Cheap Automobile Insurance

Finding affordable car insurance is a priority for many vehicle owners, as it provides essential financial protection while keeping monthly expenses manageable. With numerous insurance providers offering a wide range of policies, it can be challenging to navigate the market and identify the most cost-effective options. This article aims to guide you through the process of securing cheap automobile insurance, covering key considerations, comparison strategies, and tips to help you make informed decisions.

Understanding Automobile Insurance Costs

Automobile insurance costs can vary significantly based on a multitude of factors. These include your driving record, the make and model of your vehicle, your age and gender, the coverage limits you select, and the deductibles you choose. Understanding how these factors influence your insurance premiums is crucial to finding the most affordable coverage that meets your specific needs.

Factors Affecting Insurance Premiums

When insurers calculate your premium, they consider several key factors. Your driving history, including any accidents or traffic violations, is a significant determinant. The type of car you drive, its age, and its safety and theft ratings also play a role. Additionally, your age, gender, marital status, and even your credit score can impact your insurance rates. It’s important to note that insurance providers use different weightings for these factors, so it’s worth exploring multiple options to find the best fit.

For instance, younger drivers, especially males, are often considered higher risk due to their propensity for accidents. As a result, their insurance premiums tend to be higher. Similarly, certain vehicle models may attract higher insurance costs due to their repair expenses or likelihood of theft.

| Factor | Impact on Premium |

|---|---|

| Driving Record | Clean records lead to lower premiums; violations increase costs. |

| Vehicle Type | Luxury or high-performance cars often have higher insurance costs. |

| Age and Gender | Younger drivers and males typically pay more. |

| Coverage Limits | Higher limits provide more protection but increase premiums. |

| Deductibles | Lower deductibles result in higher premiums. |

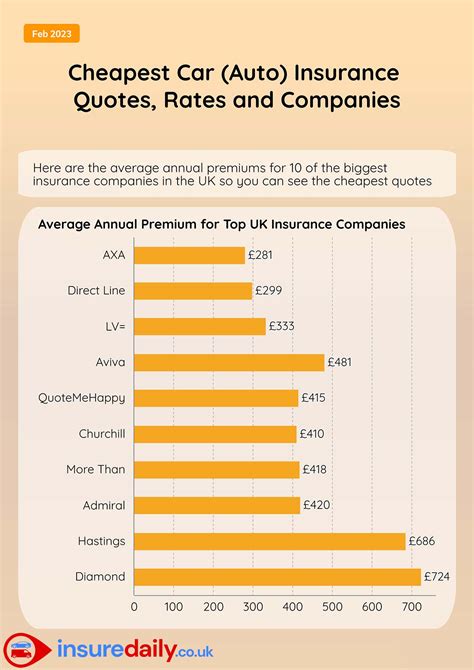

Comparison Shopping for Cheap Automobile Insurance

Comparison shopping is an essential strategy to secure cheap automobile insurance. By evaluating quotes from multiple providers, you can identify the most cost-effective options for your specific circumstances. Online quote comparison tools can be particularly useful for this purpose, allowing you to quickly assess a range of policies and their associated costs.

Online Quote Comparison Tools

Online quote comparison platforms offer a convenient way to gather quotes from various insurance providers. These tools typically require you to input basic information about yourself, your vehicle, and your driving history. Based on this data, they generate quotes from different insurers, enabling you to compare premiums, coverage limits, and other policy features side by side.

When using these tools, it's essential to provide accurate information to ensure the quotes are precise. Additionally, be mindful of the coverage limits and deductibles offered in the policies. While lower premiums may be appealing, ensuring you have adequate coverage to protect you financially in the event of an accident is crucial.

Bundling Insurance Policies

Bundling your insurance policies can often lead to significant savings. Many insurance providers offer discounts when you combine multiple policies, such as automobile insurance with homeowners or renters insurance. This strategy not only simplifies your insurance management but also reduces your overall costs.

For instance, if you own a home and a car, you could potentially save hundreds of dollars annually by bundling your automobile and homeowners insurance with the same provider. This is because insurers often reward customer loyalty and multi-policy purchases with discounts.

Tips for Securing Cheap Automobile Insurance

In addition to comparison shopping and policy bundling, there are several other strategies you can employ to secure cheap automobile insurance. These include improving your driving record, taking advantage of discounts, and adjusting your coverage limits and deductibles.

Improving Your Driving Record

Your driving record is a significant factor in determining your insurance premiums. A clean driving record with no accidents or traffic violations can lead to lower insurance costs. Conversely, a history of accidents or violations may result in higher premiums or even difficulty securing insurance.

If you have a less-than-perfect driving record, it's essential to take steps to improve it. This may involve taking defensive driving courses, which can help reduce points on your license and potentially lower your insurance premiums. Additionally, maintaining a clean driving record over time can lead to more significant savings as insurers reward safe driving habits.

Discounts and Special Offers

Insurance providers often offer a variety of discounts and special offers to attract customers. These can include discounts for safe driving, good student discounts for young drivers with good grades, and loyalty discounts for long-term customers. Additionally, some insurers may offer discounts for certain professions or memberships, such as military service or AAA membership.

