Cheap Auto Insurance Online

Welcome to an extensive guide on navigating the world of cheap auto insurance online. With the vast landscape of insurance providers and policies, finding the best deal can be a daunting task. This comprehensive article aims to shed light on the process, providing you with the tools and insights to secure the most cost-effective auto insurance coverage for your needs.

Understanding the Landscape of Auto Insurance

The auto insurance market is a diverse and dynamic space, with numerous providers offering a wide range of policies. From comprehensive coverage to basic liability, understanding your options is crucial for making an informed decision. Let’s delve into the various aspects that influence the cost of auto insurance and explore strategies to secure the best rates.

Factors Influencing Auto Insurance Rates

Several factors come into play when determining the cost of your auto insurance. These include your driving record, the type of vehicle you own, and the coverage limits you choose. Additionally, your age, gender, and location can also impact the price. By understanding these factors, you can make strategic choices to reduce your insurance premiums.

| Factor | Impact |

|---|---|

| Driving Record | Clean records often result in lower rates. |

| Vehicle Type | High-performance cars may attract higher premiums. |

| Coverage Limits | Higher limits can increase costs. |

| Age and Gender | Younger drivers and certain genders may face higher rates. |

| Location | Urban areas often have higher rates due to traffic and theft risks. |

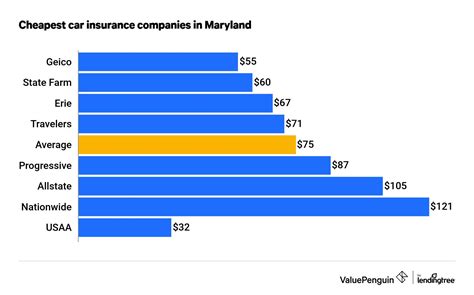

Comparing Quotes: The Key to Savings

One of the most effective ways to find cheap auto insurance is by comparing quotes from multiple providers. Online platforms and insurance comparison websites offer a convenient way to do this. By inputting your details and preferences, you can quickly generate a list of quotes, allowing you to easily compare prices and coverage options.

When comparing quotes, pay attention to the deductibles, coverage limits, and optional add-ons offered by each provider. While a lower premium may be tempting, ensure that the coverage meets your needs. Consider factors like your financial situation, the value of your vehicle, and the potential risks you face on the road.

Utilizing Online Tools and Discounts

The digital age has brought numerous advantages to the insurance landscape, with online tools and resources playing a significant role in securing cheap auto insurance. Many insurance providers now offer online discounts and digital services to enhance the customer experience and reduce overhead costs.

Online tools like quote calculators and policy management platforms provide convenient ways to obtain quotes, make payments, and manage your insurance policy. These tools often come with user-friendly interfaces, allowing you to quickly navigate through the process and make informed decisions.

Additionally, insurance providers frequently offer discounts for online purchases and paperless billing. By opting for digital services, you can often reduce your insurance premiums, making it a win-win situation for both you and the provider.

Strategies for Lowering Auto Insurance Costs

While finding the cheapest auto insurance is a priority, it’s equally important to ensure that you’re not compromising on the quality of coverage. Here are some strategies to help you strike the right balance between cost and protection.

Bundling Policies for Discounts

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with a single provider. Many insurance companies offer multi-policy discounts, which can result in significant savings. By combining your insurance needs, you not only simplify your administrative tasks but also potentially reduce your overall costs.

When bundling policies, ensure that you're still getting the best value for each type of insurance. Compare the bundled rates with those of separate policies to ensure you're not overpaying for convenience.

Adjusting Your Coverage Levels

The level of coverage you choose can significantly impact your insurance premiums. While it’s essential to have adequate coverage to protect yourself financially, you may be able to reduce costs by adjusting your coverage limits or deductibles.

For example, if you own an older vehicle with low market value, you may consider dropping collision and comprehensive coverage, which are typically more expensive. However, before making any changes, carefully assess your financial situation and the potential risks you may face.

Additionally, consider increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible often results in lower premiums, but it's crucial to ensure you can afford the deductible in the event of a claim.

Improving Your Driving Record

Your driving record is a critical factor in determining your auto insurance rates. A clean driving record with no accidents or violations can lead to lower premiums. Conversely, a history of accidents or traffic violations can significantly increase your insurance costs.

