Car Insurance Rates Comparison

When it comes to car insurance, rates can vary significantly depending on a multitude of factors. From the make and model of your vehicle to your driving history and personal demographics, every aspect plays a role in determining the cost of your insurance policy. In this comprehensive guide, we delve into the world of car insurance rates, providing you with an in-depth analysis and comparison to help you make informed decisions and potentially save money on your coverage.

Understanding the Key Factors Influencing Car Insurance Rates

Car insurance rates are influenced by a complex interplay of variables. Here, we break down the key factors that insurance providers consider when calculating premiums:

Vehicle Type and Usage

The make, model, and year of your vehicle significantly impact insurance rates. Insurance companies consider factors such as the vehicle’s safety features, repair costs, and its popularity among thieves. Additionally, the primary use of your vehicle matters. Are you using it for daily commutes or occasional pleasure drives? Understanding these nuances can help you tailor your insurance coverage accordingly.

| Vehicle Category | Average Annual Premium |

|---|---|

| Sedans (e.g., Toyota Camry) | $1,200 - $1,500 |

| SUVs (e.g., Ford Explorer) | $1,300 - $1,700 |

| Sports Cars (e.g., Porsche 911) | $2,500 - $3,000 |

Driver’s Profile and History

Your driving record is a critical factor in determining insurance rates. Insurance companies thoroughly examine your history, including any accidents, traffic violations, and claims made in the past. A clean driving record can lead to significant savings, while a history of accidents or violations may result in higher premiums.

| Driver Profile | Average Annual Premium |

|---|---|

| New Driver (18-25 years) | $2,000 - $3,500 |

| Experienced Driver (30-50 years) | $1,000 - $1,800 |

| Senior Driver (65+ years) | $800 - $1,200 |

Location and Geographical Factors

Where you live and drive your vehicle plays a crucial role in insurance rates. Insurance companies assess factors like traffic congestion, crime rates, and weather conditions in your area. Urban areas with higher population densities and more frequent accidents tend to have higher insurance premiums.

- City Premiums: $1,500 - $2,000

- Suburban Premiums: $1,200 - $1,600

- Rural Premiums: $800 - $1,100

Coverage Options and Deductibles

The type and extent of coverage you choose directly impact your insurance rates. Comprehensive and collision coverage, for instance, can provide more extensive protection but come at a higher cost. Additionally, your deductible amount, the portion you pay out-of-pocket before insurance coverage kicks in, affects your premium. Higher deductibles can lead to lower premiums, but it’s essential to strike a balance that suits your financial situation.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability Only | $500 - $1,000 |

