Cheapest Cheapest Car Insurance

Finding the cheapest car insurance is a common goal for many drivers, as it can help save a significant amount of money on a necessary expense. While the concept of cheap car insurance is enticing, it's important to understand that the lowest price might not always align with the best value or coverage. In this comprehensive guide, we'll explore the factors that influence insurance costs, offer strategies to secure affordable coverage, and provide insights into the cheapest car insurance options available in the market.

Understanding the Factors That Impact Insurance Costs

The cost of car insurance is influenced by a multitude of factors, and understanding these elements is crucial when aiming to secure the cheapest coverage. Here’s a breakdown of the key factors:

Risk Profile and Personal Information

Insurance providers assess an individual’s risk profile when determining premiums. This includes factors like age, gender, driving record, credit score, and even marital status. Younger drivers and those with a history of accidents or violations are often considered higher-risk and may face higher premiums.

Vehicle Type and Usage

The make, model, and year of your vehicle play a significant role in insurance costs. Certain vehicles, especially luxury or high-performance cars, tend to be more expensive to insure due to higher repair costs and increased likelihood of theft. Additionally, the purpose of your vehicle, such as whether it’s used for personal or business travel, can impact your insurance rates.

Coverage and Deductibles

The level of coverage you choose directly affects your insurance costs. Comprehensive and collision coverage, which provide protection for your vehicle, typically come with higher premiums. On the other hand, opting for liability-only coverage, which is legally required in most states, can be more affordable. Additionally, increasing your deductible can lead to lower premiums, but it means you’ll pay more out-of-pocket in the event of a claim.

Location and Usage Patterns

Your geographic location and daily driving habits can influence insurance rates. Urban areas with higher traffic volumes and theft rates often result in higher premiums. Similarly, individuals who drive long distances or frequently travel in high-risk areas may face increased insurance costs.

Insurance Company and Policy Features

Different insurance companies offer varying rates and policy features. Some providers specialize in certain types of coverage or cater to specific demographics. Additionally, the inclusion of features like roadside assistance, rental car reimbursement, or accident forgiveness can impact the overall cost of your policy.

Strategies to Secure the Cheapest Car Insurance

Now that we’ve established the factors that influence insurance costs, let’s delve into strategies to secure the cheapest car insurance while maintaining adequate coverage:

Compare Multiple Quotes

Obtaining quotes from multiple insurance providers is a fundamental step in finding the cheapest option. Online comparison tools can streamline this process, allowing you to quickly gather quotes from various companies based on your specific needs and circumstances. Remember, prices can vary significantly between providers, so it’s essential to compare extensively.

Assess Your Coverage Needs

Review your current coverage and assess whether you’re paying for unnecessary features. For instance, if you own an older vehicle, you might consider dropping collision and comprehensive coverage, as the cost of repairs may not justify the premiums. Additionally, evaluate your liability limits to ensure you have adequate coverage without overspending.

Explore Discounts

Insurance companies offer a variety of discounts that can significantly reduce your premiums. Common discounts include those for safe driving records, multi-policy bundles (combining auto and home insurance), and loyalty rewards for long-term customers. Additionally, some providers offer discounts for specific professions or membership in certain organizations.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that calculates premiums based on your actual driving behavior. This type of insurance uses a device or smartphone app to track factors like mileage, driving speed, and braking habits. If you have a safe and conservative driving style, you may qualify for substantial discounts with usage-based insurance.

Bundle Policies

Bundling your auto insurance with other policies, such as home, renters, or life insurance, can lead to significant savings. Many insurance providers offer multi-policy discounts, and by combining your policies, you not only save money but also streamline your insurance management.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to secure cheap car insurance. Avoid traffic violations and at-fault accidents, as these can significantly increase your premiums. Additionally, consider taking defensive driving courses, as some insurance providers offer discounts for completing these courses.

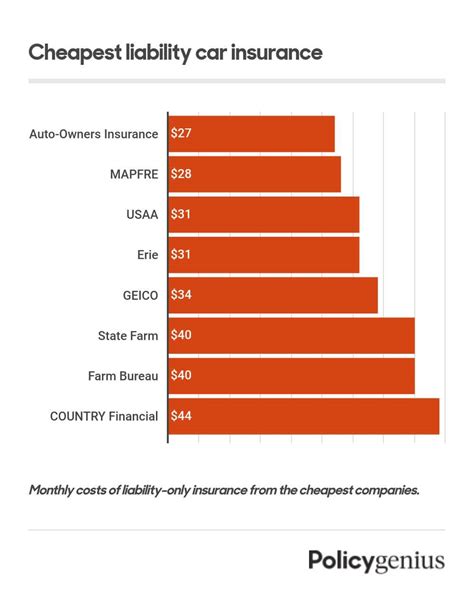

Exploring the Cheapest Car Insurance Options

Now, let’s explore some of the insurance providers known for offering the cheapest car insurance options. Keep in mind that while these providers may offer competitive rates, it’s crucial to thoroughly review their coverage options and customer service to ensure they align with your needs.

Geico

Geico, known for its catchy slogans and humorous advertisements, consistently ranks among the top providers for cheap car insurance. They offer a wide range of coverage options and discounts, including multi-policy discounts, safe driver discounts, and even discounts for federal employees and military members.

State Farm

State Farm is another well-established insurance provider known for its competitive rates and comprehensive coverage options. They offer a variety of discounts, including those for safe driving, multiple vehicles, and good grades for students. State Farm also provides additional coverage options, such as rental car reimbursement and roadside assistance.

