Cheap Insurance Auto

Welcome to our comprehensive guide on finding cheap auto insurance options. In today's fast-paced world, having a reliable vehicle and affordable insurance coverage is essential. Many drivers are often on the lookout for ways to reduce their insurance costs without compromising on quality. This article aims to provide you with expert insights, real-world examples, and practical tips to help you navigate the world of auto insurance and secure the best deals available.

Understanding Auto Insurance and its Cost Factors

Auto insurance is a vital financial safeguard for vehicle owners, providing coverage for a range of scenarios, including accidents, theft, and liability claims. The cost of auto insurance can vary significantly, influenced by a multitude of factors. These factors include the make and model of your vehicle, your driving history, the coverage limits you choose, and even your geographical location. Understanding these cost drivers is the first step towards securing cheap insurance auto.

The Role of Personal Factors

Your personal characteristics play a significant role in determining your auto insurance rates. Insurers consider your age, gender, and marital status, as these factors are often linked to driving behavior and risk profiles. For instance, young drivers, especially males, are typically charged higher premiums due to their propensity for riskier driving behaviors. Similarly, your driving record is a critical factor; a clean record with no accidents or violations can lead to lower insurance costs.

Additionally, your credit score can influence your insurance rates. Many insurance companies use credit-based insurance scores to assess risk, believing that individuals with higher credit scores are more responsible and therefore less likely to file claims. Thus, maintaining a good credit score can indirectly lead to cheaper auto insurance.

| Personal Factor | Impact on Rates |

|---|---|

| Age | Younger drivers may pay more. |

| Gender | Males often face higher premiums. |

| Credit Score | Better credit scores can lead to lower rates. |

| Driving History | Clean records result in reduced costs. |

Vehicle-Related Factors

The type of vehicle you drive is another significant cost factor. Generally, sports cars and luxury vehicles are more expensive to insure due to their higher repair costs and increased likelihood of theft. On the other hand, sedans and compact cars are often more affordable to insure.

The safety features of your vehicle can also impact insurance costs. Vehicles equipped with advanced safety technologies like lane departure warning systems, automatic emergency braking, and blind-spot detection may qualify for insurance discounts, as they reduce the risk of accidents and subsequent claims.

Coverage Limits and Deductibles

The level of coverage you choose is a critical determinant of your insurance costs. Comprehensive and collision coverage, which protect against damage to your vehicle, can be expensive, especially if you have a high-value vehicle. On the other hand, liability-only coverage, which is the minimum required by law in most states, is often much more affordable.

The deductible, or the amount you pay out-of-pocket before your insurance coverage kicks in, also influences your insurance costs. Choosing a higher deductible can result in lower premiums, as you're assuming more financial responsibility in the event of a claim.

Tips for Securing Cheap Auto Insurance

Now that we’ve covered the key factors influencing auto insurance costs, let’s explore some practical strategies to help you secure the best deals.

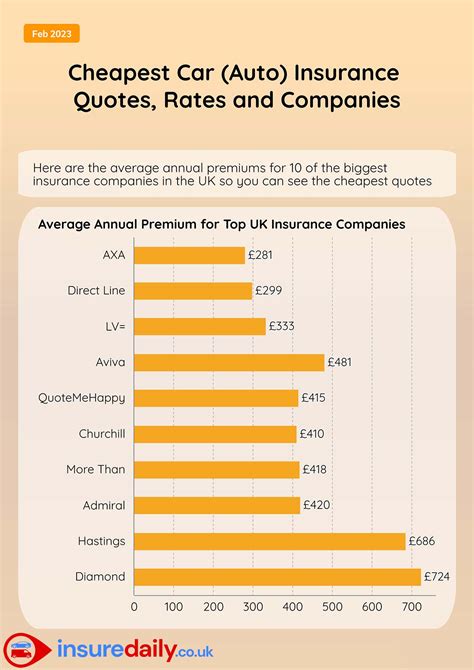

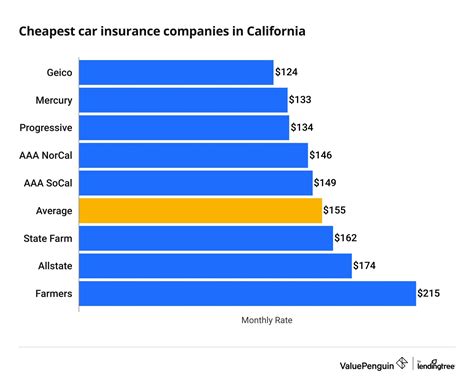

Shop Around and Compare

The auto insurance market is highly competitive, and prices can vary significantly between providers. Therefore, it’s essential to shop around and compare quotes from multiple insurers. Online comparison tools can be a great starting point, allowing you to quickly get an overview of the market and identify potential savings.

When comparing quotes, pay attention to the coverage limits and deductibles. Ensure that you're comparing like-for-like policies, as the cheapest quote might not always offer the best value if it provides inadequate coverage.

