Cheapest Auto Home Insurance

When it comes to protecting your most valuable assets, such as your home and vehicle, finding the cheapest auto and home insurance can be a top priority for many individuals. However, it's essential to strike a balance between affordability and adequate coverage to ensure you're fully protected in the event of unexpected incidents. This comprehensive guide will delve into the world of auto and home insurance, providing you with valuable insights, tips, and strategies to secure the best insurance deals while maintaining the coverage you need.

Understanding the Basics of Auto and Home Insurance

Auto and home insurance are essential components of financial planning and risk management. They provide financial protection against various risks and liabilities associated with owning and operating a vehicle or a home.

Auto Insurance

Auto insurance, also known as car insurance, is a contract between an individual and an insurance company. It provides coverage for damages and liabilities arising from vehicle ownership and use. Auto insurance policies typically include the following key components:

- Liability Coverage: This covers the policyholder’s legal responsibility for bodily injury and property damage caused to others in an accident for which the insured is at fault.

- Collision Coverage: Pays for repairs or replacement of the insured vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers damages caused by non-collision incidents such as theft, vandalism, natural disasters, or collisions with animals.

- Personal Injury Protection (PIP): Provides medical coverage for the insured and their passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects the insured in case of an accident with a driver who has no insurance or insufficient coverage.

Home Insurance

Home insurance, or homeowners insurance, provides financial protection for homeowners against various risks associated with owning a home. It covers the structure of the home, its contents, and the liability of the homeowner. Here are some key aspects of home insurance:

- Dwelling Coverage: This covers the physical structure of the home, including the main house, attached structures like garages, and even some outdoor fixtures.

- Personal Property Coverage: Protects the contents of the home, such as furniture, electronics, and personal belongings.

- Liability Coverage: Provides protection against lawsuits and medical expenses if someone is injured on the insured property.

- Additional Living Expenses (ALE): Covers the cost of temporary housing and other expenses if the home becomes uninhabitable due to a covered loss.

- Optional Coverages: Home insurance policies often offer additional coverage options, such as flood insurance, earthquake coverage, or coverage for high-value items like jewelry or art.

Factors Affecting Auto and Home Insurance Costs

The cost of auto and home insurance can vary significantly depending on various factors. Understanding these factors can help you make informed decisions when choosing insurance policies and potentially save money.

Auto Insurance Factors

- Driver’s Profile: Insurance rates are influenced by the driver’s age, gender, driving record, and credit score. Younger drivers and those with a history of accidents or violations may face higher premiums.

- Vehicle Type and Usage: The make, model, and age of the vehicle play a role in insurance costs. Additionally, the primary use of the vehicle (commuting, pleasure, business) can impact rates.

- Coverage and Deductibles: Choosing higher coverage limits and lower deductibles typically results in higher premiums. It’s essential to strike a balance between coverage and affordability.

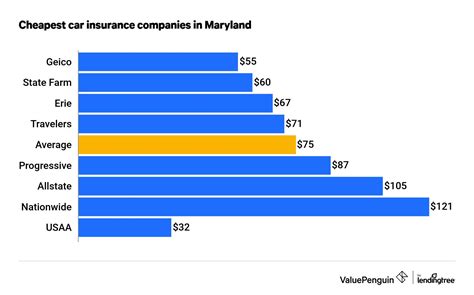

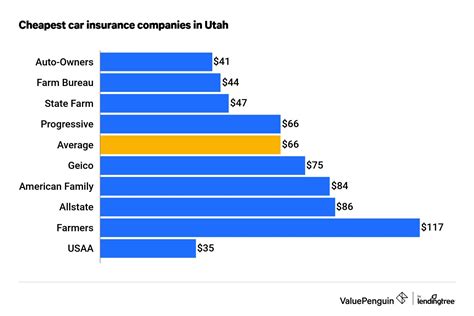

- Location: Insurance rates can vary based on the area where the vehicle is primarily garaged. Urban areas with higher crime rates or traffic congestion may have higher premiums.

- Discounts and Bundling: Many insurance companies offer discounts for good driving records, safety features in the vehicle, and bundling auto insurance with other policies, such as home insurance.

Home Insurance Factors

- Home Value and Location: The cost of home insurance is closely tied to the value of the home and its location. Homes in areas prone to natural disasters or with higher crime rates may have higher premiums.

- Coverage Limits: The amount of coverage chosen for the dwelling, personal property, and liability can significantly impact the insurance cost. It’s crucial to ensure adequate coverage without overpaying.

- Deductibles: Like auto insurance, home insurance deductibles affect the premium. Higher deductibles can lower premiums but may require a more significant out-of-pocket expense in the event of a claim.

