Cheapest Sr22 Insurance Florida

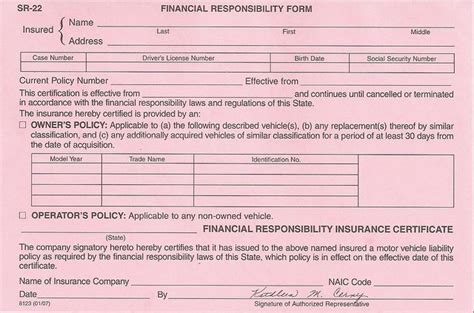

SR22 insurance, often referred to as a certificate of financial responsibility, is a specialized form of insurance that is required by law in many states for individuals with certain driving violations. Florida, being one of those states, mandates SR22 insurance for drivers who have been involved in serious accidents, received multiple traffic violations, or had their license suspended or revoked due to DUI/DWI convictions. Securing the most affordable SR22 insurance in Florida is crucial for drivers to regain their driving privileges and maintain legal compliance.

Understanding SR22 Insurance in Florida

In Florida, an SR22 certificate serves as proof to the Department of Highway Safety and Motor Vehicles (DHSMV) that a high-risk driver carries the minimum liability insurance coverage required by law. This certificate must be filed with the DHSMV and maintained for a specific period, typically ranging from three to five years, depending on the nature of the violation. During this time, the insurance provider is required to notify the DHSMV if the policy lapses or is canceled.

The cost of SR22 insurance in Florida can vary significantly based on several factors, including the driver's age, driving record, credit score, and the insurance company they choose. It's essential to compare quotes from multiple providers to find the most cost-effective option without compromising on coverage.

Factors Influencing SR22 Insurance Costs in Florida

Several key factors contribute to the cost of SR22 insurance in Florida. Understanding these factors can help drivers make informed decisions when shopping for insurance and potentially save money on their premiums.

Driving Record

The primary factor influencing SR22 insurance rates is the driver’s history of traffic violations and accidents. Drivers with a clean record will generally pay less for SR22 insurance compared to those with multiple infractions. Serious violations like DUI/DWI, reckless driving, or hit-and-run accidents can significantly increase insurance costs.

Age and Gender

Younger drivers, particularly those under the age of 25, often face higher insurance premiums due to their perceived risk level. Additionally, gender can play a role in insurance rates, with male drivers often paying more than female drivers, especially in younger age groups.

Credit Score

In many states, including Florida, insurance companies are allowed to consider an individual’s credit score when determining insurance premiums. Drivers with excellent credit scores may qualify for lower rates, while those with poor credit may face higher costs.

Insurance Company and Policy Coverage

The choice of insurance company can significantly impact the cost of SR22 insurance. It’s essential to compare quotes from multiple providers, as rates can vary widely. Additionally, the level of coverage chosen can affect the overall cost. While it’s tempting to opt for the minimum coverage to save money, drivers should consider their specific needs and potential risks to ensure they have adequate protection.

State-Specific Requirements

Each state has its own unique requirements for SR22 insurance, which can influence the cost. In Florida, the minimum liability coverage required for SR22 insurance is 10,000 for property damage, 10,000 for bodily injury per person, and $20,000 for bodily injury per accident (10/20/10). These minimums are often insufficient for many drivers, especially those with significant assets to protect, and additional coverage may be necessary.

Comparing SR22 Insurance Providers in Florida

When shopping for SR22 insurance in Florida, it’s crucial to compare quotes from various insurance providers to find the most affordable option. Here’s a comparison of some of the leading insurance companies offering SR22 insurance in the state:

Progressive

Progressive is a well-known insurance provider that offers SR22 insurance in Florida. Their policies typically include liability coverage, comprehensive and collision coverage, and personal injury protection (PIP). Progressive is known for its competitive rates and often provides discounts for safe driving, multiple policies, and good student status.

GEICO

GEICO is another popular insurance provider that caters to drivers requiring SR22 insurance. They offer a range of coverage options, including liability, comprehensive, collision, and uninsured/underinsured motorist coverage. GEICO’s rates are often among the most affordable, and they provide discounts for good driving records, military service, and membership in certain organizations.

State Farm

State Farm is a leading insurance provider with a strong presence in Florida. They offer SR22 insurance policies that include liability, collision, comprehensive, and medical payments coverage. State Farm is known for its excellent customer service and provides discounts for safe driving, multiple policies, and good student status.

Allstate

Allstate is a reputable insurance company that provides SR22 insurance in Florida. Their policies typically include liability, collision, comprehensive, and personal injury protection coverage. Allstate offers various discounts, such as those for safe driving, loyalty, and bundling multiple policies.

Esurance

Esurance is an online insurance provider that offers SR22 insurance in Florida. Their policies include liability, collision, comprehensive, and medical payments coverage. Esurance is known for its digital convenience and often provides discounts for paperless billing, safe driving, and bundling policies.

Tips for Finding the Cheapest SR22 Insurance in Florida

Securing the cheapest SR22 insurance in Florida requires careful research and consideration of various factors. Here are some tips to help drivers find the most affordable coverage:

- Compare quotes from multiple insurance providers to find the best rates.

- Consider raising your deductible to lower your premium, but ensure you can afford the higher out-of-pocket expense if needed.

- Maintain a clean driving record to avoid future violations and keep your insurance costs down.

- Explore discounts offered by insurance companies, such as safe driver discounts, good student discounts, and bundling discounts.

- If you have multiple vehicles, consider insuring them all with the same provider to potentially save on premiums.

- Review your insurance coverage regularly and adjust it as necessary to ensure you have the right level of protection at the best price.

Conclusion

Securing SR22 insurance in Florida is a necessary step for drivers who have faced certain violations or accidents. By understanding the factors that influence insurance costs and comparing quotes from multiple providers, drivers can find the most affordable SR22 insurance option. It’s essential to carefully review the coverage and choose a policy that provides adequate protection without breaking the bank. With the right approach, drivers can regain their driving privileges and maintain legal compliance while managing their insurance costs effectively.

What is an SR22 certificate, and why do I need it in Florida?

+An SR22 certificate is a form of insurance that proves you have the minimum liability coverage required by law. In Florida, it’s necessary for drivers with serious violations or accidents to maintain this certificate for a specified period to regain and maintain their driving privileges.

How much does SR22 insurance typically cost in Florida?

+The cost of SR22 insurance in Florida can vary widely based on factors like driving record, age, gender, and credit score. On average, drivers can expect to pay between 500 and 1,500 per year for SR22 insurance, but rates can be significantly higher for those with multiple violations.

Can I get SR22 insurance if I have a poor credit score?

+Yes, you can still obtain SR22 insurance with a poor credit score, but it may result in higher premiums. Some insurance companies specialize in providing coverage for high-risk drivers, so it’s essential to shop around and compare quotes.

What happens if I fail to maintain my SR22 insurance in Florida?

+Failing to maintain your SR22 insurance can result in severe consequences, including the suspension of your driver’s license and additional fees. The DHSMV will be notified if your policy lapses or is canceled, and you may be required to start the SR22 filing process anew.