Best Car Insurance App

In today's fast-paced world, having a reliable car insurance app can make managing your auto insurance policy a breeze. With numerous options available, choosing the best app for your needs can be a daunting task. This comprehensive guide will delve into the features, functionality, and user experience of top car insurance apps, helping you make an informed decision. We'll explore the leading players in the market, their unique offerings, and how they enhance the overall insurance experience.

Unveiling the Top Car Insurance Apps

The insurance industry has witnessed a digital transformation, and car insurance apps are at the forefront of this revolution. These apps aim to streamline the insurance process, offering convenience and accessibility to policyholders. Let’s take a closer look at some of the top-rated car insurance apps and explore their features.

Company X’s Mobile App

Company X, a renowned insurance provider, has developed a feature-rich mobile app that has gained popularity among users. The app boasts a user-friendly interface, making it easy for policyholders to navigate and manage their insurance policies. Here’s a breakdown of its key features:

- Policy Management: Policyholders can access their insurance policy details, view coverage limits, and make changes to their policy directly from the app. The app provides a comprehensive overview of the policy, ensuring transparency and ease of management.

- Claims Process: One of the standout features of Company X's app is its streamlined claims process. Users can report claims directly from the app, upload necessary documents, and track the progress of their claim in real-time. The app guides users through the entire claims journey, making it a hassle-free experience.

- Roadside Assistance: In case of emergencies, the app offers quick access to roadside assistance services. Users can request towing, battery jump-starts, or even locksmith services with just a few taps. The app connects users with nearby service providers, ensuring prompt assistance.

- Payment Options: The app provides multiple payment options, allowing users to pay their insurance premiums conveniently. Users can set up automatic payments, pay through various digital wallets, or even opt for installment plans.

- Accident Support: Company X's app goes beyond traditional insurance services by offering accident support. It provides users with step-by-step guidance on what to do in case of an accident, including tips on gathering evidence and documenting the incident.

Company Y’s Insurance App

Company Y, known for its innovative approach to insurance, has developed an app that focuses on enhancing the user experience. The app is designed with a modern interface and offers a range of features that cater to the needs of tech-savvy users.

- AI-Powered Claims: Company Y leverages artificial intelligence to streamline the claims process. Users can submit claims through the app, and AI algorithms assess the damage and estimate the cost of repairs. This technology accelerates the claims process, providing users with quick settlements.

- Personalized Coverage: The app offers personalized coverage recommendations based on users' driving habits and preferences. By analyzing data from connected car devices, the app suggests tailored insurance plans that align with users' needs.

- Discounts and Rewards: Company Y's app incentivizes safe driving by offering discounts and rewards. Users can earn points for practicing safe driving habits, such as maintaining a consistent speed or avoiding sudden braking. These points can be redeemed for discounts on insurance premiums or other rewards.

- Community Features: The app incorporates a social aspect by allowing users to connect with other policyholders. Users can share driving tips, discuss insurance-related topics, and even rate and review service providers within the app's community forum.

- Real-Time Alerts: Company Y's app provides real-time alerts and notifications. Users receive updates on traffic conditions, weather alerts, and even reminders for upcoming policy renewals. These alerts help users stay informed and make timely decisions regarding their insurance coverage.

Company Z’s Auto Insurance App

Company Z has developed an app that prioritizes simplicity and convenience. Their app aims to make insurance management a seamless process, focusing on user accessibility.

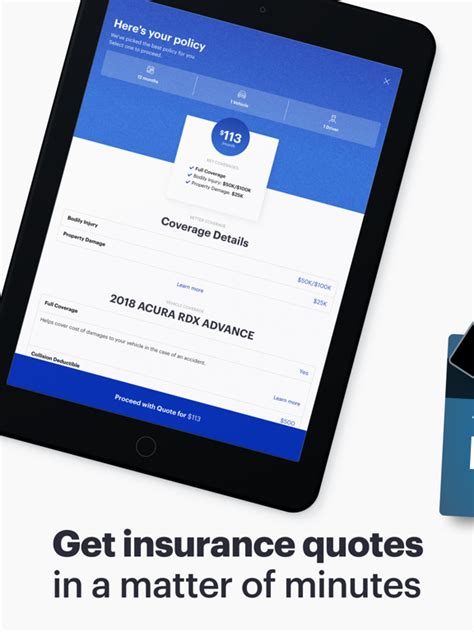

- Quick Quote: Users can obtain quick insurance quotes directly from the app. By providing basic information about their vehicle and driving history, the app generates personalized quotes, allowing users to compare and choose the best insurance plan.

