Annual Car Insurance Policies

In the world of automotive finance and insurance, annual car insurance policies stand as a fundamental pillar for vehicle owners. These policies provide a comprehensive layer of protection, offering financial security and peace of mind to drivers on the road. As a crucial aspect of vehicle ownership, annual insurance policies play a vital role in managing risks and ensuring compliance with legal requirements. In this expert-driven article, we delve into the intricacies of annual car insurance policies, exploring their benefits, coverage options, and the factors that influence their cost and effectiveness.

Understanding Annual Car Insurance Policies

Annual car insurance policies are contracts between insurance providers and vehicle owners, designed to cover a wide range of risks associated with operating a motor vehicle. These policies offer protection for a period of one year, providing a fixed premium rate and a comprehensive set of benefits tailored to the policyholder’s needs. Unlike short-term or temporary insurance, annual policies provide a more stable and cost-effective solution for long-term vehicle ownership.

The core purpose of annual car insurance is to safeguard vehicle owners against financial losses resulting from accidents, theft, vandalism, or other unforeseen events. It serves as a safety net, ensuring that drivers can navigate the complexities of vehicle ownership with confidence, knowing that they are protected in the event of an unfortunate incident. Additionally, these policies often include a range of optional add-ons and specialized coverage, allowing policyholders to customize their protection according to their specific requirements.

Key Components of Annual Car Insurance

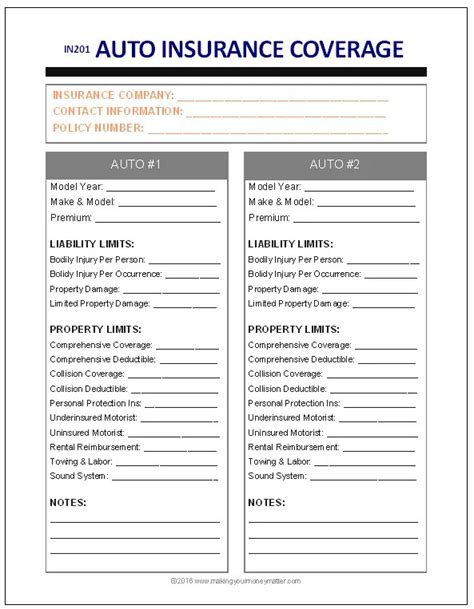

Annual car insurance policies typically consist of several key components, each designed to address different aspects of vehicle ownership and usage. The primary components include:

- Liability Coverage: This aspect of the policy covers the policyholder's legal responsibility for bodily injury or property damage caused to others in an accident. It provides financial protection against claims made by third parties, ensuring that the policyholder is not personally liable for significant costs.

- Comprehensive Coverage: This coverage extends beyond accident-related damages, protecting the policyholder's vehicle against non-collision incidents such as theft, vandalism, fire, and natural disasters. It offers a more comprehensive level of protection, ensuring that the vehicle is covered for a wider range of potential risks.

- Collision Coverage: Collision coverage specifically addresses damages sustained by the policyholder's vehicle in an accident, regardless of fault. It covers the cost of repairs or replacement if the vehicle is deemed a total loss, providing financial relief in the event of a crash.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage provides financial assistance for medical expenses incurred by the policyholder and their passengers in an accident, regardless of fault. It ensures that medical bills are covered, reducing the financial burden on the injured parties.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder in the event of an accident with a driver who either has no insurance or insufficient insurance to cover the damages. It ensures that the policyholder is not left financially vulnerable due to the actions of an uninsured or underinsured driver.

In addition to these core components, annual car insurance policies often offer a range of optional coverages and add-ons, allowing policyholders to further customize their protection. These may include rental car reimbursement, gap insurance, roadside assistance, and specialized coverage for unique vehicle types or usage scenarios.

Factors Influencing Annual Car Insurance Costs

The cost of annual car insurance policies is influenced by a multitude of factors, each playing a role in determining the premium rate. Understanding these factors is crucial for policyholders to make informed decisions and potentially reduce their insurance costs.

Driver Profile and History

One of the primary factors that insurance providers consider when calculating premiums is the driver’s profile and history. This includes factors such as age, gender, driving experience, and claims history. Younger drivers, particularly those under the age of 25, are often considered higher-risk due to their lack of experience, resulting in higher premiums. Similarly, drivers with a history of accidents or traffic violations may face increased insurance costs, as they are statistically more likely to be involved in future incidents.

| Driver Profile Factor | Impact on Premium |

|---|---|

| Age | Younger drivers (under 25) often pay higher premiums. |

| Gender | Gender may have a slight impact, with some providers offering discounts for female drivers. |

| Driving Experience | Inexperienced drivers may pay more, while experienced drivers with a clean record can expect lower rates. |

| Claims History | A history of accidents or claims can lead to increased premiums. |

Vehicle Type and Usage

The type of vehicle being insured and its intended usage also play a significant role in determining insurance costs. Sports cars, high-performance vehicles, and luxury models often carry higher premiums due to their increased risk of theft, higher repair costs, and greater potential for accidents. Additionally, the intended usage of the vehicle, such as personal or commercial, can impact the premium. Vehicles used for business purposes may require specialized coverage, resulting in higher costs.

