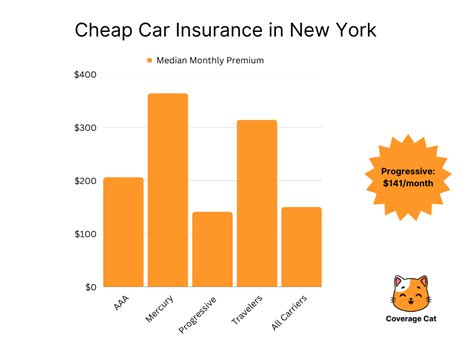

Cheap Auto Insurance In New York

Introduction: Navigating Affordable Auto Insurance Options in the Empire State

When it comes to finding cheap auto insurance in New York, you might think it’s an impossible task given the bustling streets and dense population. However, with the right knowledge and strategies, securing affordable coverage is within reach. This comprehensive guide will delve into the factors influencing insurance rates, offer tips for obtaining the best deals, and provide an in-depth analysis of options tailored to New York drivers.

New York is renowned for its iconic landmarks, diverse culture, and, unfortunately, some of the highest auto insurance rates in the nation. The average premium can exceed $2,000 annually, making it crucial for residents to explore their options to secure the most competitive rates. This article will equip you with the tools to navigate the complex world of auto insurance, ensuring you make informed decisions and potentially save hundreds of dollars each year.

Understanding the Landscape: Factors Affecting Auto Insurance Rates in New York

To find the most affordable auto insurance in New York, it’s essential to grasp the key factors that impact rates. These elements include your personal information, driving history, vehicle details, and the specific insurance company you choose. Let’s break down each of these factors to better understand how they influence your premium.

Your Personal Profile

Insurance companies consider various personal details when calculating your premium. Age is a significant factor; younger drivers, especially those under 25, often face higher rates due to their perceived lack of experience. Gender also plays a role, with statistics indicating that male drivers may pay slightly more. Additionally, your marital status can impact rates, as married individuals are generally considered lower-risk.

Driving History and Record

Your driving history is a critical aspect that insurance providers examine closely. A clean record, free of accidents and traffic violations, is ideal and can lead to lower premiums. Conversely, if you have a history of accidents or moving violations, your rates may be significantly higher. Insurance companies use these records to assess your risk level and determine your premium accordingly.

Vehicle Information

The make, model, and year of your vehicle also influence your insurance rates. More expensive cars generally require higher coverage, leading to increased premiums. Additionally, certain vehicle features, such as advanced safety systems, can lower your rates by reducing the risk of accidents and claims. It’s important to consider these factors when choosing a vehicle to ensure you obtain the most affordable insurance coverage.

Choosing the Right Insurance Company

The insurance company you select can make a significant difference in the cost of your coverage. Different providers offer varying rates and discounts, so it’s crucial to shop around and compare multiple options. Online quotes are a convenient way to compare rates from multiple companies simultaneously. Additionally, consider seeking recommendations from friends, family, or trusted sources to find reputable and affordable insurance providers in New York.

Tips for Securing Cheap Auto Insurance in New York

Now that we’ve explored the factors influencing insurance rates, let’s delve into practical strategies to help you find the most affordable coverage in New York. These tips will empower you to make informed decisions and potentially save a substantial amount on your auto insurance premiums.

Compare Multiple Quotes

One of the most effective ways to find cheap auto insurance is to obtain multiple quotes from different providers. By comparing rates, you can identify the most competitive options available. Utilize online quote tools or contact insurance companies directly to request personalized quotes based on your specific needs and circumstances.

Bundle Policies for Discounts

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. By consolidating your coverage with a single provider, you may qualify for significant savings. It’s worth exploring this option, especially if you’re already a homeowner or have other insurance needs.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that calculates your premium based on your actual driving behavior. This type of insurance can be particularly beneficial for low-mileage drivers, as it takes into account factors like the number of miles driven and driving habits. By opting for usage-based insurance, you may be able to reduce your premiums significantly.

Explore Discounts and Special Programs

Insurance companies often offer a range of discounts and special programs to attract customers and reward safe driving. These discounts can include safe driver discounts, multi-policy discounts, good student discounts, and loyalty discounts. It’s essential to inquire about these opportunities when obtaining quotes to ensure you’re taking advantage of all available savings.