- Document Storage: The app offers a secure digital storage space for users to store important insurance-related documents. Policyholders can upload and access their insurance certificates, registration documents, and even vehicle maintenance records, ensuring easy access when needed.

- 24/7 Customer Support: Company Z's app provides round-the-clock customer support. Users can chat with insurance experts or reach out via phone calls, ensuring they receive assistance whenever required. This feature is particularly beneficial for users facing urgent insurance-related queries.

- Policy Comparison: The app allows users to compare their current insurance policy with other available options. By analyzing coverage, premiums, and benefits, users can make informed decisions about switching insurance providers or opting for better coverage.

- Renewal Reminders: Company Z's app sends timely reminders for policy renewals. Users receive notifications well in advance, allowing them to plan their insurance renewal and avoid any coverage lapses.

Comparative Analysis: Which App is the Best Fit for You?

Each of the car insurance apps discussed above offers unique features and benefits. The choice of the best app depends on individual preferences and specific insurance needs. Here’s a comparative analysis to help you decide:

| Feature | Company X | Company Y | Company Z |

|---|---|---|---|

| User Interface | User-friendly, simple navigation | Modern, visually appealing | Clean and intuitive |

| Claims Process | Streamlined, with real-time tracking | AI-powered, quick settlements | Easy access, 24/7 support |

| Roadside Assistance | Quick response, nearby service providers | On-demand assistance | Immediate access, comprehensive coverage |

| Payment Options | Multiple choices, automatic payments | Digital wallet integration | Flexible payment plans |

| Additional Features | Accident support, policy management | Personalized coverage, community forum | Quick quotes, document storage |

Consider your priorities and insurance requirements when selecting an app. If you value a straightforward and efficient claims process, Company X's app might be the best choice. For those who appreciate AI-powered features and community engagement, Company Y's app offers an innovative experience. Company Z's app, with its focus on simplicity and accessibility, is ideal for users seeking a hassle-free insurance management experience.

The Future of Car Insurance Apps

As technology continues to advance, car insurance apps are likely to evolve further, offering even more sophisticated features and improved user experiences. Here are some potential future developments:

- Integration with Smart Vehicles: Insurance apps may integrate with smart vehicle technology, allowing for real-time data analysis and personalized insurance plans based on driving behavior.

- Enhanced Safety Features: Apps could incorporate advanced safety features, such as collision avoidance systems or driver monitoring, to provide additional protection and discounts for policyholders.

- Artificial Intelligence and Machine Learning: AI and ML algorithms will continue to play a significant role, improving claim assessment accuracy and providing personalized insurance recommendations.

- Voice Assistance and Chatbots: Voice-activated assistants and chatbots could enhance user interactions, offering quick answers to insurance-related queries and providing a more personalized experience.

- Data-Driven Insights: Insurance apps may leverage data analytics to offer policyholders insights into their driving habits, suggesting improvements and potential cost savings.

Conclusion

The car insurance app landscape is dynamic, offering a range of features and benefits to policyholders. By choosing the right app, you can streamline your insurance management, access convenient services, and enjoy a more personalized insurance experience. With continued technological advancements, the future of car insurance apps looks promising, bringing further innovation and enhanced user experiences.

Frequently Asked Questions

How secure are car insurance apps?

+Car insurance apps prioritize security, employing encryption and data protection measures to safeguard user information. They often require multi-factor authentication for added security.

Can I access my insurance policy details offline through the app?

+While some apps allow limited offline access to policy details, most require an internet connection for full functionality. Offline access may be available for specific features like viewing policy summaries.

Do car insurance apps offer discounts for safe driving?

+Yes, many car insurance apps incentivize safe driving by offering discounts or rewards. These incentives are often based on factors like accident-free driving, maintaining a consistent speed, or avoiding sudden braking.

Can I switch insurance providers through the app?

+While some apps offer a seamless switching process, others may require you to contact the insurance provider directly. It’s advisable to check the app’s functionality and terms before attempting to switch insurance providers.

Are there any additional fees for using a car insurance app?

+Most car insurance apps are free to use. However, some providers may charge nominal fees for specific services or features, such as roadside assistance or additional coverage options.