Business Insurance Quotation

In the realm of entrepreneurship, safeguarding your business is an essential step towards long-term success. Business insurance is a cornerstone of this protection strategy, offering a safety net against unforeseen events and potential liabilities. This article aims to guide you through the process of obtaining a comprehensive business insurance quotation, ensuring you understand the key aspects and can make informed decisions.

Understanding Business Insurance: A Necessary Investment

Business insurance is a vital component of any enterprise, large or small. It provides a financial safety net, ensuring that your business can withstand unexpected losses and continue to operate smoothly. The importance of business insurance cannot be overstated, as it protects against a wide range of risks, from property damage to legal liabilities.

For instance, imagine a small bakery that experiences a fire, causing extensive damage to the premises and equipment. Without adequate business insurance, the owner might be faced with overwhelming repair costs and potential closure. However, with the right coverage, the bakery can quickly recover and resume operations, minimizing financial strain.

The Benefits of Tailored Business Insurance

Business insurance isn’t a one-size-fits-all solution. Every business has unique needs, and an effective insurance strategy must be tailored to these specific requirements. Whether you’re a startup or an established corporation, your insurance needs will vary based on factors such as industry, location, and the nature of your operations.

Consider a technology startup that provides cloud-based services. Their primary concerns might include cyber liability and data breaches, whereas a traditional manufacturing business would focus more on property damage and product liability. Tailoring your insurance ensures that you're not overpaying for unnecessary coverage or leaving critical gaps in your protection.

Common Types of Business Insurance

There are several key types of business insurance that most companies should consider. These include:

- General Liability Insurance: This provides coverage for bodily injury, property damage, and personal and advertising injury claims.

- Professional Liability Insurance (also known as Errors and Omissions Insurance): Essential for businesses offering professional services, it protects against negligence, errors, and omissions.

- Product Liability Insurance: A critical coverage for manufacturers and distributors, protecting against claims of bodily injury or property damage caused by a product.

- Property Insurance: Covers physical damage to your business property, including buildings, equipment, and inventory.

- Business Interruption Insurance: Provides financial support during periods when your business is forced to close due to covered perils.

- Workers' Compensation Insurance: Required by most states, it covers medical bills and a portion of wages lost by an employee injured in the course of employment.

Each of these insurance types serves a specific purpose, and understanding which ones are most relevant to your business is crucial when seeking a quotation.

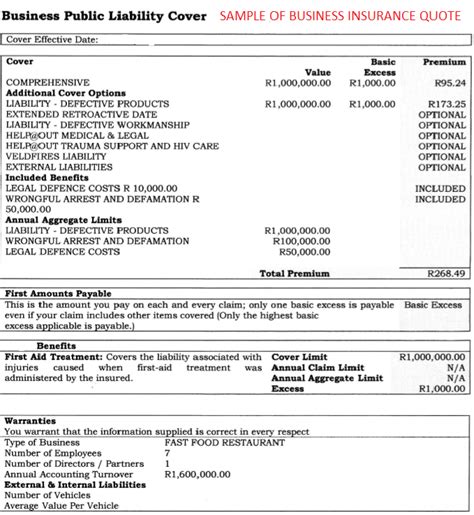

The Quotation Process: A Step-by-Step Guide

Obtaining a business insurance quotation is a detailed process, requiring careful consideration of your business’s unique needs and risks. Here’s a comprehensive guide to help you navigate this journey.

Step 1: Define Your Insurance Needs

The first step is to assess your business’s specific needs and potential risks. Consider factors such as your industry, the nature of your operations, and any unique exposures your business might face. For example, a business that deals with hazardous materials will have different insurance needs than one that provides purely digital services.

Take time to research and understand the various types of business insurance available. This will help you identify the coverages that are most critical to your operations and those that might be less relevant. It's also a good idea to consult with industry peers or experts to gain insights into their insurance strategies and the lessons they've learned.

Step 2: Gather Essential Information

To obtain an accurate quotation, you’ll need to provide detailed information about your business. This typically includes:

- Business Name, Address, and Contact Details

- Nature of Business Operations (Products/Services, Number of Employees, etc.)

- Annual Revenue and Financial Information

- Details about Existing Property (Buildings, Equipment, Vehicles, etc.)

- Previous Claims History

- Any Specific Risks or Exposures Unique to Your Business

Be as detailed as possible in your responses. This ensures that the insurance provider can accurately assess your needs and provide a tailored quotation. Remember, providing incomplete or inaccurate information can lead to gaps in coverage or higher premiums.

Step 3: Contact Insurance Providers

Once you’ve gathered the necessary information, it’s time to reach out to insurance providers. You can either contact individual insurance companies or work with an insurance broker who can provide quotations from multiple carriers.

When contacting insurance providers, be prepared to discuss your business in detail. They'll want to understand your operations, potential risks, and the types of coverage you're seeking. Be transparent and honest in your interactions, as this will help ensure you receive accurate and relevant quotations.

