Are Auto Insurance Rates Going Up

The cost of auto insurance is a concern for many drivers, and the question of whether rates are increasing has become a topic of interest for those seeking affordable coverage. In this comprehensive analysis, we delve into the factors influencing auto insurance rates and explore the current trends and future projections. By examining industry data and expert insights, we aim to provide a clear understanding of the state of auto insurance costs and offer valuable insights for drivers navigating the insurance landscape.

Understanding Auto Insurance Rates

Auto insurance rates are influenced by a myriad of factors, making it a complex and dynamic industry. Insurance providers consider various elements when determining premiums, including the driver’s age, gender, driving record, vehicle type, and geographic location. Additionally, external factors such as economic conditions, inflation, and changes in legislation can impact insurance rates.

The Impact of Claims and Accidents

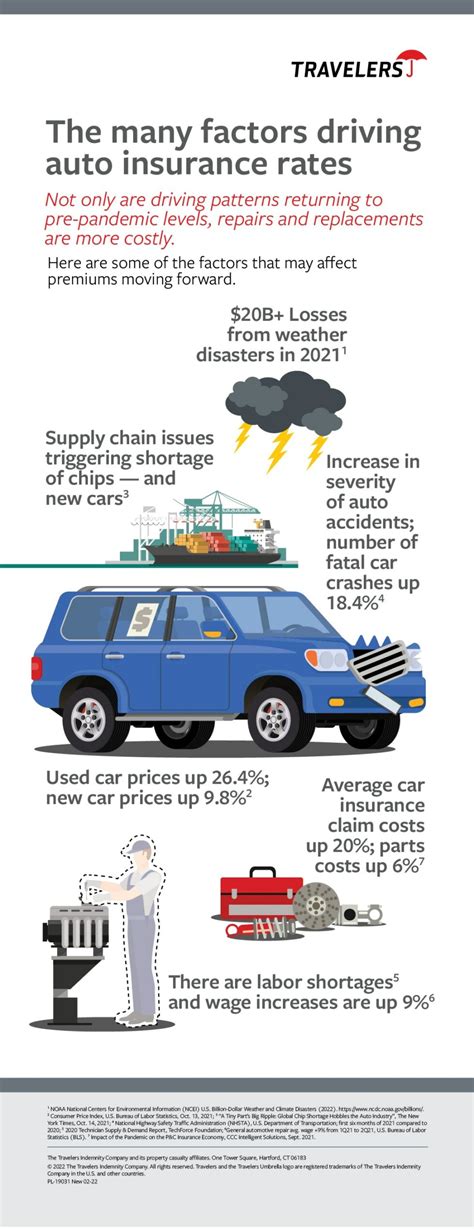

One of the primary drivers of insurance rate fluctuations is the frequency and cost of claims and accidents. When insurance companies experience a surge in claims, it can lead to increased rates to cover the financial burden. Severe weather events, natural disasters, and an uptick in accidents can all contribute to higher claim costs, resulting in rate adjustments.

For instance, let's consider the case of Hurricane Katrina, which devastated the Gulf Coast in 2005. The extensive damage to vehicles and infrastructure resulted in a significant increase in insurance claims. As a consequence, insurance companies in the affected regions had to raise rates to maintain their financial stability.

Economic Factors and Inflation

Economic conditions play a pivotal role in shaping auto insurance rates. During periods of economic growth, increased vehicle sales and higher repair costs can lead to rising insurance premiums. Conversely, economic downturns may prompt insurance companies to offer more competitive rates to attract customers.

Moreover, inflation has a direct impact on insurance rates. As the cost of living rises, so do the expenses associated with vehicle repairs and medical treatments. Insurance companies must adjust their rates to account for these increased costs, ensuring they can provide adequate coverage to policyholders.

| Year | Average Auto Insurance Premium |

|---|---|

| 2020 | $1,550 |

| 2021 | $1,620 |

| 2022 | $1,700 |

The table above illustrates the gradual increase in average auto insurance premiums from 2020 to 2022, reflecting the impact of economic factors and inflation on insurance costs.

Regulatory Changes and Legislation

Changes in legislation and regulatory environments can also affect auto insurance rates. Insurance companies must comply with various laws and regulations, and any amendments can lead to adjustments in premium structures. For example, an increase in minimum liability coverage requirements may result in higher rates for policyholders.

Current Trends in Auto Insurance Rates

Examining the current trends in auto insurance rates provides valuable insights into the industry’s trajectory. While rates may vary depending on geographic location and individual circumstances, several overarching patterns have emerged in recent years.

