Cheap Car Insure

Finding affordable car insurance can be a daunting task, especially with the multitude of options and variables that come into play. The cost of car insurance can vary significantly depending on numerous factors, such as your driving history, the type of vehicle you own, and your location. This comprehensive guide aims to provide valuable insights into the world of cheap car insurance, offering expert advice and strategies to help you secure the best coverage at the most affordable rates.

Understanding the Factors That Influence Car Insurance Costs

The price of car insurance is influenced by a variety of factors, some of which are within your control, while others are not. By understanding these factors, you can make informed decisions to potentially lower your insurance premiums.

1. Driving Record

Your driving history is one of the most significant factors that insurance companies consider when determining your premium. A clean driving record with no accidents or traffic violations can lead to lower insurance rates. Conversely, a history of accidents or moving violations may result in higher premiums or even non-renewal of your policy.

| Factor | Impact on Premium |

|---|---|

| Clean Driving Record | Lower Rates |

| Accidents or Violations | Higher Rates |

It's essential to maintain a safe driving habit and avoid any incidents that could impact your record negatively. Additionally, some insurance companies offer discounts for completing defensive driving courses, which can help improve your driving skills and potentially reduce your premiums.

2. Vehicle Type and Usage

The make, model, and year of your vehicle can significantly impact your insurance costs. Generally, newer and more expensive vehicles tend to have higher insurance premiums due to their higher replacement and repair costs. Additionally, the primary use of your vehicle, such as commuting, pleasure driving, or business purposes, can also affect your insurance rates.

| Vehicle Type | Average Premium Impact |

|---|---|

| Newer/Luxury Vehicles | Higher Rates |

| Older/Economical Vehicles | Lower Rates |

If you own a high-performance sports car, for example, your insurance premiums are likely to be higher due to the increased risk of accidents and higher repair costs. On the other hand, if you own a standard sedan and primarily use it for commuting, you may be eligible for lower rates.

3. Location and Mileage

Your geographic location and annual mileage are other crucial factors that insurance providers consider. Areas with a higher incidence of accidents, thefts, or natural disasters tend to have higher insurance rates. Similarly, if you drive a lot of miles annually, your insurance premiums may increase as you’re considered to be at a higher risk of being involved in an accident.

| Location/Mileage | Premium Impact |

|---|---|

| High-Risk Areas | Higher Rates |

| Low-Risk Areas | Lower Rates |

| High Annual Mileage | Increased Rates |

| Low Annual Mileage | Potential Discounts |

If you live in an area with a high crime rate or frequent natural disasters, your insurance premiums may be higher. However, some insurance companies offer discounts for low-mileage drivers or those who primarily drive during off-peak hours, so it's worth exploring these options.

Strategies to Secure Cheap Car Insurance

Now that we’ve covered the primary factors that influence car insurance costs, let’s delve into some effective strategies to help you find affordable coverage.

1. Shop Around and Compare Quotes

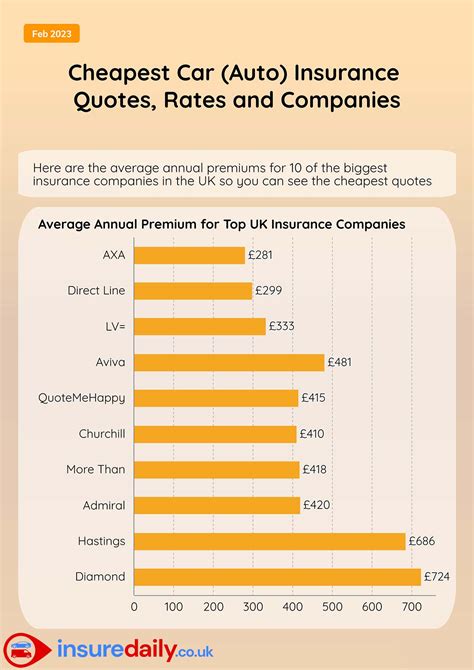

One of the most effective ways to find cheap car insurance is to shop around and compare quotes from multiple insurance providers. Insurance rates can vary significantly between companies, so it’s essential to compare apples to apples. Use online comparison tools or request quotes directly from insurers to get a comprehensive understanding of the market.

When comparing quotes, make sure you're comparing policies with similar coverage levels and deductibles. This ensures that you're not only getting the best price but also the right level of protection for your needs.

2. Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies together. For instance, if you have homeowners or renters insurance, you may be able to save money by insuring your car with the same provider. Bundling your policies can lead to significant savings, so it’s worth exploring this option.

3. Explore Discounts

Insurance companies offer a wide range of discounts that can help lower your premiums. Some common discounts include:

- Safe Driver Discount: As mentioned earlier, a clean driving record can lead to lower rates. Many insurers offer discounts for accident-free periods, so maintaining a safe driving habit is crucial.

- Multi-Car Discount: If you have multiple vehicles in your household, insuring them with the same provider can result in savings.

- Good Student Discount: Students who maintain a certain GPA or are on the honor roll may be eligible for discounts. This is a great way to encourage good academic performance while also saving money.

- Defensive Driving Course Discount: Completing an approved defensive driving course can often lead to reduced premiums. These courses can improve your driving skills and reduce the likelihood of accidents.

- Pay-in-Full Discount: Some insurers offer discounts if you pay your premium in full instead of opting for monthly installments.

Be sure to inquire about these and other potential discounts when obtaining quotes from insurance providers. Every little bit of savings can add up over time.

4. Increase Your Deductible

Increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can lead to lower premiums. While this means you’ll have to pay more in the event of a claim, it can be a cost-effective strategy if you’re confident in your ability to handle smaller repairs or incidents without insurance involvement.

