Aca Health Insurance

In the ever-evolving landscape of healthcare, understanding your options and making informed decisions is crucial. This comprehensive guide aims to shed light on the world of Aca Health Insurance, offering an in-depth analysis to help you navigate this critical aspect of your well-being.

The Evolution of Aca Health Insurance: A Comprehensive Overview

Aca Health Insurance, a cornerstone of modern healthcare systems, has undergone significant transformations, shaping the way we access and afford medical care. Let's delve into its history, features, and the impact it has on individuals and families.

A Brief History: Origins and Development

The concept of Aca Health Insurance can be traced back to the early 20th century, when innovative thinkers sought ways to mitigate the financial burden of medical emergencies. Over the decades, it evolved from simple indemnity plans to complex managed care systems. A landmark moment in its evolution was the introduction of the Affordable Care Act (ACA) in the United States, which aimed to provide more Americans with access to quality healthcare.

Key Milestones:

- 1929: The first group health insurance policy was issued, marking a significant step towards making healthcare more accessible.

- 1965: The introduction of Medicare and Medicaid revolutionized healthcare coverage for the elderly and low-income individuals.

- 2010: The Affordable Care Act was signed into law, mandating health insurance coverage and introducing new standards and protections.

Understanding Aca Health Insurance: Key Features and Benefits

Aca Health Insurance offers a range of features designed to provide comprehensive coverage and protect policyholders from financial hardship.

- Essential Health Benefits: These include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, and more.

- Preventive Care: Aca plans often cover preventive services such as vaccinations, screenings, and counseling, promoting early detection and proactive healthcare.

- Pre-Existing Condition Coverage: A significant advantage of Aca plans is their requirement to cover pre-existing conditions without waiting periods or exclusions.

- Out-of-Pocket Limits: To protect policyholders, Aca plans set annual limits on out-of-pocket expenses, ensuring financial predictability.

- Network Providers: Aca plans typically have networks of healthcare providers, offering discounted rates for in-network services.

| Category | Key Metrics |

|---|---|

| Average Premium | $450/month (for an individual) |

| Average Deductible | $1,500 (for an individual) |

| Maximum Out-of-Pocket | $8,550 (for an individual) |

Choosing the Right Aca Health Insurance Plan: A Strategic Approach

Selecting an Aca Health Insurance plan is a critical decision, impacting your financial well-being and access to healthcare services. Here's a strategic guide to help you navigate this process effectively.

Assessing Your Needs: A Personalized Approach

Your health insurance needs are unique, influenced by factors such as age, health status, family size, and lifestyle. Understanding these factors is the first step towards choosing the right plan.

- Age and Health Status: Younger, healthier individuals may opt for plans with higher deductibles and lower premiums, while older or less healthy individuals might prefer plans with lower deductibles and higher premiums.

- Family Size and Composition: Families with children or elderly dependents may require plans with more comprehensive coverage, including pediatric and geriatric care.

- Prescription Medication Needs: Individuals requiring ongoing medication should consider plans with robust prescription drug coverage and lower out-of-pocket costs.

Analyzing Plan Options: A Detailed Breakdown

Aca Health Insurance plans come in various types, each with its own set of features and coverage levels. Understanding these differences is crucial for making an informed choice.

- Bronze Plans: These plans have the lowest premiums but also the highest deductibles, making them suitable for healthy individuals who rarely need medical care.

- Silver Plans: Balancing premiums and deductibles, Silver plans are a popular choice, offering a good balance between cost and coverage.

- Gold Plans: Gold plans offer more comprehensive coverage with higher premiums and lower deductibles, making them ideal for individuals with ongoing medical needs.

- Catastrophic Plans: Designed for young adults, these plans have low premiums and high deductibles, covering only essential health benefits and major medical expenses.

Comparative Analysis: Weighing the Options

When comparing Aca Health Insurance plans, several key factors come into play. A comprehensive analysis should consider the following:

- Premium Costs: The monthly premium is a significant factor, but it's important to balance it with other costs like deductibles and out-of-pocket expenses.

- Deductibles and Out-of-Pocket Limits: Lower deductibles can make plans more affordable in the short term, but higher out-of-pocket limits may result in higher costs over time.

- Network Providers: Ensure the plan's network includes your preferred healthcare providers and facilities.

- Coverage Limits: Check for any exclusions or limitations on specific services or treatments.

- Prescription Drug Coverage: Review the plan's formulary to ensure it covers the medications you need.

