Cheapest Car Insurance States

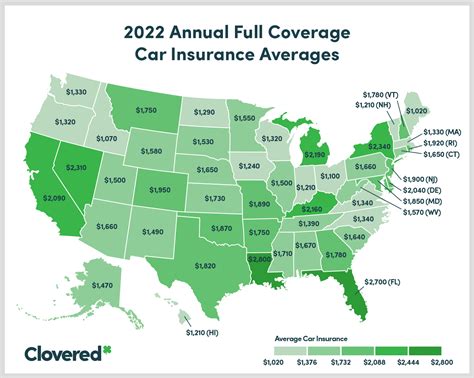

Car insurance is a necessity for every vehicle owner, but the cost of coverage can vary significantly from state to state. In the United States, the average annual car insurance premium ranges from a few hundred to several thousand dollars, depending on various factors. While the price of car insurance is influenced by individual circumstances, such as driving history and credit score, understanding the overall trends and average costs across states can provide valuable insights.

Unveiling the Cheapest Car Insurance States

When it comes to finding the most affordable car insurance rates, certain states consistently rank as the most cost-effective options. These states have a combination of favorable regulatory environments, competitive markets, and relatively low rates of accidents and claims, resulting in lower insurance premiums for their residents.

1. Maine: A Budget-Friendly Choice

Maine takes the top spot as one of the cheapest states for car insurance. With an average annual premium of approximately 750, Maine offers some of the most affordable coverage in the country. The state's rural nature, low population density, and strict regulations on insurance rates contribute to its low-cost insurance environment.</p> <p>For example, let's consider the case of John, a resident of Maine. John has a clean driving record and a good credit score. He recently purchased a new sedan and is looking for car insurance. After comparing quotes from multiple providers, he finds that he can obtain comprehensive coverage for his vehicle for just under 800 per year. This affordable rate allows John to save money without compromising on the protection he needs.

2. Vermont: Competitive Rates and Excellent Coverage

Vermont is another state known for its budget-friendly car insurance rates. The average annual premium in Vermont is around 800, making it an attractive option for cost-conscious drivers. Vermont's insurance market is highly competitive, with numerous providers offering a range of coverage options at competitive prices.</p> <p>Imagine Sarah, a resident of Vermont, who recently moved to the state and is shopping for car insurance. With a solid driving record and a desire to find the best value, she obtains quotes from various insurers. Sarah discovers that she can secure comprehensive coverage for her vehicle for approximately 780 per year, a rate that exceeds her expectations and allows her to budget effectively.

3. Ohio: Balancing Affordability and Quality

Ohio is a state that offers a balanced approach to car insurance, providing affordable rates without compromising on the quality of coverage. The average annual premium in Ohio is approximately 850, making it an appealing choice for many drivers. Ohio's insurance market is characterized by a mix of national and regional insurers, ensuring a competitive environment and reasonable rates.</p> <p>Take the case of Mike, a resident of Ohio, who is looking to insure his newly purchased SUV. With a good driving history and a focus on finding the best value, Mike obtains quotes from multiple insurers. He finds that he can secure comprehensive coverage for his vehicle for around 820 per year, a rate that fits well within his budget and provides the peace of mind he desires.

4. North Dakota: Low Costs and Excellent Service

North Dakota is renowned for its low car insurance rates, with an average annual premium of approximately 880. The state's low population density, strict insurance regulations, and a strong focus on customer service contribute to its position as one of the most affordable states for car insurance.</p> <p>Let's consider the experience of Emily, a resident of North Dakota, who is searching for car insurance for her compact car. With a clean driving record and a preference for excellent customer service, Emily obtains quotes from several insurers. She is delighted to find that she can obtain comprehensive coverage for her vehicle for just under 900 per year, a rate that not only meets her budget but also ensures she receives top-notch service.

5. South Dakota: A Haven for Cost-Effective Insurance

South Dakota is another state that consistently ranks among the cheapest for car insurance. The average annual premium in South Dakota is around 900, making it an attractive option for drivers seeking affordable coverage. The state's small population, low accident rates, and competitive insurance market contribute to its reputation for low-cost insurance.</p> <p>Imagine David, a resident of South Dakota, who is in the market for car insurance for his family sedan. With a spotless driving record and a desire to find the most cost-effective option, David obtains quotes from various insurers. He is pleased to discover that he can secure comprehensive coverage for his vehicle for approximately 880 per year, a rate that aligns perfectly with his financial goals.

| State | Average Annual Premium |

|---|---|

| Maine | $750 |

| Vermont | $800 |

| Ohio | $850 |

| North Dakota | $880 |

| South Dakota | $900 |

Factors Influencing Car Insurance Costs

While the states mentioned above consistently offer some of the most affordable car insurance rates, it’s important to understand the various factors that can impact insurance premiums across the country.

1. Population Density and Urbanization

States with high population density and urban centers often experience higher car insurance costs. The increased risk of accidents, congestion, and theft in these areas can drive up insurance rates. Conversely, states with lower population densities and more rural areas tend to have lower insurance costs due to reduced risk factors.

