Best Car Insurance In Ny

When it comes to finding the best car insurance in New York, there are numerous factors to consider. With a diverse range of insurance providers offering various coverage options, it can be challenging to navigate the market and identify the policy that best suits your needs. This comprehensive guide aims to assist New York residents in making informed decisions by evaluating key aspects such as coverage, pricing, customer satisfaction, and additional benefits offered by leading car insurance providers in the state.

Understanding the Landscape of Car Insurance in New York

New York is known for its stringent insurance regulations, which aim to protect drivers and ensure fair practices. The state requires all registered vehicles to carry minimum liability insurance coverage, including bodily injury and property damage liability. Additionally, New York is a no-fault state, meaning that drivers’ own insurance policies typically cover medical expenses and lost wages after an accident, regardless of fault.

Beyond the legal requirements, New York drivers have the flexibility to choose from a wide array of insurance coverage options, including collision, comprehensive, uninsured/underinsured motorist coverage, and various add-ons such as rental car reimbursement and gap insurance.

Top Car Insurance Providers in New York

To help you navigate the complex world of car insurance in New York, we’ve compiled a list of the top providers based on comprehensive research and analysis. These insurers have consistently demonstrated excellence in coverage, pricing, and customer satisfaction.

Geico

Coverage Options: Geico offers a comprehensive range of coverage options, including standard liability, collision, comprehensive, and additional add-ons like rental car reimbursement and emergency roadside assistance. They also provide specialized coverage for classic cars and military personnel.

Pricing: Geico is renowned for its competitive pricing, often offering some of the most affordable rates in the market. They provide discounts for safe driving, multiple policies, and military service, among others.

Customer Satisfaction: Geico has a strong reputation for excellent customer service. Their online and mobile platforms are user-friendly, and their customer support team is readily accessible via phone, email, and live chat.

State Farm

Coverage Options: State Farm provides a wide array of coverage options, including standard liability, collision, comprehensive, and various add-ons such as rental car coverage and ride-sharing insurance. They also offer specialized coverage for young drivers and mature drivers.

Pricing: State Farm's pricing is competitive, and they offer a range of discounts for safe driving, multiple policies, and good grades for students. They also provide discounts for certain vehicle safety features.

Customer Satisfaction: State Farm is known for its strong customer service and community involvement. Their local agents are readily available to assist with policy questions and claims, and they provide resources and educational materials to help drivers make informed decisions.

Allstate

Coverage Options: Allstate offers a comprehensive range of coverage options, including liability, collision, comprehensive, and various add-ons such as rental car coverage, roadside assistance, and accident forgiveness. They also provide specialized coverage for teenagers and mature drivers.

Pricing: Allstate's pricing is competitive, and they offer a range of discounts for safe driving, multiple policies, and good grades for students. They also provide discounts for paying your premium in full and for having certain safety features in your vehicle.

Customer Satisfaction: Allstate has a strong focus on customer service and provides personalized attention through their network of local agents. Their online and mobile platforms are user-friendly, and they offer a range of tools and resources to help drivers manage their policies and stay informed.

Progressive

Coverage Options: Progressive offers a wide range of coverage options, including standard liability, collision, comprehensive, and various add-ons such as rental car coverage, gap insurance, and pet injury coverage. They also provide specialized coverage for high-risk drivers and mature drivers.

Pricing: Progressive is known for its competitive pricing and provides a range of discounts for safe driving, multiple policies, and vehicle safety features. They also offer a unique Name Your Price® tool, allowing drivers to choose their desired coverage and price.

Customer Satisfaction: Progressive has a strong focus on innovation and customer convenience. Their online and mobile platforms offer a seamless experience, and their customer support is readily accessible via phone, email, and live chat. They also provide resources and tools to help drivers understand their coverage and manage their policies.

Esurance

Coverage Options: Esurance offers a comprehensive range of coverage options, including liability, collision, comprehensive, and various add-ons such as rental car coverage, roadside assistance, and gap insurance. They also provide specialized coverage for teens and mature drivers.

Pricing: Esurance is known for its competitive pricing and offers a range of discounts for safe driving, multiple policies, and vehicle safety features. They also provide a discount for insuring electric vehicles.

Customer Satisfaction: Esurance focuses on providing a seamless digital experience with its user-friendly online and mobile platforms. Their customer support is accessible via phone, email, and live chat, and they offer resources and educational materials to help drivers understand their coverage.

Comparative Analysis: Finding the Best Fit for Your Needs

When choosing the best car insurance provider in New York, it’s essential to consider your specific needs and circumstances. Here are some key factors to keep in mind:

- Coverage Options: Evaluate the range of coverage options offered by each provider. Consider your vehicle's age, value, and usage to determine the level of coverage you require.

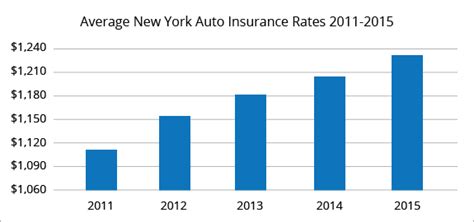

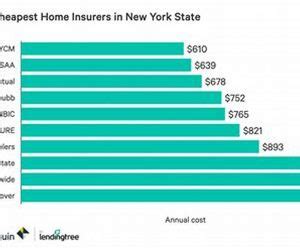

- Pricing: Compare prices from multiple providers to find the most competitive rates. Remember to consider not only the base premium but also any applicable discounts and potential add-ons.

- Customer Satisfaction: Research customer reviews and ratings to gauge each provider's reputation for customer service and claims handling. Consider factors such as response time, accessibility, and overall satisfaction.

- Additional Benefits: Look for providers that offer unique benefits or discounts that align with your needs. For example, some insurers provide discounts for electric vehicles, safe driving programs, or telematics devices.

Tips for Getting the Best Car Insurance in New York

To ensure you get the best car insurance coverage in New York, consider the following tips:

- Shop around and compare quotes from multiple providers to find the most competitive rates.

- Consider bundling your car insurance with other policies, such as homeowners or renters insurance, to potentially save on premiums.

- Evaluate your coverage needs annually and adjust your policy as your circumstances change.

- Take advantage of discounts offered by insurers, such as safe driver discounts, good student discounts, and multi-policy discounts.

- Consider using telematics devices or enrolling in safe driving programs to potentially lower your premiums.

Conclusion: Your Journey to the Best Car Insurance in New York

Finding the best car insurance in New York involves a careful evaluation of your needs and the market. By considering coverage options, pricing, customer satisfaction, and additional benefits, you can make an informed decision that provides the protection and peace of mind you deserve. Remember to shop around, compare quotes, and take advantage of discounts to ensure you’re getting the most value for your insurance premium.

What are the minimum car insurance requirements in New York?

+

New York requires all registered vehicles to carry minimum liability insurance coverage, including 25,000 for bodily injury per person, 50,000 for bodily injury per accident, and $10,000 for property damage.

Can I get car insurance without a driver’s license in New York?

+

While having a valid driver’s license is typically required to obtain car insurance, some providers may offer non-owner policies for individuals who do not have a license but wish to insure a vehicle they own.

How can I save money on my car insurance premium in New York?

+

You can save money on your car insurance premium by shopping around for quotes, bundling policies, maintaining a clean driving record, and taking advantage of discounts offered by insurers.