Blue Cross Blue Shield Individual Insurance

In today's healthcare landscape, having comprehensive insurance coverage is crucial for individuals and families alike. Blue Cross Blue Shield (BCBS) stands as one of the leading providers of health insurance, offering a range of plans designed to cater to diverse needs. This article delves into the world of BCBS Individual Insurance, exploring its features, benefits, and how it can provide peace of mind for those navigating the complexities of healthcare.

The BCBS Individual Insurance Advantage

BCBS Individual Insurance is tailored to meet the unique requirements of individuals and families who may not have access to employer-sponsored health plans. With a rich history dating back to the early 20th century, BCBS has evolved into a trusted name in the industry, known for its extensive network of healthcare providers and commitment to delivering accessible, quality care.

Network Coverage and Provider Access

One of the key strengths of BCBS Individual Insurance lies in its expansive provider network. BCBS has built strong relationships with hospitals, clinics, and healthcare professionals across the nation, ensuring that policyholders have a wide range of options when it comes to choosing their healthcare providers. This network coverage provides peace of mind, knowing that one can access the necessary medical services without worrying about being limited to a small pool of providers.

Furthermore, BCBS is renowned for its provider directories, which are meticulously maintained and updated. These directories serve as valuable resources, enabling policyholders to easily locate in-network providers, check specialist availability, and even obtain information on specific medical procedures or treatments. This level of transparency and accessibility is a hallmark of BCBS's commitment to its members.

| Network Type | Provider Access |

|---|---|

| National Network | Over 1 million healthcare professionals and specialists |

| Local Networks | Extensive coverage in each state, with specialized providers available |

Customizable Plan Options

BCBS understands that every individual’s healthcare needs are unique. As such, they offer a comprehensive range of plan options, allowing policyholders to tailor their coverage to their specific requirements. Whether it’s selecting a plan with lower premiums and higher deductibles or opting for a more comprehensive plan with lower out-of-pocket expenses, BCBS provides the flexibility needed to make informed choices.

The array of plan options includes:

- Bronze Plans: Ideal for those who are generally healthy and prefer lower monthly premiums, with higher deductibles and out-of-pocket expenses.

- Silver Plans: Balanced plans offering a mix of premium and out-of-pocket costs, providing good value for those with occasional healthcare needs.

- Gold Plans: Comprehensive plans with higher premiums but lower deductibles and out-of-pocket costs, suitable for individuals with more frequent healthcare requirements.

- Platinum Plans: Premium plans offering the most extensive coverage, with minimal out-of-pocket expenses, ideal for those who prioritize access to a wide range of healthcare services.

Additionally, BCBS offers various add-on options and riders to further customize coverage, such as dental, vision, and prescription drug benefits. This level of personalization ensures that individuals can create a plan that aligns with their healthcare needs and financial considerations.

Comprehensive Benefits and Coverage

BCBS Individual Insurance plans provide a comprehensive suite of benefits, ensuring that policyholders have access to a wide array of healthcare services. From preventive care and routine check-ups to specialized treatments and prescription medications, BCBS aims to cover all aspects of an individual’s healthcare journey.

Key benefits include:

- Preventive Care: Covering annual physicals, immunizations, and screenings, promoting early detection and prevention of potential health issues.

- Specialist Visits: Access to a wide range of specialists, including cardiologists, oncologists, and mental health professionals, ensuring specialized care when needed.

- Prescription Drugs : Coverage for a wide range of prescription medications, with various tier options to manage costs effectively.

- Maternity and Newborn Care: Comprehensive coverage for prenatal care, delivery, and postnatal services, providing peace of mind for expecting parents.

- Mental Health and Substance Abuse Services: In-network access to mental health professionals and treatment facilities, addressing a critical aspect of overall well-being.

BCBS also offers innovative benefits such as telehealth services, allowing policyholders to connect with healthcare providers virtually, enhancing accessibility and convenience.

Cost-Saving Features

BCBS recognizes the importance of managing healthcare costs, and as such, has implemented several cost-saving features within its individual insurance plans. These features empower policyholders to make informed decisions and potentially reduce their overall healthcare expenses.

Key cost-saving elements include:

- Wellness Programs: Incentivizing healthy behaviors through rewards and discounts, encouraging policyholders to maintain their well-being.

- Discounted Services: Negotiated rates with in-network providers, resulting in lower costs for various medical services and procedures.

- Generic Drug Options: Encouraging the use of generic medications, which are often significantly more affordable than brand-name alternatives.

- Health Savings Accounts (HSAs): Offering eligible policyholders the opportunity to save pre-tax dollars for qualified medical expenses, providing a tax-efficient way to manage healthcare costs.

