Auto Insurance Michigan

Auto insurance in Michigan is a complex and often misunderstood topic. With unique regulations and requirements, it's crucial to understand the ins and outs of this state's auto insurance landscape. In this comprehensive guide, we will delve into the specifics of Michigan auto insurance, providing you with valuable insights and information to navigate this crucial aspect of vehicle ownership.

The Distinctive Nature of Michigan Auto Insurance

Michigan stands out in the United States for its no-fault auto insurance system, which was introduced in 1973. This system ensures that drivers involved in accidents can access comprehensive coverage for medical expenses and other related costs, regardless of who is at fault. This unique approach has shaped the state’s auto insurance market and presents both advantages and challenges for policyholders.

One key aspect of Michigan's auto insurance is the mandatory Personal Injury Protection (PIP) coverage. PIP provides extensive medical coverage for policyholders and their passengers, as well as coverage for lost wages and replacement services. This coverage is crucial, as it ensures that those involved in accidents can receive the necessary medical attention and financial support during their recovery.

Understanding Coverage Requirements

Michigan law requires all registered vehicles to carry minimum liability coverage. This includes bodily injury liability coverage with limits of at least 20,000 per person and 40,000 per accident, as well as property damage liability coverage with a limit of $10,000. These minimum requirements ensure that drivers can cover the basic costs associated with accidents they cause.

However, it's important to note that these minimums may not provide sufficient protection in many situations. Michigan's no-fault system means that policyholders often incur significant medical expenses and other costs. Therefore, it is advisable to consider higher coverage limits to ensure adequate financial protection.

Personal Injury Protection (PIP) Coverage

As mentioned earlier, PIP coverage is a crucial component of Michigan auto insurance. It provides extensive benefits, including:

- Medical Expenses: Coverage for all necessary medical treatment, including doctor visits, hospital stays, prescription medications, and rehabilitation services.

- Lost Wages: Compensation for income lost due to injuries sustained in the accident.

- Replacement Services: Coverage for costs incurred when the policyholder or a household member cannot perform their usual tasks and needs to hire someone to take over those responsibilities.

- Survivor’s Benefits: In the unfortunate event of a policyholder’s death, PIP provides benefits to cover funeral and burial expenses and lost income for surviving dependents.

The extent of PIP coverage can vary based on policy options, with some policies offering unlimited coverage while others have set limits. It's essential to carefully review and understand the specifics of your PIP coverage to ensure it aligns with your needs.

Uninsured/Underinsured Motorist Coverage

Despite the state’s mandatory insurance laws, some drivers unfortunately operate vehicles without valid insurance. To protect against such instances, Michigan requires uninsured and underinsured motorist coverage. This coverage provides protection in the event of an accident caused by a driver who is uninsured or has insufficient insurance to cover the costs of the accident.

Uninsured motorist coverage typically includes bodily injury and property damage protection, while underinsured motorist coverage provides additional protection when the at-fault driver's insurance limits are insufficient to cover the full extent of the damages.

The Impact of Michigan’s No-Fault System

Michigan’s no-fault system has significant implications for auto insurance rates and claim processes. Here are some key aspects to consider:

Rates and Premiums

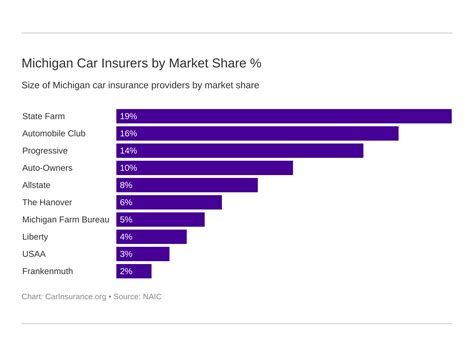

Michigan’s no-fault system can lead to higher auto insurance premiums compared to other states. This is due to the extensive coverage provided by PIP, which can result in higher claim costs for insurance companies. Factors such as the policyholder’s driving record, the type of vehicle insured, and the chosen coverage limits can also influence premium rates.