Maximizing Your Aca Health Insurance Benefits: Practical Tips

Once you've selected your Aca Health Insurance plan, it's essential to understand how to make the most of your coverage. Here are some practical tips to help you navigate the system effectively.

Understanding Your Policy: A Comprehensive Guide

Your Aca Health Insurance policy is a contract between you and your insurer. Understanding its terms and conditions is crucial to avoid surprises and make the most of your coverage.

- Read the Fine Print: Familiarize yourself with your policy's coverage limits, exclusions, and any special conditions.

- Know Your Network: Ensure you understand which healthcare providers and facilities are in-network, as using out-of-network services can result in higher costs.

- Understand Your Benefits: Be aware of the specific services and treatments covered by your plan, including any cost-sharing arrangements.

Utilizing Your Benefits: A Step-by-Step Guide

Maximizing your Aca Health Insurance benefits involves a strategic approach. Here's a step-by-step guide to help you navigate the process effectively.

- Schedule Regular Check-ups: Preventive care is a key benefit of Aca plans. Schedule regular check-ups and screenings to stay on top of your health and catch potential issues early.

- Understand Cost-Sharing: Know your plan's cost-sharing arrangements, including copays, coinsurance, and deductibles. This will help you budget for healthcare expenses effectively.

- Use In-Network Providers: Whenever possible, use in-network healthcare providers and facilities to take advantage of negotiated rates and avoid higher out-of-network costs.

- Review Your Explanation of Benefits (EOB): After receiving healthcare services, review your EOB to understand what services were covered, what you owe, and any appeals or disputes you may need to address.

Managing Costs: A Strategic Approach

Aca Health Insurance plans can be a significant expense, but there are strategies to manage these costs effectively.

- Shop Around: Compare plans and premiums annually during the open enrollment period. You may find a plan that better suits your needs and budget.

- Consider High-Deductible Plans: If you're healthy and rarely need medical care, a high-deductible plan can save you money on premiums.

- Use Health Savings Accounts (HSAs): If eligible, contribute to an HSA to save for future medical expenses tax-free. These accounts can be used to pay for qualified medical expenses, reducing your taxable income.

FAQs: Unraveling Common Aca Health Insurance Queries

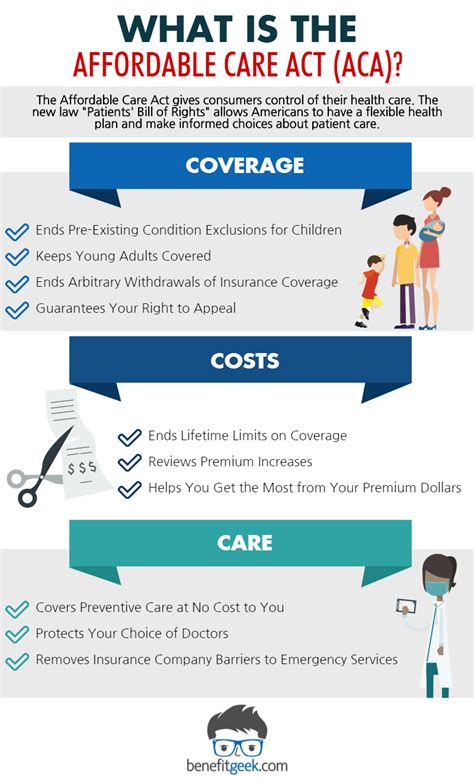

What is the Affordable Care Act (ACA)?

+The Affordable Care Act, often referred to as Obamacare, is a comprehensive healthcare reform law enacted in the United States. It aims to expand access to healthcare, improve healthcare quality, and reduce costs. The ACA introduced new standards and protections, including the requirement for most Americans to have health insurance.

What are the essential health benefits covered by Aca plans?

+Aca plans are required to cover a set of essential health benefits, including ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, and more. These benefits ensure comprehensive coverage for policyholders.

How can I enroll in an Aca Health Insurance plan?

+Enrollment in Aca plans typically occurs during the open enrollment period, which runs from November 1 to December 15 each year. However, you may also qualify for a special enrollment period if you experience certain life events, such as losing other health coverage, getting married, or having a baby.

Are there any financial assistance programs available for Aca Health Insurance plans?

+Yes, the ACA provides financial assistance in the form of premium tax credits and cost-sharing reductions. These programs help make insurance more affordable for individuals and families with low to moderate incomes. To determine your eligibility, you can use the Health Insurance Marketplace.

Aca Health Insurance is a vital component of modern healthcare, offering protection and access to essential services. By understanding its features, benefits, and strategic options, you can make informed choices to safeguard your health and financial well-being.