Car Insurance Best Rate

Finding the best rate for car insurance is a top priority for many drivers, as it can significantly impact their finances and overall experience. With numerous insurance providers offering a wide range of policies, navigating the market to secure the most cost-effective coverage can be a challenging task. This article aims to provide an in-depth guide to help drivers understand the factors that influence car insurance rates and offer strategies to secure the best possible deal.

Understanding Car Insurance Rates

Car insurance rates are determined by a complex interplay of factors that vary based on individual circumstances and the specific policies offered by insurance providers. These factors include:

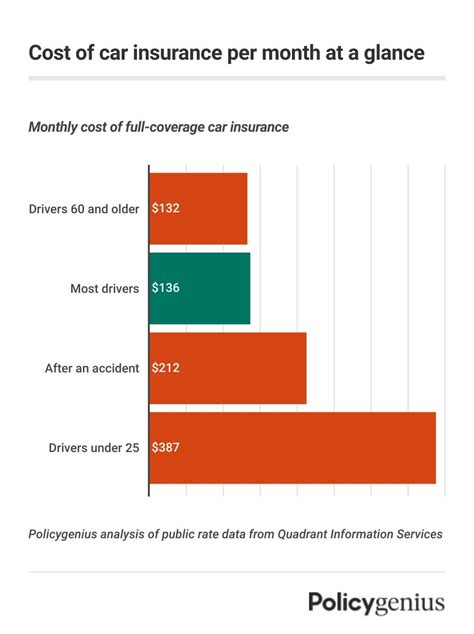

- Driver's Age and Gender: Younger drivers, particularly males under the age of 25, often face higher insurance premiums due to their perceived risk profile. Conversely, older drivers, especially those with a clean driving record, may benefit from lower rates.

- Driving History: A clean driving record with no accidents or violations is generally rewarded with lower insurance rates. On the other hand, drivers with a history of accidents, traffic violations, or DUI convictions may face higher premiums.

- Vehicle Type and Usage: The make, model, and age of your vehicle play a significant role in determining insurance rates. Additionally, the primary purpose of your vehicle (e.g., commuting, business use, pleasure driving) can influence the premium.

- Coverage and Deductibles: The level of coverage you choose (e.g., liability-only vs. comprehensive) and the deductibles you select will directly impact your insurance rate. Higher deductibles often result in lower premiums, but it's essential to strike a balance that suits your financial situation.

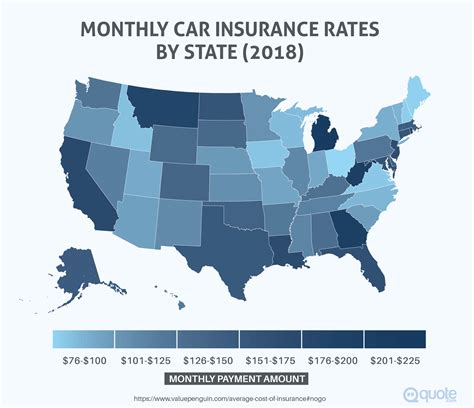

- Location and Usage: Where you live and how often you drive can affect your insurance rates. Urban areas with higher population densities and a history of frequent accidents or thefts may command higher premiums.

- Credit Score: In some states, insurance companies consider your credit score when calculating your premium. A higher credit score can lead to lower insurance rates.

- Discounts and Bundles: Many insurance providers offer discounts for various factors, such as safe driving, good grades for young drivers, or bundling multiple policies (e.g., home and auto insurance) with the same company.

Strategies to Get the Best Rate

Securing the best car insurance rate requires a combination of understanding your personal circumstances, researching the market, and negotiating with insurance providers. Here are some strategies to help you achieve this goal:

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Shopping around and comparing quotes from multiple providers is essential to finding the best rate. Online comparison tools can be a great starting point, but it’s also beneficial to contact individual insurance companies directly to explore their offerings.

