Best Type Of Life Insurance

When it comes to financial planning and securing your loved ones' future, life insurance is a crucial component. With numerous types of life insurance policies available, choosing the best one can be a daunting task. This comprehensive guide aims to shed light on the various life insurance options, their benefits, and considerations to help you make an informed decision.

Understanding Life Insurance Policies

Life insurance is a contract between an individual (the policyholder) and an insurance company. In exchange for premium payments, the insurance provider agrees to pay a specified sum of money (the death benefit) to the policyholder’s beneficiaries upon their death. This financial protection ensures that the policyholder’s loved ones can maintain their standard of living and cover expenses even after their passing.

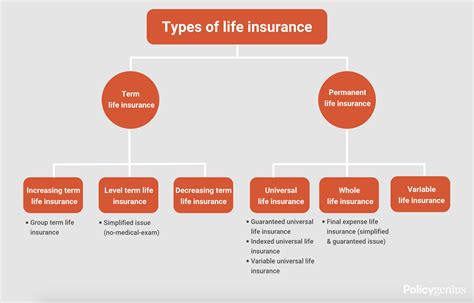

There are two primary categories of life insurance: term life insurance and permanent life insurance. Each type serves different purposes and offers distinct advantages. Let's delve into these categories and explore their key features.

Term Life Insurance: A Cost-Effective Solution

Term life insurance is often referred to as pure life insurance because it provides coverage for a specific period, known as the term. This type of policy offers protection for a defined duration, typically ranging from 10 to 30 years. During the term, the policyholder pays regular premiums, and in the event of their death, the beneficiaries receive the agreed-upon death benefit.

Key Advantages of Term Life Insurance

- Affordability: Term life insurance is generally more affordable than permanent life insurance policies. The lower premiums make it an attractive option for individuals with budget constraints.

- Flexibility: Policyholders can choose the coverage amount and term length based on their needs. This flexibility allows for a customized approach to financial protection.

- Renewability: Many term life policies offer the option to renew at the end of the term, providing ongoing coverage as long as the policyholder continues to pay premiums.

- No Cash Value: Term life insurance is purely for protection. Unlike permanent life insurance, it does not accumulate cash value over time, making it a straightforward and focused financial tool.

Considerations for Term Life Insurance

While term life insurance is an excellent choice for many, it’s essential to consider a few factors:

- Coverage Duration: Ensure that the term length aligns with your financial goals and the period during which you anticipate needing life insurance coverage.

- Health and Lifestyle: Term life insurance premiums can vary based on your health and lifestyle. It’s crucial to disclose all relevant information to obtain an accurate quote.

- Renewal Options: Understand the renewal process and any potential increases in premiums when renewing your policy.

Permanent Life Insurance: Lifetime Protection and More

Permanent life insurance, as the name suggests, provides coverage for the policyholder’s entire life. This type of policy offers not only death benefit protection but also accumulates cash value over time, which can be accessed during the policyholder’s lifetime.

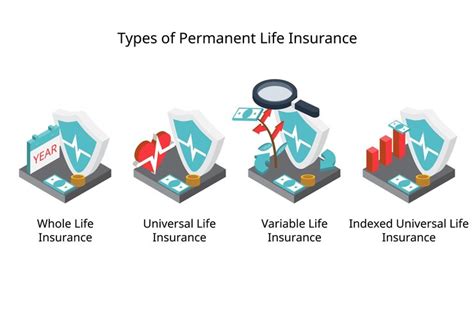

Types of Permanent Life Insurance

- Whole Life Insurance: This is the most common type of permanent life insurance. It offers guaranteed death benefits, fixed premiums, and cash value accumulation. Whole life insurance provides lifetime coverage and stability.

- Universal Life Insurance: Universal life insurance offers more flexibility than whole life. Policyholders can adjust their premiums and death benefits within certain limits. It also provides a cash value account that earns interest.

- Variable Life Insurance: Variable life insurance allows policyholders to invest a portion of their premiums in different investment options. The death benefit and cash value can fluctuate based on the performance of these investments.

Advantages of Permanent Life Insurance

- Lifetime Coverage: As the name implies, permanent life insurance ensures that your loved ones are protected for as long as you live.

