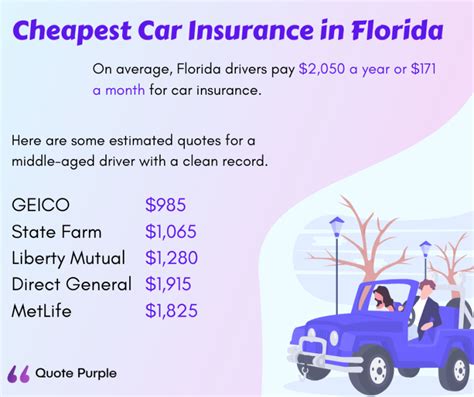

Cheapest Car Insurance For Florida

Florida, known for its sunny beaches and vibrant culture, is also a state where car insurance is a necessity. With its diverse population and unique traffic laws, finding the cheapest car insurance can be a challenging task. However, with the right knowledge and strategies, it is possible to secure affordable coverage that meets your needs.

Understanding Florida’s Car Insurance Landscape

Florida has a unique set of laws and regulations when it comes to car insurance. One key aspect is the Personal Injury Protection (PIP) coverage, which is mandatory for all registered vehicles. PIP covers medical expenses and lost wages for the policyholder and their passengers in the event of an accident, regardless of fault. This requirement adds a layer of complexity to insurance shopping in the Sunshine State.

In addition to PIP, Florida also mandates a minimum amount of property damage liability coverage. This ensures that if you cause an accident, the resulting damage to other vehicles or property is covered up to the policy limit. Failure to maintain the required insurance coverage can lead to legal consequences and even vehicle registration issues.

Factors Influencing Insurance Rates

When it comes to car insurance rates, several factors come into play. Here are some key considerations:

- Driver Profile: Your age, gender, driving history, and credit score all play a role in determining your insurance premium. Younger drivers and those with a history of accidents or violations may face higher rates.

- Vehicle Type: The make, model, and age of your vehicle can impact your insurance costs. High-performance cars or luxury vehicles often attract higher premiums due to their repair and replacement costs.

- Location: Insurance rates can vary significantly depending on where you live. Urban areas with higher population densities and traffic volumes often result in increased rates.

- Coverage Options: Beyond the mandatory PIP and liability coverage, you have the option to customize your policy with additional coverages like collision, comprehensive, uninsured/underinsured motorist, and rental car reimbursement. The more coverage you choose, the higher your premium may be.

Strategies to Find the Cheapest Car Insurance in Florida

Navigating the car insurance market in Florida can be daunting, but with a systematic approach, you can identify the most affordable options. Here are some strategies to help you secure the cheapest car insurance:

Compare Multiple Providers

Florida is home to numerous insurance companies, both local and national. It’s crucial to compare quotes from multiple providers to find the best deal. Each insurer has its own rating system and considers factors differently, so obtaining quotes from at least three to five companies is recommended.

Online comparison tools can be a convenient way to gather quotes quickly. However, it's essential to provide accurate and detailed information to ensure you receive precise estimates. Be prepared to disclose your driver history, vehicle details, and desired coverage levels.

Understand Coverage Options

As mentioned earlier, Florida mandates specific coverage types. Beyond these requirements, you have the flexibility to choose additional coverages. It’s important to understand the benefits and limitations of each coverage option to tailor your policy to your needs.

For instance, collision coverage pays for repairs or replacements if your vehicle is damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, protects against non-collision events like theft, vandalism, or natural disasters. While these coverages add to your premium, they provide peace of mind and financial protection in the event of unexpected incidents.

Explore Discount Opportunities

Insurance companies offer a variety of discounts to attract customers and reward safe driving behaviors. Some common discounts include:

- Safe Driver Discount: Insurers often provide discounts for drivers with clean records, free of accidents or violations.

- Multi-Policy Discount: Bundling your car insurance with other policies, such as homeowners or renters insurance, can result in significant savings.

- Defensive Driving Course Discount: Completing an approved defensive driving course can lead to reduced premiums.

- Low-Mileage Discount: If you drive fewer miles annually, you may be eligible for a discount.

- Anti-Theft Device Discount: Installing approved anti-theft devices in your vehicle can lower your insurance costs.

