Affordable Dental Insurance Plans

Dental care is an essential aspect of overall health, yet many individuals struggle to access affordable dental services due to the high costs associated with dental treatments and procedures. Affordable dental insurance plans aim to bridge this gap by providing individuals and families with accessible and cost-effective options for maintaining their oral health. In this comprehensive guide, we will delve into the world of affordable dental insurance plans, exploring the key features, benefits, and considerations to help you make informed decisions regarding your oral healthcare.

Understanding Affordable Dental Insurance Plans

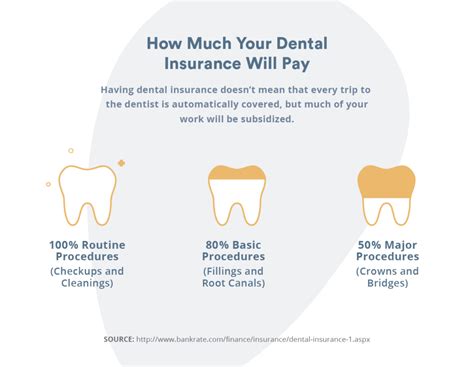

Affordable dental insurance plans are designed to offer comprehensive coverage for a wide range of dental services at a reasonable cost. These plans typically cover preventive care, such as routine check-ups, cleanings, and X-rays, which are crucial for early detection and maintenance of oral health. Additionally, they often provide coverage for more extensive procedures, including fillings, root canals, and even orthodontics, depending on the specific plan chosen.

One of the primary advantages of affordable dental insurance plans is their focus on accessibility. Many insurers offer plans with low monthly premiums and minimal out-of-pocket expenses, making dental care more attainable for individuals and families on a budget. By providing an affordable means to access necessary dental services, these plans contribute to improved oral health and overall well-being.

Key Features of Affordable Dental Insurance Plans

When evaluating affordable dental insurance plans, several key features should be considered to ensure the plan aligns with your specific needs and circumstances.

Coverage Options

Different dental insurance plans offer varying levels of coverage. Some plans may prioritize preventive care with higher coverage limits for routine procedures, while others may place more emphasis on restorative and cosmetic treatments. Assess your dental health needs and choose a plan that provides adequate coverage for the procedures you anticipate requiring.

For example, if you have a history of dental issues and require frequent fillings or root canals, a plan with higher coverage limits for these procedures might be more suitable. On the other hand, if you primarily seek preventive care and routine check-ups, a plan with lower premiums and comprehensive preventive coverage could be a better fit.

Network Providers

Dental insurance plans often have networks of preferred providers, which are dentists and specialists who have agreed to accept the plan’s negotiated rates. When choosing an affordable dental insurance plan, consider the network providers in your area. Ensure that the plan includes reputable dentists and specialists who are conveniently located and have a good reputation for quality care.

Review the plan's network directory to assess the availability of providers near your home or workplace. It's essential to have easy access to dental care, especially in emergency situations. Additionally, some plans may offer out-of-network coverage, although it typically comes with higher out-of-pocket costs.

Waiting Periods

Many dental insurance plans have waiting periods before certain procedures are covered. These waiting periods can vary depending on the type of procedure and the plan’s specific terms. It’s crucial to understand the waiting periods associated with the plan you choose to avoid any surprises when seeking treatment.

For instance, some plans may have a 6-month waiting period for major restorative procedures like crowns or bridges. Understanding these waiting periods can help you plan your dental care accordingly and ensure you receive the necessary treatment within the appropriate timeframe.

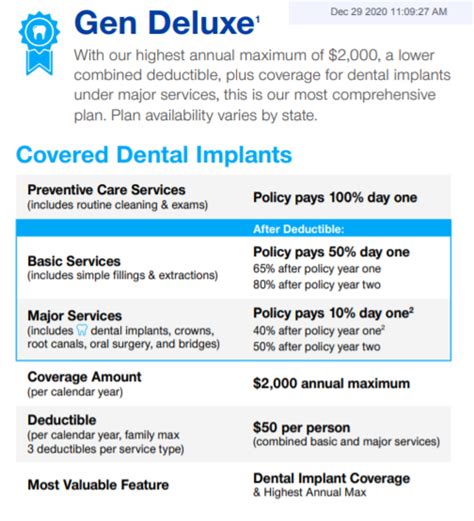

Annual Maximums and Deductibles

Dental insurance plans often have annual maximums, which represent the maximum amount the insurance company will pay toward your dental care in a given year. Additionally, some plans may have deductibles, which are the out-of-pocket expenses you must pay before the insurance coverage kicks in.

