Auto Insurance Fl

Auto insurance in the state of Florida, often referred to as "Auto Insurance FL," is a topic of great importance for residents and visitors alike. With its unique geographical features, diverse demographics, and a thriving tourism industry, Florida presents a complex landscape when it comes to automotive insurance.

In this comprehensive guide, we will delve into the intricacies of Auto Insurance FL, exploring the various factors that influence insurance rates, the unique regulations governing the industry, and the best practices for obtaining affordable and comprehensive coverage. By the end of this article, you will have a deep understanding of the Auto Insurance FL landscape and be equipped with the knowledge to make informed decisions regarding your automotive insurance needs.

Understanding the Unique Landscape of Auto Insurance in Florida

Florida, with its sunny beaches, vibrant cities, and a population that includes both long-term residents and seasonal visitors, presents a unique set of challenges and opportunities for auto insurance providers. The state’s diverse demographics, high tourism rate, and the frequent occurrence of natural disasters, such as hurricanes, all contribute to a complex insurance environment.

One of the key factors that sets Florida apart is its status as a no-fault state. This means that, in the event of an accident, each driver's insurance company is responsible for paying their respective policyholders' claims, regardless of who was at fault. This system is designed to expedite the claims process and reduce the number of lawsuits. However, it also means that Florida drivers must carry personal injury protection (PIP) insurance, which covers medical expenses and lost wages up to a certain limit.

The Impact of Natural Disasters on Auto Insurance Rates

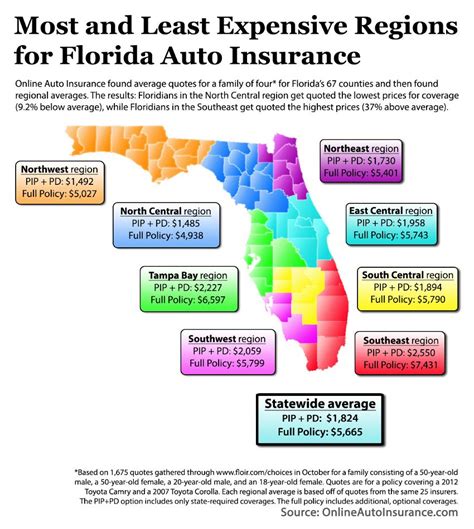

Florida’s susceptibility to hurricanes and other natural disasters is a significant factor influencing auto insurance rates. Insurance providers carefully assess the risk of insuring vehicles in areas prone to these events, which often results in higher premiums for residents in such regions. For instance, a study by the Insurance Research Council revealed that counties along the coast, which are more vulnerable to hurricane damage, consistently have higher average insurance premiums compared to inland counties.

Furthermore, the frequency and severity of natural disasters in Florida can lead to rate fluctuations. Insurance companies regularly review their policies and may increase rates to account for the higher risk of claims during hurricane season. This dynamic pricing strategy ensures that insurance providers can remain financially stable while providing coverage for potentially costly natural disasters.

| County | Average Annual Premium |

|---|---|

| Monroe (Key West) | $2,350 |

| Palm Beach | $2,100 |

| Broward | $1,950 |

| Miami-Dade | $1,850 |

| Hillsborough (Tampa) | $1,600 |

Regulations and Requirements for Auto Insurance in Florida

Florida has a comprehensive set of regulations governing auto insurance to protect both drivers and insurance companies. These regulations outline the minimum coverage requirements, the rights and responsibilities of policyholders, and the claims process. Understanding these regulations is essential for drivers to ensure they are adequately protected and compliant with state laws.

Minimum Coverage Requirements

As mentioned earlier, Florida is a no-fault state, which means that drivers are required to carry personal injury protection (PIP) insurance. The minimum PIP coverage in Florida is 10,000</strong>, which covers medical expenses and lost wages for the policyholder and their passengers up to this limit. Additionally, drivers must carry <strong>property damage liability (PDL)</strong> insurance with a minimum coverage of <strong>10,000, which covers damage to others’ property in the event of an accident.

While PIP and PDL are the mandatory coverages, Florida also recommends that drivers consider additional coverage options, such as bodily injury liability, uninsured/underinsured motorist coverage, and comprehensive and collision coverage. These optional coverages provide broader protection in the event of an accident, especially if the at-fault driver does not have sufficient insurance.