| Comprehensive and Collision | $1,500 - $2,500 |

Comparing Insurance Providers: A Detailed Analysis

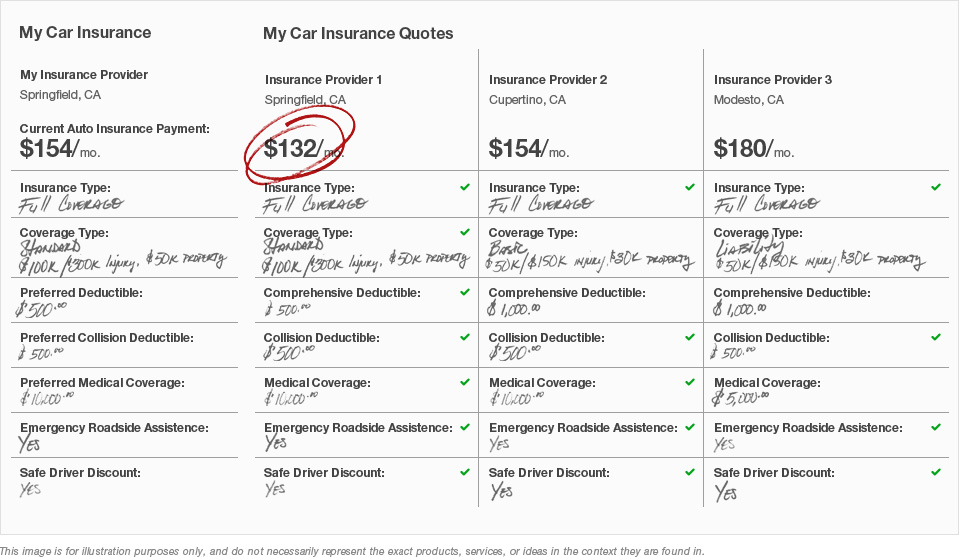

With numerous insurance providers in the market, it’s essential to compare rates and coverage options to find the best fit for your needs. Here, we present a comprehensive comparison of top insurance providers, highlighting their unique features and offerings.

Provider A: Focus on Personalized Coverage

Provider A stands out for its commitment to offering personalized insurance plans. They understand that every driver’s needs are unique and tailor their coverage options accordingly. With a range of add-ons and customizable features, they provide flexibility to drivers seeking tailored protection.

| Coverage Options | Average Annual Premium |

|---|---|

| Standard Coverage | $1,300 - $1,600 |

| Personalized Add-ons (e.g., Roadside Assistance) | Varies based on selection |

Provider B: Emphasis on Technology and Discounts

Provider B leverages technology to offer innovative insurance solutions. They provide drivers with telematics devices, allowing them to monitor and improve their driving habits. Additionally, they offer a range of discounts for safe driving, multiple policy bundles, and loyalty programs.

| Discounts and Features | Potential Savings |

|---|---|

| Safe Driving Discount | Up to 20% off |

| Multiple Policy Bundle | 10-15% off |

| Loyalty Program | Annual discounts for long-term customers |

Provider C: Comprehensive Coverage with Excellent Customer Service

Provider C is renowned for its comprehensive coverage options and exceptional customer service. They offer a wide range of insurance products, including specialized coverage for high-risk vehicles and drivers. Their customer service team is highly responsive, ensuring a seamless experience throughout the policy journey.

| Coverage Options | Average Annual Premium |

|---|---|

| Standard Coverage | $1,200 - $1,800 |

| Specialized Coverage (e.g., Classic Car Insurance) | Varies based on vehicle type |

Tips for Getting the Best Car Insurance Rates

Now that we’ve explored the factors influencing insurance rates and compared top providers, here are some expert tips to help you secure the best rates:

- Shop Around: Compare rates from multiple providers to find the best deal. Use online comparison tools or contact insurance brokers to streamline the process.

- Review Your Coverage Annually: Regularly assess your coverage to ensure it aligns with your current needs. Update your policy as your circumstances change to avoid overpaying.

- Improve Your Driving Record: Maintain a safe driving record by avoiding accidents and traffic violations. This can lead to significant premium reductions over time.

- Explore Discounts: Take advantage of available discounts, such as safe driver discounts, loyalty programs, and multi-policy bundles. These can substantially lower your insurance costs.

- Consider Higher Deductibles: While it's a delicate balance, opting for higher deductibles can lead to lower premiums. Ensure you have the financial means to cover higher out-of-pocket expenses in the event of a claim.

Conclusion: Empowering Your Car Insurance Journey

Understanding the factors that influence car insurance rates and comparing top providers is crucial to making informed decisions. By staying informed, shopping around, and implementing expert tips, you can navigate the insurance landscape confidently and secure the best coverage at the most competitive rates. Remember, your car insurance journey is unique, and finding the right balance of protection and affordability is essential for a worry-free driving experience.

How often should I review my car insurance policy?

+It’s recommended to review your policy annually or whenever your circumstances change significantly. This ensures your coverage remains adequate and you’re not overpaying.

Can I switch insurance providers mid-policy term?

+Yes, you can switch providers at any time. However, be mindful of cancellation fees and potential penalties. Ensure you understand the terms of your current policy before making a switch.

What factors can lead to an increase in my insurance rates?

+Rates can increase due to factors like accidents, traffic violations, changes in your vehicle, or moving to a higher-risk area. Regularly review your coverage to stay informed.