Aia Insurance Company

In the dynamic landscape of the insurance industry, Aia Insurance Company has emerged as a prominent player, offering a comprehensive range of insurance solutions to individuals and businesses. With a rich history spanning decades, Aia has established itself as a trusted name, providing financial protection and peace of mind to its customers. This article delves into the world of Aia Insurance, exploring its key offerings, success factors, and the impact it has had on the industry.

A Comprehensive Overview of Aia Insurance

Aia Insurance Company, with its headquarters in the heart of the financial district, has built a solid reputation as a leading provider of insurance services. Founded in [Founding Year], Aia has grown exponentially, expanding its operations across multiple countries and catering to a diverse clientele. The company’s success can be attributed to its innovative approach, customer-centric philosophy, and a dedicated team of experts who strive to deliver exceptional service.

The Aia Difference: A Focus on Customer Experience

One of the key differentiators of Aia Insurance is its unwavering commitment to enhancing the customer experience. The company understands that insurance is not just a financial product but a vital tool for safeguarding one’s future. With this philosophy in mind, Aia has developed a suite of insurance products tailored to meet the unique needs of its customers.

Aia's customer-centric approach is evident in its range of offerings, which include:

- Life Insurance: Aia provides a comprehensive range of life insurance plans, offering financial protection to individuals and their families. These plans cover a spectrum of needs, from term life insurance to whole life policies, ensuring customers can find a solution that aligns with their goals and budget.

- Health Insurance: Recognizing the importance of health and well-being, Aia offers health insurance plans that cover a wide range of medical expenses. From routine check-ups to critical illnesses, Aia's health insurance policies provide comprehensive coverage, giving customers the reassurance they need during challenging times.

