Average Vehicle Insurance Cost

Vehicle insurance, often referred to as auto insurance or car insurance, is a crucial aspect of vehicle ownership. It provides financial protection against various risks and liabilities associated with owning and operating a motor vehicle. The cost of vehicle insurance can vary significantly depending on several factors, including the type of coverage, the driver's profile, and regional variations. Understanding the average cost of vehicle insurance is essential for both new and experienced drivers to make informed decisions when choosing an insurance policy.

Factors Influencing Vehicle Insurance Costs

The price of vehicle insurance is influenced by a multitude of factors, each contributing to the overall cost. Here’s an in-depth look at some of the key factors:

Coverage Options and Limits

The type of coverage you select plays a significant role in determining the cost of your vehicle insurance. Different coverage options, such as liability-only, comprehensive, collision, and personal injury protection (PIP), offer varying levels of protection. The more comprehensive the coverage, the higher the premium is likely to be. Additionally, the coverage limits you choose, such as the maximum amount your insurer will pay for property damage or medical expenses, can impact the cost.

Driver’s Profile and History

Your personal driving record and history are crucial factors in vehicle insurance pricing. Insurance companies assess your risk profile based on factors like age, gender, driving experience, and claims history. Young drivers, especially males under the age of 25, are often considered high-risk due to their higher propensity for accidents. Similarly, drivers with a history of accidents or traffic violations may face higher premiums. On the other hand, safe drivers with clean records can often qualify for discounts.

Vehicle Type and Usage

The make, model, and year of your vehicle can significantly influence the cost of insurance. High-performance sports cars, luxury vehicles, and SUVs often come with higher insurance premiums due to their higher repair costs and increased risk of accidents. Additionally, the primary purpose of using the vehicle, such as commuting, business travel, or pleasure driving, can impact the insurance rate. Vehicles used for business purposes or as part of a fleet may require specialized coverage, resulting in higher costs.

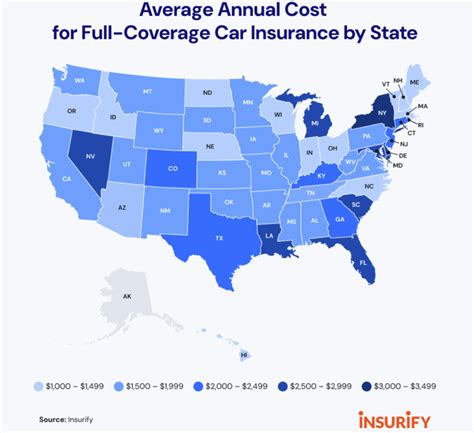

Regional Differences

Vehicle insurance rates can vary considerably from one region to another, even within the same country. Factors such as traffic density, crime rates, and weather conditions can influence insurance costs. Areas with a higher incidence of accidents, thefts, or natural disasters may experience higher insurance rates. Moreover, the availability of medical facilities and repair shops can also impact the cost of insurance, as these factors affect the potential payout in the event of an accident.

| Region | Average Annual Premium |

|---|---|

| Urban Areas | $1,500 - $2,000 |

| Suburban Areas | $1,200 - $1,800 |

| Rural Areas | $800 - $1,500 |

Average Vehicle Insurance Costs by Coverage Type

The average cost of vehicle insurance varies depending on the coverage type chosen. Here’s a breakdown of average premiums for different coverage options:

Liability-Only Coverage

Liability-only coverage is the most basic form of vehicle insurance, providing protection against bodily injury and property damage claims made against you. It does not cover damage to your own vehicle or personal injury protection. The average annual premium for liability-only coverage ranges from 500 to 1,000, depending on the driver’s profile and regional factors.

Comprehensive Coverage

Comprehensive coverage, also known as full coverage, provides the most extensive protection. It includes liability coverage, collision coverage (which covers damage to your vehicle in an accident), and additional coverages like personal injury protection (PIP), medical payments coverage, and uninsured/underinsured motorist coverage. The average annual premium for comprehensive coverage ranges from 1,000 to 2,500, with variations based on the driver’s profile and vehicle type.

