Aig Insurance Quote

When it comes to safeguarding your assets and securing your financial future, obtaining an accurate and reliable insurance quote is paramount. In the world of insurance, Aig Insurance stands out as a trusted provider, offering comprehensive coverage tailored to individual needs. In this comprehensive guide, we will delve into the intricacies of Aig Insurance quotes, exploring the factors that influence them, the steps involved in the quotation process, and the unique benefits that set Aig Insurance apart. By the end of this article, you'll have a thorough understanding of how to navigate the world of insurance quotes and make informed decisions to protect what matters most.

Understanding the Aig Insurance Quote Process

The journey towards obtaining an Aig Insurance quote begins with a deep understanding of the company’s commitment to providing tailored solutions. Aig Insurance, a global leader in the insurance industry, prides itself on offering customized coverage plans that cater to the unique requirements of its clients. Whether you’re seeking protection for your home, vehicle, business, or health, Aig Insurance employs a meticulous approach to assess your specific needs and provide accurate quotes.

Factors Influencing Aig Insurance Quotes

Several key factors play a significant role in determining the cost of your Aig Insurance quote. These factors are carefully considered to ensure that the coverage you receive aligns with your expectations and provides the necessary financial protection. Here’s a breakdown of the primary influences on Aig Insurance quotes:

- Coverage Type and Scope: The type of insurance you require, such as home, auto, health, or life insurance, is a fundamental determinant. The extent of coverage you desire, including the limits, deductibles, and additional features, also impact the quote.

- Risk Assessment: Aig Insurance conducts a thorough risk assessment to evaluate the likelihood of potential losses. This assessment considers factors like your location, occupation, driving record (for auto insurance), and health history (for health insurance). Higher-risk profiles may result in higher premiums.

- Personal and Business Factors: Individual circumstances, such as your age, marital status, and credit history, can influence your insurance quote. For business insurance, the size and nature of your business, as well as its risk profile, are crucial considerations.

- Discounts and Bundling: Aig Insurance often offers discounts to incentivize customers. These discounts can be based on factors like loyalty, multiple policy bundling (e.g., home and auto insurance), safety features (for auto insurance), or healthy lifestyle choices (for health insurance). Bundling policies can lead to significant savings.

- State and Local Regulations: Insurance rates can vary based on state and local regulations. Certain states have specific laws that influence insurance premiums, so it's essential to understand the regulatory environment in your area.

- What type of insurance are you seeking (e.g., home, auto, health, life)?

- Do you have any existing policies that you wish to review or replace?

- What are the specific coverage limits and features you require?

- Are there any unique circumstances or risks associated with your situation that should be considered?

- Online Quote Request: Visit the official Aig Insurance website and navigate to the "Get a Quote" section. Here, you'll find user-friendly forms that guide you through the quote process. Simply fill in the required details, and you'll receive an initial quote estimate.

- Phone Call: For a more personalized experience, you can contact Aig Insurance's customer service team via phone. Trained representatives will guide you through the quote process, addressing any questions or concerns you may have.

- In-Person Meeting: If you prefer a face-to-face interaction, schedule an appointment with an Aig Insurance agent in your area. This option allows for a detailed discussion of your insurance needs and provides an opportunity to build a relationship with your insurance provider.

- Coverage Details: Ensure that the coverage limits, deductibles, and additional features match your expectations and provide adequate protection for your needs.

- Cost: Evaluate the premium amount and consider whether it fits within your budget. Remember that the cost may vary based on the coverage scope and any applicable discounts.

- Policy Terms and Conditions: Read through the policy document to understand the terms, exclusions, and any potential limitations. This step is crucial to ensure that you're fully aware of your rights and responsibilities under the policy.

By considering these factors, Aig Insurance strives to provide accurate and competitive quotes that reflect the unique risks and needs of each client. This personalized approach ensures that you receive the coverage you require without paying for unnecessary features.

The Step-by-Step Guide to Obtaining an Aig Insurance Quote

Securing an Aig Insurance quote is a straightforward process designed to be user-friendly and efficient. Here's a detailed breakdown of the steps involved, from initiation to finalization:

Step 1: Gathering Information

Before initiating the quote process, it's essential to gather relevant information about your insurance needs. Consider the following:

By compiling this information, you'll be well-prepared to provide accurate details during the quote process, ensuring that the resulting quote aligns with your expectations.

Step 2: Contacting Aig Insurance

There are several convenient ways to initiate contact with Aig Insurance:

Step 3: Providing Accurate Information

During the quote process, whether online, over the phone, or in person, it’s crucial to provide accurate and honest information. Misrepresenting your circumstances or withholding relevant details can lead to inaccurate quotes and potential issues with your policy down the line. Be transparent about your needs, risks, and any pre-existing conditions or claims.