Understand Your Coverage Needs

Different drivers have different insurance needs. Before shopping for insurance, it’s crucial to understand your specific coverage requirements. Consider factors such as your financial situation, the value of your vehicle, and your personal risk tolerance. This will help you choose the right level of coverage and avoid over-insuring or under-insuring yourself.

Explore Discounts and Savings Opportunities

Insurance providers offer a variety of discounts that can significantly reduce your premiums. These may include:

- Multi-policy discounts: If you bundle your auto insurance with other policies, such as home or renters insurance, you may be eligible for a discount.

- Safe driver discounts: Many insurers offer discounts for accident-free driving over a certain period.

- Good student discounts: Students with a good academic record may qualify for reduced rates.

- Low mileage discounts: If you drive fewer miles than average, you may be eligible for a discount.

- Safety feature discounts: As mentioned earlier, vehicles equipped with advanced safety features may qualify for reduced rates.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach to auto insurance that uses real-time data about your driving behavior to determine your premiums. This type of insurance can be beneficial for safe drivers, as it rewards good driving habits with lower premiums.

With usage-based insurance, your insurer installs a device in your vehicle that tracks factors such as mileage, driving speed, and braking habits. This data is then used to calculate your insurance rates, which can lead to significant savings if you drive safely and responsibly.

Maintain a Good Driving Record

A clean driving record is one of the most effective ways to secure cheap auto insurance. Avoid traffic violations and accidents, as these can lead to increased premiums. If you’ve had a violation or accident in the past, consider taking a defensive driving course. Many insurers offer discounts for completing such courses, and it can also help improve your driving skills and reduce the likelihood of future incidents.

Regularly Review and Adjust Your Policy

Your insurance needs and circumstances can change over time. Regularly review your policy to ensure it still meets your requirements. As your driving record improves or your vehicle gets older, you may be able to adjust your coverage limits or deductibles to reduce your premiums. Additionally, keep an eye out for new discounts or promotions that your insurer may offer.

The Future of Auto Insurance: Trends and Predictions

The auto insurance industry is evolving rapidly, driven by advancements in technology and changing consumer expectations. Here are some key trends and predictions for the future of auto insurance:

Increased Use of Telematics

Telematics, the technology behind usage-based insurance, is expected to become more widespread. As more drivers embrace this pay-as-you-drive model, insurers will have access to more comprehensive data about driving behavior, allowing them to offer more tailored and affordable insurance products.

Rise of AI and Machine Learning

Artificial intelligence and machine learning are already being used in the auto insurance industry to automate tasks, enhance fraud detection, and personalize insurance offerings. These technologies are expected to play an even bigger role in the future, leading to more efficient and accurate risk assessment and pricing.

Expansion of Online and Digital Services

The digital transformation of the insurance industry is well underway. Insurers are increasingly offering online and mobile services, from quote comparisons and policy purchases to claims submissions and policy management. This trend is expected to continue, with more insurers investing in digital platforms to enhance customer experience and reduce operational costs.

Growth of Alternative Risk Transfer Mechanisms

Alternative risk transfer mechanisms, such as parametric insurance and risk pooling, are gaining traction in the auto insurance sector. These innovative approaches to risk management can provide more efficient and cost-effective coverage, particularly for specific types of risks or in certain geographical areas.

Integration of Autonomous Vehicle Technologies

As autonomous vehicles become more prevalent, the auto insurance industry will need to adapt. While fully autonomous vehicles are expected to reduce the number of accidents, they will also introduce new types of risks and liabilities. Insurers will need to develop new coverage models and pricing structures to address these evolving risks.

Conclusion: Navigating the World of Auto Insurance

Finding cheap auto insurance is a complex process, but with the right knowledge and strategies, it’s achievable. By understanding the cost factors, exploring your coverage options, and taking advantage of discounts and savings opportunities, you can secure affordable insurance without compromising on quality.

Remember, the auto insurance market is dynamic, and keeping up with the latest trends and innovations can give you an edge in securing the best deals. Stay informed, shop around, and don't be afraid to ask questions or seek expert advice. With a bit of research and diligence, you can navigate the world of auto insurance with confidence and find the coverage that suits your needs and your budget.

How often should I review my auto insurance policy?

+It’s recommended to review your policy annually, or whenever your circumstances change significantly. This ensures your coverage remains adequate and your premiums are competitive.

Can I switch insurance providers to save money?

+Absolutely! Shopping around and comparing quotes from different insurers is a great way to find cheaper rates. Remember to compare like-for-like policies to ensure you’re getting the coverage you need.

What is the best type of coverage for me?

+The best coverage for you depends on your specific needs and circumstances. Consider factors like your financial situation, the value of your vehicle, and your personal risk tolerance. It’s often a balance between adequate coverage and affordable premiums.

Are there any downsides to usage-based insurance?

+While usage-based insurance can offer significant savings for safe drivers, it may not be suitable for everyone. Some drivers may be uncomfortable with the idea of their insurer having access to their driving data. Additionally, it’s important to note that not all insurers offer this type of coverage, and it may not be available in all states.