Automobile Insurance Prices

Automobile insurance, a fundamental aspect of vehicle ownership, plays a pivotal role in protecting drivers and their assets on the road. With a myriad of factors influencing insurance prices, understanding this complex system is essential for every motorist. From geographic location to driving history, these elements collectively determine the cost of coverage, often leaving drivers with more questions than answers.

This in-depth exploration aims to demystify the intricate world of automobile insurance pricing, providing a comprehensive guide to help drivers navigate this essential yet often confusing aspect of vehicle ownership. By delving into the key factors, real-world examples, and industry insights, we aim to empower drivers with the knowledge to make informed decisions about their insurance coverage.

The Complex Web of Factors Affecting Insurance Prices

Automobile insurance prices are determined by a complex interplay of variables, each contributing uniquely to the overall cost of coverage. These factors are diverse, ranging from personal attributes like age and gender to external influences such as geographic location and the specific vehicle being insured. Understanding this intricate web is crucial for drivers to effectively navigate the insurance landscape and make informed choices.

Demographic Factors: Age and Gender

Age and gender are two fundamental demographic factors that significantly impact insurance prices. Statistics show that younger drivers, typically under the age of 25, are often charged higher premiums due to their relative inexperience behind the wheel. This trend is further supported by data indicating that this age group tends to be involved in a higher number of accidents, leading insurers to classify them as higher risk.

Similarly, gender plays a role in insurance pricing, with some insurers historically charging different rates for male and female drivers. However, this practice is becoming less common as many jurisdictions implement regulations prohibiting gender-based discrimination in insurance pricing. It's important to note that while these demographic factors can influence premiums, they are just one piece of the complex puzzle that is automobile insurance pricing.

Geographic Location: Regional Differences

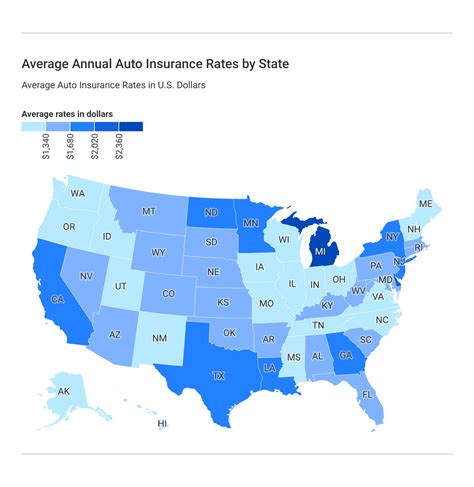

Geographic location is a key determinant in automobile insurance prices, with significant variations existing between different regions. Factors such as the population density, crime rates, and the frequency of natural disasters in a given area can all influence insurance costs. For instance, urban areas with higher populations often experience more frequent accidents and thefts, leading to increased insurance premiums.

In contrast, rural areas may enjoy lower insurance rates due to reduced traffic and a lower likelihood of accidents. However, it's important to note that these regional differences can vary greatly, even within the same state or country. As such, understanding the specific geographic factors at play in your area is crucial for accurately estimating insurance costs.

Vehicle Characteristics: Make, Model, and Usage

The characteristics of the vehicle being insured are another critical factor in determining insurance prices. Factors such as the make, model, and age of the vehicle can significantly impact premiums. For instance, sports cars and luxury vehicles are often associated with higher insurance costs due to their increased value and performance capabilities, which can lead to more severe accidents and higher repair costs.

Additionally, the intended use of the vehicle can also affect insurance rates. Commercial vehicles used for business purposes, for example, may require specialized coverage and thus incur higher premiums. Conversely, vehicles used primarily for pleasure or commuting may enjoy more competitive rates. Understanding how these vehicle-specific factors influence insurance costs is essential for drivers to accurately assess their coverage needs.

Driving History: A Record of Risk

A driver’s history behind the wheel is a critical factor in insurance pricing, providing insurers with a record of their risk profile. This history includes not only accidents and traffic violations but also the driver’s overall experience on the road. For instance, drivers with a clean record and extensive driving experience often enjoy lower premiums due to their demonstrated ability to avoid accidents and maintain a safe driving record.

Conversely, drivers with a history of accidents, especially those at fault, or multiple traffic violations are typically classified as higher risk and may face significantly higher insurance premiums. It's important to note that while a driver's history is a significant factor, it's not the sole determinant of insurance costs. Other factors, such as those mentioned above, also play a role in shaping the overall insurance landscape.

The Impact of Claims and Risk Assessment

The process of assessing risk and managing claims is at the heart of automobile insurance, shaping the very foundation of the industry. This intricate system, driven by data and statistical analysis, is designed to accurately predict and manage the financial risks associated with insuring vehicles and their drivers.

Understanding Risk Assessment Models

Insurance companies employ sophisticated risk assessment models to evaluate the likelihood of an insured individual filing a claim. These models consider a multitude of factors, including those discussed above, to assign a risk score to each policyholder. This score is then used to determine the premium the individual will pay for their insurance coverage.

