Cancel State Farm Renters Insurance

Terminating Your State Farm Renters Insurance Policy: A Comprehensive Guide

Renters insurance is an essential aspect of protecting your belongings and ensuring peace of mind, especially for those who rent their homes. However, there may come a time when you need to cancel your insurance policy, whether it's due to a change in circumstances, a move to a new location, or a desire to switch providers. This guide will walk you through the process of canceling your State Farm renters insurance policy, providing you with a step-by-step breakdown and offering valuable insights to ensure a smooth transition.

Understanding the Cancellation Process

Canceling your State Farm renters insurance policy is a straightforward process, but it's important to understand the steps involved and the potential consequences. State Farm offers flexible cancellation options, allowing policyholders to terminate their coverage at any time without incurring excessive fees. However, it's crucial to be aware of any potential financial implications and ensure that you have adequate alternative coverage in place before proceeding.

State Farm provides a clear and transparent cancellation process, aiming to make it as hassle-free as possible for its customers. The insurer understands that life circumstances can change, and they strive to accommodate their policyholders' needs. By following the guidelines and providing the necessary information, you can efficiently cancel your renters insurance policy with State Farm.

Initiating the Cancellation

To initiate the cancellation process, you'll need to contact State Farm directly. The insurer offers multiple channels for communication, allowing you to choose the most convenient method. You can reach out to them via their official website, through their dedicated customer service hotline, or by visiting your local State Farm agent's office.

When contacting State Farm, ensure that you have your policy number and relevant personal information readily available. This will help expedite the process and ensure that your request is handled efficiently. State Farm's customer service representatives are trained to guide you through the cancellation procedure, answering any questions you may have along the way.

During your initial contact, you'll be asked to provide the reason for canceling your policy. While State Farm values customer feedback, they do not require an extensive explanation. However, providing a brief overview of your circumstances can help improve their services and ensure a smoother transition for future customers.

Required Documentation

To officially cancel your State Farm renters insurance policy, you'll need to submit a written request. This can be done through various methods, including email, fax, or regular mail. State Farm provides a standard cancellation form on their website, which you can download, fill out, and return to them.

| Method | Details |

|---|---|

| Send the completed form to the designated email address provided by State Farm. Ensure that you receive a confirmation of receipt to verify that your request has been successfully submitted. | |

| Fax | Fax the completed form to the designated fax number. Keep a record of the fax transmission for your records. |

| Send the completed form via regular mail to the address specified by State Farm. Consider using certified mail with a return receipt to ensure delivery and provide proof of cancellation. |

In addition to the cancellation form, you may also be required to provide supporting documentation. This could include a copy of your new insurance policy with another provider or proof of your move to a new location. State Farm may request this information to ensure that you are adequately covered and to maintain accurate records.

Processing Time and Refunds

Once State Farm receives your cancellation request, they will process it as soon as possible. The exact processing time may vary depending on the method of submission and the workload of their customer service team. However, State Farm aims to provide a timely response and complete the cancellation process within a reasonable timeframe.

If you are eligible for a refund, State Farm will calculate the amount based on the pro-rata basis. This means that you will receive a portion of your premium, adjusted for the coverage period you have already enjoyed. The refund will be issued according to your preferred method of payment, whether it's a check, direct deposit, or credit to your credit card account.

It's important to note that State Farm may deduct any applicable fees or charges from your refund. These fees could include cancellation fees, administrative costs, or any outstanding balances on your policy. State Farm will provide a detailed breakdown of the refund calculation, ensuring transparency and clarity.

Alternatives and Considerations

Before canceling your State Farm renters insurance policy, it's essential to consider your alternatives and ensure a seamless transition to your new coverage. Here are some key factors to keep in mind:

New Insurance Provider

If you have already secured a new renters insurance policy with another provider, ensure that the coverage is effective immediately. You don't want to find yourself without adequate protection during the transition period. Compare the coverage limits, deductibles, and exclusions between your old and new policies to ensure that you are not compromising on essential protections.

State Farm understands that customers may switch providers, and they are willing to provide assistance during this process. They can help you understand any differences between your old and new policies, ensuring that you make an informed decision. Their customer service representatives can also guide you through any necessary steps to ensure a smooth transfer of coverage.

Moving to a New Location

If you are canceling your State Farm renters insurance policy due to a move, it's crucial to understand the insurance requirements of your new location. Different states or cities may have varying regulations regarding renters insurance, so be sure to research and comply with any local mandates.

State Farm can provide valuable insights and guidance if you are moving to a new area. They can inform you of any specific coverage needs or potential risks associated with your new location. By leveraging their expertise, you can make informed decisions and secure the appropriate insurance coverage for your new home.

Comparing Coverage and Costs

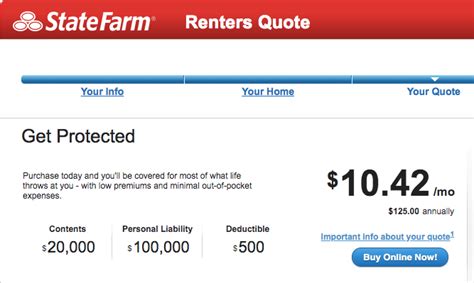

When considering alternatives to State Farm renters insurance, it's essential to compare coverage options and costs. Renters insurance policies can vary significantly between providers, so take the time to assess the coverage limits, deductibles, and additional perks offered by different insurers.