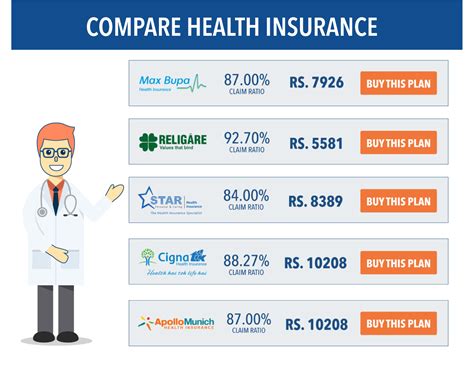

Step 4: Compare Quotations

After submitting your information, you’ll receive quotations from the insurance providers. Take time to carefully review and compare these quotations. Consider not just the cost but also the scope of coverage, any exclusions or limitations, and the reputation and financial stability of the insurance provider.

Create a detailed comparison chart to help you evaluate the quotations side by side. This will make it easier to identify the most comprehensive and cost-effective option. Don't hesitate to reach out to the providers with any questions or clarifications you might have.

Step 5: Make an Informed Decision

Based on your thorough comparison and analysis, select the business insurance quotation that best meets your needs and budget. Remember, while cost is an important factor, it shouldn’t be the sole deciding factor. The right coverage can mean the difference between a minor setback and a devastating loss for your business.

Once you've made your decision, finalize the policy, ensuring you understand all the terms and conditions. Keep a copy of the policy documents for future reference and review them regularly to ensure they continue to meet your evolving business needs.

The Future of Business Insurance: Trends and Innovations

The business insurance landscape is constantly evolving, driven by technological advancements, changing regulatory environments, and shifting market dynamics. Staying informed about these trends can help businesses make more strategic insurance decisions.

The Rise of Digital Insurance Solutions

The digital transformation of the insurance industry is a notable trend. Many insurance providers are now offering online platforms and mobile apps, making it easier and faster for businesses to obtain quotations, manage policies, and file claims. These digital solutions also often provide real-time data and analytics, helping businesses better understand and manage their risks.

For instance, some insurance providers now offer predictive analytics tools that can help businesses identify potential risks and take proactive measures to mitigate them. This level of insight can be particularly beneficial for businesses operating in dynamic and competitive markets.

Increasing Focus on Cyber Security

With the rapid growth of digital technologies and the increasing sophistication of cyber threats, cyber security has become a critical concern for businesses of all sizes. As a result, many insurance providers are expanding their offerings to include more comprehensive cyber liability insurance.

Cyber liability insurance typically covers a range of risks, including data breaches, system failures, and cyber extortion. Given the potential financial impact of a cyber incident, this coverage is becoming an essential component of a business's insurance portfolio.

Sustainable and Socially Responsible Insurance

There’s a growing trend towards sustainable and socially responsible insurance practices. This includes not only insuring businesses that prioritize environmental and social sustainability but also offering insurance products that support these goals.

For instance, some insurance providers now offer policies that incentivize businesses to adopt more sustainable practices, such as reducing carbon emissions or implementing energy-efficient technologies. These policies can provide financial benefits, such as premium discounts or additional coverage, for businesses that meet certain sustainability criteria.

Data-Driven Insurance Pricing

The use of advanced data analytics is transforming the way insurance premiums are priced. Insurance providers are now able to use vast amounts of data to more accurately assess risk, leading to more tailored and competitive pricing.

For businesses, this means that insurance quotations are becoming increasingly accurate and reflective of their unique risk profiles. This can result in more cost-effective insurance solutions, especially for businesses that have successfully managed their risks and implemented effective risk management strategies.

Conclusion: Securing Your Business’s Future

Obtaining a comprehensive business insurance quotation is a critical step towards safeguarding your business and ensuring its long-term success. By understanding your unique needs, researching the available options, and comparing quotations carefully, you can make informed decisions that provide the best protection for your business.

Remember, business insurance is an investment in your company's future. It provides the financial resilience to withstand unexpected challenges and the peace of mind to focus on what matters most: growing and thriving in a competitive business landscape.

What is the typical turnaround time for receiving a business insurance quotation?

+The turnaround time can vary depending on the complexity of your business and the insurance provider. Generally, you can expect to receive a quotation within a few business days after submitting your information. However, for more complex businesses or those with unique risks, the process might take slightly longer.

Can I negotiate the terms of my business insurance quotation?

+Yes, negotiation is often possible, especially when working with an insurance broker who has relationships with multiple carriers. You can discuss your specific needs and budget with the broker, who can then advocate for you to secure the best possible terms and pricing.

How often should I review and update my business insurance coverage?

+It’s recommended to review your insurance coverage annually, or whenever there are significant changes to your business. This could include expansion into new markets, the introduction of new products or services, or changes in staffing levels. Regular reviews ensure your coverage remains up-to-date and adequately protects your evolving business.