Regional Variations

Auto insurance rates can vary significantly across different regions. Factors such as traffic density, crime rates, and the frequency of natural disasters contribute to these regional differences. For instance, urban areas with high traffic volumes and a higher likelihood of accidents tend to have higher insurance rates compared to rural areas.

Additionally, states with more stringent insurance regulations may have higher average rates. For example, states with no-fault insurance systems, such as Michigan and New Jersey, often have higher premiums due to the unique coverage requirements.

The Rise of Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, has gained traction in recent years. This innovative approach to auto insurance pricing involves tracking a driver’s behavior and mileage through a device installed in their vehicle. Insurance companies use this data to offer personalized rates based on an individual’s actual driving habits.

Usage-based insurance has the potential to benefit safe drivers by offering lower rates. Drivers who maintain a good driving record and exhibit responsible behavior behind the wheel can see significant savings with this type of insurance.

Technological Advancements and Data Analytics

The auto insurance industry is embracing technological advancements and data analytics to enhance its operations and pricing models. Insurers are utilizing advanced analytics to better understand customer behavior, predict claim probabilities, and optimize pricing structures.

For example, insurance companies are leveraging machine learning algorithms to analyze vast amounts of data, including driving behavior, accident patterns, and claim histories. This enables them to identify high-risk drivers and accurately price their policies, leading to more precise and fair insurance rates.

Future Implications and Predictions

Looking ahead, several factors suggest that auto insurance rates may continue to rise in the coming years. However, it’s important to note that rate increases are not uniform across all regions and demographics.

Increased Repair and Medical Costs

As technology advances, the cost of repairing modern vehicles continues to rise. Advanced safety features, sophisticated electronics, and complex engine systems contribute to higher repair bills. Additionally, medical costs associated with treating injuries from accidents are also on the rise, impacting insurance rates.

Climate Change and Severe Weather Events

The increasing frequency and severity of severe weather events due to climate change pose a significant challenge for the auto insurance industry. Hurricanes, floods, and wildfires can result in extensive vehicle damage and higher insurance claims. As a result, insurance companies may need to raise rates to mitigate the financial impact of these natural disasters.

Autonomous Vehicles and Safety Innovations

The widespread adoption of autonomous vehicles and advanced safety features has the potential to revolutionize the auto insurance industry. While these technologies aim to reduce accidents and make roads safer, they also come with a price tag. The cost of repairing or replacing advanced autonomous systems can be substantial, leading to potential increases in insurance rates.

However, as autonomous vehicles become more prevalent, insurance companies may adjust their pricing models to account for the reduced risk of accidents. This could lead to a shift towards usage-based insurance, where rates are based on actual driving data rather than historical accident statistics.

Regulatory and Legislative Changes

Changes in insurance regulations and legislation can have a significant impact on auto insurance rates. For example, if states implement stricter liability coverage requirements or introduce new insurance mandates, it may result in higher premiums for policyholders.

Additionally, legislative efforts to address rising insurance costs, such as reforms to personal injury protection (PIP) or no-fault insurance systems, can influence the overall rate landscape. These changes aim to strike a balance between providing adequate coverage for policyholders and ensuring affordable insurance options.

How can I find the best auto insurance rates for my specific circumstances?

+To find the best auto insurance rates, it's essential to compare quotes from multiple providers. Consider factors such as your driving record, vehicle type, and geographic location. Additionally, explore usage-based insurance options, which may offer personalized rates based on your driving behavior. Regularly review and update your insurance policy to ensure you're getting the most competitive rates.

Are there any ways to lower my auto insurance premiums?

+Yes, there are several strategies to lower your auto insurance premiums. Maintaining a clean driving record, bundling multiple insurance policies with the same provider, and opting for higher deductibles can lead to significant savings. Additionally, exploring discounts for safe driving, good student status, or installing anti-theft devices can further reduce your insurance costs.

What factors influence the variability of auto insurance rates across different regions?

+Regional variations in auto insurance rates are influenced by factors such as traffic density, crime rates, and the frequency of natural disasters. Urban areas with higher traffic volumes and accident rates often have higher insurance costs compared to rural areas. Additionally, states with specific insurance regulations, like no-fault systems, may have unique pricing structures that impact average rates.

In conclusion, the question of whether auto insurance rates are going up is a complex one, influenced by a multitude of factors. While rates may fluctuate based on regional variations, economic conditions, and legislative changes, the overall trend suggests a gradual increase in insurance costs. However, with the advent of usage-based insurance and technological advancements, there are opportunities for drivers to obtain more personalized and potentially lower rates. By staying informed about industry trends and exploring various insurance options, drivers can navigate the insurance landscape and make informed decisions to secure the best coverage at the most affordable rates.