State Farm offers a range of coverage options and customizable policies to meet the diverse needs of its customers. Before canceling your policy, explore the various add-ons and endorsements available with State Farm. These additional coverages can enhance your protection and provide peace of mind, ensuring that your belongings are adequately safeguarded.

The Future of Renters Insurance

The renters insurance industry is constantly evolving, with insurers adapting to meet the changing needs and preferences of their customers. State Farm, as a leading provider, is committed to staying at the forefront of these developments, ensuring that their policies remain relevant and competitive.

State Farm continuously evaluates market trends and customer feedback to enhance their renters insurance offerings. They strive to provide comprehensive coverage at competitive rates, making it accessible and affordable for a wide range of renters. By staying agile and responsive, State Farm aims to remain a trusted partner for individuals seeking reliable insurance protection.

Emerging Trends in Renters Insurance

The renters insurance landscape is witnessing several emerging trends that are shaping the future of the industry. These trends include:

- Digitalization and Convenience: Renters increasingly prefer digital platforms and mobile apps for managing their insurance needs. State Farm recognizes this trend and has invested in developing user-friendly digital tools, allowing policyholders to access their policies, file claims, and make payments conveniently.

- Customizable Coverage: Renters now have more options to tailor their insurance policies to their specific needs. State Farm offers a range of customizable coverage options, enabling renters to choose the level of protection that suits their circumstances and belongings.

- Bundling and Discounts: Many renters are opting to bundle their insurance policies, such as combining renters and auto insurance, to take advantage of multi-policy discounts. State Farm encourages bundling by offering attractive discounts to customers who choose to insure multiple aspects of their lives with the company.

- Enhanced Protection for High-Value Items : With the rise of technology and valuable personal possessions, renters are seeking insurance coverage that provides adequate protection for their high-value items. State Farm understands this need and offers endorsements to enhance coverage for valuable belongings like jewelry, artwork, and electronics.

State Farm's Commitment to Innovation

State Farm is dedicated to staying ahead of the curve and adapting to the evolving needs of its customers. They actively engage in research and development to introduce innovative solutions and improve their existing offerings. By embracing technology and customer feedback, State Farm aims to provide a seamless and personalized insurance experience.

State Farm's commitment to innovation is evident in their recent initiatives, such as the launch of their mobile app, which allows policyholders to manage their insurance on the go. The app provides real-time updates, claim tracking, and convenient payment options, enhancing the overall customer experience. State Farm also invests in data analytics to identify trends and personalize coverage recommendations, ensuring that renters receive the most suitable protection for their unique situations.

Conclusion

Canceling your State Farm renters insurance policy is a straightforward process, and with the right preparation and considerations, you can ensure a smooth transition. By understanding the cancellation process, providing the necessary documentation, and exploring alternative coverage options, you can confidently terminate your policy and move forward with your insurance needs.

Remember, State Farm values its customers and strives to accommodate their changing circumstances. By staying informed and proactive, you can make informed decisions about your insurance coverage and continue to protect what matters most.

Frequently Asked Questions

How long does it take for State Farm to process a cancellation request?

+The processing time for a cancellation request can vary depending on several factors. Typically, State Farm aims to process cancellations within a few business days. However, factors such as the method of submission, the workload of their customer service team, and the complexity of your policy can influence the processing time. It is advisable to allow a reasonable timeframe and follow up with State Farm if you have not received a confirmation within a week.

Can I cancel my State Farm renters insurance policy online?

+Yes, State Farm provides an online cancellation option through their official website. You can log in to your online account, access the cancellation form, and submit your request electronically. This method offers a convenient and efficient way to initiate the cancellation process without the need for physical documentation.

What happens if I cancel my policy before the end of the coverage period?

+If you cancel your State Farm renters insurance policy before the end of the coverage period, you may be eligible for a refund. The refund will be calculated on a pro-rata basis, meaning you will receive a portion of your premium based on the unused coverage period. State Farm will deduct any applicable fees or charges from the refund amount. It’s important to note that you will no longer be covered by the policy once the cancellation is effective, so it’s essential to have alternative coverage in place.

Can I cancel my policy if I have an outstanding balance?

+Yes, you can cancel your State Farm renters insurance policy even if you have an outstanding balance. However, it’s important to note that State Farm may deduct the outstanding balance from your refund. If the refund amount is insufficient to cover the balance, you may be required to make additional payments to settle the outstanding debt. State Farm will provide a detailed breakdown of the refund calculation and any deductions.

Are there any cancellation fees associated with terminating my policy?

+State Farm may charge a cancellation fee when terminating your renters insurance policy. The fee amount can vary depending on your policy and the reason for cancellation. It’s advisable to review your policy documents or contact State Farm’s customer service to understand the specific cancellation fee structure. State Farm will provide transparency regarding any fees involved in the cancellation process.