Cheap Car Insurances

Navigating the world of car insurance can be a challenging task, especially when aiming to find a policy that offers comprehensive coverage without breaking the bank. The market is saturated with numerous providers, each touting unique selling points and competitive rates. This guide aims to provide an in-depth analysis of the landscape of affordable car insurance, offering valuable insights and strategies to help drivers secure the best possible deal.

Understanding the Fundamentals of Affordable Car Insurance

Affordable car insurance is not solely about the lowest premium; it’s about striking a balance between cost and the level of coverage that suits your specific needs. This section delves into the key factors that influence the cost of car insurance, providing a foundation for making informed decisions.

The Role of Risk Assessment

Insurance providers assess the level of risk associated with insuring a particular driver. Factors such as age, gender, driving history, and the type of vehicle all play a role in this assessment. Understanding how these factors influence your premium is essential for identifying areas where you can potentially reduce costs.

For instance, younger drivers are often considered high-risk due to their lack of experience, leading to higher premiums. However, enrolling in a defensive driving course can help mitigate this risk and potentially lower insurance costs. Similarly, choosing a vehicle with advanced safety features can also impact your risk profile and subsequently, your insurance rates.

The Impact of Coverage Types

The type of coverage you select will significantly affect the cost of your insurance. Liability insurance, which covers damage to other people’s property or injuries sustained in an accident you cause, is typically the most affordable option. However, it may not provide sufficient protection for your own vehicle in the event of an accident.

Comprehensive and collision insurance, on the other hand, offer broader coverage, including protection against theft, vandalism, and natural disasters. While these policies provide more extensive protection, they come at a higher cost. It’s crucial to assess your specific needs and the value of your vehicle when deciding on the level of coverage.

Discounts and Savings Opportunities

Insurance providers often offer a range of discounts to attract and retain customers. These discounts can significantly reduce the overall cost of your insurance policy. Some common discounts include:

- Safe Driver Discount: Rewarding drivers with a clean driving record.

- Multi-Policy Discount: Offering lower rates when you bundle your car insurance with other policies, such as home or life insurance.

- Loyalty Discount: Recognizing long-term customers with reduced rates.

- Student Discount: Providing lower rates for students with good academic standing.

- Telematics Discount: Using telematics devices to monitor driving behavior, rewarding safe driving habits with discounted rates.

Exploring Cost-Effective Insurance Providers

While understanding the factors that influence insurance costs is crucial, identifying providers that offer the best value for money is equally important. This section profiles some of the most affordable car insurance companies, highlighting their unique offerings and strategies for cost reduction.

State Farm: A Leader in Customer Satisfaction

State Farm is a prominent player in the insurance industry, known for its excellent customer service and competitive rates. The company offers a range of discounts, including multi-policy discounts, good student discounts, and safe driver discounts. State Farm also provides accident forgiveness, which can prevent your rates from increasing after an at-fault accident.

One of the standout features of State Farm is its Drive Safe & Save program. This program uses telematics technology to monitor your driving habits, offering discounts to those who maintain a safe driving record. By incentivizing safe driving, State Farm not only helps reduce accidents but also provides a pathway for drivers to lower their insurance costs.

Geico: The Digital Insurance Giant

Geico has built a reputation as one of the most affordable car insurance providers in the market. The company’s focus on digital innovation and streamlined processes allows it to offer highly competitive rates. Geico provides a range of discounts, including those for federal employees, military personnel, and members of certain professional organizations.

Geico’s Military Discount Program is particularly notable, offering discounted rates to active-duty military personnel, veterans, and their families. The company also provides a range of digital tools and resources to help customers manage their policies, file claims, and access important documents, all at their convenience.

Progressive: Customizable Coverage Options

Progressive is known for its customizable insurance policies, allowing customers to tailor their coverage to their specific needs and budget. The company offers a range of discounts, including those for safe driving, bundling policies, and continuous insurance.

One of Progressive’s unique offerings is its Name Your Price tool. This feature allows customers to set their desired monthly premium and then presents them with coverage options that match their budget. While this approach may limit the scope of coverage, it provides a level of flexibility that is appealing to budget-conscious consumers.

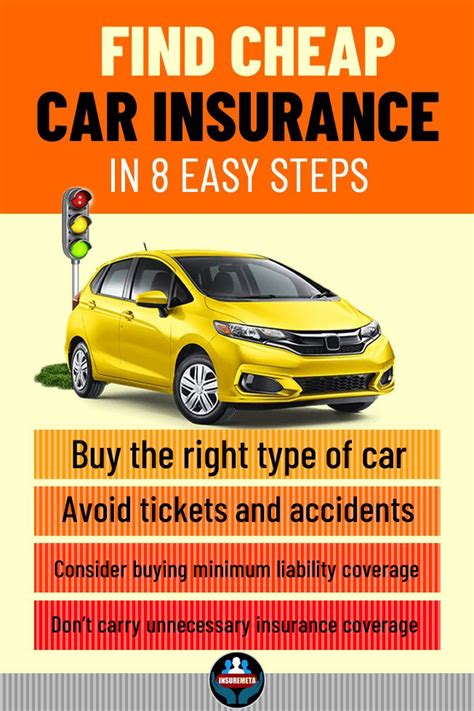

Strategies for Reducing Car Insurance Costs

Beyond selecting an affordable insurance provider, there are several strategies drivers can employ to further reduce their insurance costs. This section provides practical tips and insights to help drivers minimize their insurance expenses without compromising on coverage.