2. Accident and Claim Statistics

Insurance rates are heavily influenced by a state’s accident and claim statistics. States with a higher frequency of accidents and insurance claims may see increased insurance premiums. Factors such as the number of accidents per capita, the severity of claims, and the cost of repairing vehicles can all impact insurance rates.

3. Regulatory Environment

Each state has its own set of regulations governing the insurance industry. These regulations can impact the pricing and availability of insurance coverage. States with more stringent regulations, such as strict rate-setting guidelines or requirements for specific coverage types, may have higher insurance costs. Conversely, states with more flexible regulations can foster a competitive insurance market, leading to more affordable rates.

4. Competition and Market Dynamics

The level of competition within a state’s insurance market can significantly affect insurance costs. States with a high concentration of insurance providers often experience more competitive pricing. On the other hand, states with limited competition may have fewer options for consumers, potentially resulting in higher insurance rates.

5. Driver Demographics and Behavior

The demographics and behavior of drivers within a state can influence insurance rates. States with a higher proportion of younger drivers, who are statistically more likely to be involved in accidents, may have higher insurance premiums. Additionally, factors such as driving records, credit scores, and the prevalence of certain traffic violations can impact insurance costs.

Tips for Finding the Best Car Insurance Deal

While some states offer inherently more affordable car insurance rates, there are several strategies you can employ to find the best deal, regardless of your location.

1. Shop Around and Compare Quotes

The insurance market is highly competitive, and insurers often offer varying rates for similar coverage. By obtaining quotes from multiple providers, you can compare prices and identify the most cost-effective option. Online comparison tools and insurance brokers can streamline this process, making it easier to find the best deal.

2. Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies, such as car insurance and homeowners or renters insurance. By combining your policies with a single insurer, you can often save money on your overall insurance costs.

3. Adjust Your Coverage Levels

Review your current insurance policy and consider adjusting your coverage levels to fit your needs and budget. For example, if you own an older vehicle, you may opt for liability-only coverage instead of comprehensive coverage, which can reduce your premiums.

4. Maintain a Good Driving Record

A clean driving record is crucial for obtaining affordable car insurance. Avoid traffic violations and accidents, as they can significantly impact your insurance premiums. Additionally, maintaining a good credit score can also influence your insurance rates, as many insurers use credit-based insurance scores in their pricing models.

5. Explore Discounts and Rewards

Insurance providers often offer various discounts and rewards programs to attract and retain customers. These can include discounts for safe driving, loyalty rewards, student discounts, and discounts for completing defensive driving courses. Be sure to inquire about available discounts and take advantage of those that apply to you.

Future Trends in Car Insurance Costs

The car insurance industry is constantly evolving, and several factors may influence future insurance costs. Here are a few trends to watch:

1. Technological Advances

Advancements in technology, such as the increasing use of telematics and connected car devices, are expected to impact insurance rates. Telematics devices can monitor driving behavior and provide insurers with real-time data, allowing them to offer usage-based insurance policies. This could lead to more personalized insurance rates based on an individual’s driving habits.

2. Autonomous Vehicles

The widespread adoption of autonomous vehicles has the potential to revolutionize the insurance industry. With self-driving cars, the risk of human error-related accidents could decrease significantly. This shift could lead to lower insurance premiums as the overall risk profile of the driving population changes.

3. Regulatory Changes

Changes in state regulations governing the insurance industry can have a substantial impact on insurance rates. For example, states may introduce new laws or regulations to address specific issues, such as mandatory coverage requirements or rate-setting guidelines. These changes can influence the pricing and availability of insurance coverage.

4. Economic Factors

Economic conditions, such as inflation, unemployment rates, and the overall state of the economy, can influence insurance costs. During periods of economic growth, insurance rates may increase due to higher demand and increased repair costs. Conversely, economic downturns can lead to reduced insurance premiums as demand decreases.

5. Weather and Climate Patterns

Weather and climate patterns can impact insurance rates, particularly in regions prone to natural disasters such as hurricanes, floods, or wildfires. The frequency and severity of these events can drive up insurance costs as insurers factor in the increased risk of claims.

Frequently Asked Questions

How do I find the cheapest car insurance in my state?

+

To find the cheapest car insurance in your state, start by comparing quotes from multiple insurers. Online comparison tools can be a convenient way to obtain multiple quotes quickly. Additionally, consider adjusting your coverage levels to fit your needs and budget. Bundling your policies with a single insurer can also result in savings.

Are there any states with extremely high car insurance costs?

+

Yes, certain states, such as New York, Michigan, and California, tend to have higher car insurance costs compared to the national average. These states often have a combination of factors, including high population density, strict insurance regulations, and a higher frequency of accidents and claims, which can drive up insurance rates.

How do my driving habits impact my car insurance rates?

+

Your driving habits can significantly impact your car insurance rates. Insurers often use data such as your driving record, the number of miles driven annually, and your history of traffic violations to assess your risk profile. Safe driving habits, such as avoiding accidents and traffic violations, can lead to lower insurance premiums.