When comparing insurance quotes, be sure to inquire about all available discounts. Applying for these discounts can potentially reduce your premiums and make insurance more affordable.

Adjusting Coverage Limits and Deductibles

Your coverage limits and deductibles play a significant role in determining your insurance premiums. Higher coverage limits and lower deductibles typically result in higher premiums, while lower limits and higher deductibles can lead to lower costs.

It's important to strike a balance between affordability and adequate coverage. While opting for lower limits and higher deductibles may reduce your premiums, it could leave you financially vulnerable in the event of an accident. Conversely, higher limits and lower deductibles provide more financial protection but come at a higher cost.

Consider your financial situation and the potential risks you may face on the road. If you're a cautious driver with a low risk of accidents, you may be comfortable with lower coverage limits and higher deductibles to keep costs down. However, if you frequently drive in high-risk areas or have a history of accidents, opting for higher limits and lower deductibles may provide the financial protection you need.

Future Implications of Cheap Automobile Insurance

As the insurance market continues to evolve, the future of cheap automobile insurance looks promising. Technological advancements, such as telematics and usage-based insurance, are expected to play a significant role in shaping the industry. These innovations offer opportunities for drivers to demonstrate their safe driving habits and potentially secure lower insurance premiums.

Telematics and Usage-Based Insurance

Telematics involves the use of technology to track and record driving behavior. Usage-based insurance, also known as pay-as-you-drive insurance, is a type of policy that uses telematics data to calculate insurance premiums based on an individual’s actual driving habits and mileage.

This approach to insurance offers several benefits. It provides an accurate assessment of an individual's risk, potentially leading to more affordable premiums for safe drivers. Additionally, it encourages safer driving habits, as drivers are incentivized to drive more cautiously to reduce their insurance costs.

As telematics and usage-based insurance become more prevalent, it's likely that insurers will offer a wider range of policies and discounts tailored to individual driving behaviors. This could lead to more personalized and affordable insurance options for drivers.

Insurtech Innovations

The rise of insurtech, or insurance technology, is also expected to have a significant impact on the automobile insurance market. Insurtech companies are leveraging technology to streamline insurance processes, improve customer experiences, and offer more competitive pricing.

For instance, some insurtech startups are developing artificial intelligence (AI) and machine learning algorithms to more accurately assess risk and price insurance policies. This technology can analyze vast amounts of data, including driving behavior, weather patterns, and accident statistics, to provide more precise insurance premiums.

Additionally, insurtech companies are often more agile and customer-centric than traditional insurance providers. They may offer innovative features such as real-time claims processing, personalized policy recommendations, and digital tools for managing insurance portfolios. These advancements can enhance the overall customer experience and potentially lead to more affordable and efficient insurance options.

The Impact of Autonomous Vehicles

The emergence of autonomous vehicles is also likely to influence the automobile insurance market. As self-driving cars become more prevalent, the nature of accidents and liabilities may shift. This could potentially lead to a reduction in insurance claims and, consequently, lower insurance premiums.

However, the transition to autonomous vehicles may also introduce new risks and challenges. For instance, there may be increased liability for vehicle manufacturers and software developers in the event of an accident. Additionally, the complex technology involved in autonomous vehicles may lead to new types of failures and vulnerabilities that insurers will need to address.

As the autonomous vehicle market evolves, insurers will need to adapt their policies and pricing models to accommodate these changes. This could involve developing new insurance products specifically tailored to autonomous vehicles and their unique risks.

Conclusion

Securing cheap automobile insurance requires a thoughtful approach that considers various factors and strategies. By understanding the key elements that influence insurance premiums, comparing quotes from multiple providers, and implementing cost-saving measures, you can find affordable coverage that meets your needs.

As the insurance market continues to evolve with technological advancements and the rise of autonomous vehicles, the future of automobile insurance looks promising. Insurers will need to adapt to these changes, offering innovative policies and pricing models to remain competitive. For consumers, this evolution may lead to more personalized and affordable insurance options, empowering them to make informed choices and secure the protection they need.

How often should I review my automobile insurance policy to ensure I’m getting the best rate?

+It’s recommended to review your insurance policy annually, or whenever your circumstances change significantly. This ensures that your coverage and premiums remain aligned with your needs and any new discounts or offers that may be available.

Are there any drawbacks to opting for lower coverage limits and higher deductibles to reduce insurance costs?

+While this strategy can lead to lower premiums, it’s important to consider the potential financial implications. In the event of an accident, you may be responsible for a larger portion of the costs, which could strain your finances. It’s crucial to strike a balance between affordability and adequate coverage.

Can I negotiate my automobile insurance premiums with my provider?

+While insurance premiums are largely determined by a standardized formula, there may be room for negotiation in certain situations. If you have a long-standing relationship with your insurer or have multiple policies with them, you may be able to negotiate a better rate or additional discounts. It’s worth discussing your options with your provider.

What should I look for when comparing automobile insurance quotes online?

+When comparing quotes, pay attention to the coverage limits, deductibles, and any additional benefits or discounts offered. Ensure that the policies provide adequate protection for your needs and consider the reputation and financial stability of the insurance providers. It’s also beneficial to read customer reviews and ratings to gauge the overall satisfaction and reliability of the insurer.