Consider your anticipated dental needs and choose a plan with annual maximums and deductibles that align with your budget and expected expenses. A higher annual maximum may be beneficial if you anticipate extensive dental work, while a lower deductible can reduce your out-of-pocket costs in the short term.

Additional Benefits

Affordable dental insurance plans may offer additional benefits beyond basic coverage. These can include discounts on dental products, access to a dental hotline for advice and guidance, or even coverage for alternative dental procedures like dental implants or sedation dentistry.

Review the plan's additional benefits to determine if they align with your specific needs and preferences. For instance, if you have a fear of dental procedures, a plan that offers sedation dentistry coverage could be a valuable option.

Choosing the Right Affordable Dental Insurance Plan

Selecting the right affordable dental insurance plan involves careful consideration of your individual needs, budget, and circumstances. Here are some steps to guide you through the decision-making process.

Assess Your Dental Health Needs

Begin by evaluating your current and future dental health needs. Consider any existing dental issues, such as cavities, gum disease, or misaligned teeth, and anticipate any potential procedures you may require in the near future. This assessment will help you choose a plan with adequate coverage for your specific needs.

For instance, if you have a history of gum disease, a plan that provides comprehensive periodontal care, including deep cleanings and gum treatments, would be beneficial. On the other hand, if you're considering orthodontic treatment, a plan with orthodontics coverage and a network of orthodontists could be a better fit.

Compare Multiple Plans

Research and compare various affordable dental insurance plans offered by different insurers. Look for plans that align with your budget and provide the necessary coverage. Consider factors such as premiums, deductibles, annual maximums, and network providers when making comparisons.

Online resources, insurance brokers, and dental associations can provide valuable information and comparisons to help you narrow down your options. Don't hesitate to reach out to insurance providers directly to clarify any questions or concerns you may have about their plans.

Review Plan Details

Once you’ve identified a few potential plans, thoroughly review the plan details to understand the coverage, limitations, and exclusions. Pay close attention to the waiting periods, network providers, and any specific restrictions or requirements. Ensure that the plan’s terms and conditions align with your expectations and needs.

For example, some plans may have restrictions on the number of cleanings per year or limit the frequency of certain procedures. Understanding these details beforehand can prevent any unexpected surprises or denials of coverage.

Consider Your Budget

While affordability is a key consideration, it’s important to strike a balance between cost and coverage. Assess your budget and determine how much you can allocate for dental insurance premiums. Choose a plan that offers the best coverage within your budget constraints.

Consider whether you can afford higher premiums for more comprehensive coverage or if a plan with lower premiums and limited coverage suits your needs. Remember that while lower premiums may be appealing, they might result in higher out-of-pocket expenses if you require extensive dental work.

Maximizing Your Affordable Dental Insurance Plan

Once you’ve selected an affordable dental insurance plan, it’s essential to make the most of your coverage to ensure optimal oral health and minimize costs.

Regular Dental Check-ups

One of the most important aspects of maintaining good oral health is attending regular dental check-ups and cleanings. These routine visits allow your dentist to detect and address any potential issues early on, preventing more significant and costly problems down the line.

Take advantage of your plan's coverage for preventive care and schedule regular check-ups with your dentist. Most plans cover two check-ups and cleanings per year, so be sure to use this benefit to stay on top of your oral hygiene and overall dental health.

Utilize In-Network Providers

To maximize your plan’s benefits and minimize out-of-pocket expenses, utilize the network providers included in your plan. These dentists and specialists have agreed to accept the plan’s negotiated rates, ensuring you receive quality care at a discounted price.

Before scheduling any dental procedures, verify that your chosen provider is within the plan's network. If you require specialized care, such as orthodontics or oral surgery, ensure that the specialist you choose is also part of the network to avoid unexpected costs.

Understand Your Coverage Limits

Familiarize yourself with the coverage limits and exclusions of your affordable dental insurance plan. Understanding these limits will help you manage your expectations and plan your dental care accordingly.