Raising Your Deductible

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can significantly reduce your insurance premiums. However, it’s important to choose a deductible amount that you can comfortably afford in the event of an accident.

For example, if you typically drive an older vehicle with a low market value, opting for a higher deductible can be a cost-effective strategy. In the event of an accident, you may choose to cover the cost of repairs yourself, rather than filing an insurance claim and incurring a higher premium increase.

Maintaining a Clean Driving Record

Insurance providers reward safe drivers with lower premiums. Maintaining a clean driving record, free of accidents and traffic violations, is one of the most effective ways to reduce your insurance costs over time.

Additionally, many insurance companies offer discounts for completing defensive driving courses. These courses not only improve your driving skills but also demonstrate your commitment to safe driving, potentially leading to lower insurance rates.

Bundling Your Policies

If you have multiple insurance needs, such as home, auto, and life insurance, consider bundling your policies with a single provider. Many insurance companies offer multi-policy discounts, providing a cost-effective solution for managing all your insurance needs under one roof.

By bundling your policies, you not only save on premiums but also streamline the management of your insurance portfolio. This approach can be particularly beneficial for those who value convenience and simplicity in their insurance arrangements.

The Future of Affordable Car Insurance

The landscape of car insurance is evolving rapidly, driven by technological advancements and changing consumer expectations. This section explores the emerging trends and innovations that are shaping the future of affordable car insurance, offering a glimpse into what drivers can expect in the years to come.

The Rise of Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to monitor driving behavior, is gaining traction in the insurance industry. Usage-based insurance (UBI) programs, which offer personalized rates based on actual driving habits, are becoming increasingly popular. These programs reward safe driving behaviors, providing an incentive for drivers to adopt safer habits and potentially reducing insurance costs.

For instance, drivers who maintain consistent speeds, avoid aggressive driving, and reduce their overall mileage may be eligible for discounted rates through UBI programs. This approach not only encourages safer driving but also provides a more accurate assessment of individual risk, leading to fairer and more affordable insurance rates.

The Impact of Autonomous Vehicles

The advent of autonomous vehicles is expected to have a significant impact on the car insurance industry. As self-driving cars become more prevalent, the number of accidents is likely to decrease, leading to a reduction in insurance claims and potentially lower insurance premiums.

Additionally, autonomous vehicles are equipped with advanced safety features that can further reduce the risk of accidents. These features, such as collision avoidance systems and lane departure warnings, can play a role in lowering insurance costs by mitigating the risk of accidents.

The Role of Artificial Intelligence and Data Analytics

Artificial Intelligence (AI) and data analytics are transforming the way insurance companies operate. These technologies enable insurers to analyze vast amounts of data, identifying patterns and trends that can inform risk assessment and pricing strategies.

By leveraging AI and data analytics, insurance companies can offer more accurate and personalized insurance rates. This approach not only benefits consumers by providing fairer pricing but also helps insurers manage risk more effectively, ultimately contributing to a more stable and affordable insurance market.

Conclusion

Securing affordable car insurance is a complex but achievable task. By understanding the factors that influence insurance costs, exploring cost-effective providers, and employing strategic cost-saving measures, drivers can find policies that offer the right balance of coverage and value. As the insurance landscape continues to evolve, embracing emerging technologies and trends will be key to staying ahead of the curve and securing the best possible insurance deals.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the United States varies depending on several factors, including your location, driving history, and the type of vehicle you drive. According to recent data, the national average for car insurance premiums is approximately $1,674 per year. However, it’s important to note that rates can vary significantly from state to state and even within the same state.

How can I find the cheapest car insurance for my specific needs?

+To find the cheapest car insurance that suits your specific needs, it’s essential to compare quotes from multiple providers. Consider factors such as your driving history, the value of your vehicle, and the level of coverage you require. Online comparison tools can be helpful in this regard, allowing you to quickly assess rates from various insurers. Additionally, be sure to explore the discounts offered by each provider and tailor your coverage to your budget and needs.

Are there any government programs that can help reduce car insurance costs for low-income individuals?

+Yes, some states offer government-sponsored programs to help low-income individuals and families afford car insurance. These programs typically provide reduced rates or even free insurance coverage for eligible applicants. It’s worth researching these programs in your state and applying if you meet the eligibility criteria. Additionally, some insurance companies offer discounted rates or payment plans for low-income customers.