Ca Dmv Vehicle Insurance Program

In California, vehicle ownership comes with a set of responsibilities, including ensuring that your vehicle is adequately insured. The California Department of Motor Vehicles (DMV) has implemented a Vehicle Insurance Program to help motorists navigate the complexities of insurance requirements and provide a safety net for those who may struggle to obtain traditional insurance coverage.

This program, often referred to as the California Low-Cost Auto Insurance Program or CLCA, is designed to offer affordable insurance options to eligible California residents. With a focus on providing coverage to those who may be considered high-risk or face challenges in obtaining insurance, the CLCA program aims to ensure that all drivers on California roads are properly insured, contributing to safer roads and communities.

Understanding the California DMV Vehicle Insurance Program

The California DMV Vehicle Insurance Program, officially known as the California Low-Cost Auto Insurance Program, is a state-sponsored initiative that provides low-cost automobile insurance to eligible California drivers. This program was established to address the issue of uninsured motorists on California roads, ensuring that all drivers have access to the necessary insurance coverage.

The CLCA program is unique in that it offers insurance coverage specifically designed for low-income individuals who may otherwise struggle to afford standard auto insurance policies. By making insurance more accessible and affordable, the program aims to reduce the number of uninsured drivers, thereby increasing road safety and ensuring that all motorists are financially protected in the event of an accident.

Program Eligibility

To be eligible for the CLCA program, applicants must meet certain criteria. Firstly, they must be California residents with a valid driver's license or identification card issued by the California DMV. Additionally, applicants should have a clean driving record, free from major violations and at-fault accidents in the past three years. This is to ensure that the program provides insurance to responsible drivers who may face financial challenges.

Income is a key factor in eligibility. Applicants' household income must be at or below 250% of the Federal Poverty Level, which varies depending on the size of the household. For example, a single individual would need to earn $33,525 or less annually to qualify, while a family of four could earn up to $61,925 and still be eligible for the program. This income threshold ensures that the program is accessible to those who truly need affordable insurance options.

| Household Size | Income Eligibility |

|---|---|

| 1 | $33,525 or less |

| 2 | $42,875 or less |

| 3 | $50,225 or less |

| 4 | $61,925 or less |

| 5 | $69,275 or less |

| 6 | $76,625 or less |

| 7 | $83,975 or less |

| 8 | $91,325 or less |

It's important to note that the program has specific vehicle eligibility criteria as well. Only certain vehicle types are covered, and the vehicle's value cannot exceed a specified limit. This ensures that the program provides insurance for vehicles that are commonly used by low-income individuals and families.

Coverage and Benefits

The CLCA program offers a basic liability insurance policy that covers bodily injury and property damage. This means that if you're at fault in an accident, your policy will pay for the other party's medical expenses and property repairs up to the limits of your policy. This coverage is essential for protecting yourself financially and ensuring that you can fulfill your legal obligations after an accident.

The program also provides uninsured motorist bodily injury coverage, which protects you and your passengers if you're involved in an accident with an uninsured or underinsured driver. This coverage ensures that you and your passengers are financially protected, even if the other driver doesn't have adequate insurance.

Furthermore, the CLCA program offers medical payments coverage, which can cover the medical expenses of you and your passengers, regardless of who is at fault in an accident. This coverage provides an added layer of protection and can help alleviate the financial burden of medical bills after an accident.

| Coverage Type | Policy Limits |

|---|---|

| Liability Insurance | $15,000 per person, $30,000 per accident for bodily injury and $5,000 for property damage |

| Uninsured Motorist Bodily Injury | $15,000 per person, $30,000 per accident |

| Medical Payments | $5,000 per person |

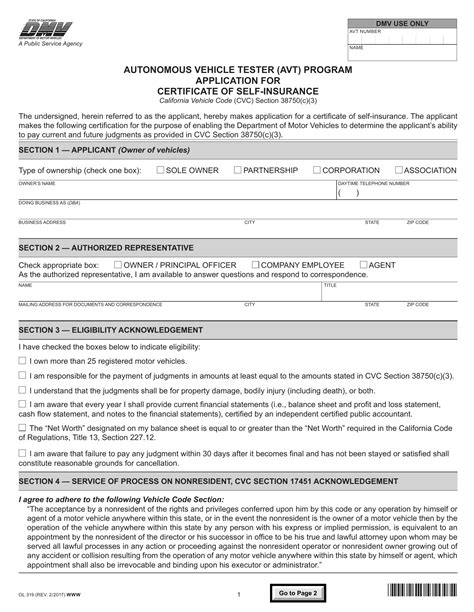

Application Process and Program Details

Applying for the CLCA program is a straightforward process. Applicants can download and complete the CLCA Application Form from the California DMV website. The form requires basic personal and vehicle information, as well as details about the applicant's income and household composition. It's important to provide accurate and up-to-date information to ensure eligibility.

