Buy Insurance Online Cheap

Purchasing insurance online has become an increasingly popular option for consumers seeking affordable coverage. With the rise of digital platforms and insurance aggregators, it is now easier than ever to compare policies and find the best deals. This article will delve into the world of online insurance shopping, offering insights on how to navigate the process effectively and highlighting strategies to secure the cheapest rates.

The Appeal of Online Insurance

The digital age has revolutionized the insurance industry, offering a range of benefits to consumers. Online insurance platforms provide a convenient, efficient, and often cost-effective way to secure coverage. With just a few clicks, individuals can compare multiple policies, obtain quotes, and even purchase coverage, all from the comfort of their homes.

One of the key advantages of online insurance is the ability to compare various policies side by side. Aggregator websites compile information from multiple insurance providers, allowing users to see the features, benefits, and costs of different plans at a glance. This transparency empowers consumers to make informed decisions, ensuring they find the coverage that best suits their needs and budgets.

Strategies for Securing Cheap Insurance Rates Online

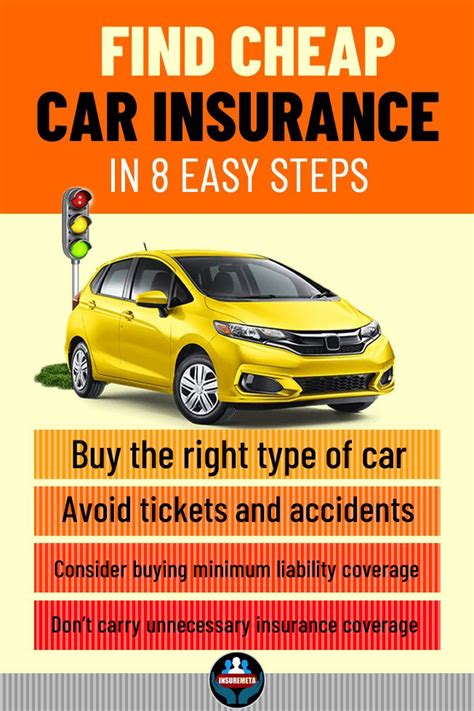

While the convenience of online insurance is undeniable, securing the cheapest rates requires a strategic approach. Here are some tips to help you navigate the process and get the best deals:

Research and Compare

Before committing to a policy, take the time to research and compare different options. Use insurance comparison websites to view a range of policies and their features. Pay attention to factors like coverage limits, deductibles, and additional benefits. Understanding these details will help you make an informed choice and ensure you’re not overpaying for coverage you don’t need.

Consider using tools like insurance calculators to estimate the cost of coverage based on your specific circumstances. These calculators can provide a more accurate estimate of your premium, helping you identify the most affordable options.

Understand Your Needs

Different insurance policies cater to different needs. Before shopping around, assess your insurance requirements. Consider factors like your age, health status, lifestyle, and the level of coverage you desire. Understanding your unique needs will help you narrow down your options and focus on policies that offer the right coverage at the right price.

Bundling Policies

Bundling multiple insurance policies with the same provider can often lead to significant savings. Insurance companies frequently offer discounts when you combine policies like home and auto insurance. By doing so, you not only simplify your insurance management but also enjoy reduced premiums.

Shop Around for the Best Deals

Don’t settle for the first insurance quote you receive. Shopping around is essential to finding the best deals. Compare quotes from multiple providers to identify the most competitive rates. Remember, insurance companies have different pricing structures, and what might be expensive with one provider could be a bargain with another.

Utilize insurance comparison websites to your advantage. These platforms aggregate quotes from various providers, making it easier to identify the most affordable options. However, be cautious of websites that only feature certain providers, as this may limit your options and prevent you from accessing the best deals.

Leverage Technology

Embrace digital tools to streamline your insurance shopping experience. Mobile apps and online platforms often offer more than just comparison features. Many providers now allow you to file claims, track policy details, and manage your insurance needs entirely online. These digital tools can enhance convenience and potentially lower your premiums.

Additionally, consider using insurance brokers or agents who operate online. These professionals can provide personalized advice and help you navigate the complex world of insurance, ensuring you get the coverage you need at a competitive price.

Consider Alternative Providers

Traditional insurance companies aren’t the only option. Explore alternative providers like mutual insurance companies, which are owned by their policyholders. These companies often offer competitive rates and focus on long-term relationships with their customers. Additionally, consider insurance startups that leverage technology to offer innovative coverage at affordable rates.

Negotiate and Ask for Discounts

Don’t be afraid to negotiate with insurance providers. Many companies are willing to offer discounts or special rates to secure your business. Ask about discounts for loyalty, safe driving, or even for paying your premium annually instead of monthly. Negotiating can lead to significant savings and help you secure the best deal.

Monitor Your Credit Score

Your credit score plays a significant role in determining your insurance rates. Insurance companies often use credit-based insurance scores to assess risk and set premiums. Maintaining a good credit score can help you qualify for lower rates and save money on your insurance policies.

The Future of Online Insurance

The insurance industry is continuously evolving, and the future of online insurance holds exciting possibilities. With advancements in technology, we can expect more personalized insurance policies that adapt to individual needs and lifestyles. Insurtech startups are leading the way with innovative solutions, such as usage-based insurance, which tailors premiums to your actual driving habits.

Furthermore, the rise of artificial intelligence and machine learning is expected to enhance the accuracy of risk assessment, potentially leading to more affordable premiums for policyholders. These advancements, coupled with the increasing popularity of online insurance platforms, will likely drive down costs and improve the overall insurance experience for consumers.

Conclusion

Securing cheap insurance online is within reach for savvy consumers. By adopting a strategic approach, leveraging technology, and staying informed about the latest trends, you can navigate the insurance market with confidence. Remember, the key to success lies in research, comparison, and understanding your unique insurance needs. With these strategies in mind, you’re well on your way to finding the best deals and securing the coverage you deserve at a price that fits your budget.

Can I get insurance quotes without providing personal information?

+Yes, many insurance comparison websites allow you to obtain initial quotes without sharing sensitive personal details. However, to get more accurate and personalized quotes, you may need to provide some basic information.

Are online insurance policies as reliable as traditional ones?

+Absolutely. Online insurance policies are offered by reputable companies and provide the same coverage and benefits as traditional policies. The mode of purchase is the only difference.

What factors can impact my insurance rates online?

+Several factors can influence your insurance rates, including your age, gender, location, driving record, credit score, and the type of coverage you choose. Comparing quotes from multiple providers is essential to find the best rates.