To ensure you are getting the best value for your insurance, it's crucial to compare quotes from multiple insurers and carefully review the coverage and exclusions in each policy.

Claim Process

In a no-fault state like Michigan, the claim process is designed to be straightforward and efficient. Policyholders typically file claims with their own insurance company, regardless of who is at fault in the accident. This process allows for quicker access to benefits and coverage, ensuring policyholders can receive the necessary medical treatment and financial support promptly.

It's important to note that Michigan's no-fault system does not eliminate the possibility of pursuing legal action against the at-fault driver. However, the claim process is primarily focused on providing coverage to policyholders, rather than assigning fault.

Tips for Navigating Michigan Auto Insurance

Here are some practical tips to help you navigate the complexities of Michigan auto insurance:

Shop Around

Compare quotes from multiple insurance companies to find the best coverage at the most competitive rates. Insurance rates can vary significantly between providers, so taking the time to shop around can lead to substantial savings.

Understand Your Coverage

Review your policy thoroughly to ensure you understand the coverage limits, exclusions, and benefits. This knowledge will help you make informed decisions about any additional coverage you may need.

Consider Higher Limits

Given the extensive medical expenses that can arise from accidents, it’s often advisable to opt for higher coverage limits. This ensures that you have adequate financial protection in the event of a serious accident.

Take Advantage of Discounts

Many insurance companies offer discounts for various factors, such as good driving records, safe vehicle features, and multi-policy discounts. Be sure to inquire about available discounts to reduce your insurance costs.

Maintain a Clean Driving Record

Your driving record plays a significant role in determining your insurance rates. By maintaining a clean record, you can often qualify for lower premiums and better coverage options.

Seek Professional Advice

If you have questions or concerns about your auto insurance coverage, don’t hesitate to consult with an insurance professional. They can provide personalized guidance based on your specific needs and circumstances.

Conclusion

Understanding Michigan’s unique auto insurance landscape is essential for vehicle owners in the state. By comprehending the coverage requirements, the impact of the no-fault system, and the various factors that influence premiums, you can make informed decisions to protect yourself and your finances.

Remember, auto insurance is a vital aspect of responsible vehicle ownership. By staying informed and proactive, you can ensure you have the coverage you need to navigate the roads of Michigan with confidence.

What is the average cost of auto insurance in Michigan?

+The average cost of auto insurance in Michigan can vary significantly depending on factors such as the policyholder’s driving record, the type of vehicle insured, and the coverage limits chosen. According to recent data, the average annual premium in Michigan is approximately $2,300. However, it’s important to note that rates can range from a few hundred dollars to several thousand dollars, so it’s crucial to compare quotes to find the best value.

Can I choose to have lower PIP coverage limits to reduce my premiums?

+Yes, Michigan law allows policyholders to choose between unlimited PIP coverage or limited PIP coverage with set dollar amounts. However, it’s important to carefully consider your options. Lower PIP limits may result in reduced premiums, but they may not provide sufficient coverage for extensive medical expenses. It’s advisable to consult with an insurance professional to determine the appropriate PIP coverage for your needs.

What happens if I’m involved in an accident with an uninsured driver in Michigan?

+If you’re involved in an accident with an uninsured driver in Michigan, your uninsured motorist coverage will come into play. This coverage provides protection for bodily injury and property damage, allowing you to recover compensation for your losses. It’s important to promptly report the accident to your insurance company and provide all necessary details to initiate the claims process.

Can I still pursue legal action against the at-fault driver in a no-fault state like Michigan?

+While Michigan’s no-fault system primarily focuses on providing coverage to policyholders, it does not eliminate the possibility of pursuing legal action against the at-fault driver. In certain situations, such as severe injuries or significant property damage, you may be able to file a lawsuit to seek additional compensation beyond what your insurance coverage provides. It’s advisable to consult with a legal professional to understand your rights and options in such cases.