurance ensures that its members can maintain their standard of living and meet their financial obligations without undue strain. This financial security is particularly vital during retirement, when income streams may be more limited and unexpected expenses can have a significant impact.

Furthermore, AARP Insurance fosters a sense of community and support among its members. Through its insurance offerings, AARP creates a network of individuals who can rely on each other and the organization for guidance and assistance. This sense of belonging and mutual support is invaluable, especially during challenging times, and further enhances the overall well-being of AARP members.

The Future of AARP Insurance: Innovations and Trends

As the landscape of insurance continues to evolve, AARP Insurance remains committed to staying at the forefront of innovation and trendsetting. The organization is constantly exploring new technologies and strategies to enhance its offerings and improve the overall member experience.

One area of focus for AARP Insurance is the integration of digital technologies. By leveraging the power of digital platforms and mobile applications, AARP Insurance aims to make its services more accessible and convenient for members. This includes online policy management, digital claim submissions, and real-time policy updates, ensuring that members can stay connected and informed about their insurance coverage at all times.

Additionally, AARP Insurance is dedicated to personalizing its offerings to meet the unique needs of each member. Through advanced data analytics and member feedback, the organization is able to tailor its insurance plans to individual preferences and requirements. This personalized approach ensures that members receive the coverage they need, without unnecessary add-ons, resulting in more efficient and cost-effective policies.

In the realm of healthcare, AARP Insurance is also exploring innovative solutions to enhance the well-being of its members. This includes partnering with leading healthcare providers and technology companies to offer members access to cutting-edge treatments and services. By staying at the forefront of healthcare innovation, AARP Insurance is committed to providing its members with the best possible care and support.

Looking ahead, AARP Insurance is poised to continue its legacy of excellence and innovation. With a steadfast commitment to its members and a proactive approach to staying ahead of industry trends, AARP Insurance is well-positioned to remain a trusted partner for older adults, empowering them to navigate retirement with confidence and peace of mind.

Frequently Asked Questions (FAQ)

What is AARP Insurance, and how does it benefit its members?

+

AARP Insurance is a suite of insurance products specifically designed for AARP members, offering comprehensive coverage at competitive rates. It includes Medicare Supplement Insurance, Dental, Vision, and Hearing Care Insurance, Homeowners and Renters Insurance, Auto Insurance, and Life Insurance. AARP Insurance benefits its members by providing financial protection, access to essential healthcare services, and peace of mind during retirement.

How can I obtain an AARP Insurance quote?

+

To obtain an AARP Insurance quote, you can visit the AARP Insurance website or call their dedicated phone line. The website provides an easy-to-use online tool where you can compare and select the insurance plans that best suit your needs. You will be guided through the process, with clear and concise information, to ensure an informed decision.

What sets AARP Insurance apart from other insurance providers?

+

AARP Insurance stands out for its commitment to its members, offering competitive pricing, exceptional customer service, and an easy enrollment process. It provides a wide range of insurance products tailored to the unique needs of older adults, ensuring comprehensive coverage and financial protection during retirement. AARP Insurance also fosters a sense of community and support among its members.

Can I customize my AARP Insurance plan to fit my specific needs?

+

Absolutely! AARP Insurance understands that every member has unique needs. That’s why they offer a range of coverage options within each insurance plan. Whether it’s choosing the level of coverage for your Medicare Supplement Insurance or selecting the benefits that matter most for your Life Insurance, AARP Insurance allows you to customize your plan to fit your specific requirements.

How does AARP Insurance ensure the quality of its insurance carriers and providers?

+

AARP Insurance maintains high standards when it comes to selecting insurance carriers and providers. They carefully evaluate each partner based on their financial stability, reputation, and track record of delivering quality services. By partnering with leading insurance carriers, AARP Insurance ensures that its members receive the best possible coverage and support.