Average Cost Of Full Coverage Car Insurance

In the world of automotive insurance, the term "full coverage" is often used to describe a comprehensive policy that includes both liability and collision coverage. However, the cost of full coverage car insurance can vary significantly depending on numerous factors, making it essential to understand the nuances of this type of insurance. This article aims to delve into the factors influencing the average cost of full coverage car insurance, providing a comprehensive guide for individuals seeking to protect their vehicles and finances.

Understanding Full Coverage Car Insurance

Full coverage car insurance is a comprehensive policy that offers protection for a vehicle in a variety of situations. It typically includes two main components: liability coverage and collision coverage, along with other optional add-ons.

Liability Coverage

Liability coverage is a crucial aspect of any car insurance policy. It provides financial protection in the event that the policyholder is found at fault in an accident, covering the costs associated with property damage, medical expenses, and other losses incurred by the other party involved in the accident. This coverage is mandatory in most states and is designed to protect the policyholder from potentially devastating financial consequences.

Collision Coverage

Collision coverage, on the other hand, is an optional coverage that provides protection for the policyholder’s vehicle in the event of a collision. This coverage pays for repairs or replacements needed after an accident, regardless of who is at fault. Collision coverage is particularly beneficial for newer or more valuable vehicles, as it ensures that the policyholder can restore their vehicle to its pre-accident condition.

Factors Influencing the Cost of Full Coverage

The cost of full coverage car insurance is influenced by a multitude of factors, each playing a significant role in determining the final premium. Understanding these factors can help individuals make informed decisions when selecting their insurance coverage.

Vehicle Type and Age

The type and age of the vehicle being insured are key factors in determining the cost of full coverage. Newer vehicles, especially those with advanced safety features, may be eligible for lower premiums due to their reduced risk of accidents and lower repair costs. Conversely, older vehicles may have higher premiums, as they are more susceptible to mechanical issues and may require more extensive repairs.

Driving Record and History

An individual’s driving record is a crucial factor in insurance pricing. A clean driving record with no accidents or traffic violations can lead to lower premiums, as it indicates a lower risk of future claims. On the other hand, a history of accidents or traffic violations can significantly increase insurance costs, as these events suggest a higher likelihood of future claims.

Location and Usage

The location where the vehicle is primarily driven and the purpose of its usage can also impact insurance costs. Areas with higher rates of accidents, theft, or vandalism may have higher insurance premiums. Additionally, vehicles used for business purposes or those driven frequently in high-traffic areas may be considered higher risk, leading to increased premiums.

Insurance Company and Policy Options

The choice of insurance company and the specific policy options selected can greatly affect the cost of full coverage. Different insurance providers offer varying rates and policy features, so it’s essential to compare quotes from multiple companies. Additionally, policyholders can customize their coverage by adding or removing optional features, such as rental car coverage or roadside assistance, which can impact the overall cost.

Average Cost of Full Coverage Car Insurance

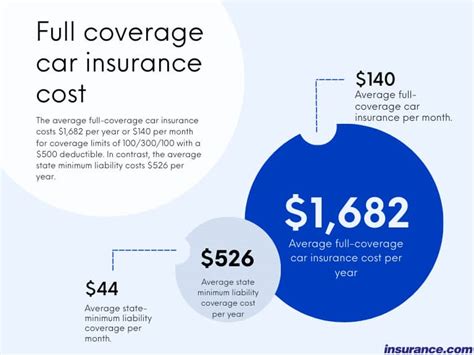

Determining an exact average cost for full coverage car insurance is challenging due to the multitude of factors involved. However, industry data provides some insights into the range of premiums that policyholders can expect.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability Only | $500 - $1,500 |

| Full Coverage (Liability + Collision) | $1,000 - $3,000 |

It's important to note that these averages are just a rough guide, and actual premiums can vary significantly based on individual circumstances. Additionally, factors such as discounts, deductibles, and optional coverages can further impact the cost of full coverage car insurance.

Tips for Reducing Full Coverage Insurance Costs

While full coverage car insurance is essential for comprehensive protection, the cost can sometimes be a burden. Here are some strategies to help reduce insurance premiums without compromising coverage:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates. Online comparison tools can be a valuable resource for this.

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance.

- Increase Deductibles: Opting for a higher deductible can lower your premium, but ensure that you can afford the deductible in the event of a claim.

- Take Advantage of Discounts: Many insurers offer discounts for safe driving, good student status, senior citizens, or loyalty. Ask your insurer about available discounts.

- Maintain a Clean Driving Record: A clean driving record can lead to significant savings on insurance premiums. Avoid accidents and traffic violations to keep your record clear.

Conclusion

Full coverage car insurance is a vital aspect of financial protection for vehicle owners. By understanding the factors that influence insurance costs and taking steps to reduce premiums, individuals can ensure that they have the necessary coverage without straining their budgets. Remember, when selecting insurance, it’s crucial to strike a balance between cost and comprehensive coverage to safeguard your vehicle and your finances.

Frequently Asked Questions

What is the difference between full coverage and liability-only car insurance?

+

Full coverage car insurance includes both liability coverage and collision coverage, providing protection for the policyholder’s vehicle and financial liability in case of an accident. Liability-only insurance, on the other hand, covers only the financial liability, leaving the policyholder responsible for any damage to their own vehicle.

Are there any ways to get full coverage car insurance for cheaper rates?

+

Yes, there are several strategies to reduce full coverage car insurance premiums. These include shopping around for quotes, bundling policies, increasing deductibles, maintaining a clean driving record, and taking advantage of available discounts.

What factors can cause my full coverage car insurance premium to increase over time?

+

Full coverage car insurance premiums can increase due to various factors, including changes in your driving record (such as accidents or traffic violations), increases in the cost of repairs or replacement parts, and changes in your personal circumstances (such as a move to a higher-risk area or an increase in the value of your vehicle).

Is full coverage car insurance worth the cost for an older vehicle?

+

The value of full coverage car insurance for an older vehicle depends on various factors, including the make and model of the vehicle, its current market value, and your personal financial situation. In some cases, the cost of full coverage insurance may outweigh the potential benefits, especially if the vehicle is older and has a lower market value. In such cases, liability-only insurance may be a more cost-effective option.