Best Rated Health Insurance Companies

Unveiling the Top Health Insurance Providers: A Comprehensive Guide

In the complex world of healthcare, having the right health insurance is crucial. With countless options available, finding the best-rated health insurance company can be a daunting task. This comprehensive guide aims to demystify the process, offering an in-depth analysis of the top-performing providers in the industry. By evaluating key factors such as coverage, customer satisfaction, and financial stability, we'll help you make an informed decision when choosing a health insurance plan.

Understanding the Criteria: How We Rate Health Insurance Companies

To identify the best health insurance providers, we consider a range of critical factors. These include, but are not limited to:

- Coverage Options: We assess the breadth and depth of coverage offered by each company, including the range of medical services, prescription drugs, and specialist care. A top-rated provider should offer comprehensive plans that cater to a variety of healthcare needs.

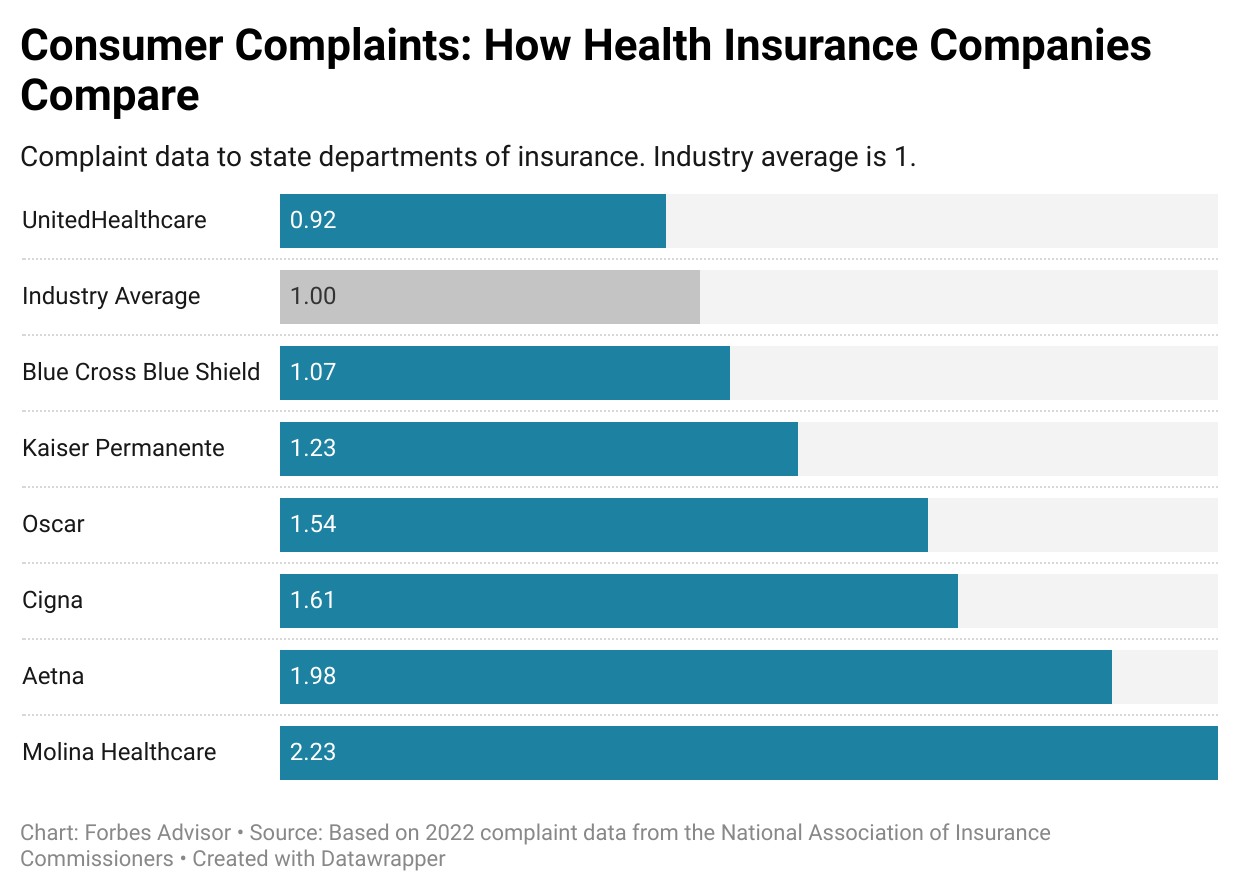

- Customer Satisfaction: Feedback from existing and former customers provides valuable insights. We analyze surveys, reviews, and ratings to understand how well the company serves its policyholders.

- Financial Stability: The financial health of an insurance company is crucial. We evaluate their financial strength, solvency, and ability to meet their long-term obligations. A stable company ensures your coverage remains secure over time.