For instance, a young driver with a history of traffic violations and accidents is likely to be classified as a high-risk driver, leading to higher premiums. Conversely, an older driver with a clean driving record and extensive experience on the road is likely to be classified as a low-risk driver, resulting in more competitive insurance rates. Understanding these risk assessment models is crucial for drivers to effectively navigate the insurance landscape and make informed decisions about their coverage.

The Role of Claims in Shaping Insurance Prices

Claims play a pivotal role in shaping insurance prices, serving as a key indicator of the financial risks associated with insuring a particular individual or vehicle. When an insured individual files a claim, the insurance company must cover the associated costs, which can range from minor repairs to significant medical expenses and property damage. The frequency and severity of these claims directly impact insurance prices, as they represent the actual costs that insurers must bear.

For example, a driver who frequently files claims for minor accidents is likely to face higher insurance premiums due to the increased financial burden they place on the insurer. Conversely, a driver who has never filed a claim may enjoy more competitive rates due to their demonstrated ability to avoid accidents and keep costs down. Understanding the impact of claims on insurance prices is essential for drivers to make informed decisions about their coverage and driving behavior.

Strategies for Managing Risk and Premiums

Drivers have the power to influence their insurance premiums by actively managing their risk profile and driving behavior. One effective strategy is to maintain a clean driving record by avoiding accidents and traffic violations. This not only reduces the likelihood of claims but also demonstrates a responsible driving attitude, which can lead to more competitive insurance rates.

Additionally, drivers can consider various coverage options and policy enhancements to further manage their premiums. For instance, opting for higher deductibles can reduce monthly premiums, as the insured individual assumes a larger portion of the financial risk. Similarly, bundling multiple policies, such as auto and home insurance, can often lead to significant discounts and more affordable overall coverage. By proactively managing their risk and exploring these strategies, drivers can take control of their insurance costs and find the coverage that best suits their needs and budget.

Navigating the Insurance Landscape: Tips and Insights

Understanding the intricate world of automobile insurance pricing is a complex but crucial task for every driver. With a myriad of factors influencing premiums, from demographic details to vehicle characteristics, it’s essential to have a comprehensive grasp of this landscape to make informed decisions about coverage.

Comparing Quotes: The Power of Research

One of the most effective strategies for securing competitive insurance rates is to conduct thorough research and compare quotes from multiple providers. By soliciting quotes from various insurers, drivers can gain a clearer understanding of the market rates for their specific circumstances and identify the most affordable options. This process not only empowers drivers to make informed choices but also encourages competition among insurers, driving down prices and improving overall service.

When comparing quotes, it's essential to consider not only the price but also the coverage offered. While a lower premium may be enticing, it's crucial to ensure that the policy provides adequate protection for your needs. This balance between price and coverage is a delicate one, and it's where the expertise of an insurance agent or broker can be invaluable. They can guide you through the process, helping you understand the nuances of different policies and ensuring you make the right choice for your situation.

Understanding Coverage: Beyond the Basics

Automobile insurance policies are intricate documents, offering a range of coverage options that extend beyond the basic liability coverage. These additional coverages, such as collision, comprehensive, and uninsured/underinsured motorist coverage, provide protection for a variety of scenarios, from accidents with uninsured drivers to damage caused by natural disasters.

Understanding these coverage options is crucial for drivers to ensure they have the protection they need. For instance, if you live in an area prone to severe weather, comprehensive coverage, which covers damage from events like hail or flooding, may be essential. Similarly, if you frequently drive in urban areas or on busy highways, uninsured/underinsured motorist coverage can provide a vital safety net, protecting you from the financial consequences of an accident with a driver who lacks sufficient insurance.

The Role of Deductibles and Policy Adjustments

Deductibles and policy adjustments are powerful tools that drivers can leverage to manage their insurance costs. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can significantly reduce your monthly premiums, as you’re assuming a larger portion of the financial risk. However, it’s crucial to ensure that you can afford the deductible in the event of a claim, as paying it is a requirement for accessing your insurance coverage.

Policy adjustments, such as increasing coverage limits or adding optional coverages, can also impact your premiums. While these adjustments may lead to higher costs, they can provide essential protection in specific situations. For instance, if you frequently drive long distances or in areas with high accident rates, increasing your liability coverage limits can provide vital financial protection in the event of an accident. Understanding these policy adjustments and their impact on your premiums is crucial for making informed decisions about your insurance coverage.

Expert Tips for Managing Insurance Costs

Navigating the complex world of automobile insurance pricing can be daunting, but with the right strategies and insights, drivers can effectively manage their insurance costs. Here are some expert tips to help you secure the best coverage at the most competitive rates:

- Shop Around: Don't settle for the first insurance quote you receive. Take the time to solicit quotes from multiple providers to ensure you're getting the best deal. Comparison shopping is a powerful tool that can help you identify the most affordable options and negotiate better rates.

- Bundle Policies: If you have multiple insurance needs, such as auto, home, and life insurance, consider bundling your policies with the same provider. Many insurers offer significant discounts for customers who bundle their policies, making this a cost-effective strategy for managing your insurance costs.

