Allegiance Insurance

Welcome to an in-depth exploration of Allegiance Insurance, a renowned name in the insurance industry. With a rich history spanning decades, Allegiance has established itself as a trusted provider of comprehensive insurance solutions. In this article, we delve into the core aspects of Allegiance Insurance, uncovering its unique offerings, innovative approaches, and the impact it has made on the lives of its clients. Join us on this insightful journey as we uncover the secrets behind Allegiance's success and its unwavering commitment to protecting what matters most.

A Legacy of Excellence: Allegiance Insurance’s Story

Allegiance Insurance has etched its name in the annals of the insurance industry with a remarkable journey that began over 50 years ago. Founded by a visionary group of insurance experts, Allegiance was established with a singular purpose: to revolutionize the way individuals and businesses approached risk management. Since its inception, the company has maintained an unwavering focus on delivering exceptional insurance services tailored to meet the diverse needs of its clients.

Headquartered in the heart of the insurance hub, Allegiance has expanded its reach across the nation, establishing a network of regional offices and a robust online presence. This strategic expansion has enabled Allegiance to cater to a diverse range of clients, from individuals and small businesses to large corporations, offering them access to a comprehensive suite of insurance products and services.

Allegiance's success story is a testament to its commitment to innovation, customer satisfaction, and ethical business practices. The company's leadership team, comprised of industry veterans, has played a pivotal role in shaping Allegiance's trajectory, guiding the organization towards sustained growth and success. Under their stewardship, Allegiance has consistently delivered on its promise of providing tailored insurance solutions that offer peace of mind and financial security to its valued clients.

A Comprehensive Suite of Insurance Solutions

At Allegiance Insurance, we understand that every client’s needs are unique. That’s why we offer a comprehensive range of insurance products designed to cater to diverse requirements. Our suite of offerings includes:

- Auto Insurance: Protect your vehicle and your peace of mind with our customizable auto insurance plans. From comprehensive coverage to liability protection, we've got you covered.

- Homeowners Insurance: Your home is your sanctuary, and we're here to ensure it stays that way. Our homeowners insurance policies provide protection against a wide range of risks, from natural disasters to theft.

- Business Insurance: Whether you're a small startup or a large corporation, our business insurance solutions are tailored to meet your specific needs. From general liability to property insurance, we help you safeguard your business assets.

- Life Insurance: Provide for your loved ones with our life insurance policies. We offer a variety of options, including term life, whole life, and universal life insurance, to ensure you have the coverage that's right for you.

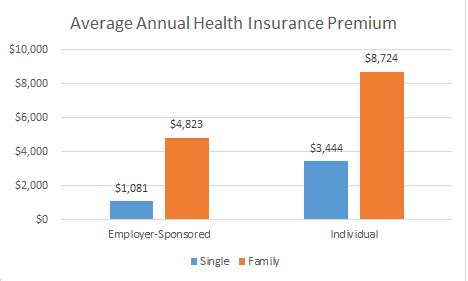

- Health Insurance: Access affordable and comprehensive health insurance plans through Allegiance. We work with top providers to offer a range of options, including individual and family plans, to ensure you and your family stay healthy.

At Allegiance, we believe in the power of choice. That's why we offer a wide range of insurance options, allowing you to customize your coverage to fit your unique needs and budget. Our expert team is dedicated to helping you navigate the complex world of insurance, ensuring you have the protection you need without unnecessary expenses.

Tailored Coverage, Unparalleled Service

One of the key strengths of Allegiance Insurance is our ability to provide tailored coverage solutions. Our team of experienced insurance professionals takes the time to understand your unique circumstances, risks, and goals. By conducting a comprehensive assessment of your needs, we develop customized insurance plans that offer the perfect balance of coverage and affordability.

But our commitment to excellence doesn't end there. At Allegiance, we pride ourselves on delivering unparalleled customer service. Our dedicated account managers are always available to provide support, answer questions, and guide you through the insurance process. We believe that building strong relationships with our clients is essential to ensuring their long-term satisfaction and peace of mind.

| Insurance Type | Coverage Highlights |

|---|---|

| Auto Insurance | Customizable plans, comprehensive coverage, liability protection |

| Homeowners Insurance | Protection against natural disasters, theft, and more |

| Business Insurance | Tailored solutions for small businesses and large corporations |

| Life Insurance | Term life, whole life, and universal life options |

| Health Insurance | Affordable individual and family plans |

Innovative Approaches to Risk Management

Allegiance Insurance is at the forefront of innovation in the insurance industry. We continuously seek out new technologies and strategies to enhance our risk management capabilities and deliver even better outcomes for our clients. Here’s a glimpse into some of our innovative approaches:

Advanced Data Analytics

By leveraging advanced data analytics and machine learning, we can identify patterns and trends that help us better understand and mitigate risks. This enables us to develop more accurate risk models and provide our clients with more precise and cost-effective insurance solutions.