- Home Age and Condition: Older homes may require more extensive coverage due to potential maintenance issues or outdated electrical or plumbing systems.

- Discounts and Bundling: Similar to auto insurance, bundling home insurance with other policies can lead to significant savings. Additionally, home insurance providers may offer discounts for safety features like burglar alarms or smoke detectors.

Tips for Finding the Cheapest Auto and Home Insurance

While it’s important to find affordable insurance, ensuring you have adequate coverage is equally vital. Here are some tips to help you navigate the insurance market and find the best deals without compromising on protection.

Compare Quotes

Obtain quotes from multiple insurance providers to compare rates and coverage options. Online quote comparison tools can be a convenient way to get a quick overview of various options.

Understand Your Needs

Assess your specific needs and requirements for auto and home insurance. Consider factors like the value of your vehicle and home, the level of coverage you desire, and any unique circumstances that may impact your insurance needs.

Shop Around

Don’t settle for the first insurance quote you receive. Explore different providers and compare their rates, coverage options, and customer reviews. Shopping around can reveal significant differences in pricing and coverage.

Consider Bundling

Bundling your auto and home insurance policies with the same provider can often result in substantial savings. Many insurance companies offer multi-policy discounts, so it’s worth exploring this option.

Review Your Coverage Regularly

Insurance needs can change over time. Regularly review your policies to ensure they still meet your requirements. Life events like getting married, having children, or purchasing a new vehicle may impact your insurance needs.

Maintain a Good Driving Record

A clean driving record can lead to lower insurance premiums. Avoid accidents and violations to keep your insurance costs down.

Choose Higher Deductibles

Opting for higher deductibles can reduce your insurance premiums. However, ensure you can afford the deductible amount in the event of a claim.

Explore Discounts

Insurance companies often offer various discounts, such as safe driver discounts, good student discounts, loyalty discounts, or discounts for specific professions. Ask your insurance provider about available discounts and ensure you’re taking advantage of them.

Consider Usage-Based Insurance

Some insurance providers offer usage-based insurance programs, where your premium is determined by your actual driving behavior. This can be beneficial for low-mileage drivers or those with safe driving habits.

Review Coverage Limits

Ensure your coverage limits are adequate for your needs. Reviewing your coverage limits regularly can help you avoid being underinsured in the event of a claim.

The Importance of Adequate Coverage

While finding the cheapest insurance is important, it’s equally crucial to ensure you have adequate coverage. Inadequate coverage can leave you vulnerable to significant financial losses in the event of an accident, natural disaster, or other insured events.

Understanding Coverage Limits

Coverage limits define the maximum amount an insurance company will pay for a covered loss. It’s essential to choose coverage limits that align with your financial needs and the value of your assets.

The Risk of Underinsurance

Underinsurance occurs when your coverage limits are too low to fully cover your potential losses. This can result in financial hardship if you need to cover the remaining expenses out of pocket.

Assessing Your Risk Profile

Evaluate your unique risk profile when choosing insurance coverage. Consider factors like your location, the frequency of natural disasters in your area, your driving habits, and the value of your assets.

Choosing the Right Coverage

Select insurance policies that provide comprehensive coverage for your specific needs. This may include additional coverage options, such as flood insurance or earthquake coverage, depending on your location and circumstances.

Conclusion: A Balanced Approach

Finding the cheapest auto and home insurance is a desirable goal, but it should be approached with caution. While saving money is important, ensuring you have adequate coverage to protect your assets and financial well-being is equally vital.

By understanding the basics of auto and home insurance, the factors that influence costs, and the tips for finding affordable coverage, you can make informed decisions. Regularly reviewing your policies, comparing quotes, and assessing your coverage needs will help you strike the right balance between affordability and protection.

FAQ

What is the average cost of auto insurance in the United States?

+The average cost of auto insurance in the U.S. varies by state and can range from a few hundred dollars to over $1,000 per year. Factors like the driver’s age, driving record, and location play a significant role in determining insurance rates.

Can I get auto insurance without a car?

+Yes, it is possible to obtain auto insurance even if you don’t currently own a car. Non-owner car insurance policies provide liability coverage for situations where you borrow or rent a vehicle.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually or whenever significant changes occur, such as renovations, additions, or changes in personal property value. Regular reviews ensure your coverage remains adequate.

Are there any alternatives to standard home insurance?

+Yes, there are alternative insurance options, such as HO-8 or HO-5 policies, which provide broader coverage for older homes or those with unique construction. These policies may be more expensive but offer enhanced protection.