- Cash Value Accumulation: The cash value component of permanent life insurance can serve as a financial resource, providing access to funds during your lifetime for various purposes, such as retirement or emergency expenses.

- Tax Benefits: The cash value growth within a permanent life insurance policy is typically tax-deferred, offering potential tax advantages.

Considerations for Permanent Life Insurance

When considering permanent life insurance, keep the following in mind:

- Higher Premiums: Permanent life insurance policies often have higher premiums compared to term life insurance due to the added cash value component.

- Investment Risk: Variable life insurance carries investment risks, as the policy’s performance is tied to the chosen investment options. Whole life and universal life insurance provide more stability but may offer lower returns.

- Policy Complexity: Permanent life insurance policies can be more complex, with various features and options. It’s essential to thoroughly understand the policy’s terms and conditions.

Comparing Term and Permanent Life Insurance

Here’s a simplified comparison table to help you understand the key differences between term and permanent life insurance:

| Category | Term Life Insurance | Permanent Life Insurance |

|---|---|---|

| Coverage Period | Fixed term (e.g., 10-30 years) | Lifetime coverage |

| Premium Cost | Lower premiums | Higher premiums |

| Cash Value | None | Accumulates cash value |

| Flexibility | Flexible term and coverage amount | Flexible premiums and death benefits (depending on type) |

| Suitability | Ideal for temporary needs or budget-conscious individuals | Suitable for long-term financial planning and asset accumulation |

Choosing the Right Life Insurance for You

Selecting the best life insurance policy depends on your unique circumstances, financial goals, and needs. Here are some key factors to consider when making your decision:

Your Financial Goals

Evaluate your financial objectives. If you have short-term financial goals, such as covering mortgage payments or providing for your family’s immediate needs, term life insurance might be sufficient. However, if you’re looking for long-term financial planning and asset accumulation, permanent life insurance could be more suitable.

Your Family’s Needs

Consider your family’s financial situation and their future needs. Term life insurance can provide a significant death benefit to cover immediate expenses, while permanent life insurance offers lifetime protection and the potential for wealth transfer.

Your Budget

Assess your financial capabilities and budget. Term life insurance is generally more affordable, making it an excellent choice for those on a tighter budget. Permanent life insurance, with its higher premiums, may be more accessible to individuals with stable financial situations and long-term financial goals.

Your Health and Lifestyle

Your health and lifestyle can impact the cost and availability of life insurance. It’s essential to be transparent about your health and disclose any pre-existing conditions when applying for a policy. Some insurance providers may offer more favorable rates for healthier individuals.

Seek Professional Advice

Consulting with a qualified financial advisor or insurance broker can provide valuable insights tailored to your specific circumstances. They can help you navigate the complex world of life insurance and ensure you make an informed decision.

The Importance of Regular Review

Life insurance is not a one-time decision. As your life circumstances change, it’s crucial to review and adjust your policy accordingly. Major life events, such as marriage, the birth of a child, or retirement, can impact your insurance needs. Regularly reassessing your coverage ensures that you maintain adequate protection for your loved ones.

Conclusion: The Power of Financial Protection

Life insurance is a powerful tool that provides peace of mind and financial security for your loved ones. Whether you choose term life insurance for its affordability and flexibility or permanent life insurance for its lifetime protection and cash value accumulation, the key is to make an informed decision based on your unique needs. Remember, life insurance is an essential component of your overall financial plan, and it’s never too early to start considering your options.

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on various factors, including your income, debts, and financial goals. A common rule of thumb is to aim for 10-15 times your annual income. However, it’s best to consult with a financial advisor to determine your specific needs.

Can I switch from term life insurance to permanent life insurance later in life?

+Yes, it is possible to switch from term life insurance to permanent life insurance. However, it’s essential to carefully evaluate your options and consider the potential impact on your premiums and coverage. Consulting with an insurance professional can help guide your decision.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage expires, and you may need to purchase a new policy or consider permanent life insurance options. It’s important to plan for this possibility and review your insurance needs regularly.

Are there any tax implications with permanent life insurance cash value?

+The tax treatment of permanent life insurance cash value depends on the type of policy and how it’s used. Generally, cash value growth is tax-deferred, but withdrawals or loans against the cash value may have tax implications. Consult with a tax advisor for specific guidance.