Best Affordable Insurance

In today's world, insurance is an essential aspect of financial planning and risk management. It provides individuals and businesses with a safety net, offering protection and peace of mind. However, finding the best affordable insurance options can be a daunting task, especially with the vast array of providers and policies available. This comprehensive guide aims to explore the world of affordable insurance, delving into various aspects to help you make informed decisions and secure the coverage you need without breaking the bank.

Understanding Affordable Insurance

Affordable insurance is not merely about finding the cheapest policy; it involves a thoughtful balance between cost and coverage. It is essential to recognize that the most affordable option might not always align with your specific needs and circumstances. To make an informed decision, you must consider a range of factors, including your personal or business requirements, the level of coverage desired, and, of course, your budget.

The insurance landscape is vast, offering a myriad of policies catering to different needs. From health and life insurance to property and liability coverage, each type serves a unique purpose. Let's delve deeper into some of these categories and explore the affordable options within each.

Health Insurance: Covering Your Well-being

Health insurance is a cornerstone of personal financial security. It ensures that you have access to necessary medical care without incurring crippling expenses. When it comes to affordable health insurance, there are several key considerations:

Public vs. Private Insurance

Public health insurance plans, often government-funded, are a cost-effective option for many. These plans typically have lower premiums and offer a range of benefits, including coverage for hospital stays, prescription medications, and sometimes even dental and vision care. Examples of public health insurance include Medicaid and Children's Health Insurance Program (CHIP) in the United States.

Private health insurance, on the other hand, provides more flexibility and often a broader network of healthcare providers. While premiums can be higher, private plans may offer additional benefits like coverage for alternative therapies or specialized treatments. Some popular private health insurance providers include Blue Cross Blue Shield and UnitedHealthcare.

Discounted Health Plans

Discounted health plans, such as Dental and Vision Discount Plans, provide access to reduced-cost services without the traditional insurance model. These plans often include a network of providers offering services at discounted rates, making them an affordable option for those who don't require extensive medical coverage.

Health Insurance Premium Factors

The cost of health insurance premiums can vary significantly based on several factors. Age is a primary consideration, with younger individuals often paying lower premiums. Additionally, the level of coverage chosen (e.g., bronze, silver, gold) and the inclusion of family members can impact the overall cost. Understanding these factors can help you tailor your health insurance plan to your budget.

Life Insurance: Securing Your Legacy

Life insurance is an essential tool for protecting your loved ones' financial well-being in the event of your untimely passing. While it might not be the most pleasant topic to discuss, having adequate life insurance coverage is a responsible financial decision. Let's explore the affordable options in this realm:

Term Life Insurance

Term life insurance is often the most affordable option for those seeking straightforward coverage. It provides protection for a specific period, typically 10, 20, or 30 years. If the insured individual passes away during the term, the beneficiaries receive a payout. The beauty of term life insurance is its simplicity and affordability, making it an excellent choice for those on a budget.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers coverage for the insured's entire life. While more expensive than term life, it provides a death benefit guarantee and often includes a cash value component that can be borrowed against or withdrawn. This type of insurance is suitable for those seeking long-term coverage and the potential for tax-advantaged savings.

Simplified Issue Life Insurance

Simplified issue life insurance is a unique offering that requires no medical exam, making it an attractive option for those with health concerns. The application process is straightforward, and coverage is often approved within a few days. However, it's important to note that the premiums for simplified issue policies are typically higher than those for traditional life insurance plans.

Property and Casualty Insurance: Protecting Your Assets

Property and casualty insurance is crucial for safeguarding your personal or business assets against various risks, including theft, fire, and natural disasters. Here's a closer look at the affordable options within this category:

Homeowners Insurance

Homeowners insurance is a must-have for those who own a home. It provides coverage for the structure itself and often includes personal liability protection. When seeking affordable homeowners insurance, it's beneficial to shop around and compare quotes from multiple providers. Additionally, consider bundling your home and auto insurance policies to potentially save on premiums.

| Insurance Provider | Average Annual Premium |

|---|---|

| State Farm | $1,024 |

| Allstate | $1,255 |

| Farmers | $1,162 |

Renters Insurance

Renters insurance is an affordable way for tenants to protect their personal belongings and liability. It covers losses due to fire, theft, or other covered perils. The cost of renters insurance varies based on the value of the belongings insured and the location of the rental property. On average, renters insurance can cost as little as a few hundred dollars annually.

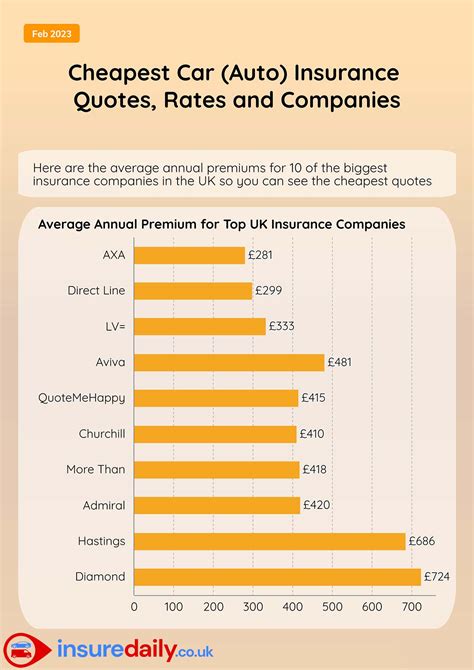

Auto Insurance

Auto insurance is mandatory in most states, and finding an affordable policy is crucial for many drivers. When shopping for auto insurance, consider the following tips to keep costs down:

- Compare quotes from multiple providers.