Once the application is completed, it should be mailed to the address provided on the form. The California DMV will then review the application to verify eligibility. If approved, the applicant will receive a CLCA Identification Card and an insurance policy from one of the program's participating insurance companies.

The CLCA program offers a 12-month insurance policy, which can be renewed annually as long as the applicant continues to meet the program's eligibility criteria. The insurance coverage provided by the program is comprehensive, including liability, collision, and comprehensive coverage, ensuring that drivers are protected in a variety of situations.

One unique aspect of the CLCA program is its premium structure. The program uses a pay-as-you-go model, where premiums are calculated based on the number of miles driven. This means that individuals who drive less can save on insurance costs, making it an even more affordable option for low-income drivers.

Program Enrollment and Benefits

Upon enrollment in the CLCA program, participants receive a unique CLCA Identification Card that serves as proof of insurance. This card must be carried in the vehicle at all times, just like a standard insurance card. It's important to note that the CLCA program is not a replacement for traditional insurance, but rather a supplemental program for those who may not qualify for or afford standard insurance policies.

One of the key benefits of the CLCA program is its focus on education and safe driving. Participants are encouraged to take advantage of various driver education programs and safe driving initiatives. By promoting safe driving practices, the program aims to reduce accidents and improve overall road safety in California.

Additionally, the CLCA program provides access to a network of approved auto repair shops that offer discounts on repairs and maintenance. This benefit not only saves participants money but also ensures that their vehicles are properly maintained, further enhancing road safety.

Impact and Future of the Program

The California DMV Vehicle Insurance Program has had a significant impact on reducing the number of uninsured drivers in the state. By providing an affordable and accessible insurance option, the program has helped ensure that more drivers are financially protected and can fulfill their legal obligations. This, in turn, has contributed to a safer and more responsible driving environment in California.

Looking ahead, the future of the CLCA program appears promising. The program has consistently evolved to meet the changing needs of California drivers, particularly those with limited financial means. With ongoing support from the California DMV and participating insurance companies, the program is well-positioned to continue providing essential insurance coverage to eligible drivers.

As the program continues to grow, it is expected to further refine its eligibility criteria and coverage options to better serve the diverse needs of California's low-income population. This includes exploring ways to increase awareness and accessibility, ensuring that more eligible drivers are aware of and can benefit from the program.

Program Expansion and Innovations

In recent years, the CLCA program has expanded its reach by partnering with various community organizations and outreach programs. These partnerships have helped to increase awareness of the program among low-income communities, ensuring that more eligible individuals can access the benefits of affordable insurance.

Furthermore, the program has embraced technological advancements to streamline the application and renewal processes. Online platforms and mobile apps have been developed to make it easier for participants to manage their insurance policies, report claims, and stay up-to-date with program requirements. This digital transformation has not only improved efficiency but also enhanced the overall user experience.

Looking to the future, the CLCA program is exploring innovative ways to enhance its services. This includes potential partnerships with ride-sharing and car-sharing platforms to provide insurance coverage for gig workers and those who rely on shared mobility options. By staying adaptable and responsive to changing transportation trends, the program aims to remain a relevant and valuable resource for California's diverse driving population.

What is the California DMV Vehicle Insurance Program?

+The California DMV Vehicle Insurance Program, also known as the California Low-Cost Auto Insurance Program (CLCA), is a state-sponsored initiative that provides low-cost automobile insurance to eligible California drivers. It aims to reduce the number of uninsured motorists and ensure that all drivers have access to necessary insurance coverage.

Who is eligible for the CLCA program?

+Eligible applicants must be California residents with a valid driver’s license or ID card. They should have a clean driving record and household income at or below 250% of the Federal Poverty Level. The program also has specific vehicle eligibility criteria.

What type of coverage does the CLCA program offer?

+The CLCA program offers basic liability insurance, uninsured motorist bodily injury coverage, and medical payments coverage. These policies provide protection for bodily injury, property damage, and medical expenses, ensuring financial protection for drivers and their passengers.

How do I apply for the CLCA program?

+Applicants can download and complete the CLCA Application Form from the California DMV website. The form requires personal, vehicle, and income information. Once submitted, the DMV will review the application for eligibility.

What are the benefits of enrolling in the CLCA program?

+Enrollees receive a CLCA Identification Card and comprehensive insurance coverage. The program also promotes safe driving practices and provides access to a network of approved auto repair shops offering discounts. It’s an affordable option for those who may not qualify for or afford standard insurance policies.