Car And Insurance Monthly

Welcome to this in-depth exploration of the intricate world of car insurance! In today's fast-paced world, where our lives revolve around mobility and transportation, understanding the nuances of automobile insurance has become increasingly crucial. This comprehensive guide will delve into the key aspects of car insurance, shedding light on its importance, various types, coverage options, and the factors that influence premiums. By the end of this article, you'll have a clear grasp of how car insurance works and how to make informed decisions when it comes to safeguarding your vehicle and your finances.

Understanding Car Insurance: A Necessity for Modern Drivers

Car insurance is a financial safety net that every driver needs. It provides protection against potential financial losses resulting from accidents, theft, or other unforeseen events. In many countries, having valid car insurance is a legal requirement, but even where it’s not mandatory, the benefits of insurance coverage far outweigh the potential risks and costs associated with driving without it.

Imagine a scenario where you're involved in an accident, and your vehicle sustains significant damage. Without insurance, you would be responsible for covering all the repair costs, which can be financially devastating. Car insurance steps in to mitigate these risks, offering a range of coverage options tailored to different driving needs and preferences.

The Different Types of Car Insurance: Finding the Right Fit

Car insurance comes in various forms, each designed to cater to specific needs and circumstances. Understanding these types is crucial in making an informed decision about your coverage.

Liability Insurance

Liability insurance is the most basic form of car insurance and is often mandatory. It covers the costs associated with bodily injury or property damage to others as a result of an accident you cause. This type of insurance protects you from potential lawsuits and financial liabilities, ensuring that you can meet your legal obligations.

Collision Insurance

Collision insurance is an optional coverage that pays for repairs or replaces your vehicle if it’s damaged in an accident, regardless of fault. This type of insurance is particularly beneficial for newer or more valuable vehicles, as it can help cover the costs of repairing or replacing them after an accident.

Comprehensive Insurance

Comprehensive insurance, often referred to as “full coverage,” is another optional type of car insurance. It provides protection against damage to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or accidents with animals. Comprehensive insurance offers a broader level of protection, ensuring that your vehicle is covered in a wide range of situations.

Gap Insurance

Gap insurance, or Guaranteed Asset Protection, is designed to cover the difference between the actual cash value of your vehicle and the amount you still owe on your loan or lease. This type of insurance is especially useful if your car is totaled or stolen, as it ensures you’re not left with a financial gap between the insurance payout and your remaining loan balance.

Personal Injury Protection (PIP) and Medical Payments

PIP and Medical Payments coverage focus on the medical expenses of the policyholder and their passengers, regardless of fault. These policies cover a wide range of medical costs, including doctor visits, hospital stays, rehabilitation, and even funeral expenses. They provide peace of mind, knowing that your health and well-being are prioritized, even in the event of an accident.

Factors Influencing Car Insurance Premiums: A Deep Dive

Car insurance premiums are determined by a complex interplay of factors, each playing a unique role in calculating the cost of your policy. Understanding these factors can help you make strategic decisions to potentially lower your insurance costs.

Vehicle Type and Usage

The type of vehicle you drive and how you use it are significant factors in determining your insurance premium. Generally, newer, more expensive, or high-performance vehicles tend to have higher insurance costs due to their higher replacement or repair values. Additionally, if your vehicle is used for business purposes or has modified features, your insurance rates may increase.

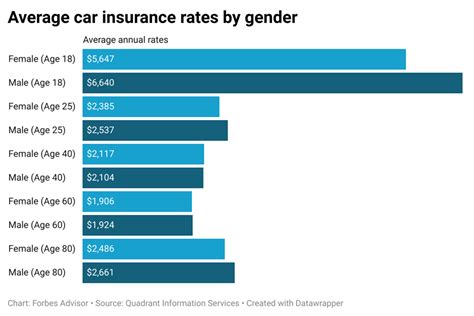

Driver Profile and History

Your personal driving history and demographic factors play a crucial role in insurance pricing. Insurance companies carefully evaluate your driving record, considering factors such as accidents, traffic violations, and claims history. Young drivers and those with a history of accidents or violations may face higher premiums, as they are statistically more likely to be involved in accidents.

Location and Usage Patterns

Your geographic location and driving habits also influence insurance rates. Insurance providers analyze local crime rates, traffic patterns, and the likelihood of accidents in your area. If you live in an urban area with high traffic congestion or a region with a high incidence of theft or vandalism, your insurance premiums may be higher. Additionally, the distance you drive each year and the purpose of your trips (e.g., commuting, pleasure, or business) can impact your insurance costs.

Coverage Levels and Deductibles

The level of coverage you choose and the deductibles you select can significantly affect your insurance premium. Higher coverage limits and lower deductibles generally result in higher premiums, as they provide more extensive protection. On the other hand, opting for lower coverage levels and higher deductibles can lead to reduced premiums, but it’s important to strike a balance between cost and adequate protection.

Insurance Company and Policy Features

Different insurance companies offer varying rates and policy features. It’s essential to shop around and compare quotes from multiple providers to find the best fit for your needs. Additionally, some insurance companies may offer discounts for certain policy features, such as bundling multiple policies (e.g., car and home insurance), installing safety devices, or maintaining a good driving record.

Maximizing Coverage and Savings: Strategies for Car Insurance

Now that we’ve explored the key factors influencing car insurance premiums, let’s delve into some practical strategies to maximize your coverage while keeping costs manageable.