Understand Your Coverage Needs

Assess your specific coverage requirements. Consider factors such as the value of your vehicle, your financial situation, and any state-mandated minimum coverage levels. Tailor your coverage to your needs to avoid paying for unnecessary extras.

Improve Your Driving Record

A clean driving record is a significant factor in determining insurance rates. Strive to maintain a safe driving history by avoiding accidents and traffic violations. Additionally, consider taking defensive driving courses, as some insurance companies offer discounts for completing these courses.

Consider Higher Deductibles

Opting for a higher deductible can lead to lower insurance premiums. However, ensure that you can afford the deductible in the event of an accident or claim. This strategy works best for drivers who are confident in their ability to avoid accidents and maintain a clean driving record.

Explore Discounts and Bundles

Insurance companies often offer a variety of discounts to attract and retain customers. Common discounts include those for safe driving, good student grades, loyalty, bundling multiple policies, and vehicle safety features. Take advantage of these discounts by discussing your eligibility with insurance providers.

Utilize Telematics Insurance

Telematics insurance, also known as usage-based insurance, allows drivers to link their insurance premiums to their actual driving behavior. By installing a tracking device or using a smartphone app, insurance companies can monitor factors like mileage, driving speed, and braking habits. Drivers who exhibit safe driving behaviors may qualify for lower premiums.

Negotiate and Leverage Competition

Don’t be afraid to negotiate with insurance providers. Share the competitive quotes you’ve received from other companies and inquire about matching or beating those rates. Insurance companies often value customer loyalty and may be willing to offer better deals to retain your business.

Maintain a Good Credit Score

In states where credit scores are considered for insurance rates, maintaining a good credit score can lead to lower premiums. Focus on paying your bills on time, reducing credit card balances, and regularly reviewing your credit report for accuracy.

Consider Alternative Insurance Providers

Traditional insurance companies aren’t the only option. Explore alternative insurance providers, such as peer-to-peer insurance models or insurance startups, which may offer innovative coverage options and competitive rates.

Performance Analysis and Future Implications

The car insurance market is dynamic, with constant changes in pricing structures, coverage options, and regulatory environments. Keeping abreast of these changes is crucial for drivers to ensure they are getting the best value for their insurance premiums. Regularly reviewing and comparing insurance policies, especially during major life events like purchasing a new vehicle or moving to a new location, can help drivers stay informed and secure the most cost-effective coverage.

Additionally, the rise of telematics insurance and the increasing use of technology in the insurance industry present both opportunities and challenges. While these innovations can reward safe drivers with lower premiums, they also raise concerns about data privacy and the potential for algorithmic bias. As the insurance industry continues to evolve, it's essential for drivers to remain proactive in understanding the latest trends and developments to make informed decisions about their car insurance coverage.

| Key Factor | Impact on Insurance Rates |

|---|---|

| Driver's Age and Gender | Younger drivers, especially males, often face higher premiums due to perceived risk. |

| Driving History | Clean driving records result in lower rates, while accidents and violations can increase premiums. |

| Vehicle Type and Usage | Vehicle make, model, and age, as well as primary usage, influence insurance costs. |

| Coverage and Deductibles | Higher deductibles can lead to lower premiums, but coverage levels should match individual needs. |

| Location and Usage | Urban areas and frequent driving may result in higher premiums. |

| Credit Score | In some states, a higher credit score can lead to lower insurance rates. |

How often should I review my car insurance policy and rates?

+It’s advisable to review your car insurance policy and rates at least once a year, or whenever you experience significant life changes such as purchasing a new vehicle, moving to a different location, or getting married. Regular reviews ensure you’re getting the best value and coverage for your needs.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time, but be mindful of any cancellation fees or penalties that may apply. It’s a good idea to compare rates and coverage options regularly to ensure you’re not overpaying.

How can I improve my chances of getting a lower insurance rate if I have a poor driving record?

+If you have a poor driving record, consider taking defensive driving courses to improve your skills and demonstrate a commitment to safer driving. Additionally, explore insurance providers that specialize in high-risk drivers or offer programs to help drivers with a history of accidents or violations.