- Increase your deductible to lower premiums.

- Maintain a clean driving record.

- Bundle your auto insurance with other policies.

- Explore discounts for safe driving or vehicle safety features.

Liability Insurance: Shielding Your Legal Responsibilities

Liability insurance is a critical component of risk management, especially for businesses. It protects you from financial losses arising from lawsuits and claims. Here's a look at some affordable liability insurance options:

General Liability Insurance

General liability insurance is a fundamental coverage for businesses, protecting them against third-party claims for bodily injury, property damage, and personal and advertising injury. For small businesses, the cost of general liability insurance can be as low as a few hundred dollars per year. However, the specific premium will depend on the nature of the business and its risk profile.

Professional Liability Insurance

Also known as errors and omissions (E&O) insurance, professional liability insurance is tailored for professionals like accountants, consultants, and real estate agents. It provides coverage for claims arising from negligent acts, errors, or omissions in the course of business. The cost of professional liability insurance varies based on the professional's industry and the limits of liability chosen.

Product Liability Insurance

Product liability insurance is essential for businesses that manufacture, distribute, or sell products. It covers the business against claims resulting from defective products that cause harm to consumers. The cost of product liability insurance depends on the nature of the products and the size of the business. For small businesses with low-risk products, premiums can start as low as a few hundred dollars annually.

The Role of Insurance Brokers

Insurance brokers play a vital role in helping individuals and businesses find the best affordable insurance options. These professionals have a deep understanding of the insurance market and can provide valuable guidance. Here's how an insurance broker can assist you:

- Comparing Policies: Brokers have access to a wide range of insurance providers and can compare policies to find the best fit for your needs.

- Negotiating Premiums: They can negotiate with insurance companies to secure the most competitive rates, potentially saving you money.

- Tailored Advice: Brokers provide personalized advice based on your unique circumstances, ensuring you have the right coverage without overspending.

- Claims Assistance: In the event of a claim, brokers can guide you through the process, ensuring a smoother and more efficient resolution.

Future of Affordable Insurance

The insurance industry is evolving, and the future holds exciting prospects for affordable coverage. With the rise of digital technology, insurance providers are leveraging data analytics and artificial intelligence to offer more tailored and cost-effective policies. Here are some trends to watch:

Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-go or pay-per-mile insurance, is gaining popularity, especially in the auto insurance sector. This model uses telematics to track driving behavior, allowing insurers to offer more accurate and personalized premiums. Drivers who exhibit safe driving habits can benefit from lower premiums, making insurance more affordable.

Digital Insurance Platforms

Digital insurance platforms are disrupting the traditional insurance model by offering a more streamlined and efficient experience. These platforms use advanced algorithms to provide instant quotes and allow users to purchase policies online. By cutting out intermediaries and streamlining processes, digital insurance platforms can offer more competitive rates, making insurance more accessible and affordable.

Insurtech Innovations

Insurtech, a term referring to the use of technology in the insurance industry, is driving innovation and cost-effectiveness. Insurtech startups are developing new products and services, such as on-demand insurance and parametric insurance, which offer flexibility and affordability. These innovations are reshaping the insurance landscape and making coverage more accessible to a broader range of individuals and businesses.

Conclusion

Affordable insurance is not a one-size-fits-all proposition. It requires a thoughtful approach, considering your specific needs, budget, and circumstances. By understanding the different types of insurance and the factors that influence premiums, you can make informed decisions and secure the coverage you need without straining your finances. Whether you're seeking health, life, property, or liability insurance, there are affordable options available to protect what matters most to you.

Frequently Asked Questions

What is the best affordable health insurance plan for families?

+For families, it's crucial to consider a plan that covers a broad range of services and providers. Blue Cross Blue Shield and UnitedHealthcare often offer comprehensive family plans with a wide network of doctors and hospitals. Additionally, exploring public health insurance options like Medicaid or CHIP can provide cost-effective coverage for eligible families.

<div class="faq-item">

<div class="faq-question">

<h3>How can I save money on life insurance as a young adult?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Young adults often benefit from the lowest life insurance premiums due to their age and good health. Consider a <strong>term life insurance</strong> policy, which offers affordable coverage for a specified period. You can also explore <strong>group life insurance</strong> through your employer, which is often more affordable than individual policies.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What factors impact the cost of auto insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The cost of auto insurance is influenced by various factors, including your driving record, the make and model of your vehicle, your location, and the coverage limits you choose. Additionally, insurance providers often offer discounts for safe driving, bundling policies, and maintaining a good credit score.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can small businesses afford liability insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Small businesses can explore <strong>general liability insurance</strong> options tailored to their industry and risk profile. By comparing quotes from multiple providers and negotiating premiums, small businesses can find affordable coverage. Additionally, certain business associations and organizations offer group liability insurance plans at discounted rates.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What is the average cost of renters insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The average cost of renters insurance varies based on factors like the location of the rental property and the value of the belongings insured. On average, renters insurance can cost between $150 and $300 per year. However, it's essential to review your policy and ensure it provides adequate coverage for your needs.</p>

</div>

</div>

</div>