For example, if your plan has a limited annual maximum, you may need to prioritize certain procedures within that timeframe. Additionally, be aware of any exclusions or restrictions on specific treatments, as these can impact your ability to receive coverage for certain procedures.

Explore Additional Benefits

Many affordable dental insurance plans offer additional benefits beyond basic coverage. These benefits can include discounts on dental products, access to a dental hotline for advice, or coverage for alternative dental procedures.

Take the time to explore and utilize these additional benefits. For instance, if your plan offers discounts on dental products, you can save money on toothbrushes, toothpaste, and other oral hygiene essentials. Additionally, if you have questions or concerns about your oral health, don't hesitate to reach out to the dental hotline for guidance and support.

Future Trends and Considerations

The landscape of affordable dental insurance plans is constantly evolving, driven by advancements in dental technology, changing consumer needs, and shifts in healthcare policies.

Digital Dentistry and Telehealth

The integration of digital technology into dentistry is transforming the way dental care is delivered. From digital impressions for orthodontic treatment to remote consultations via telehealth platforms, the future of affordable dental insurance plans may include increased coverage for these innovative services.

As digital dentistry and telehealth become more prevalent, insurers may adapt their plans to include coverage for these remote and efficient methods of dental care. This could provide greater accessibility and convenience for individuals seeking dental treatment, especially in remote or underserved areas.

Preventive Care Focus

There is a growing emphasis on preventive care in the dental industry, recognizing the long-term benefits of early detection and maintenance of oral health. Affordable dental insurance plans are likely to continue prioritizing preventive care coverage to encourage regular check-ups and cleanings.

By promoting preventive care, insurers can help individuals avoid more complex and costly dental issues in the future. This focus on preventive care aligns with the goal of providing accessible and affordable dental insurance options while also improving overall oral health outcomes.

Customized Plans and Personalized Care

As consumer needs become more diverse, affordable dental insurance plans may shift towards offering customized coverage options. This approach allows individuals to select specific coverage levels and benefits based on their unique dental health needs and preferences.

For instance, individuals with a history of gum disease may opt for a plan with enhanced periodontal care coverage, while those seeking cosmetic procedures may choose a plan with higher coverage limits for veneers or whitening treatments. Customized plans can provide a more personalized approach to dental insurance, ensuring individuals receive the coverage that aligns with their specific requirements.

Conclusion

Affordable dental insurance plans play a crucial role in making dental care accessible and cost-effective for individuals and families. By understanding the key features, benefits, and considerations outlined in this guide, you can make informed decisions when choosing an affordable dental insurance plan that suits your needs and budget.

Remember to assess your dental health needs, compare multiple plans, and thoroughly review the plan details before making a decision. Maximize your plan's benefits by attending regular check-ups, utilizing in-network providers, and exploring additional perks. As the dental insurance landscape evolves, stay informed about emerging trends and consider how they may impact your coverage and care.

With the right affordable dental insurance plan, you can take control of your oral health, maintain a healthy smile, and ensure that dental care remains an affordable and attainable part of your overall healthcare journey.

What is the average cost of an affordable dental insurance plan?

+The average cost of an affordable dental insurance plan can vary based on factors such as the level of coverage, the insurer, and the region. On average, individual plans can range from 30 to 50 per month, while family plans may cost around 100 to 150 per month. It’s important to note that these are approximate ranges, and actual costs may differ based on specific plan details and location.

Are there any discounts or incentives for enrolling in an affordable dental insurance plan?

+Some insurers offer discounts or incentives for enrolling in their affordable dental insurance plans. These may include loyalty discounts for long-term members, discounts for paying premiums annually instead of monthly, or even discounts for bundling dental insurance with other types of insurance, such as life or health insurance.

Can I enroll in an affordable dental insurance plan at any time of the year?

+Enrollment periods for affordable dental insurance plans can vary depending on the insurer and the specific plan. Some plans may have open enrollment periods throughout the year, allowing individuals to enroll at any time. However, other plans may have designated enrollment periods, typically coinciding with the open enrollment period for health insurance plans. It’s important to check with the insurer or review the plan’s terms and conditions to understand the enrollment timeline.