Collision Coverage

Collision coverage is a crucial component of comprehensive coverage, providing protection for damage to your vehicle in the event of an accident, regardless of fault. The average annual premium for collision coverage alone ranges from 500 to 1,200, depending on the driver’s profile and the value of the insured vehicle.

Personal Injury Protection (PIP) Coverage

Personal Injury Protection (PIP) coverage, also known as no-fault insurance, provides medical coverage for the insured driver and passengers, regardless of who is at fault in an accident. It covers medical expenses, lost wages, and other related costs. The average annual premium for PIP coverage varies widely, ranging from 200 to 1,000, depending on the state’s laws and the level of coverage chosen.

Tips for Reducing Vehicle Insurance Costs

While vehicle insurance is a necessary expense, there are strategies to reduce the cost of your policy. Here are some tips to consider:

- Shop around and compare quotes from multiple insurance providers to find the best rates.

- Consider increasing your deductible, as this can lower your premium, but ensure you can afford the out-of-pocket expense in the event of a claim.

- Maintain a clean driving record and avoid accidents and traffic violations, as this can lead to higher premiums.

- Take advantage of discounts offered by insurance companies, such as safe driver discounts, good student discounts, or multi-policy discounts.

- Consider bundling your vehicle insurance with other types of insurance, such as home or renters insurance, to potentially save on premiums.

- Review your coverage annually and adjust it based on changes in your circumstances, such as a change in vehicle or driving habits.

Understanding Deductibles and Policy Limits

When selecting a vehicle insurance policy, it’s essential to understand the concept of deductibles and policy limits. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, as you are assuming more financial responsibility. Policy limits, on the other hand, refer to the maximum amount your insurance company will pay for a covered claim.

It's crucial to choose deductibles and policy limits that align with your financial capabilities and the level of protection you require. While higher deductibles can save you money in the short term, they may leave you financially vulnerable in the event of a significant accident or loss. Similarly, policy limits that are too low may not provide adequate coverage for serious accidents or injuries.

The Future of Vehicle Insurance

The vehicle insurance industry is evolving rapidly, driven by technological advancements and changing consumer needs. One notable trend is the increasing adoption of usage-based insurance (UBI) models. These models use telematics devices or smartphone apps to track driving behavior, rewarding safe drivers with lower premiums. UBI models provide a more personalized insurance experience and can encourage safer driving habits.

Additionally, the rise of electric vehicles (EVs) and autonomous driving technologies is expected to impact the vehicle insurance landscape. EVs may present unique challenges in terms of repair costs and availability of replacement parts, potentially affecting insurance rates. Autonomous vehicles, while promising safer roads, may also raise questions about liability and the need for specialized coverage.

As the industry adapts to these changes, insurance providers will likely develop innovative products and services to meet the evolving needs of vehicle owners. This could include tailored coverage options for EV owners, specialized policies for autonomous vehicles, and further integration of technology into the insurance process.

How do I choose the right vehicle insurance coverage for my needs?

+

Choosing the right coverage involves assessing your specific needs and circumstances. Consider factors such as the value of your vehicle, your financial ability to cover repairs or medical expenses, and the level of protection you desire. It’s advisable to consult with insurance professionals and obtain multiple quotes to make an informed decision.

Are there any government regulations that impact vehicle insurance costs?

+

Yes, government regulations play a significant role in vehicle insurance costs. For instance, some states require minimum liability coverage limits, which can impact the cost of insurance. Additionally, laws regarding no-fault insurance, uninsured motorist coverage, and other mandatory coverages can influence the overall cost of insurance policies.

What are some common misconceptions about vehicle insurance costs?

+

One common misconception is that vehicle insurance is a fixed expense that cannot be influenced by personal factors. In reality, your driving behavior, vehicle choice, and insurance history can significantly impact your premiums. Additionally, the belief that insurance companies are all the same can lead to missed opportunities for cost savings. It’s important to shop around and compare policies to find the best value.