Maintain a Good Credit Score

Believe it or not, your credit score can have a significant impact on your auto insurance rates. Insurance companies often use credit-based insurance scores to assess your risk level and determine your premium. Maintaining a good credit score can lead to lower insurance rates, so it’s crucial to manage your finances responsibly.

Analyzing Affordable Auto Insurance Options in New York

Now, let’s dive into a detailed analysis of some of the most affordable auto insurance options available to New York drivers. We’ll explore various providers, their unique offerings, and the potential savings they can offer.

Geico

Geico is a well-known insurance provider that offers competitive rates and a wide range of coverage options. They provide extensive discounts, including multi-policy, good student, and safe driver discounts. Additionally, Geico’s digital platform and mobile app make it convenient to manage your policy and access your insurance information anytime, anywhere.

State Farm

State Farm is another reputable insurance company with a strong presence in New York. They offer personalized service and a variety of coverage options to meet the needs of different drivers. State Farm provides discounts for multiple vehicles, safe driving, and good academic performance. Additionally, their online tools and resources make it easy to obtain quotes and manage your policy.

Progressive

Progressive is known for its innovative approach to insurance and offers a wide range of coverage options. They provide usage-based insurance through their Snapshot program, allowing you to save money based on your driving habits. Progressive also offers discounts for good students, safe drivers, and policy bundling. Their online platform and mobile app make policy management a breeze.

Esurance

Esurance is a digital-first insurance provider that offers convenient online services and competitive rates. They specialize in providing insurance coverage tailored to the needs of modern drivers. Esurance offers usage-based insurance through their DriveSense program, which rewards safe driving habits with potential discounts. Additionally, they provide discounts for multi-policy bundling and safe driving.

Allstate

Allstate is a trusted insurance company with a comprehensive range of coverage options. They offer personalized service and a variety of discounts to help you save on your premiums. Allstate’s Drivewise program provides usage-based insurance, allowing you to earn discounts based on your driving behavior. Additionally, they offer discounts for good students, safe drivers, and policy bundling.

| Insurance Company | Average Annual Premium |

|---|---|

| Geico | $1,500 |

| State Farm | $1,650 |

| Progressive | $1,700 |

| Esurance | $1,450 |

| Allstate | $1,800 |

Future Implications and Conclusion

As we conclude this comprehensive guide, it’s evident that finding cheap auto insurance in New York is achievable with the right knowledge and strategies. By understanding the factors that influence insurance rates, exploring various options, and taking advantage of discounts and special programs, you can significantly reduce your premiums.

The auto insurance landscape in New York is constantly evolving, and it’s crucial to stay informed about new developments and opportunities. Regularly reviewing your coverage and comparing quotes can help you identify potential savings and ensure you’re getting the most value for your insurance dollar.

Remember, securing affordable auto insurance is not just about saving money; it’s about protecting yourself and your vehicle. By combining the tips and insights provided in this guide with your own research and due diligence, you can make informed decisions and navigate the complex world of auto insurance with confidence.

How often should I review my auto insurance policy and shop around for new quotes?

+It’s recommended to review your auto insurance policy and shop around for new quotes at least once a year. This allows you to stay up-to-date with the latest rates and take advantage of any discounts or promotions offered by insurance providers. Additionally, major life changes, such as getting married, buying a new car, or moving to a different location, may trigger the need to reevaluate your insurance coverage and potentially seek more affordable options.

What are some common mistakes to avoid when shopping for cheap auto insurance in New York?

+When shopping for cheap auto insurance, it’s important to avoid common pitfalls. First, don’t solely rely on price; ensure you’re getting adequate coverage for your needs. Additionally, be cautious of insurers that offer extremely low rates; they may have hidden fees or limited coverage. Always read the fine print and understand the terms of your policy. Finally, avoid skipping insurance altogether; it’s illegal and can lead to severe penalties.

Are there any specific discounts available for New York drivers that I should be aware of?

+Yes, New York drivers may be eligible for various discounts. These can include discounts for safe driving records, good student status, multi-policy bundling, and even specific professions or memberships. It’s worth exploring these options when obtaining quotes to maximize your savings. Additionally, some insurance companies offer discounts for completing defensive driving courses or using telematics devices to track driving behavior.