- Claims Process: The ease and efficiency of filing claims are essential. We look at the claims process, including how quickly claims are processed, the transparency of the process, and the support provided to policyholders during claims.

- Additional Benefits and Services: Some insurance companies offer extra perks such as wellness programs, disease management support, or travel insurance. These value-added services can significantly enhance the overall customer experience.

The Elite List: Top-Rated Health Insurance Companies

Based on our rigorous evaluation process, here are the health insurance companies that consistently rank among the best in the industry:

1. UnitedHealthcare

UnitedHealthcare stands out for its extensive network of healthcare providers and its commitment to innovation. With a focus on digital health solutions, the company offers convenient access to healthcare services and streamlined processes. Their plans cover a wide range of medical services, including preventive care, making it an excellent choice for those seeking comprehensive coverage.

| Key Strengths | Areas of Excellence |

|---|---|

| Broad Network of Providers | Digital Health Solutions |

| Comprehensive Coverage | Preventive Care Emphasis |

| Excellent Customer Service | Financial Stability |

2. Kaiser Permanente

Kaiser Permanente operates as an integrated healthcare system, providing both insurance coverage and direct medical care through its network of hospitals and clinics. This unique model ensures seamless coordination of care and efficient claims processing. The company is known for its emphasis on preventive care and wellness programs, making it an ideal choice for those seeking proactive healthcare management.

| Key Strengths | Areas of Excellence |

|---|---|

| Integrated Healthcare System | Preventive Care and Wellness Programs |

| Seamless Coordination of Care | Efficient Claims Processing |

| Excellent Customer Satisfaction | Strong Financial Performance |

3. Blue Cross Blue Shield

Blue Cross Blue Shield is a trusted name in the health insurance industry, offering a wide range of plans to cater to diverse healthcare needs. With a vast network of healthcare providers across the nation, they ensure policyholders have easy access to quality care. The company's focus on customer education and support sets them apart, making them a preferred choice for those seeking personalized guidance in navigating their healthcare options.

| Key Strengths | Areas of Excellence |

|---|---|

| Extensive National Network | Customer Education and Support |

| Wide Range of Plan Options | Financial Strength and Stability |

| Excellent Claims Processing | Focus on Member Satisfaction |

4. Humana

Humana is known for its comprehensive Medicare Advantage plans, offering an array of additional benefits beyond standard coverage. They excel in providing personalized care and support to their members, ensuring a seamless and positive healthcare experience. With a strong focus on customer service and satisfaction, Humana is an excellent choice for those seeking a caring and supportive insurance provider.

| Key Strengths | Areas of Excellence |

|---|---|

| Comprehensive Medicare Advantage Plans | Personalized Care and Support |

| Excellent Customer Service | Focus on Member Satisfaction |

| Innovative Digital Health Tools | Financial Stability |

5. Cigna

Cigna takes a holistic approach to healthcare, offering a range of wellness programs and support services to promote overall well-being. Their plans are designed to cater to individual needs, ensuring personalized coverage. With a strong focus on mental health and behavioral health services, Cigna is an ideal choice for those seeking comprehensive mental health coverage.

| Key Strengths | Areas of Excellence |

|---|---|

| Holistic Healthcare Approach | Wellness Programs and Support Services |

| Personalized Coverage Options | Strong Mental Health and Behavioral Health Services |

| Excellent Customer Support | Financial Stability |

Additional Considerations: Navigating the Health Insurance Landscape

While the above-listed companies consistently rank among the best, it's essential to remember that individual needs and circumstances vary. When choosing a health insurance provider, consider factors such as your specific healthcare requirements, the cost of premiums and out-of-pocket expenses, and the availability of preferred healthcare providers in the company's network.

Additionally, keep an eye on industry trends and changes. The health insurance landscape is dynamic, and new players may emerge with innovative offerings. Regularly reviewing your options and staying informed can help you make the most suitable choice for your healthcare needs.

How do I choose the right health insurance plan for my needs?

+

Choosing the right health insurance plan involves assessing your specific healthcare needs, considering the cost of premiums and out-of-pocket expenses, and evaluating the network of healthcare providers. It’s beneficial to compare multiple plans and seek expert advice to ensure you find the best fit for your circumstances.

What should I look for in a health insurance company’s financial stability?

+

Financial stability is crucial for any insurance company. Look for companies with strong financial ratings from reputable agencies. This indicates their ability to meet their obligations and provides assurance for the long-term security of your coverage.

Are there any health insurance companies that specialize in certain areas of healthcare?

+

Yes, some health insurance companies focus on specific areas of healthcare. For example, some providers offer specialized plans for individuals with pre-existing conditions or those seeking coverage for mental health services. Researching these specialized providers can be beneficial if you have specific healthcare needs.