However, it's important to choose a deductible amount that you can comfortably afford. Striking the right balance between your deductible and premium can help you save money without compromising your financial stability.

5. Maintain a Good Credit Score

Believe it or not, your credit score can impact your insurance premiums. Many insurance companies use credit-based insurance scores to assess your risk level. A higher credit score may lead to lower insurance rates, as it’s often correlated with responsible financial behavior.

If you have a less-than-perfect credit score, focus on improving it. Pay your bills on time, reduce your credit card balances, and consider consolidating your debt to boost your credit score over time. A higher credit score can lead to savings not only on your insurance premiums but also on other financial products.

6. Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that bases your premiums on your actual driving behavior. This type of insurance uses telematics devices or smartphone apps to track your driving habits, such as miles driven, time of day, and driving style.

If you're a safe and cautious driver, usage-based insurance can lead to significant savings. It rewards good driving behavior and provides an accurate assessment of your risk level. However, it's essential to understand the terms and conditions of these policies, as they may not be suitable for everyone.

Choosing the Right Coverage

While finding cheap car insurance is important, it’s equally crucial to ensure you have the right level of coverage to protect yourself and your assets. Here’s a quick breakdown of the different types of car insurance coverage and when you might need them.

1. Liability Coverage

Liability coverage is the most basic type of car insurance and is typically required by law. It covers the cost of damages or injuries you cause to others in an accident. This includes property damage, medical expenses, and legal fees. While it’s the minimum coverage required, it’s essential to ensure you have adequate liability limits to protect your assets in the event of a serious accident.

2. Collision and Comprehensive Coverage

Collision coverage pays for damages to your vehicle if you’re involved in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers non-accident-related incidents, such as theft, vandalism, natural disasters, or collisions with animals. These coverages are optional, but they’re highly recommended, especially if you have a loan or lease on your vehicle.

3. Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you in the event of an accident with a driver who has little or no insurance. This coverage can be vital in ensuring you’re not left financially vulnerable if you’re involved in an accident with an uninsured or underinsured driver.

4. Personal Injury Protection (PIP) and Medical Payments Coverage

PIP and medical payments coverage provide coverage for your medical expenses and those of your passengers in the event of an accident, regardless of fault. These coverages can help ensure you have the financial support you need to recover from injuries sustained in a crash.

5. Additional Coverages

Some insurance companies offer additional coverages that can be beneficial, such as rental car reimbursement, roadside assistance, or gap insurance. These coverages can provide added peace of mind and financial protection in certain situations.

The Future of Car Insurance

The car insurance industry is evolving rapidly, with technological advancements and changing consumer behaviors shaping the future of coverage. Here are some key trends and insights to consider:

1. Telematics and Usage-Based Insurance

As mentioned earlier, usage-based insurance is gaining traction, and it’s expected to play a significant role in the future of car insurance. With the increasing adoption of telematics and smartphone apps, insurance providers can gather more accurate data on driving behavior, leading to fairer and more personalized pricing.

2. Autonomous Vehicles

The rise of autonomous vehicles is expected to have a profound impact on the car insurance industry. As self-driving cars become more prevalent, the number of accidents caused by human error is expected to decrease, potentially leading to lower insurance rates. However, new risks and challenges may emerge, such as software glitches or cyberattacks, which could impact insurance premiums.

3. Digital Transformation

The digital transformation of the insurance industry is already well underway, with many insurers offering online quote comparisons, policy management, and claims processing. This trend is expected to continue, with more insurers embracing digital technologies to enhance the customer experience and reduce operational costs.

4. Personalized Insurance

With the wealth of data available through telematics and other sources, insurance providers are increasingly able to offer personalized insurance products tailored to individual driving behaviors and risk profiles. This shift towards personalized insurance can lead to more accurate pricing and better coverage options for consumers.

5. Sustainable and Electric Vehicles

The growing popularity of sustainable and electric vehicles is expected to influence car insurance rates. These vehicles often have advanced safety features and lower maintenance costs, which could lead to reduced insurance premiums. Additionally, the environmental impact of these vehicles may influence public perception and insurance pricing in the future.

Conclusion: Navigating the World of Cheap Car Insurance

Finding cheap car insurance is a balance between securing the best coverage for your needs and managing your premiums. By understanding the factors that influence insurance costs and implementing the strategies outlined in this guide, you can navigate the complex world of car insurance with confidence. Remember, it’s essential to compare quotes, explore discounts, and choose the right coverage to protect yourself and your assets.

Stay informed about the latest trends and advancements in the car insurance industry, as they can provide valuable insights into future pricing and coverage options. With the right approach and a bit of research, you can find affordable car insurance that meets your needs without compromising on quality.

Can I get cheap car insurance with a bad driving record?

+While a bad driving record can make it challenging to find affordable insurance, it’s not impossible. Some insurance companies specialize in high-risk drivers and offer competitive rates. Additionally, focusing on improving your driving record over time can lead to lower premiums.

What are some tips for lowering my car insurance premiums if I’m a young driver?

+Young drivers often face higher insurance premiums due to their perceived higher risk. To lower your premiums, consider maintaining a good academic record (many insurers offer good student discounts), completing a defensive driving course, and exploring usage-based insurance options that reward safe driving habits.

Are there any downsides to usage-based insurance?

+Usage-based insurance has the potential to save you money if you’re a safe driver. However, it may not be suitable for everyone. Some drivers may feel uncomfortable with the idea of their driving behavior being constantly monitored, and there may be privacy concerns. Additionally, if you drive a lot of miles or have a history of accidents, you may not see significant savings with this type of insurance.