All Types Of Insurance

Insurance, an indispensable aspect of modern life, plays a pivotal role in mitigating risks and providing financial security to individuals, businesses, and societies. It offers a sense of stability and peace of mind, protecting against unforeseen events and their potential financial consequences. In today's complex and unpredictable world, understanding the various types of insurance and their specific applications is crucial for making informed decisions to safeguard one's interests and future.

The Evolution and Importance of Insurance

Insurance has a long and intriguing history, dating back to ancient civilizations. The concept of sharing risk was first recorded in Babylonian times, where merchants would divide their goods across several ships to ensure that a loss by shipwreck would not be devastating. This early form of marine insurance laid the foundation for the modern insurance industry we know today.

The importance of insurance in contemporary society cannot be overstated. It provides a safety net against unforeseen events, from natural disasters to health emergencies and legal liabilities. By spreading the risk across a large pool of policyholders, insurance companies are able to offer financial protection and stability to individuals and businesses alike. This not only helps individuals and businesses recover from unforeseen events but also plays a crucial role in supporting economic growth and development.

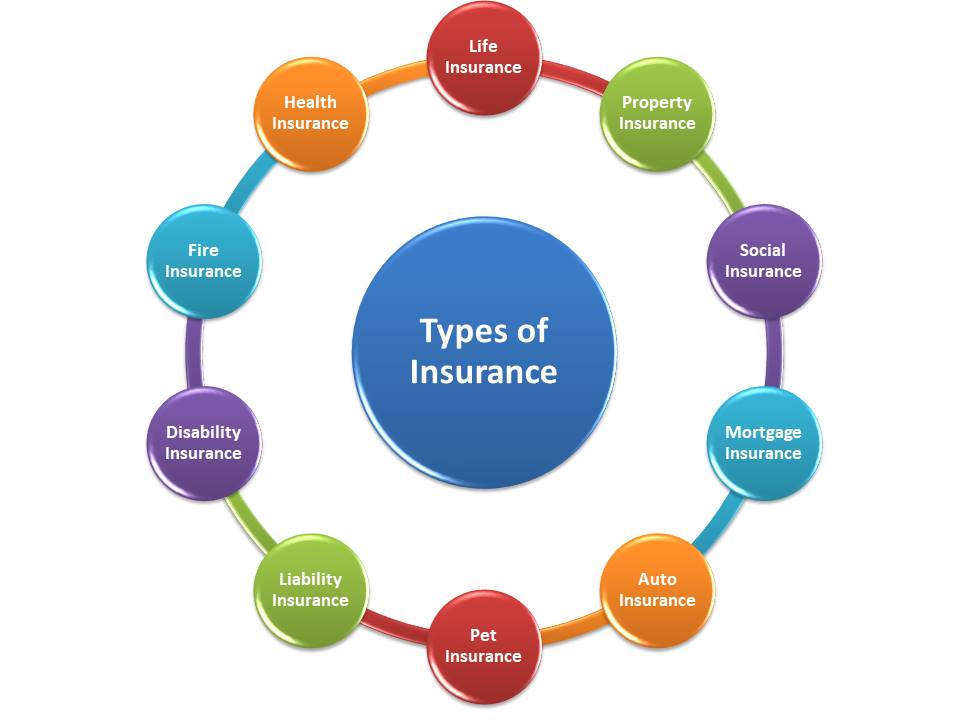

Types of Insurance: An In-Depth Exploration

The insurance landscape is vast and diverse, catering to a multitude of needs and risks. Here, we delve into the various types of insurance, their specific applications, and how they can provide essential protection in different areas of life.

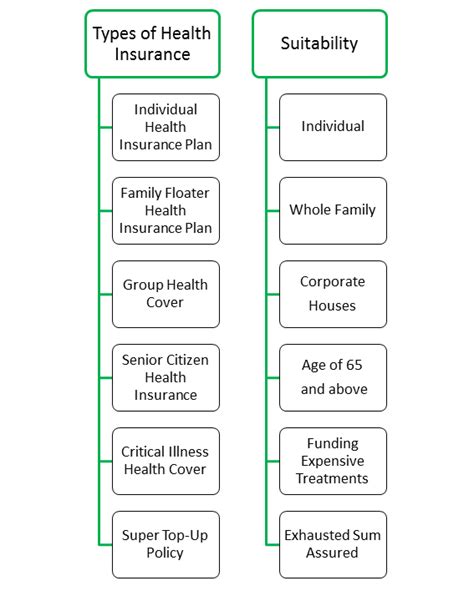

Health Insurance: A Shield for Well-Being

Health insurance is perhaps one of the most critical types of insurance, especially in the face of rising healthcare costs. It provides financial coverage for medical expenses, ensuring that individuals and families can access necessary healthcare services without facing crippling financial burdens. With health insurance, policyholders can receive treatment for illnesses, injuries, and even preventive care, promoting overall well-being.

There are several types of health insurance plans, each with its own set of benefits and coverage limits. For instance, HMO (Health Maintenance Organization) plans typically require members to select a primary care physician and obtain referrals for specialist care, offering comprehensive coverage at a lower cost. In contrast, PPO (Preferred Provider Organization) plans provide more flexibility, allowing policyholders to choose their healthcare providers without referrals, albeit at a higher cost.

| Health Insurance Type | Description |

|---|---|

| HMO | Requires primary care physician selection and referrals for specialist care. |

| PPO | Offers flexibility in choosing healthcare providers without referrals. |

| EPO (Exclusive Provider Organization) | Limits coverage to in-network providers, except in emergencies. |

| POS (Point of Service) | Combines features of HMO and PPO, offering choice and coverage. |

Life Insurance: Securing Your Legacy

Life insurance is a crucial tool for ensuring financial security for loved ones in the event of an individual’s untimely demise. It provides a lump-sum payment, known as a death benefit, to the policyholder’s beneficiaries, helping them cope with the loss of income and cover various expenses such as funeral costs, mortgage payments, and daily living expenses.