Geographic Location

The geographic location where the vehicle is primarily garaged and driven can have a substantial impact on insurance costs. Areas with higher crime rates, frequent natural disasters, or a higher incidence of accidents may result in increased premiums. Similarly, the density of the population and the corresponding traffic volume can also influence insurance rates, with urban areas often experiencing higher costs.

Coverage Options and Deductibles

The level of coverage and the chosen deductibles are key factors in determining the cost of annual car insurance policies. Higher levels of coverage, such as comprehensive and collision, provide more extensive protection but come at a higher premium. On the other hand, selecting a higher deductible (the amount the policyholder pays out of pocket before the insurance kicks in) can reduce the premium, as it indicates a willingness to bear more financial responsibility in the event of a claim.

Maximizing Value and Savings in Annual Car Insurance

While annual car insurance policies are a necessary expense for vehicle owners, there are strategies and considerations that can help maximize value and potentially reduce costs. By being proactive and informed, policyholders can make more effective choices to ensure they are adequately protected without paying more than necessary.

Shopping Around and Comparing Quotes

One of the most effective ways to find the best value in annual car insurance is to shop around and compare quotes from multiple providers. Insurance rates can vary significantly between companies, and by obtaining multiple quotes, policyholders can identify the most competitive options. Online comparison tools and direct communication with insurance agents can provide a comprehensive view of the market, ensuring that the best rates are secured.

Bundling Policies and Multi-Policy Discounts

Many insurance providers offer discounts when policyholders bundle multiple policies together. This could involve combining car insurance with other types of coverage, such as home or renters insurance, or adding additional vehicles to a single policy. By bundling policies, policyholders can often secure significant discounts, making their insurance more affordable.

Safe Driving Practices and Discounts

Maintaining a clean driving record and practicing safe driving habits can lead to substantial savings on annual car insurance. Many insurance providers offer discounts for drivers who have not had accidents or traffic violations for a certain period. Additionally, some providers offer usage-based insurance programs, where policyholders can earn discounts by demonstrating safe driving behavior through the use of telematics devices or smartphone apps.

Exploring Coverage Options and Add-Ons

When selecting an annual car insurance policy, it’s important to carefully consider the coverage options and add-ons available. While it’s crucial to have adequate protection, over-insuring can lead to unnecessary expenses. Policyholders should assess their specific needs and risks, ensuring that they have the appropriate level of coverage without paying for unnecessary benefits. By understanding the various coverage options and their costs, policyholders can make informed choices to optimize their insurance portfolio.

The Future of Annual Car Insurance Policies

The automotive insurance landscape is continually evolving, driven by technological advancements, changing consumer behaviors, and emerging trends in the industry. As we look towards the future, several key developments are expected to shape the world of annual car insurance policies.

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of devices or smartphone apps to track driving behavior, is expected to play a significant role in the future of car insurance. Usage-based insurance programs, where premiums are calculated based on actual driving habits, are becoming increasingly popular. These programs offer policyholders the opportunity to reduce their insurance costs by demonstrating safe and responsible driving behavior. As telematics technology advances and becomes more widely adopted, it is likely to revolutionize the way insurance premiums are determined, providing a more accurate reflection of individual risk profiles.

Autonomous Vehicles and Insurance Implications

The emergence of autonomous vehicles is poised to have a profound impact on the insurance industry. As self-driving cars become more prevalent, the traditional liability model of insurance may need to be reevaluated. In a world where vehicles are capable of operating independently, the question of fault in accidents becomes more complex. Insurance providers will need to adapt their policies and coverage models to accommodate the unique risks and benefits associated with autonomous vehicles. This could involve the development of specialized coverage for autonomous technology, as well as adjustments to liability and comprehensive coverage.

Digitalization and Insurance Innovation

The ongoing digitalization of the insurance industry is expected to bring about significant changes in the way annual car insurance policies are sold, serviced, and administered. With the rise of online platforms and digital tools, policyholders can increasingly expect a more seamless and efficient experience when purchasing and managing their insurance policies. Digital innovations such as real-time claim processing, interactive policy management, and personalized coverage recommendations are likely to become more prevalent, enhancing the overall customer experience and improving the efficiency of insurance operations.

Conclusion

Annual car insurance policies are a critical component of responsible vehicle ownership, providing a comprehensive safety net for drivers and their vehicles. By understanding the intricacies of these policies, including their key components, coverage options, and the factors influencing their cost, policyholders can make informed decisions to ensure they are adequately protected. With a proactive approach and a focus on maximizing value, annual car insurance can be a cost-effective and reliable solution for managing the risks associated with automotive ownership.

How often should I review my annual car insurance policy?

+It is recommended to review your insurance policy annually, or whenever there are significant changes in your life or driving circumstances. Regular reviews ensure that your coverage remains adequate and that you are not paying for unnecessary benefits.

Can I switch insurance providers during the policy year?

+Yes, you can switch insurance providers at any time during the policy year. However, it is important to ensure that your new policy is in place before canceling the old one to avoid any gaps in coverage.

What factors can lead to an increase in my insurance premiums?

+Insurance premiums can increase due to a variety of factors, including accidents, traffic violations, changes in your vehicle’s value or usage, or even general market fluctuations. Regularly reviewing your policy and maintaining a clean driving record can help mitigate these increases.