Broker Insurance

In today's fast-paced and dynamic business landscape, understanding the complexities of Broker Insurance is essential for professionals seeking to navigate the intricate world of risk management. This comprehensive guide delves into the core aspects of Broker Insurance, shedding light on its importance, practical applications, and future trends.

Unraveling the World of Broker Insurance

Broker Insurance stands as a pivotal pillar in the realm of financial security, offering a range of specialized services to protect businesses and individuals from potential risks and uncertainties. With a focus on mitigating losses and providing tailored coverage, this sector has become an indispensable part of modern commerce.

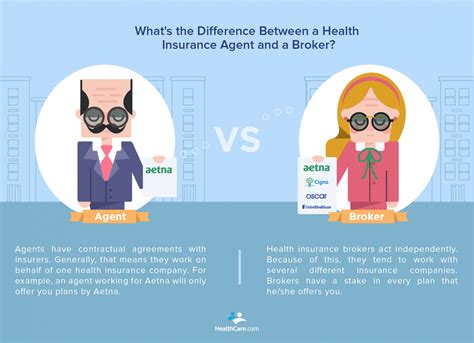

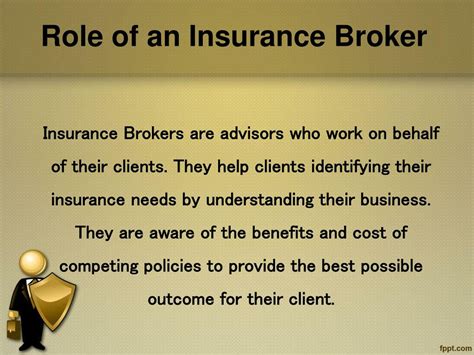

The primary function of Broker Insurance is to act as an intermediary between clients and insurance companies, offering expert advice and facilitating the procurement of suitable insurance policies. Brokers, with their in-depth knowledge of the industry, play a crucial role in assessing risks, identifying appropriate coverage, and negotiating terms on behalf of their clients.

The Diverse Spectrum of Broker Insurance

Broker Insurance encompasses a broad spectrum of services, catering to a wide array of industries and personal needs. From commercial insurance policies that safeguard businesses against property damage, liability claims, and business interruption to personal insurance plans that provide coverage for life, health, and property, brokers offer tailored solutions for every aspect of life.

In the commercial sector, brokers play a vital role in helping businesses identify and manage risks associated with their operations. This includes providing coverage for property damage, liability, workers' compensation, and business interruption. Additionally, brokers can offer specialized insurance solutions for unique industries, such as marine insurance for shipping companies or professional liability insurance for consultants.

For individuals, Broker Insurance offers a comprehensive range of personal insurance policies. Life insurance policies provide financial security for families in the event of the policyholder's death, while health insurance plans cover medical expenses and provide peace of mind. Property insurance, including home and auto insurance, protects against losses due to theft, damage, or natural disasters. Brokers can also assist with travel insurance, ensuring individuals are covered for unexpected events while abroad.

| Insurance Type | Coverage Highlights |

|---|---|

| Commercial Insurance | Property, Liability, Workers' Comp, Business Interruption |

| Personal Insurance | Life, Health, Property, Travel |

The Process of Broker Insurance: A Step-by-Step Guide

-

Risk Assessment: Brokers begin by conducting a thorough evaluation of their client’s specific risks and vulnerabilities. This step involves understanding the client’s industry, operations, and potential hazards.

-

Policy Recommendation: Based on the risk assessment, brokers recommend suitable insurance policies that provide adequate coverage. This includes identifying the right type of insurance, such as liability, property, or health insurance, and selecting appropriate coverage limits.

-

Negotiation: Brokers negotiate with insurance companies to secure the best terms and rates for their clients. This may involve discussing coverage limits, premiums, deductibles, and any additional endorsements or riders that can enhance the policy.

-

Policy Procurement: Once terms are agreed upon, brokers facilitate the procurement of the insurance policy. This involves completing necessary paperwork, ensuring the policy meets the client’s needs, and providing any required documentation.

-

Policy Management: Brokers continue to provide support throughout the policy term. This includes assisting with policy renewals, reviewing coverage to ensure it remains adequate, and addressing any claims or changes in the client’s circumstances.

The Role of Technology in Broker Insurance

The integration of technology has revolutionized the Broker Insurance industry, offering enhanced efficiency and convenience. Online platforms and digital tools enable brokers to streamline their processes, providing clients with real-time updates and simplified access to policy information.

Additionally, technology facilitates data-driven decision-making, allowing brokers to analyze vast amounts of information to identify trends and risks more accurately. This data-centric approach enables brokers to offer more precise and tailored insurance solutions, ultimately benefiting their clients.

The Future of Broker Insurance: Trends and Innovations

As the insurance landscape continues to evolve, Broker Insurance is poised to embrace several exciting trends and innovations. Here’s a glimpse into the future:

-

Artificial Intelligence (AI): AI-powered systems are set to transform the way brokers operate. From automated risk assessment to personalized policy recommendations, AI will enhance efficiency and accuracy, revolutionizing the client experience.

-

Blockchain Technology: The adoption of blockchain technology in Broker Insurance will bring increased transparency, security, and efficiency to transactions. Smart contracts, powered by blockchain, will automate various processes, reducing administrative burdens.

-

Digital Transformation: The digital transformation of Broker Insurance will see the industry embrace online platforms and mobile apps, making insurance services more accessible and convenient for clients. This shift will also enable brokers to reach a wider audience and offer personalized services.

-

Data Analytics: Advanced data analytics will play a pivotal role in Broker Insurance, enabling brokers to make more informed decisions. By leveraging predictive analytics and machine learning, brokers can anticipate risks and offer proactive insurance solutions.

Conclusion

Broker Insurance is an indispensable aspect of modern risk management, offering tailored solutions to protect businesses and individuals from a myriad of risks. With its evolving landscape and embrace of technological advancements, the Broker Insurance industry is well-positioned to continue providing essential financial security and peace of mind.

How do I choose the right broker for my insurance needs?

+Selecting the right broker involves considering factors such as their expertise in your industry, their reputation, and their ability to provide personalized service. Researching and comparing brokers based on client reviews, qualifications, and the range of insurance products they offer can help you make an informed decision.

What are the benefits of using a broker instead of directly purchasing insurance from an insurance company?

+Brokers offer several advantages, including their expertise in risk assessment and policy recommendation. They can provide tailored solutions, negotiate better terms, and offer ongoing support throughout the policy term. Brokers also have access to a wider range of insurance products, ensuring you get the best coverage for your needs.

How does technology enhance the broker insurance experience for clients?

+Technology simplifies the insurance process by providing online platforms and digital tools for policy management. Clients can access real-time updates, make changes to their policies, and receive support more conveniently. Additionally, technology enables brokers to offer more precise and timely insurance solutions, benefiting clients with efficient and effective risk management.