The two main types of life insurance are term life insurance and permanent life insurance. Term life insurance offers coverage for a specific period, typically 10, 20, or 30 years, and is generally more affordable. On the other hand, permanent life insurance, including whole life and universal life policies, provides coverage for the policyholder's entire life and also includes a cash value component that can be borrowed against or withdrawn.

Auto Insurance: Protecting Your Mobility

Auto insurance is mandatory in most countries and provides financial protection against physical damage and bodily injury resulting from traffic accidents. It also covers liability that could arise from an accident, protecting the policyholder from lawsuits related to an accident they cause.

The coverage offered by auto insurance policies can vary widely. Liability coverage is the most basic form, covering the cost of damage or injury to others for which the policyholder is found to be at fault. Collision coverage pays for damage to the policyholder's vehicle in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damage to the vehicle caused by incidents other than collisions, such as theft, vandalism, or natural disasters.

| Auto Insurance Coverage | Description |

|---|---|

| Liability | Covers damage or injury to others caused by the policyholder. |

| Collision | Pays for damage to the policyholder's vehicle in an accident. |

| Comprehensive | Covers non-collision related damage, such as theft or natural disasters. |

Home Insurance: Safeguarding Your Haven

Home insurance, also known as homeowners insurance, provides financial protection against damages to a residence, as well as its contents. It covers a wide range of risks, including fire, theft, vandalism, and certain natural disasters. Home insurance also offers liability coverage, protecting the homeowner from lawsuits related to accidents or injuries that occur on the property.

There are different types of home insurance policies, with the most common being HO-2, which covers a specific list of perils, and HO-3, which provides open-peril coverage, meaning it covers all perils except those specifically excluded in the policy. Other types, such as HO-4 and HO-6, are designed for condo and renters' insurance, respectively, providing coverage for personal property and liability.

Business Insurance: Guarding Your Enterprise

Business insurance is essential for any company, large or small, to protect against a variety of risks. These risks can include property damage, liability, loss of income, and employee-related issues. By purchasing the right business insurance policies, companies can ensure their financial stability and continuity in the face of unforeseen events.

The type of business insurance needed can vary greatly depending on the nature of the business. General liability insurance is a basic coverage that protects businesses from a range of risks, including bodily injury and property damage claims. Professional liability insurance, also known as errors and omissions insurance, is crucial for professionals like doctors, lawyers, and consultants, as it covers them against claims of negligence, errors, or omissions in their work.

| Business Insurance Type | Description |

|---|---|

| General Liability | Protects businesses from bodily injury and property damage claims. |

| Professional Liability | Covers professionals against claims of negligence or errors in their work. |

| Product Liability | Provides coverage for businesses that produce or sell products, protecting against claims of product-related injuries or damages. |

| Workers' Compensation | Ensures payment of compensation and medical benefits to employees injured in the course of employment. |

Travel Insurance: A Companion on Your Adventures

Travel insurance is designed to provide coverage for trip-related losses and emergencies. It can cover a range of situations, from trip cancellations and delays to lost luggage and medical emergencies while abroad. Travel insurance is particularly valuable for international trips, where unexpected events can lead to significant financial losses.

There are various types of travel insurance policies, each tailored to different needs. Trip cancellation insurance reimburses non-refundable expenses if a trip is canceled due to unforeseen circumstances. Medical travel insurance provides coverage for medical emergencies while traveling, ensuring that individuals can access necessary healthcare services without incurring significant out-of-pocket expenses.

Pet Insurance: Caring for Your Furry Friends

Pet insurance is a growing trend, offering financial protection for pet owners against veterinary costs. With the rising costs of veterinary care, pet insurance can provide peace of mind, ensuring that pets receive the best possible medical treatment without placing a strain on their owners’ finances.

Pet insurance policies can vary in their coverage and benefits. Some policies offer accidental injury coverage, providing financial assistance for injuries sustained by pets due to accidents. Illness coverage is another common feature, helping pet owners manage the cost of veterinary treatment for illnesses or diseases that their pets may develop.

The Future of Insurance: Innovation and Adaptation

The insurance industry is constantly evolving, driven by technological advancements and changing consumer needs. The rise of digital platforms and data analytics has enabled insurers to offer more personalized and efficient services, while also improving risk assessment and underwriting processes.

One of the most significant trends in the insurance industry is the move towards parametric insurance, which provides rapid payouts based on pre-defined parameters, such as wind speed or rainfall. This type of insurance is particularly useful in disaster-prone areas, as it can provide immediate financial relief to policyholders without the need for traditional claims processes.

FAQs

What is the primary purpose of insurance?

+Insurance serves as a risk management tool, providing financial protection against potential future losses. It helps individuals, businesses, and societies manage unforeseen events and their financial consequences.

How does insurance work?

+Insurance operates on the principle of risk sharing. Many people pay premiums to an insurance company, which pools this money together. When a policyholder experiences a covered loss, the insurance company pays out a claim from this pooled fund.

What are the key factors to consider when choosing an insurance policy?

+When selecting an insurance policy, it’s crucial to consider factors such as the level of coverage, the policy’s exclusions and limitations, the reputation of the insurance provider, and the cost of the premiums. It’s also important to understand the specific risks you want to protect against and choose a policy that aligns with those needs.

How do insurance premiums work?

+Insurance premiums are the amounts paid by policyholders to insurance companies for coverage. The cost of premiums is based on a variety of factors, including the type of insurance, the level of coverage, the policyholder’s risk profile, and the location. Premiums are typically paid on a monthly or annual basis.