Telematics and Usage-Based Insurance

In the auto insurance space, we’re exploring the use of telematics and usage-based insurance. By installing small devices in vehicles, we can collect real-time data on driving behavior, such as speed, acceleration, and braking patterns. This data allows us to offer personalized insurance rates based on actual driving habits, rewarding safe drivers with lower premiums.

Digital Transformation

Allegiance is committed to digital transformation, investing in cutting-edge technology to streamline our processes and enhance the client experience. Our online platform offers a seamless and secure way to manage insurance policies, file claims, and access important documents. Additionally, we’ve developed mobile apps that put insurance information at your fingertips, making it easier than ever to stay connected and informed.

Collaborative Risk Management

We believe in the power of collaboration. That’s why we actively engage with our clients, industry experts, and other stakeholders to develop innovative risk management strategies. By sharing knowledge and best practices, we can collectively identify and address emerging risks, ensuring our clients are always protected.

Impact and Success Stories

At Allegiance Insurance, we’re proud to have made a positive impact on the lives of our clients. Here are a few success stories that showcase the power of our insurance solutions:

Protecting a Small Business Owner’s Dream

John, a passionate entrepreneur, had always dreamed of opening his own bakery. With hard work and dedication, he turned his dream into a reality. However, as a small business owner, he faced numerous risks, from equipment failures to liability claims. That’s where Allegiance stepped in. We worked closely with John to develop a comprehensive business insurance plan that protected his bakery against a wide range of risks. With peace of mind and financial security, John could focus on what he loved most – baking delicious treats for his community.

Securing a Family’s Future

Sarah and Michael, a young couple with two children, wanted to ensure their family’s financial security. They approached Allegiance Insurance to explore their life insurance options. Our team helped them understand the different types of life insurance policies available and guided them in choosing the right coverage for their needs. With a life insurance policy in place, Sarah and Michael could rest assured knowing that their family would be protected and provided for, even in the event of an unforeseen tragedy.

Helping a Homeowner Rebuild

After a devastating wildfire, Susan, a homeowner in a high-risk area, was left with a damaged home and a sense of uncertainty. Fortunately, she had invested in homeowners insurance with Allegiance. Our team sprang into action, providing prompt and efficient support throughout the claims process. We worked tirelessly to ensure Susan received the compensation she deserved, helping her rebuild her home and regain a sense of normalcy in her life.

Why Choose Allegiance Insurance

When it comes to choosing an insurance provider, there are countless options available. So, why should you choose Allegiance Insurance? Here are a few compelling reasons:

- Expertise and Experience: With decades of industry experience, our team of insurance professionals brings a wealth of knowledge and expertise to the table. We understand the unique challenges and risks faced by our clients, and we're dedicated to providing tailored solutions that meet their needs.

- Personalized Service: At Allegiance, we believe in building strong relationships with our clients. Our dedicated account managers take the time to understand your specific circumstances and goals, ensuring you receive personalized attention and support throughout your insurance journey.

- Innovative Approaches: We're constantly pushing the boundaries of innovation to deliver better outcomes for our clients. From advanced data analytics to usage-based insurance, we're committed to staying ahead of the curve and providing cutting-edge risk management solutions.

- Client Satisfaction: Our success is measured by the satisfaction and peace of mind we bring to our clients. We pride ourselves on delivering exceptional service and going above and beyond to ensure our clients are protected and happy.

FAQs

What types of insurance does Allegiance Insurance offer?

+Allegiance Insurance offers a comprehensive range of insurance products, including auto insurance, homeowners insurance, business insurance, life insurance, and health insurance. We strive to cater to the diverse needs of our clients, providing tailored coverage solutions for individuals and businesses alike.

How does Allegiance Insurance ensure personalized coverage for its clients?

+At Allegiance, we believe in taking a holistic approach to insurance. Our experienced team conducts a thorough assessment of your unique circumstances, risks, and goals. By understanding your specific needs, we can develop customized insurance plans that offer the perfect balance of coverage and affordability.

What sets Allegiance Insurance apart from other insurance providers?

+Allegiance Insurance stands out for its commitment to innovation, personalized service, and client satisfaction. We continuously seek out new technologies and strategies to enhance our risk management capabilities, ensuring our clients receive the most advanced and effective insurance solutions. Additionally, our dedicated account managers provide ongoing support and guidance, fostering strong relationships with our clients.