To improve your driving record and potentially lower your insurance rates, consider taking defensive driving courses or safe driving programs offered by insurance providers. These courses can help enhance your driving skills and may even result in discounts on your insurance policy.

Additionally, maintain a safe driving habit by obeying traffic laws, avoiding aggressive driving, and regularly maintaining your vehicle. A clean and safe driving record can not only lower your insurance costs but also contribute to a safer and more responsible driving experience.

The Future of Cheap Auto Insurance

The auto insurance industry is constantly evolving, and advancements in technology and data analytics are shaping the future of insurance. Here’s a glimpse into how the landscape of cheap auto insurance may change in the coming years.

Telematics and Usage-Based Insurance

Telematics is a technology that uses sensors and GPS to track driving behavior and vehicle performance. With telematics, insurance providers can gather real-time data on factors like driving speed, acceleration, braking, and even the time of day you drive. This data is then used to determine your insurance rates based on your actual driving habits.

Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is a concept that leverages telematics data to offer more personalized and affordable insurance options. By rewarding safe driving habits with lower premiums, usage-based insurance has the potential to revolutionize the auto insurance industry, making it more equitable and tailored to individual needs.

Data Analytics and Personalized Pricing

The power of data analytics is transforming the way insurance providers assess risk and set prices. With advanced analytics tools, insurance companies can now analyze vast amounts of data, including driving behavior, vehicle performance, and even external factors like weather and traffic conditions, to develop more accurate and personalized pricing models.

By leveraging data analytics, insurance providers can offer tailored insurance packages that cater to the specific needs and risks of individual drivers. This level of personalization has the potential to benefit both cautious drivers who may pay lower premiums and high-risk drivers who can access coverage at more affordable rates.

Artificial Intelligence and Claims Processing

Artificial Intelligence (AI) is playing an increasingly significant role in the auto insurance industry, particularly in claims processing. AI-powered systems can automate various aspects of the claims process, from initial intake and assessment to fraud detection and settlement. This automation not only streamlines the claims process but also reduces costs for insurance providers, which can ultimately translate to savings for policyholders.

Additionally, AI can enhance the accuracy and efficiency of claims handling by analyzing large volumes of data and identifying patterns that may indicate fraudulent claims. By reducing the risk of fraud, insurance providers can offer more competitive rates to their customers, contributing to a more affordable and secure insurance landscape.

Conclusion

Navigating the world of auto insurance can be complex, but with the right tools and strategies, finding cheap auto insurance online is within reach. By understanding the factors that influence rates, comparing quotes, and utilizing online tools and discounts, you can secure the best value for your insurance needs. Additionally, by implementing strategies to lower costs and keeping an eye on the future of insurance, you can stay ahead of the curve and make informed decisions.

What are some common factors that influence auto insurance rates?

+

Common factors include driving record, vehicle type, coverage limits, age, gender, and location. These factors play a significant role in determining the cost of your auto insurance.

How can I compare quotes effectively to find the best deal?

+

Use online platforms or insurance comparison websites to generate multiple quotes. Compare not only the prices but also the deductibles, coverage limits, and optional add-ons offered by each provider. Ensure the coverage meets your needs while considering your financial situation and potential risks.

Are there any online tools or discounts that can help me save on auto insurance?

+

Yes, many insurance providers offer online discounts and digital services to enhance the customer experience and reduce overhead costs. Utilize online tools like quote calculators and policy management platforms for a convenient and efficient insurance journey.

How can I lower my auto insurance costs without compromising coverage?

+

Consider bundling your policies with a single provider to take advantage of multi-policy discounts. Adjust your coverage levels by reviewing your coverage limits and deductibles. Improve your driving record by taking defensive driving courses or safe driving programs. These strategies can help you balance cost and protection effectively.

What does the future hold for cheap auto insurance?

+

Advancements in technology and data analytics are shaping the future of auto insurance. Telematics and usage-based insurance offer personalized pricing based on real-time driving data. Data analytics enables more accurate and personalized pricing models. AI enhances claims processing, reducing costs and improving efficiency. These innovations have the potential to make auto insurance more affordable and tailored to individual needs.