Cheapest Health Insurance Plan

When it comes to finding the cheapest health insurance plan, it's important to understand that the cost of insurance can vary significantly based on several factors. The concept of "cheap" may not always align with the best value or coverage, so it's crucial to strike a balance between affordability and adequate healthcare coverage. This comprehensive guide aims to explore the landscape of affordable health insurance options, providing insights into how to secure the best deal without compromising on essential medical services.

Understanding the Basics of Health Insurance

Health insurance is a vital aspect of modern healthcare, providing financial protection against the high costs of medical treatments and services. In the United States, the health insurance market offers a wide range of plans with varying levels of coverage and premiums. Understanding the fundamentals of health insurance is the first step towards making informed choices when selecting a plan.

Types of Health Insurance Plans

There are several types of health insurance plans available, each with its own set of features and benefits. Some common types include:

- Fee-for-Service Plans (Indemnity Plans): These traditional plans offer flexibility, allowing individuals to choose their healthcare providers. However, they often come with higher premiums and out-of-pocket costs.

- Managed Care Plans:

- Health Maintenance Organizations (HMOs): HMOs typically have lower premiums but a more restricted network of providers.

- Preferred Provider Organizations (PPOs): PPOs offer a balance between cost and flexibility, with a broader network of providers and some out-of-network coverage.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs, giving enrollees the option to choose between in-network and out-of-network providers.

- High-Deductible Health Plans (HDHPs): These plans have lower premiums but higher deductibles, making them a popular choice for those who prioritize saving on monthly costs.

- Catastrophic Health Insurance Plans: Designed for individuals under 30 or those with a hardship exemption, these plans offer basic coverage with low premiums but high deductibles.

Factors Affecting Health Insurance Costs

The cost of health insurance is influenced by various factors, including:

- Age: Younger individuals often pay lower premiums, while older adults may face higher costs due to increased healthcare needs.

- Location: Insurance rates can vary significantly based on the state and even the specific county or city.

- Tobacco Use: Smokers and tobacco users may be charged higher premiums.

- Family Size: Family plans tend to be more expensive than individual plans.

- Type of Plan: As mentioned earlier, different plan types have varying premium structures.

- Network of Providers: Plans with a limited network of providers may offer lower premiums.

Exploring the Cheapest Health Insurance Plans

Now, let’s delve into the options for finding the most affordable health insurance plans without sacrificing essential coverage.

Low-Cost Options for Individual Coverage

If you’re seeking an individual health insurance plan, here are some strategies to find the cheapest option:

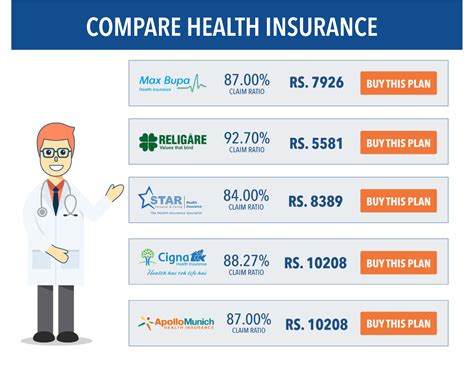

- Compare Quotes: Use online tools or insurance brokers to compare quotes from different providers. This allows you to quickly assess the range of premiums and coverage options available.

- Consider High-Deductible Plans: As mentioned earlier, HDHPs offer lower premiums but require you to pay more out-of-pocket before insurance coverage kicks in. If you’re generally healthy and don’t anticipate frequent medical expenses, this could be a cost-effective choice.

- Explore Short-Term Plans: Short-term health insurance plans offer temporary coverage and can be a more affordable option if you’re between jobs or have a gap in coverage. However, these plans often have limited benefits and may not comply with the Affordable Care Act (ACA) requirements.

- Look for Discounts: Many insurance companies offer discounts for early payment, auto-pay setups, or loyalty programs. Additionally, some states have programs that provide financial assistance for low-income individuals.

Affordable Family Health Insurance Plans

Securing health insurance for your entire family can be challenging, but there are ways to make it more affordable:

- Employer-Sponsored Plans: If you or your spouse has access to employer-sponsored health insurance, it’s often the most cost-effective option. These plans may offer family coverage at a discounted rate.

- Marketplace Plans: The Health Insurance Marketplace, established by the ACA, offers a range of plans with varying levels of coverage and premiums. You can browse and compare plans to find the most suitable and affordable option for your family.

- Government Programs: Depending on your income and family size, you may qualify for government-sponsored health insurance programs like Medicaid or the Children’s Health Insurance Program (CHIP). These programs provide comprehensive coverage at little to no cost.

- Family Discounts: Some insurance companies offer discounts for families, so it’s worth inquiring about family-specific plans and promotions.

Tips for Reducing Health Insurance Costs

In addition to choosing the right plan, there are several strategies you can employ to reduce your overall health insurance costs:

- Increase Your Deductible: While this may result in higher out-of-pocket expenses if you need medical care, it can significantly lower your monthly premiums.

- Choose a Plan with a Health Savings Account (HSA): HSAs allow you to save pre-tax dollars for medical expenses, providing a tax-efficient way to cover out-of-pocket costs.

- Utilize Preventive Care Services: Many health insurance plans cover preventive care services, such as annual check-ups and screenings, at no cost to you. Taking advantage of these services can help identify potential health issues early on, potentially saving you from more costly treatments down the line.