Rights and Responsibilities of Policyholders

Florida law grants policyholders certain rights and imposes specific responsibilities. For instance, policyholders have the right to choose their own repair shop for vehicle repairs after an accident. Additionally, they have the right to dispute insurance claims if they believe their claim was unfairly denied or undervalued. On the other hand, policyholders also have the responsibility to maintain continuous coverage and to provide accurate information when applying for insurance or filing a claim.

The Claims Process

In Florida, the claims process follows a no-fault system, meaning that each driver’s insurance company is responsible for paying their respective policyholder’s claims. This process aims to reduce the number of lawsuits and expedite the resolution of claims. However, if the policyholder’s damages exceed their PIP coverage limits or if the accident involves a serious injury or fatality, the at-fault driver’s liability insurance may be involved.

It's important for policyholders to understand that while the no-fault system provides quick access to benefits, it may limit their ability to pursue legal action against the at-fault driver unless certain criteria, such as significant injury or damage, are met.

Tips for Obtaining Affordable and Comprehensive Auto Insurance in Florida

Navigating the complex world of Auto Insurance FL can be challenging, but with the right approach, you can secure affordable and comprehensive coverage that meets your needs. Here are some expert tips to guide you through the process.

Compare Multiple Quotes

The insurance market in Florida is highly competitive, with numerous providers offering a wide range of coverage options. By comparing multiple quotes, you can identify the best value for your money. Consider using online quote comparison tools, but also reach out to individual insurers or brokers to explore all available options.

Understand Your Coverage Options

Florida offers a variety of coverage options, and it’s important to understand what each covers and the associated costs. While the minimum coverage requirements are a good starting point, consider your specific needs and circumstances. For instance, if you frequently drive in congested areas or have a history of accidents, comprehensive and collision coverage may be worth the investment.

Explore Discounts and Special Programs

Insurance providers in Florida often offer a variety of discounts and special programs to attract and retain customers. These can include discounts for safe driving records, multi-policy bundles (e.g., bundling auto and home insurance), and loyalty rewards. Additionally, some insurers offer discounts for specific professions or affiliations, such as teachers, military personnel, or members of certain organizations.

Consider Your Deductible

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it’s important to select a deductible that you can comfortably afford in the event of a claim. It’s a balance between saving on your monthly premium and being able to cover your deductible in an emergency.

Maintain a Clean Driving Record

Insurance providers reward safe driving with lower premiums. Maintain a clean driving record by avoiding accidents and traffic violations. A single at-fault accident or a speeding ticket can significantly increase your insurance rates, so it’s important to practice defensive driving and adhere to traffic laws.

Bundle Your Policies

If you have multiple insurance needs, such as auto, home, and life insurance, consider bundling your policies with the same insurer. Many insurers offer multi-policy discounts, which can significantly reduce your overall insurance costs. By consolidating your insurance needs, you can not only save money but also streamline your insurance management.

Shop Around Regularly

Insurance rates can change over time, and new providers may enter the market with competitive offers. It’s a good practice to shop around regularly, especially when your policy is up for renewal. This allows you to stay updated on the latest rates and coverage options, ensuring you’re always getting the best value for your insurance dollar.

What is the average cost of auto insurance in Florida?

+The average cost of auto insurance in Florida varies depending on several factors, including the driver’s age, gender, driving history, and the type of vehicle insured. According to recent data, the average annual premium in Florida is around 1,700, but this can range from as low as 1,200 to over $2,500 depending on the aforementioned factors and the specific coverage chosen.

Are there any ways to reduce my auto insurance premiums in Florida?

+Yes, there are several strategies to potentially reduce your auto insurance premiums in Florida. These include maintaining a clean driving record, bundling your policies with the same insurer, exploring discounts and special programs offered by insurance providers, and considering a higher deductible. It’s also important to regularly shop around for the best rates and coverage options.

What should I do if I’m involved in a car accident in Florida?

+If you’re involved in a car accident in Florida, it’s important to remain calm and follow these steps: first, ensure your safety and the safety of others involved; call the police to report the accident; exchange information with the other driver(s), including names, contact details, and insurance information; take photos of the accident scene and any damage to vehicles; and notify your insurance company as soon as possible to start the claims process.