BCBS also provides tools and resources to help policyholders compare costs and make informed decisions, ensuring they can take control of their healthcare spending.

Customer Support and Resources

BCBS understands that navigating the complexities of healthcare and insurance can be daunting. That’s why they prioritize providing exceptional customer support and a wealth of resources to assist policyholders every step of the way.

Support features include:

- 24/7 Customer Service: A dedicated team available around the clock to answer queries, address concerns, and provide assistance with claims or policy changes.

- Online Portals: Secure digital platforms where policyholders can manage their accounts, view coverage details, and access helpful resources, providing convenience and accessibility.

- Educational Materials: A range of guides, articles, and videos offering insights on various healthcare topics, helping policyholders make informed decisions about their well-being.

- Provider Search Tools: Easy-to-use directories and search functions to locate in-network providers, ensuring policyholders can find the right healthcare professionals quickly.

BCBS's commitment to customer support ensures that policyholders feel supported and informed, making the most of their insurance coverage.

Real-Life Examples and Testimonials

To illustrate the impact of BCBS Individual Insurance, let’s explore a few real-life scenarios and hear directly from policyholders about their experiences:

John's Story

"As a self-employed individual, BCBS Individual Insurance has been a lifesaver. I opted for a Bronze plan, which has helped me manage my costs effectively. When I needed surgery, the coverage and access to specialized care were invaluable. The provider network was extensive, and I was able to choose a top-rated hospital nearby. The entire process, from scheduling to recovery, was seamless, and I'm grateful for the peace of mind BCBS has provided."

Sarah's Perspective

"As a young professional, I value my health and wanted comprehensive coverage. BCBS's Silver plan offered the perfect balance for me. I've utilized the preventive care benefits extensively, and the online portal has been a game-changer for managing my appointments and tracking my wellness goals. The customer service team has also been incredibly responsive whenever I've had questions or needed guidance."

Michael's Experience

"My family and I have been with BCBS for several years now, and their Individual Insurance plans have been a blessing. With two young children, we've had our fair share of medical emergencies and routine check-ups. The Platinum plan has given us the reassurance we need, knowing that we have access to the best care without worrying about overwhelming expenses. The telehealth services have been especially convenient, allowing us to connect with doctors quickly and efficiently."

The Future of BCBS Individual Insurance

BCBS remains dedicated to evolving its Individual Insurance offerings to meet the changing needs of its policyholders. With a focus on innovation and accessibility, BCBS is continuously enhancing its plans, incorporating new technologies, and expanding its network to provide even better coverage and support.

As healthcare continues to evolve, BCBS is committed to staying at the forefront, ensuring that individuals and families have access to the care they need, when they need it. With its rich history, expansive network, and commitment to excellence, BCBS Individual Insurance stands as a trusted partner in the journey toward better health and well-being.

How do I choose the right BCBS Individual Insurance plan for me?

+Choosing the right plan involves considering your healthcare needs, budget, and preferences. Assess your past medical expenses, evaluate your current health status, and determine your comfort level with potential out-of-pocket costs. BCBS offers a range of plans, from Bronze to Platinum, allowing you to find the right balance of premiums and coverage.

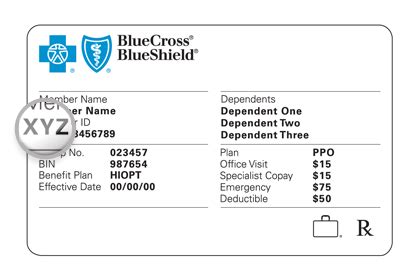

Can I add dependents to my BCBS Individual Insurance plan?

+Yes, BCBS Individual Insurance plans typically allow you to add dependents, such as your spouse and children, to your coverage. This ensures that your loved ones have access to the same comprehensive benefits and provider network as you.

What happens if I need to visit an out-of-network provider?

+While BCBS encourages the use of in-network providers to maximize benefits, it understands that emergencies or specialized care may require out-of-network visits. In such cases, BCBS typically offers some level of coverage, although the out-of-pocket expenses may be higher compared to in-network visits. It’s advisable to review your plan’s specifics and consider adding a rider for out-of-network coverage if needed.

How can I enroll in BCBS Individual Insurance?

+Enrollment in BCBS Individual Insurance is typically done during the annual Open Enrollment Period, which occurs each year. However, you may also qualify for a Special Enrollment Period if you experience certain life events, such as losing your job or getting married. Visit the BCBS website or contact their customer service team to learn more about enrollment options and the steps to secure your coverage.