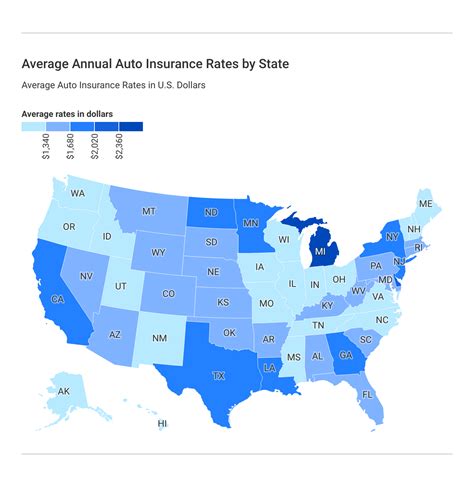

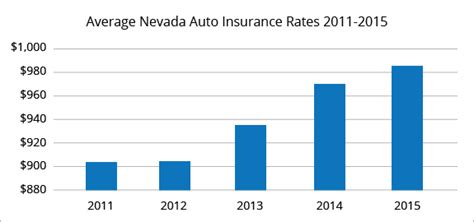

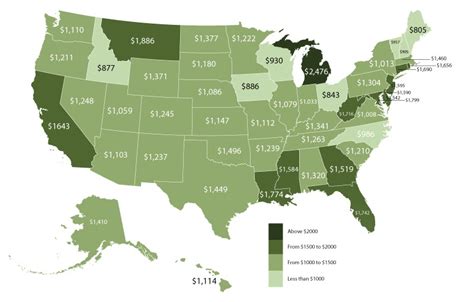

Auto Insurance Rates By State

When it comes to auto insurance, the rates you pay can vary significantly depending on your location. Each state in the US has its own unique set of factors that influence insurance premiums, creating a diverse landscape of rates across the country. Understanding these variations is crucial for drivers, as it can help them make informed decisions about their insurance coverage and potentially save money. This comprehensive guide delves into the key factors influencing auto insurance rates by state, offering insights and strategies to navigate this complex landscape.

The Complex Web of Factors Influencing Auto Insurance Rates

The cost of auto insurance is influenced by a multitude of factors, many of which are unique to each state. These include the state’s specific laws and regulations regarding insurance, the average cost of medical care, the frequency and cost of car accidents, and the prevalence of car theft and vandalism. Additionally, local weather conditions, road quality, and even the average credit score of residents can impact insurance rates.

Legal and Regulatory Landscape

Each state has its own set of laws and regulations governing auto insurance. These can include mandatory coverage requirements, no-fault versus tort liability systems, and various other rules that impact the cost of insurance. For instance, states with no-fault insurance systems often have higher premiums due to the complex and costly process of settling claims.

| State | Average Annual Premium | No-Fault System |

|---|---|---|

| Michigan | $2,663 | Yes |

| Florida | $1,840 | Yes |

| New York | $1,632 | Yes |

Cost of Living and Medical Care

The cost of living, and particularly the cost of medical care, plays a significant role in insurance rates. States with higher costs of living and medical expenses generally have higher insurance premiums, as these costs are often reflected in the price of insurance policies.

| State | Average Annual Premium | Cost of Living Index |

|---|---|---|

| Hawaii | $1,379 | 184.7 |

| California | $1,606 | 140.2 |

| New Jersey | $1,628 | 131.3 |

Accident and Crime Rates

The frequency and severity of car accidents, as well as the rates of car theft and vandalism, are major contributors to insurance rates. States with higher rates of these incidents typically have higher insurance premiums, as insurance companies must factor in the increased likelihood and cost of paying out claims.

| State | Average Annual Premium | Car Theft Rate |

|---|---|---|

| California | $1,606 | 5.21 per 1000 vehicles |

| Texas | $1,068 | 4.68 per 1000 vehicles |

| Florida | $1,840 | 4.51 per 1000 vehicles |

Demographics and Credit Scores

The demographics of a state, including the average age and credit score of residents, can also influence insurance rates. States with younger populations or lower average credit scores may see higher insurance premiums, as these factors are often correlated with higher risk and more frequent claims.

| State | Average Annual Premium | Average Credit Score |

|---|---|---|

| California | $1,606 | 685 |

| Texas | $1,068 | 670 |

| Florida | $1,840 | 648 |

Strategies for Navigating State-Specific Auto Insurance Rates

Understanding the factors that influence auto insurance rates is the first step towards making informed decisions about your coverage. Here are some strategies to consider when navigating state-specific insurance rates:

Shop Around and Compare Rates

Insurance rates can vary significantly between providers, even within the same state. It’s important to shop around and compare rates from multiple insurance companies to find the best deal. Online comparison tools can be a useful starting point, but it’s also beneficial to speak directly with insurance agents to understand the specific coverage and discounts offered.

Understand Your State’s Specific Factors

Each state has its own unique set of factors that influence insurance rates. By understanding these factors, you can better anticipate the cost of insurance and potentially negotiate better rates. For instance, if your state has a high cost of living but relatively low accident rates, you might be able to negotiate a lower premium by highlighting this discrepancy to your insurer.

Consider Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. This can be a cost-effective strategy, especially if you own both a home and a vehicle. Bundling policies can also simplify your insurance management, as you’ll only have one company and one bill to deal with.

Utilize Discounts and Special Programs

Insurance companies offer a wide range of discounts and special programs that can reduce your premium. These may include discounts for safe driving, loyalty rewards, or even educational achievements. Additionally, many states have special programs or incentives to encourage certain behaviors, such as safe driving or purchasing electric vehicles. Stay informed about these opportunities to potentially save on your insurance costs.

Maintain a Good Credit Score

Your credit score is a significant factor in determining your insurance premium. Generally, individuals with higher credit scores are considered lower risk and are offered lower insurance rates. Maintaining a good credit score can therefore lead to significant savings on your insurance policy. Regularly check your credit report and take steps to improve your score if necessary.

Conclusion

Navigating the complex landscape of auto insurance rates by state requires a deep understanding of the various factors at play. From legal and regulatory considerations to demographics and credit scores, each state presents a unique set of challenges and opportunities for drivers. By leveraging the strategies outlined in this guide, you can make informed decisions about your insurance coverage and potentially save money on your premiums.

What is the average cost of auto insurance in the US?

+

The average cost of auto insurance in the US is around $1,674 per year. However, this figure can vary significantly by state, with some states having much higher or lower averages.

Why do insurance rates vary so much between states?

+

Insurance rates vary between states due to a multitude of factors, including legal and regulatory differences, cost of living and medical care, accident and crime rates, and demographics. Each of these factors can significantly impact the cost of insurance, leading to the wide variation in rates across the country.

How can I lower my auto insurance rates?

+

There are several strategies you can employ to lower your auto insurance rates. These include shopping around and comparing rates, understanding your state’s specific factors and negotiating based on them, bundling policies, utilizing discounts and special programs, and maintaining a good credit score.

Are there any resources to help me understand my state’s insurance rates better?

+

Yes, there are several resources available to help you understand your state’s insurance rates better. These include state-specific insurance guides, online forums and communities where drivers share their experiences, and tools provided by insurance companies and comparison websites. Additionally, you can consult with a licensed insurance agent who can provide state-specific insights and advice.