- Negotiate Your Medical Bills: If you receive a medical bill, don’t hesitate to contact the provider and negotiate a lower rate. Many healthcare providers are willing to work with patients to reduce costs.

Analyzing Performance and Future Implications

The health insurance landscape is constantly evolving, and it’s important to stay informed about the latest trends and developments. Here’s a brief analysis of the performance and future implications of affordable health insurance plans:

Performance Analysis

The introduction of the Affordable Care Act (ACA) has had a significant impact on the availability and affordability of health insurance. The ACA’s key provisions, such as the individual mandate and subsidies for low- and middle-income individuals, have expanded access to insurance and made it more affordable for many Americans. However, the future of the ACA remains uncertain, with ongoing political debates and legal challenges.

Additionally, the COVID-19 pandemic has highlighted the importance of health insurance and the need for affordable coverage. Many individuals who lost their jobs during the pandemic also lost their employer-sponsored insurance, underscoring the need for more accessible and affordable options.

Future Implications

Looking ahead, several factors may influence the affordability and accessibility of health insurance:

- Political Landscape: The future of the ACA and other healthcare policies will be shaped by political decisions and court rulings. Changes in these policies can significantly impact the cost and availability of insurance plans.

- Healthcare Technology: Advances in healthcare technology, such as telemedicine and digital health solutions, have the potential to reduce costs and improve access to care. These innovations may play a pivotal role in making healthcare more affordable and efficient.

- Consumer Behavior: As consumers become more educated about their healthcare options and costs, they may increasingly seek out value-based plans and services. This shift in consumer behavior could drive insurance companies to offer more competitive and affordable plans.

Real-World Examples and Data

Let’s examine some real-world examples and data to illustrate the impact of choosing affordable health insurance plans:

Case Study: John’s Journey to Affordable Coverage

John, a 30-year-old freelance writer, was facing high health insurance premiums due to his self-employed status. He decided to explore his options and found a more affordable plan through the Health Insurance Marketplace. Here’s a breakdown of his journey:

| Previous Plan | New Plan (Marketplace) |

|---|---|

| Premium: 450/month</td> <td>Premium: 320/month | |

| Deductible: 5,000</td> <td>Deductible: 3,000 | |

| Out-of-Pocket Maximum: 7,500</td> <td>Out-of-Pocket Maximum: 6,000 |

By switching to a marketplace plan, John was able to save $130 per month in premiums and reduce his out-of-pocket expenses. This real-world example demonstrates how exploring different options can lead to significant cost savings.

Industry Data and Statistics

Here are some key industry data points related to affordable health insurance:

- According to a KFF report, the average monthly premium for a benchmark silver plan purchased through the Health Insurance Marketplace was 452 in 2020, down from 470 in 2019. This decrease in premiums is a positive trend for consumers.

- The same report notes that 87% of Marketplace enrollees qualified for premium tax credits, which help lower the cost of insurance.

- A National Center for Health Statistics survey found that the percentage of people without health insurance coverage decreased from 13.3% in 2013 to 8.5% in 2020, indicating that more Americans are gaining access to affordable insurance.

Expert Insights and Recommendations

To provide further guidance, here are some expert recommendations for finding the cheapest health insurance plan:

Advice from Industry Professionals

Key Takeaways

- Finding the cheapest health insurance plan involves a balance between affordability and adequate coverage.

- Compare quotes, explore different plan types, and take advantage of discounts and subsidies to reduce costs.

- Consider HDHPs and HSAs for lower premiums and tax-efficient savings.

- Stay informed about healthcare policies and advancements to make well-informed decisions.

FAQ

What is the most affordable type of health insurance plan?

+The most affordable plan will depend on your individual needs and circumstances. Generally, High-Deductible Health Plans (HDHPs) offer lower premiums but higher deductibles. If you’re healthy and don’t anticipate frequent medical expenses, an HDHP could be a cost-effective choice. However, for those who require more frequent medical care, a plan with a lower deductible may be a better fit, despite the higher premiums.

Can I get health insurance if I have a pre-existing condition?

+Yes, thanks to the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions. This means that even if you have a chronic illness or a history of medical issues, you can still obtain health insurance and receive the necessary care.

Are there any government programs that offer free or low-cost health insurance?

+Yes, several government programs provide free or low-cost health insurance to eligible individuals. These include Medicaid, which offers coverage to low-income adults, children, pregnant women, elderly adults, and people with disabilities. The Children’s Health Insurance Program (CHIP) is another option, providing low-cost coverage for children in families who earn too much to qualify for Medicaid.

Can I switch health insurance plans during the year?

+In most cases, you can only switch health insurance plans during the annual Open Enrollment Period, which typically occurs in the fall. However, if you experience a qualifying life event, such as getting married, having a baby, or losing your job, you may be eligible for a Special Enrollment Period, allowing you to switch plans outside of the regular Open Enrollment.

What are some common mistakes to avoid when choosing a health insurance plan?

+Some common mistakes include failing to compare quotes from different providers, not understanding the network of providers covered by the plan, and not reviewing the plan’s benefits and exclusions. It’s crucial to thoroughly research and understand the plan’s details to avoid unexpected costs or limited coverage.