- Understand Your Coverage: Automobile insurance policies can be complex, with a range of coverage options and exclusions. Take the time to thoroughly understand your policy, including the types of coverage you have and the limits of those coverages. This knowledge will help you make informed decisions about your coverage needs and ensure you're adequately protected.

- Manage Your Risk Profile: Your risk profile, which includes factors like your driving history and credit score, plays a significant role in determining your insurance premiums. By maintaining a clean driving record and managing your credit responsibly, you can improve your risk profile and potentially secure more competitive insurance rates.

- Explore Discounts: Many insurers offer a variety of discounts, from safe driver discounts to discounts for certain professions or affiliations. Take the time to research and understand the discounts you may be eligible for, and don't hesitate to ask your insurance provider about these opportunities. These discounts can significantly reduce your insurance costs and make your coverage more affordable.

The Future of Automobile Insurance: Technological Innovations

The automobile insurance industry is on the cusp of significant transformation, driven by rapid technological advancements and evolving consumer expectations. These changes are reshaping the way insurance is priced, purchased, and delivered, offering new opportunities for both insurers and policyholders alike.

The Rise of Telematics and Usage-Based Insurance

Telematics, the integration of telecommunications and informatics, is revolutionizing the automobile insurance industry with the introduction of usage-based insurance (UBI) models. These innovative policies, also known as pay-as-you-drive or pay-how-you-drive insurance, use telematics devices to collect real-time data on driving behavior, such as miles driven, driving speed, and acceleration and braking patterns. This data is then used to calculate insurance premiums, offering a more accurate and personalized pricing model.

For instance, a driver who primarily uses their vehicle for short, local trips may be classified as a lower risk and enjoy more competitive insurance rates. Conversely, a driver who frequently travels long distances or drives aggressively may be considered higher risk and face higher premiums. This shift towards UBI models not only provides a more accurate assessment of risk but also incentivizes safer driving behaviors, leading to improved road safety overall.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are transforming the automobile insurance landscape, enabling insurers to make more informed decisions and deliver personalized services. These technologies are used to analyze vast amounts of data, including driving behavior, claims history, and demographic information, to identify patterns and trends that can influence insurance pricing and risk management strategies.

For example, AI algorithms can analyze driving behavior data collected from telematics devices to identify high-risk driving behaviors, such as aggressive acceleration or frequent hard braking. This information can then be used to develop targeted interventions, such as driver education programs or incentives for safer driving, to mitigate risks and reduce insurance costs. Additionally, AI-powered chatbots and virtual assistants are enhancing customer service, providing real-time assistance and streamlining the insurance claims process.

Blockchain and Smart Contracts

Blockchain technology is revolutionizing the insurance industry by introducing smart contracts, self-executing contracts that automatically enforce the terms of an agreement. In the context of automobile insurance, smart contracts can streamline the claims process, reducing the time and resources required to settle claims. For instance, a smart contract can automatically trigger the payment of an insurance claim when certain conditions, such as a verified accident report or repair estimate, are met.

Additionally, blockchain technology can enhance data security and transparency in the insurance industry. By storing data on a distributed ledger, blockchain provides a secure and tamper-proof record of transactions, including insurance policies, claims, and payments. This increased transparency can build trust between insurers and policyholders, improve fraud detection, and enhance overall efficiency in the insurance ecosystem.

The Impact of Electric Vehicles and Autonomous Driving

The rapid adoption of electric vehicles (EVs) and the emergence of autonomous driving technologies are poised to have a significant impact on the automobile insurance industry. EVs, with their advanced safety features and lower risk of certain types of accidents, may lead to reduced insurance premiums for their owners. Additionally, the widespread adoption of autonomous driving technologies, which can significantly reduce accidents caused by human error, may further drive down insurance costs across the board.

However, the introduction of these new technologies also presents challenges for the insurance industry. For instance, the complex liability issues surrounding autonomous driving accidents and the potential for new types of insurance fraud associated with EVs and autonomous vehicles require careful consideration and innovative solutions. Insurers must adapt their risk assessment models and policies to address these emerging risks, ensuring they remain relevant and competitive in this rapidly evolving landscape.

How do I find the best automobile insurance rates for my needs?

+To find the best automobile insurance rates, it’s essential to compare quotes from multiple providers. Consider not only the price but also the coverage offered. Understand your coverage needs and shop around to identify the most competitive rates. Additionally, explore discounts and policy adjustments to further manage your insurance costs.

What factors influence automobile insurance prices?

+A multitude of factors influence automobile insurance prices, including demographic details like age and gender, geographic location, vehicle characteristics, and driving history. These factors collectively shape an individual’s risk profile, which insurers use to determine insurance premiums.

How do I manage my automobile insurance costs effectively?

+To manage your automobile insurance costs, consider strategies such as comparing quotes from multiple providers, bundling policies, understanding your coverage needs, managing your risk profile, and exploring available discounts. These strategies can help you secure the coverage you need at a price you can afford.

What is usage-based insurance, and how does it work?

+Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, uses telematics devices to collect real-time