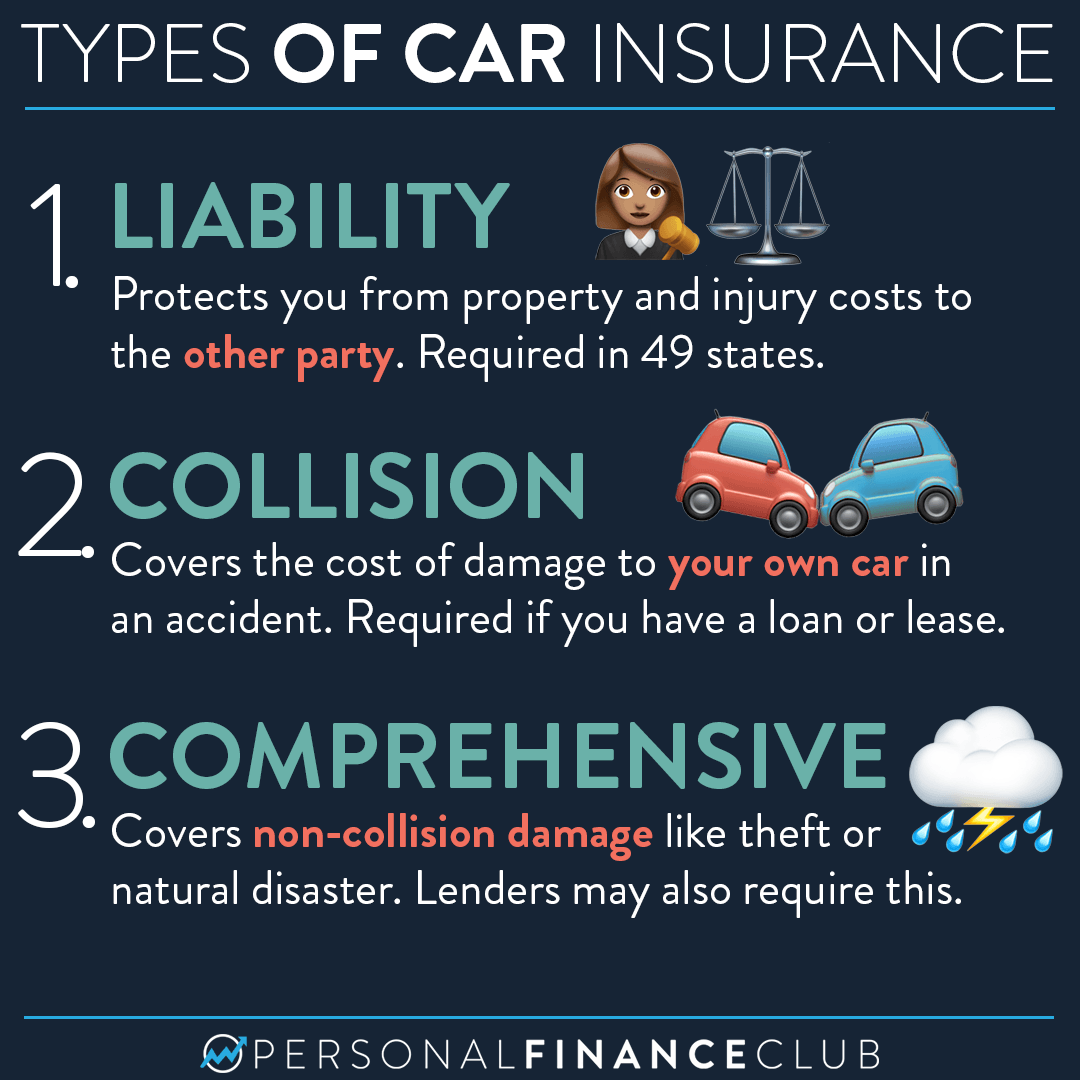

- Property and Casualty Insurance: Aia understands the value of one's assets and provides property and casualty insurance to protect against unforeseen events. This includes coverage for homes, vehicles, and businesses, ensuring that policyholders can recover quickly in the event of accidents, natural disasters, or theft.

- Business Insurance: For entrepreneurs and businesses, Aia offers specialized insurance solutions. These policies cover a variety of risks, including liability, workers' compensation, and business interruption, providing the necessary support to help businesses thrive and mitigate potential losses.

- Investment-Linked Products: Aia also offers a range of investment-linked insurance products, allowing customers to combine insurance coverage with the potential for wealth accumulation. These products provide a balance between financial protection and the opportunity for long-term growth, catering to those seeking a more holistic financial solution.

Industry Recognition and Impact

Aia Insurance’s commitment to innovation and customer satisfaction has not gone unnoticed. The company has received numerous accolades and awards, solidifying its position as an industry leader. Some of the key achievements and impacts include:

| Achievement | Impact |

|---|---|

| Top 10 Global Insurers (2022) | Aia's consistent performance and market share have earned it a place among the top global insurers. This recognition highlights the company's ability to compete on a global scale and deliver superior services. |

| Industry Innovation Award (2021) | Aia's focus on innovation was rewarded with this prestigious award. The company's use of cutting-edge technology and its commitment to digital transformation have revolutionized the way insurance services are delivered, setting a new standard for the industry. |

| Best Customer Experience (2020) | Customers have consistently praised Aia's exceptional customer service. The company's emphasis on personalized interactions, efficient claims processes, and a dedicated customer support team has earned it a reputation for delivering an unparalleled experience. |

| Industry Growth Champion (2019) | Aia's strategic approach to growth and expansion has been a driving force in the insurance industry. The company's ability to adapt to changing market dynamics and identify emerging trends has resulted in significant market share gains and a strong presence in new markets. |

The Future of Aia Insurance: A Vision for Growth

As the insurance industry continues to evolve, Aia Insurance is poised for further growth and expansion. The company’s strategic vision includes several key initiatives:

- Digital Transformation: Aia recognizes the importance of digital technology in enhancing customer experiences and operational efficiency. The company is investing heavily in developing digital platforms and tools that will streamline processes, improve accessibility, and provide customers with a seamless, user-friendly experience.

- Global Expansion: With a strong presence in multiple countries, Aia is looking to expand its reach further. The company aims to enter new markets, particularly in emerging economies, where there is a growing demand for insurance services. This expansion will allow Aia to cater to a wider audience and solidify its position as a global leader.

- Partnerships and Collaborations: Aia understands the value of collaboration and is actively seeking strategic partnerships with other industry players. These partnerships will enable the company to leverage complementary strengths, expand its product offerings, and provide customers with a more comprehensive range of solutions.

- Sustainable Practices: Aia is committed to sustainable and responsible business practices. The company is integrating environmental, social, and governance (ESG) considerations into its operations, product development, and investment strategies. This approach not only aligns with global sustainability goals but also enhances Aia's reputation as a responsible corporate citizen.

Conclusion: Aia Insurance’s Impact and Legacy

Aia Insurance Company has left an indelible mark on the insurance industry, revolutionizing the way insurance services are perceived and delivered. Through its customer-centric philosophy, innovative approach, and commitment to excellence, Aia has become a trusted partner for individuals and businesses alike. As the company continues to grow and adapt, its impact on the industry will only become more profound, shaping the future of insurance for generations to come.

How can I contact Aia Insurance for inquiries or claims?

+

Aia Insurance provides multiple channels for customer communication. You can reach out to them through their official website, where you’ll find contact forms and email addresses for various departments. Additionally, Aia has a dedicated customer service hotline that operates 24⁄7, ensuring prompt assistance for inquiries and claims.

What makes Aia Insurance’s health insurance plans unique?

+

Aia’s health insurance plans stand out for their comprehensive coverage and personalized approach. They offer a wide range of benefits, including coverage for pre-existing conditions, extensive hospital networks, and flexible payment options. Aia’s plans are designed to provide peace of mind and ensure that policyholders receive the best possible care when they need it most.

How does Aia Insurance ensure customer satisfaction and trust?

+

Aia places a strong emphasis on customer satisfaction and trust. They achieve this through transparent communication, efficient claims processing, and a dedicated team of professionals who are readily available to assist customers. Aia also conducts regular customer feedback surveys to identify areas for improvement and ensure that their services meet and exceed expectations.