Step 4: Reviewing the Quote

Once you’ve received your initial Aig Insurance quote, take the time to carefully review it. Here’s what to consider:

Step 5: Customizing Your Quote

Aig Insurance understands that insurance needs can evolve, and they offer flexibility to tailor your quote to your changing circumstances. If you require adjustments to your coverage or have specific requests, don’t hesitate to reach out to your Aig Insurance representative. They can guide you through the process of customizing your quote to ensure it remains aligned with your needs.

Step 6: Finalizing Your Quote

Once you’re satisfied with your Aig Insurance quote and have confirmed that it meets your expectations, it’s time to finalize the process. This typically involves signing the necessary documentation and providing payment for your initial premium. Aig Insurance will then issue your policy, providing you with the peace of mind that comes with comprehensive insurance coverage.

Benefits of Choosing Aig Insurance

Selecting Aig Insurance as your trusted insurance provider comes with a host of benefits that set them apart from the competition. Here’s a closer look at some of the advantages you can expect:

Comprehensive Coverage Options

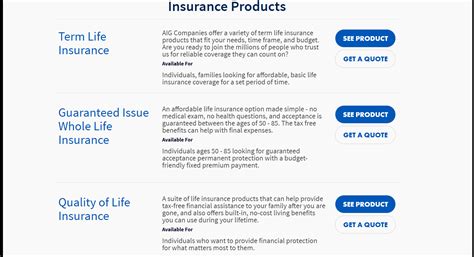

Aig Insurance offers a wide range of insurance products to meet the diverse needs of their clients. Whether you require home, auto, health, life, or business insurance, Aig Insurance has you covered. Their comprehensive coverage options ensure that you can protect every aspect of your life, from your property to your health and financial well-being.

Customized Solutions

Aig Insurance prides itself on providing personalized insurance solutions. Their team of experienced professionals takes the time to understand your unique circumstances and tailors coverage plans accordingly. By assessing your specific risks and needs, they can offer customized quotes that provide the right level of protection without unnecessary costs.

Excellent Customer Service

At Aig Insurance, customer satisfaction is a top priority. Their dedicated customer service team is readily available to assist you throughout the quote process and beyond. Whether you have questions, need clarification, or require assistance with a claim, Aig Insurance’s representatives are known for their expertise, friendliness, and commitment to ensuring your satisfaction.

Advanced Technology and Digital Tools

Aig Insurance embraces innovation to enhance the customer experience. Their user-friendly website and mobile app make it convenient to obtain quotes, manage your policies, and access important information anytime, anywhere. Additionally, they utilize advanced technology to streamline the claims process, ensuring prompt and efficient resolution.

Financial Stability and Reputation

As a globally recognized insurance provider, Aig Insurance boasts a strong financial foundation and an impeccable reputation. Their financial stability provides assurance that they will be there to support you when you need it most. With a long-standing track record of success and a commitment to ethical business practices, Aig Insurance is a trusted partner for your insurance needs.

Conclusion: Empowering Your Financial Security

Securing an Aig Insurance quote is a crucial step towards safeguarding your financial well-being and protecting what matters most to you. By understanding the factors that influence insurance quotes and following the step-by-step guide provided in this article, you can navigate the process with confidence. Aig Insurance’s commitment to personalized solutions, exceptional customer service, and financial stability makes them an ideal choice for individuals and businesses seeking comprehensive insurance coverage. Take the first step towards empowering your financial security by exploring Aig Insurance’s quote options and discovering the peace of mind that comes with tailored protection.

How long does it take to receive an Aig Insurance quote?

+The time it takes to receive an Aig Insurance quote can vary depending on the method of contact and the complexity of your insurance needs. Online quote requests are typically processed within a few minutes, providing you with an initial estimate. Phone calls and in-person meetings may take slightly longer, as they involve a more detailed discussion of your circumstances. On average, you can expect to receive a quote within 24 hours of initiating the process.

Can I customize my Aig Insurance quote to fit my budget?

+Absolutely! Aig Insurance understands that insurance is a significant financial commitment, and they strive to make coverage accessible to all. During the quote process, you can discuss your budget constraints with your Aig Insurance representative. They can guide you in adjusting coverage limits, deductibles, and additional features to find a balance that provides adequate protection while staying within your financial means.

What happens if my circumstances change after receiving an Aig Insurance quote?

+Life is full of unexpected changes, and Aig Insurance recognizes this. If your circumstances change after receiving a quote, you can reach out to your Aig Insurance representative to discuss the modifications. They can assist you in updating your coverage to reflect your new situation, ensuring that you maintain the appropriate level of protection.

Does Aig Insurance offer discounts for multiple policies or long-term customers?

+Yes, Aig Insurance values loyalty and offers various discounts to reward customers. If you bundle multiple policies (e.g., home and auto insurance) with Aig Insurance, you may be eligible for significant savings. Additionally, long-term customers often receive loyalty discounts, so it’s advantageous to maintain a long-standing relationship with Aig Insurance.