Progressive

Progressive is a popular choice for affordable car insurance, especially for those who prefer a more modern and tech-savvy approach. They offer usage-based insurance through their Snapshot program, which can lead to significant savings for safe drivers. Additionally, Progressive provides a range of discounts, including multi-policy bundles and loyalty rewards.

Esurance

Esurance, a subsidiary of Allstate, is known for its online-centric approach, making it convenient for tech-savvy individuals to manage their insurance policies. They offer competitive rates and a variety of discounts, including those for safe driving, multi-policy bundles, and vehicle safety features. Esurance also provides options for personalized coverage, allowing you to tailor your policy to your specific needs.

USAA

USAA is a unique insurance provider that caters exclusively to active-duty military members, veterans, and their families. They consistently offer some of the cheapest car insurance rates available, often providing significant discounts for their eligible members. USAA also provides a range of additional benefits, such as roadside assistance and rental car discounts.

Performance Analysis and Customer Satisfaction

When selecting the cheapest car insurance, it’s important to consider not only the cost but also the provider’s performance and customer satisfaction. Here’s a brief analysis of the aforementioned providers based on these factors:

| Insurance Provider | Performance | Customer Satisfaction |

|---|---|---|

| Geico | Geico consistently ranks well in terms of financial stability and claim handling. They offer a seamless online experience and provide efficient customer service. | Geico receives high marks for customer satisfaction, with many praising their easy-to-use website and responsive customer support. |

| State Farm | State Farm is known for its strong financial stability and comprehensive claim handling. They provide a range of resources and support for customers, ensuring a smooth experience. | State Farm maintains a solid reputation for customer satisfaction, with customers appreciating their personalized approach and local agent support. |

| Progressive | Progressive has a strong track record for financial stability and offers innovative coverage options. Their claim handling process is efficient and customer-centric. | Progressive receives positive feedback for its customer service, with many praising the convenience of their online tools and the accessibility of their customer support. |

| Esurance | Esurance excels in financial stability and offers a range of coverage options. Their claim handling process is streamlined and customer-focused. | Esurance customers appreciate the convenience of their online platform and the personalized coverage options. However, some reviews suggest that customer service could be more responsive. |

| USAA | USAA stands out for its exceptional financial stability and tailored coverage options for military members. Their claim handling process is highly efficient and military-focused. | USAA consistently receives top marks for customer satisfaction, with members praising their dedicated support and tailored benefits. However, it's important to note that USAA is exclusive to military personnel and their families. |

Evidence-Based Future Implications

As the insurance industry continues to evolve, several trends and advancements are likely to impact the availability and cost of car insurance in the future. Here’s an analysis of these implications:

Telematics and Usage-Based Insurance

The use of telematics and usage-based insurance is expected to grow significantly in the coming years. This technology allows insurance providers to collect real-time data on driving behavior, which can lead to more accurate risk assessments and potentially lower premiums for safe drivers. However, privacy concerns and the potential for increased surveillance may pose challenges to this trend.

Artificial Intelligence and Data Analytics

The integration of artificial intelligence (AI) and advanced data analytics is transforming the insurance industry. AI-powered systems can analyze vast amounts of data to identify patterns and predict risks more accurately. This can lead to more efficient claim handling, improved fraud detection, and potentially lower insurance costs for consumers.

Connected Vehicles and Autonomous Driving

The rise of connected vehicles and autonomous driving technologies is likely to have a significant impact on car insurance. These advancements can lead to safer driving conditions and potentially reduce the frequency and severity of accidents. As a result, insurance providers may adjust their risk assessments and offer more affordable coverage for drivers utilizing these advanced technologies.

Regulatory Changes and Industry Consolidation

Regulatory changes and industry consolidation are also expected to shape the future of car insurance. Government initiatives aimed at promoting competition and consumer protection may influence insurance pricing and availability. Additionally, mergers and acquisitions within the insurance industry could lead to shifts in market dynamics and potentially impact the range of options available to consumers.

Environmental Factors and Sustainable Practices

The growing focus on environmental sustainability is likely to influence the car insurance industry. As electric and hybrid vehicles become more prevalent, insurance providers may need to adjust their coverage options and pricing to accommodate these changes. Additionally, initiatives promoting eco-friendly driving practices could lead to incentives and discounts for consumers who adopt sustainable transportation methods.

Conclusion

Securing the cheapest car insurance is a balance between finding affordable coverage and ensuring adequate protection. By understanding the factors that influence insurance costs, comparing quotes, and implementing strategic approaches, drivers can make informed decisions to obtain the best value for their insurance needs. As the insurance industry continues to evolve, staying informed about advancements and trends will be crucial in navigating the ever-changing landscape of car insurance.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. varies widely based on factors like location, vehicle type, and driving record. As of [current year], the national average for car insurance premiums is approximately $1,674 per year, according to data from the Insurance Information Institute.

Can I get car insurance if I have a poor credit score?

+Yes, it’s possible to obtain car insurance with a poor credit score. However, insurance providers often consider credit scores as an indicator of risk, and individuals with lower credit scores may face higher premiums. It’s advisable to shop around and compare quotes from multiple providers to find the best rates.

Are there any states with particularly cheap car insurance rates?

+Yes, certain states tend to have lower average car insurance rates. For example, states like Maine, Idaho, and North Dakota often rank among the cheapest for car insurance. However, it’s important to note that rates can vary significantly within states, and individual circumstances play a crucial role in determining insurance costs.