Auto Insurance For Florida

Auto insurance is an essential aspect of responsible vehicle ownership, and in the state of Florida, it is not just a financial safeguard but a legal requirement. Florida is known for its unique insurance landscape, with a no-fault system that differs significantly from other states. Understanding the intricacies of auto insurance in Florida is crucial for residents to make informed decisions about their coverage and stay compliant with the law.

The Florida No-Fault Auto Insurance System

Florida operates under a no-fault insurance system, which means that regardless of who is at fault in an accident, each driver’s insurance policy will typically cover their own damages and medical expenses up to a certain limit. This system is designed to streamline the claims process and provide quicker access to benefits, but it also comes with some specific requirements and implications for policyholders.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a mandatory coverage in Florida auto insurance policies. PIP covers the policyholder and their passengers for medical expenses and lost wages resulting from an accident, regardless of fault. Florida requires a minimum PIP coverage of $10,000, but drivers can opt for higher limits to provide more comprehensive protection.

| PIP Coverage Levels | Limit |

|---|---|

| Minimum | $10,000 |

| Enhanced | $25,000 or $50,000 |

It's important to note that while PIP covers most medical expenses, there are certain treatments and services that may not be included. For example, chiropractic care has specific coverage limits, and massage therapy is typically not covered by PIP.

Property Damage Liability (PDL)

In addition to PIP, Florida drivers are required to carry Property Damage Liability (PDL) coverage. This coverage protects against claims made by others for damage to their property (vehicles, structures, etc.) caused by the policyholder’s vehicle. The minimum required PDL limit in Florida is $10,000.

| PDL Coverage Levels | Limit |

|---|---|

| Minimum | $10,000 |

| Enhanced | $25,000 or more |

Bodily Injury Liability (BIL)

Bodily Injury Liability (BIL) coverage is optional in Florida, but it provides crucial protection in the event that an accident results in injuries to others. BIL covers medical expenses, pain and suffering, and lost wages for individuals injured in an accident caused by the policyholder. The absence of mandatory BIL coverage in Florida can leave drivers vulnerable to significant out-of-pocket expenses in the event of a serious accident.

| BIL Coverage Levels | Limit |

|---|---|

| Minimum (Optional) | $10,000 per person / $20,000 per accident |

| Enhanced | $25,000 per person / $50,000 per accident or higher |

Understanding Coverage Limits and Deductibles

When choosing auto insurance in Florida, it’s crucial to understand the concept of coverage limits and deductibles. Coverage limits refer to the maximum amount an insurance policy will pay for a specific type of claim. For instance, if your PIP coverage limit is $10,000, that is the most your insurance company will pay for your medical expenses and lost wages after an accident.

Deductibles, on the other hand, are the amount you agree to pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible on your comprehensive coverage and your vehicle is damaged in a hailstorm, you'll need to pay the first $500 of repairs, and your insurance will cover the rest, up to your coverage limit.

Choosing the Right Coverage Limits

Selecting appropriate coverage limits is a critical decision. While higher limits provide more protection, they also come with higher premiums. It’s essential to strike a balance between affordability and adequate coverage. Here are some factors to consider when choosing your coverage limits:

- Your Financial Situation: Can you afford higher premiums for increased coverage, or would you prefer to keep costs down?

- Vehicle Value: If you drive an older, less valuable vehicle, you may not need as much coverage as someone with a newer, more expensive car.

- Driving Habits and Risk Factors: Do you frequently drive in high-risk areas or during hazardous weather conditions? If so, higher coverage limits might be beneficial.

- Personal Assets: If you have significant personal assets, you may want to consider higher coverage limits to protect them in the event of a serious accident.

The Role of Deductibles

Deductibles can significantly impact the cost of your insurance premiums. Typically, higher deductibles result in lower premiums, and vice versa. It’s a trade-off between paying more upfront in the event of a claim or paying higher premiums over time. Here are some considerations regarding deductibles:

- Frequency of Claims: If you rarely make insurance claims, opting for a higher deductible can save you money on premiums.

- Financial Planning: Ensure you have the means to cover a higher deductible if needed. Consider setting aside funds specifically for this purpose.

- Coverage Type: Some coverages, like comprehensive and collision, often have separate deductibles. Be aware of these when choosing your policy.

Additional Coverages and Add-Ons

Beyond the mandatory PIP and PDL coverages, Florida drivers have the option to enhance their auto insurance policies with additional coverages and add-ons. These can provide extra protection and peace of mind in various situations.

Collision Coverage

Collision coverage is an optional coverage that protects against damage to your vehicle in an accident, regardless of fault. This coverage is especially beneficial for drivers who lease or finance their vehicles, as it can help cover the cost of repairs or replacement if the vehicle is damaged beyond repair.

Comprehensive Coverage

Comprehensive coverage, also known as “other than collision” coverage, provides protection for damages caused by events other than collisions. This includes damage from natural disasters like hurricanes or floods, vandalism, theft, and even damage caused by animals. In Florida, where severe weather is a common occurrence, comprehensive coverage is particularly valuable.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

Uninsured/Underinsured Motorist Coverage is an optional coverage that provides protection in the event that you are involved in an accident with a driver who either has no insurance or does not have sufficient insurance to cover the damages. In Florida, where there is a high rate of uninsured drivers, UM/UIM coverage can be a crucial safeguard.