Shop Around and Compare

One of the most effective ways to find the best car insurance deal is to compare quotes from multiple insurance providers. Each company has its own rating system and pricing strategies, so getting quotes from at least three different insurers can help you identify the most competitive rates. Online comparison tools and insurance brokerages can streamline this process, making it easier to find the right coverage at the right price.

Bundling Policies for Discounts

Many insurance companies offer discounts when you bundle multiple policies, such as combining your car insurance with home, renters, or life insurance. By doing so, you can often save a significant amount on your overall insurance costs. Additionally, bundling policies can provide added convenience, as you only need to deal with one insurance provider for all your coverage needs.

Maintain a Clean Driving Record

Your driving record is a key factor in determining your insurance rates. Maintaining a clean driving record, free from accidents and traffic violations, can lead to substantial savings on your insurance premiums. Insurance companies often reward safe drivers with discounts, so it’s essential to practice defensive driving and adhere to traffic laws.

Consider Higher Deductibles

Opting for a higher deductible can reduce your insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially accepting more financial responsibility in the event of a claim. While this strategy can lead to lower premiums, it’s important to ensure that you have the financial means to cover the deductible if needed.

Explore Discounts and Special Programs

Insurance companies often offer a variety of discounts and special programs to attract and retain customers. These can include discounts for safe driving, good student status, loyalty rewards, or even occupational-based discounts for certain professions. Additionally, some insurers provide incentives for adopting safe driving technologies, such as telematics devices or apps that track driving behavior.

The Future of Car Insurance: Technological Innovations and Trends

The car insurance industry is continuously evolving, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future of car insurance and the trends that are shaping the industry.

Telematics and Usage-Based Insurance (UBI)

Telematics and UBI are transforming the way insurance premiums are calculated. These technologies use real-time data from onboard sensors or smartphone apps to track driving behavior, such as speed, acceleration, braking, and mileage. By analyzing this data, insurance companies can offer more personalized and accurate premiums, rewarding safe drivers with lower rates. UBI programs are gaining popularity, providing drivers with an incentive to adopt safer driving habits.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are playing an increasingly significant role in the car insurance industry. Insurance providers are leveraging AI to process vast amounts of data, including driver behavior, vehicle performance, and accident patterns. This enables them to make more informed decisions about risk assessment and pricing. AI-powered systems can also streamline claims processing, making it faster and more efficient for policyholders.

Connected Cars and Autonomous Vehicles

The rise of connected cars and autonomous vehicles is set to revolutionize the car insurance landscape. These vehicles generate massive amounts of data, which can be used by insurance companies to gain deeper insights into driver behavior and vehicle performance. As autonomous vehicles become more prevalent, insurance policies may need to adapt to cover new risks and liabilities associated with self-driving technology.

Blockchain and Smart Contracts

Blockchain technology and smart contracts are emerging as potential game-changers in the insurance industry. Blockchain’s decentralized and secure nature can enhance data integrity and streamline insurance processes. Smart contracts, self-executing contracts with predefined rules, can automate various aspects of insurance, such as claims processing and policy management. This technology has the potential to reduce administrative costs and improve overall efficiency in the insurance sector.

Personalized Insurance and Risk Assessment

The future of car insurance is moving towards highly personalized policies and risk assessment. With the wealth of data available, insurance companies can tailor policies to individual driver profiles, taking into account factors such as driving behavior, vehicle usage, and even lifestyle choices. This level of personalization can lead to more accurate pricing and coverage, ensuring that policyholders pay for the risks they truly face.

Conclusion: Navigating the Road Ahead with Confidence

Car insurance is an essential component of responsible driving and financial planning. By understanding the different types of insurance, the factors that influence premiums, and the strategies to maximize coverage and savings, you can make informed decisions to protect your vehicle and your finances. As the car insurance industry continues to evolve with technological advancements, staying informed and adaptable will be key to navigating the road ahead with confidence and peace of mind.

Frequently Asked Questions (FAQ)

How often should I review my car insurance policy?

+

It’s recommended to review your car insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains up-to-date and reflects your current needs. Regular reviews can help you identify potential savings or additional coverage options.

Can I switch insurance companies mid-policy term?

+

Yes, you can switch insurance companies at any time. However, it’s important to note that some policies may have cancellation fees or require a minimum notice period. Be sure to carefully review the terms of your current policy before making a switch.

What should I do if I’m involved in an accident?

+

If you’re involved in an accident, remain calm and assess the situation. Ensure the safety of yourself and others involved. Exchange contact and insurance information with the other parties. Take photos of the accident scene and any damage to vehicles. Notify your insurance company as soon as possible to initiate the claims process.

How can I reduce my insurance premiums if I have a poor driving record?

+

If you have a poor driving record, you may face higher insurance premiums. However, you can take steps to improve your record and potentially reduce your rates. Attend defensive driving courses, maintain a clean driving record going forward, and consider opting for a higher deductible to lower your premiums. Shopping around for quotes from different insurers can also help you find more competitive rates.

Are there any discounts available for students or young drivers?

+

Yes, many insurance companies offer discounts for students and young drivers. These discounts may be based on factors such as good grades, enrollment in a college or university, or completion of a recognized driving course. It’s worth inquiring with insurance providers about these discounts to potentially save on your premiums.