Car Insurance Types

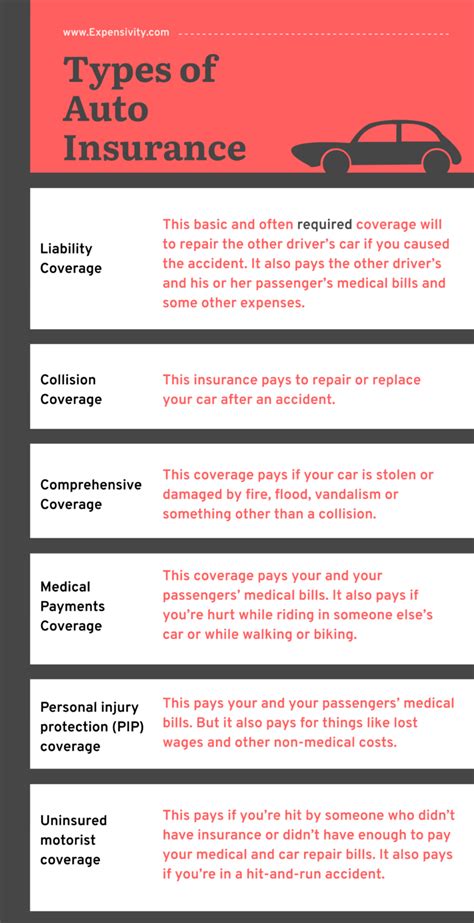

The world of car insurance is diverse and complex, offering a range of options to suit different needs and circumstances. From comprehensive coverage to more specialized plans, understanding the various types of car insurance is crucial for ensuring you have the right protection on the road. In this in-depth exploration, we delve into the specifics of different car insurance types, providing a comprehensive guide to help you navigate this essential aspect of vehicle ownership.

Comprehensive Car Insurance

Comprehensive car insurance is often considered the most robust form of coverage. It offers protection against a wide array of incidents and situations, providing a safety net for vehicle owners. This type of insurance typically covers damages caused by collisions, natural disasters, theft, and even vandalism. For instance, if your car is damaged in a severe storm or is stolen from your driveway, comprehensive insurance will step in to help cover the costs of repairs or replacements.

Key features of comprehensive car insurance include:

- Collision Coverage: Pays for repairs or replacements if your vehicle is involved in a collision, regardless of fault.

- Comprehensive Coverage: Covers non-collision incidents such as fire, flood, theft, and vandalism.

- Additional Benefits: Often includes perks like rental car reimbursement and glass repair coverage.

| Comprehensive Insurance | Coverage |

|---|---|

| Collision | Up to $100,000 (varies by policy) |

| Comprehensive | Up to $50,000 (varies by policy and incident) |

| Rental Car Reimbursement | Up to $50 per day, for a maximum of 30 days |

Liability-Only Car Insurance

Liability-only car insurance is a more basic form of coverage, focusing on protecting the policyholder from financial losses arising from accidents they cause. This type of insurance covers bodily injury and property damage claims made against the insured driver. It's important to note that liability-only insurance does not cover the insured vehicle or its contents.

Key aspects of liability-only car insurance:

- Bodily Injury Liability: Covers medical expenses and lost wages of individuals injured in an accident caused by the insured driver.

- Property Damage Liability: Pays for repairs or replacements of property damaged in an accident caused by the insured driver, such as other vehicles or structures.

| Liability-Only Insurance | Coverage |

|---|---|

| Bodily Injury Liability | $100,000 per person / $300,000 per accident (varies by state) |

| Property Damage Liability | $50,000 per accident (varies by state) |

Collision and Comprehensive Car Insurance

Collision and comprehensive car insurance is a combination of two critical coverages: collision and comprehensive. This type of insurance is often recommended for vehicle owners who want more extensive protection beyond liability coverage. Collision insurance covers damages to the insured vehicle if it's involved in a collision, regardless of fault. On the other hand, comprehensive insurance covers damages caused by events other than collisions, such as theft, vandalism, or natural disasters.

Key benefits of collision and comprehensive car insurance include:

- Collision Coverage: Pays for repairs or replacements if your vehicle is damaged in a collision, regardless of fault.

