Car Insurance For Full Coverage

In the world of automotive protection, understanding the nuances of car insurance is crucial. Full coverage, a comprehensive insurance plan, offers a safety net for vehicle owners, safeguarding them against various unforeseen events. This article aims to delve deep into the world of full coverage car insurance, exploring its components, benefits, and considerations to help you make an informed decision about your automotive protection.

Understanding Full Coverage Car Insurance

Full coverage car insurance is an extensive policy that goes beyond the basic liability coverage. It’s designed to provide financial protection for your vehicle in a wide range of scenarios, including accidents, theft, and natural disasters. This type of insurance is a popular choice for individuals who want to ensure their vehicles are protected against various risks, offering peace of mind and financial security.

The term "full coverage" is often used colloquially to describe a policy that includes both collision coverage and comprehensive coverage, along with liability insurance. Let's break down these components to understand their significance.

Collision Coverage

Collision coverage is a vital part of full coverage insurance. It steps in when your vehicle is involved in an accident, whether it’s a collision with another vehicle, an object, or even a rollover. This coverage pays for the repairs or replacement of your car, up to the actual cash value, minus your deductible. It’s particularly beneficial for newer or leased vehicles, as it can help cover the cost of repairs or replacements that might otherwise be expensive.

| Key Fact | Description |

|---|---|

| Coverage Extent | Covers repairs or replacement costs for your vehicle after an accident. |

| Limitations | Does not cover damages caused by theft, natural disasters, or vandalism. |

Comprehensive Coverage

Comprehensive coverage, often paired with collision coverage, is a crucial aspect of full coverage insurance. It provides protection for your vehicle against events beyond your control, such as theft, vandalism, natural disasters (like hail, floods, or fires), and even damage caused by animals (like deer collisions). This coverage is especially valuable for protecting your vehicle from risks that are not directly related to accidents.

| Coverage Highlight | Details |

|---|---|

| Theft Protection | Reimburses the cost of a stolen vehicle or its parts. |

| Natural Disaster Shield | Covers damage from events like floods, fires, or storms. |

Liability Insurance

Liability insurance is a fundamental component of any car insurance policy, including full coverage. It protects you financially if you are found at fault in an accident, covering the costs of injuries or property damage caused to others. This coverage is legally required in most states and is a critical aspect of responsible vehicle ownership.

| Liability Coverage | Explanation |

|---|---|

| Bodily Injury Liability | Pays for medical expenses of injured parties in an accident you caused. |

| Property Damage Liability | Covers the cost of repairing or replacing damaged property, like another vehicle. |

Benefits of Full Coverage Car Insurance

Full coverage car insurance offers a multitude of advantages, making it an appealing choice for many vehicle owners. Let’s explore some of the key benefits:

Financial Protection

One of the most significant advantages of full coverage insurance is the financial protection it provides. In the event of an accident, theft, or natural disaster, your insurance policy steps in to cover the costs, ensuring you’re not left with a hefty bill. This financial safety net is particularly valuable for those who might not have the means to cover unexpected expenses.

Peace of Mind

Knowing that your vehicle is protected against a wide range of risks can bring immense peace of mind. Full coverage insurance allows you to drive with confidence, knowing that you’re prepared for the unexpected. Whether it’s a fender bender or a severe storm, you can rest assured that your insurance policy has your back.

Comprehensive Protection

Full coverage car insurance is aptly named because it offers comprehensive protection. Unlike basic liability insurance, which only covers damages to others, full coverage extends to your vehicle as well. This means that regardless of the situation, your vehicle is protected, ensuring its longevity and value.

Considerations and Customization

While full coverage car insurance offers extensive protection, it’s essential to consider your specific needs and circumstances. Here are some factors to keep in mind when choosing a full coverage policy:

Vehicle Value

The value of your vehicle plays a significant role in determining the cost and benefits of full coverage insurance. For older vehicles with low resale value, the cost of full coverage might outweigh the benefits. In such cases, liability-only insurance might be a more cost-effective choice.

Deductibles

Deductibles are the amount you pay out of pocket before your insurance kicks in. Higher deductibles can lower your premium, but they also mean you’ll pay more if you need to make a claim. Choose a deductible that balances your financial comfort with the level of protection you desire.

Personalized Add-Ons

Full coverage insurance policies often allow for personalized add-ons, such as roadside assistance, rental car coverage, or gap insurance. These additional coverages can enhance your protection and provide added convenience in certain situations.

| Add-On Coverage | Description |

|---|---|

| Roadside Assistance | Provides emergency services like towing, flat tire changes, or battery jumps. |

| Rental Car Coverage | Covers the cost of a rental car while your vehicle is being repaired. |

| Gap Insurance | Covers the difference between your vehicle's actual value and what you owe on a lease or loan. |

Making an Informed Decision

Choosing the right car insurance policy is a crucial decision. When considering full coverage, it’s beneficial to:

- Research multiple providers to compare rates and coverage options.

- Read reviews and seek recommendations from trusted sources.

- Understand the specific exclusions and limitations of each policy.

- Discuss your options with an insurance agent to tailor a policy to your needs.

Remember, while full coverage offers extensive protection, it might not be the best fit for everyone. Assess your risks, driving habits, and financial situation to make an informed decision. It's always beneficial to seek professional advice to ensure you're adequately protected.

Conclusion

Full coverage car insurance is a robust solution for vehicle owners seeking comprehensive protection. By understanding the components, benefits, and considerations, you can make an informed decision about your automotive insurance. Remember, the right coverage can provide peace of mind and financial security, ensuring your vehicle is protected against a wide range of unforeseen events.

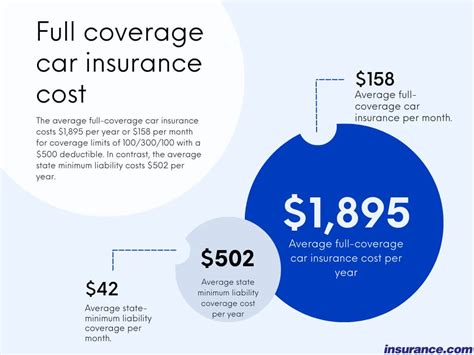

What is the average cost of full coverage car insurance?

+

The cost of full coverage car insurance varies widely based on factors like location, vehicle type, driving history, and coverage limits. On average, full coverage policies can range from 1,000 to 3,000 annually. However, it’s crucial to obtain quotes from multiple providers to find the most competitive rates for your specific circumstances.

Do I need full coverage car insurance for an older vehicle?

+

For older vehicles with low resale value, full coverage might not be cost-effective. In such cases, liability-only insurance can provide the necessary protection without a high premium. It’s essential to weigh the cost of insurance against the value of your vehicle to make an informed decision.

Can I customize my full coverage policy with add-ons?

+

Yes, full coverage policies often allow for personalized add-ons. These can include roadside assistance, rental car coverage, or gap insurance. These add-ons enhance your protection and provide additional convenience in certain situations. Discuss your options with your insurance provider to tailor your policy to your needs.

What are the typical exclusions in a full coverage policy?

+

Full coverage policies typically exclude damages caused by wear and tear, mechanical or electrical breakdowns, and intentional acts. It’s essential to review the specific exclusions in your policy to understand what’s covered and what’s not. This ensures you’re aware of any gaps in your coverage.