Be sure to inquire about available discounts when obtaining quotes and ask your insurer for advice on qualifying for these savings.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that allows insurers to tailor premiums based on your actual driving behavior. By installing a small device or using a smartphone app to track your driving habits, insurers can offer personalized rates.

This type of insurance can be beneficial for safe drivers who log fewer miles or exhibit good driving habits. However, it may not be suitable for everyone, as it requires ongoing monitoring and can impact privacy. Carefully consider your driving habits and preferences before opting for usage-based insurance.

Shop Around Regularly

Insurance rates can fluctuate over time due to various factors, including changes in your personal circumstances, insurer rating systems, and market competition. It’s a good practice to shop around for car insurance annually or whenever your policy renews. By comparing quotes regularly, you can ensure you’re still getting the best deal and aren’t overpaying.

Additionally, don't hesitate to negotiate with your insurer. Many companies are willing to match or beat competitors' rates to retain your business. Be proactive and advocate for yourself to secure the most affordable coverage.

Performance Analysis: Top Insurers in Florida

To help you navigate the competitive Florida insurance market, we’ve analyzed the performance of some of the top insurers in the state. Here’s a snapshot of their offerings and key features:

| Insurers | Coverage Options | Discounts | Additional Benefits |

|---|---|---|---|

| State Farm | Wide range of coverage options, including specialty policies for classic cars and ridesharing. | Safe driver, multi-policy, good student, and loyalty discounts. | Roadside assistance and rental car coverage included in some policies. |

| Geico | Comprehensive coverage options with add-ons like mechanical breakdown insurance and pet injury coverage. | Military and federal employee discounts, good student discount, and savings for safe drivers. | Emergency roadside service and accident forgiveness programs available. |

| Progressive | Customizable coverage with options for gap insurance and pet injury coverage. | Multi-policy, safe driver, and snapshot (usage-based) discounts. | 24/7 customer support and flexible payment options. |

| Allstate | Comprehensive coverage with optional add-ons like rental reimbursement and sound system coverage. | Safe driver, multi-policy, and good student discounts. | Accident forgiveness and dedicated claims specialists. |

| USAA | Specialized coverage for military members and their families, including deployment discounts. | Discounts for safe driving, multi-policy, and good student. | Roadside assistance and rental car coverage included in some policies. |

Future Implications and Trends

The car insurance landscape in Florida is continually evolving, and staying informed about upcoming changes can help you make informed decisions. Here are some key trends to watch:

Technological Advancements

The insurance industry is embracing technology to enhance customer experience and streamline processes. Telematics and usage-based insurance are gaining traction, allowing insurers to offer personalized rates based on real-time driving data. Additionally, digital platforms and mobile apps are making it easier for customers to manage their policies and file claims.

Regulatory Changes

Florida’s insurance regulations are subject to periodic updates and revisions. Keep an eye on any proposed changes to PIP coverage limits or other mandatory requirements. Understanding these changes can help you anticipate their impact on your insurance costs and coverage options.

Market Competition

The competitive nature of the Florida insurance market is a boon for consumers. As more insurers enter the market and existing providers strive to retain customers, you can expect increased access to affordable coverage and innovative products. Stay engaged with the latest insurance news and compare quotes regularly to take advantage of competitive pricing.

FAQ

How can I get cheap car insurance in Florida with a poor driving record?

+While a poor driving record can make it challenging to find affordable insurance, there are still options. Consider comparing quotes from insurers that specialize in high-risk drivers. Additionally, focus on improving your driving behavior to qualify for safe driver discounts in the future.

What are the minimum coverage requirements in Florida?

+Florida mandates a minimum of 10,000 in Personal Injury Protection (PIP) coverage and 10,000 in property damage liability coverage. However, it’s important to note that these minimums may not provide sufficient protection in the event of an accident. Consider increasing your coverage limits to ensure adequate financial protection.

Are there any insurance providers that offer discounts for specific occupations or affiliations in Florida?

+Yes, some insurance providers offer discounts for certain occupations or affiliations. For example, USAA caters specifically to military members and their families, offering specialized coverage and discounts. Other insurers may provide discounts for teachers, students, or certain professional organizations. Be sure to inquire about these options when obtaining quotes.

By understanding Florida’s unique insurance landscape, comparing multiple providers, and employing strategic approaches, you can secure the cheapest car insurance that meets your needs. Stay informed, shop around, and take advantage of the competitive market to make informed decisions about your coverage.