- Comprehensive Coverage: Protects against non-collision incidents, covering theft, vandalism, and natural disasters.

- Additional Perks: Often includes benefits like rental car reimbursement and glass repair coverage.

| Collision and Comprehensive Insurance | Coverage |

|---|---|

| Collision | Up to $100,000 (varies by policy) |

| Comprehensive | Up to $50,000 (varies by policy and incident) |

| Rental Car Reimbursement | Up to $50 per day, for a maximum of 30 days |

Gap Insurance

Gap insurance, or Guaranteed Asset Protection, is a specialized type of coverage designed to bridge the gap between the actual cash value of a vehicle and the amount owed on a lease or loan. This type of insurance is particularly beneficial for individuals who have financed or leased their vehicles, as it can help cover the difference if the vehicle is totaled or stolen.

Key characteristics of gap insurance:

- Bridge the Gap: Pays the difference between the insurance payout and the amount owed on a lease or loan if the vehicle is totaled or stolen.

- Lease and Loan Protection: Ideal for those who have leased or financed their vehicles, ensuring they are not left with a large debt burden in the event of a total loss.

| Gap Insurance | Coverage |

|---|---|

| Lease or Loan Balance | Up to the full amount owed on the lease or loan |

Uninsured and Underinsured Motorist Insurance

Uninsured and underinsured motorist insurance is a critical coverage that protects policyholders against financial losses caused by drivers who either lack insurance or have insufficient coverage. This type of insurance covers bodily injury and property damage in the event of an accident with an uninsured or underinsured driver. It's an important safeguard to have, especially in areas where uninsured driving is prevalent.

Key aspects of uninsured and underinsured motorist insurance:

- Uninsured Motorist Coverage: Protects against financial losses caused by drivers who do not have insurance.

- Underinsured Motorist Coverage: Covers situations where the at-fault driver's insurance is insufficient to cover the full extent of the damages.

| Uninsured and Underinsured Motorist Insurance | Coverage |

|---|---|

| Uninsured Motorist Bodily Injury | $100,000 per person / $300,000 per accident (varies by state) |

| Underinsured Motorist Bodily Injury | $100,000 per person / $300,000 per accident (varies by state) |

Conclusion: Navigating the Car Insurance Landscape

The world of car insurance is diverse, offering a range of options to suit different needs and circumstances. From comprehensive coverage to specialized protections like gap insurance, understanding the various types of car insurance is essential for making informed decisions about your vehicle's protection. By carefully evaluating your needs and circumstances, you can choose the right type of car insurance to ensure you're adequately protected on the road.

Tips for Choosing the Right Car Insurance

- Assess your vehicle’s value and your financial situation to determine the level of coverage you need.

- Consider your driving habits and the risks you face, such as living in an area prone to natural disasters or having a high risk of theft.

- Compare quotes from multiple insurers to find the best coverage at the most competitive price.

The Future of Car Insurance

As technology advances, the car insurance industry is evolving. The rise of autonomous vehicles and advanced driver-assistance systems is already impacting insurance rates and coverage. Additionally, the use of telematics and data-driven analytics is expected to play a significant role in personalizing insurance policies and premiums in the future.

In conclusion, staying informed about the different types of car insurance and keeping up with industry trends is essential for making smart decisions about your vehicle's protection. By staying ahead of the curve, you can ensure you have the right coverage at the best value.

What is the difference between comprehensive and collision insurance?

+Comprehensive insurance covers damages caused by non-collision incidents such as theft, vandalism, and natural disasters. Collision insurance, on the other hand, covers damages to your vehicle if it’s involved in a collision, regardless of fault.

Is liability-only insurance sufficient for most drivers?

+Liability-only insurance provides financial protection against causing accidents, but it may not be sufficient for drivers who want coverage for their own vehicle’s repairs or replacement. It’s important to assess your specific needs and circumstances to determine the right level of coverage.

How does gap insurance work, and who needs it?

+Gap insurance bridges the gap between the actual cash value of a vehicle and the amount owed on a lease or loan. It’s crucial for individuals who have leased or financed their vehicles, ensuring they are not left with a large debt burden in the event of a total loss.