Roadside Assistance

Roadside assistance coverage offers peace of mind by providing services like towing, battery jumps, and flat tire changes. In a state as large as Florida, where travel distances can be significant, roadside assistance can be a valuable addition to your policy.

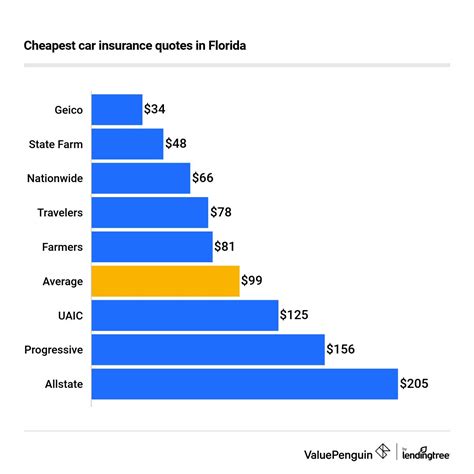

The Cost of Auto Insurance in Florida

The cost of auto insurance in Florida can vary significantly depending on several factors, including the type and amount of coverage chosen, the driver’s age and driving record, the make and model of the vehicle, and the specific location within the state. On average, Florida drivers can expect to pay around 1,500 to 2,000 annually for auto insurance. However, premiums can range from as low as a few hundred dollars to several thousand dollars, based on individual circumstances.

Factors Affecting Insurance Rates

Several key factors influence the cost of auto insurance in Florida. These include:

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower insurance rates. On the other hand, a history of accidents or moving violations can significantly increase premiums.

- Age and Gender: Younger drivers, particularly those under 25, often face higher insurance rates due to their perceived higher risk. Gender can also play a role, with some insurers charging slightly different rates based on gender.

- Vehicle Type: The make, model, and year of your vehicle can impact insurance rates. Luxury vehicles and sports cars, for example, tend to have higher insurance costs due to their higher repair and replacement costs.

- Location: Where you live and drive your vehicle can significantly affect your insurance rates. Urban areas with higher population density and a history of frequent claims often have higher insurance rates.

Strategies to Reduce Insurance Costs

While auto insurance is a necessary expense, there are strategies that Florida drivers can employ to potentially reduce their insurance costs:

- Maintain a Clean Driving Record: Avoid accidents and traffic violations. A clean driving record can lead to significant savings over time.

- Shop Around: Compare quotes from multiple insurance providers. Rates can vary significantly between companies, so shopping around can help you find the best deal.

- Consider Bundling Policies: If you have multiple insurance needs, such as auto, home, and life insurance, bundling these policies with the same provider can often result in discounted rates.

- Explore Discounts: Many insurance companies offer discounts for various reasons, such as safe driving, good grades (for young drivers), loyalty, and more. Ask your insurer about available discounts and how you can qualify.

The Future of Auto Insurance in Florida

The auto insurance landscape in Florida is continually evolving, influenced by technological advancements, changing regulations, and shifting market dynamics. Several key trends and developments are shaping the future of auto insurance in the state.

Telematics and Usage-Based Insurance

Telematics technology, which uses data from sensors and GPS devices to monitor driving behavior, is gaining traction in the insurance industry. Usage-based insurance programs, also known as pay-as-you-drive or pay-how-you-drive, use telematics data to tailor insurance rates based on individual driving habits. This technology has the potential to reward safe drivers with lower premiums.

Electric and Autonomous Vehicles

The increasing adoption of electric vehicles (EVs) and the emergence of autonomous vehicles (AVs) are likely to have a significant impact on auto insurance. EVs may lead to reduced insurance costs due to their enhanced safety features and lower repair costs. AVs, while still in their early stages, could potentially reduce accident rates, leading to lower insurance premiums over time.

Regulatory Changes

Florida’s insurance regulations are subject to change, and proposed reforms could significantly impact the auto insurance market. For example, there have been discussions about changing the no-fault system, which could lead to more comprehensive liability coverage requirements. Keeping up with potential regulatory changes is essential for Florida drivers to stay informed about potential shifts in their insurance landscape.

Digital Transformation

The digital transformation of the insurance industry is ongoing, with insurers increasingly leveraging technology to streamline processes, enhance customer experiences, and improve efficiency. This includes the use of artificial intelligence, machine learning, and digital tools for claims processing, policy management, and customer service. Florida drivers can expect to see continued innovation in these areas, making insurance interactions more convenient and efficient.

What happens if I get into an accident in Florida and the other driver is at fault but doesn’t have insurance?

+If you are involved in an accident with an uninsured driver, your own insurance policy’s Uninsured Motorist (UM) coverage may apply. This coverage protects you in cases where the at-fault driver doesn’t have insurance. However, it’s important to review your policy to understand the specific terms and limits of your UM coverage.

Are there any discounts available for Florida drivers who want to lower their auto insurance costs?

+Yes, there are various discounts that Florida drivers can take advantage of to reduce their insurance premiums. These may include safe driver discounts, multi-policy discounts (bundling auto insurance with other types of insurance), loyalty discounts, and discounts for completing defensive driving courses. It’s worth inquiring with your insurance provider to see what discounts you may qualify for.

How often should I review and update my auto insurance policy in Florida?

+It’s a good practice to review your auto insurance policy annually or whenever your circumstances change significantly. This could include changes in your driving habits, vehicle upgrades, marital status, or address. Regular reviews ensure that your coverage remains adequate and that you’re not overpaying for unnecessary coverage.