Basic Car Insurance Coverage

Understanding basic car insurance coverage is essential for every vehicle owner. This type of insurance provides a safety net, protecting you from financial losses in the event of an accident, theft, or other unforeseen circumstances. While it may not cover all eventualities, it offers a crucial foundation for protecting your vehicle and, more importantly, yourself and others on the road. In this article, we will delve into the specifics of basic car insurance coverage, exploring its components, benefits, and limitations to help you make informed decisions about your insurance needs.

The Essentials of Basic Car Insurance

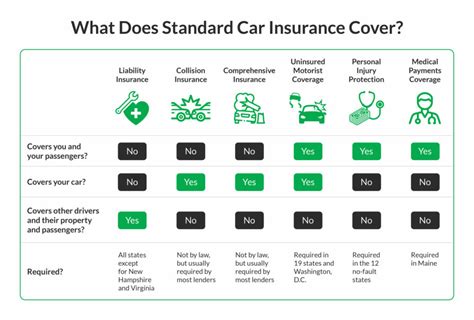

Basic car insurance, often referred to as liability coverage, is the minimum level of insurance required by law in most states. It’s designed to cover the costs associated with bodily injury and property damage that you might cause to others in an accident. This coverage is crucial as it helps protect you from significant financial liability in the event of an at-fault accident. While the specifics can vary by state and insurance provider, basic car insurance typically includes the following key components:

Bodily Injury Liability

This coverage pays for the medical expenses and lost wages of individuals injured in an accident caused by you. It also covers legal fees and settlements if you’re sued as a result of the accident. The limits for bodily injury liability are usually expressed as a combination of per-person and per-accident amounts, such as 100,000 per person / 300,000 per accident. It’s important to note that bodily injury liability doesn’t cover your own injuries or those of passengers in your vehicle.

Property Damage Liability

Property damage liability coverage steps in to repair or replace damaged property belonging to others, such as another vehicle, a fence, or even a building. The coverage limit for property damage is typically a single amount, like $50,000. Similar to bodily injury liability, this coverage doesn’t extend to your own vehicle.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages of injured individuals (not your own passengers) |

| Property Damage Liability | Repairs or replaces damaged property of others, excluding your own vehicle |

Limitations and Additional Considerations

While basic car insurance provides a vital level of protection, it has certain limitations that are important to be aware of. Firstly, as mentioned, it doesn’t cover damage to your own vehicle or injuries to yourself or your passengers. This means that if you’re involved in an at-fault accident, you’ll need to rely on other types of coverage or pay out of pocket for repairs and medical expenses.

Secondly, the liability limits of basic car insurance might not always be sufficient. If you cause an accident resulting in severe injuries or extensive property damage, the costs can quickly exceed the limits of your policy. In such cases, you could be personally liable for the remaining amount, which could be substantial. Therefore, it's advisable to carefully consider your coverage limits and opt for higher limits if your budget allows.

Additionally, basic car insurance typically doesn't include coverage for comprehensive and collision damages. Comprehensive coverage protects against non-collision incidents like theft, vandalism, natural disasters, and animal collisions, while collision coverage pays for repairs to your vehicle after an accident, regardless of fault. If you own a newer vehicle or have a loan or lease on your car, it's often recommended to consider adding these coverages to your policy to ensure comprehensive protection.

Exploring Optional Add-Ons

Depending on your specific needs and circumstances, there are several optional coverages you might consider adding to your basic car insurance policy. These include:

- Medical Payments Coverage (MedPay): Covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the damages.

- Personal Injury Protection (PIP): Similar to MedPay, PIP covers medical expenses and lost wages for you and your passengers, but it also includes additional benefits like funeral expenses and rehabilitation costs.

- Rental Car Reimbursement: Offers coverage for rental car expenses if your vehicle is being repaired after an insured accident.

- Gap Insurance: Helps cover the difference between what your insurance pays and what you owe on your car loan or lease if your vehicle is totaled.

It's crucial to carefully assess your needs and budget when deciding on optional coverages. While they can provide additional peace of mind and protection, they also come at an added cost. Consulting with an insurance professional can help you strike the right balance between coverage and affordability.

Factors Affecting Basic Car Insurance Premiums

The cost of basic car insurance can vary significantly based on several factors. These include your driving record, the type of vehicle you own, your age and gender, the area where you live and drive, and even your credit score. For instance, drivers with a clean record and a history of safe driving typically enjoy lower premiums compared to those with multiple violations or accidents.

Additionally, the make, model, and year of your vehicle can impact your premiums. Newer, more expensive vehicles generally require higher coverage limits, which can increase the cost of insurance. Similarly, vehicles that are more commonly involved in accidents or are targets for theft might also lead to higher premiums.

The area where you live and drive also plays a role. Insurance companies consider factors like the local crime rate, the frequency of accidents, and the cost of labor and parts in your area when determining premiums. Furthermore, your credit score can be a significant factor in some states, with a higher credit score often resulting in lower insurance costs.

Tips for Lowering Your Basic Car Insurance Premiums

- Maintain a clean driving record. Avoid traffic violations and at-fault accidents to keep your premiums low.

- Compare quotes from multiple insurance providers to find the best rates for your specific circumstances.

- Consider increasing your deductible. A higher deductible can lead to lower premiums, but it’s important to ensure you can afford the deductible in the event of a claim.

- Explore discounts. Many insurance companies offer discounts for safe driving, good grades (for young drivers), loyalty, and more.

- Keep your vehicle well-maintained. Regular maintenance can help prevent unexpected breakdowns and accidents, reducing the likelihood of claims.

Remember, while it's important to keep costs down, ensuring you have adequate coverage is paramount. Basic car insurance is a legal requirement, but it's also a critical aspect of financial responsibility and safety on the road.

What is the average cost of basic car insurance?

+The average cost of basic car insurance can vary widely based on numerous factors, including the state you live in, your driving record, and the type of vehicle you own. On average, drivers in the United States pay around 500 to 1,500 per year for basic liability coverage. However, this range can be significantly higher or lower depending on individual circumstances.

Do I need basic car insurance if I own an old, inexpensive vehicle?

+Yes, basic car insurance is typically required by law, regardless of the age or value of your vehicle. While an older vehicle might not require as extensive coverage as a newer, more expensive one, liability coverage is crucial to protect you financially in the event of an accident.

Can I get basic car insurance without a driver’s license?

+In most cases, you will need a valid driver’s license to obtain car insurance. However, there may be exceptions for individuals who own a vehicle but don’t drive, such as collectors or those with a disabled family member who uses a specially equipped vehicle. It’s best to consult with an insurance professional to understand your options.