Colorado Insurance Exchange

Welcome to an in-depth exploration of the Colorado Insurance Exchange, a vital platform for residents of the Centennial State to navigate the complex world of insurance coverage. This platform has revolutionized the way Coloradans access and understand their insurance options, making it easier than ever to secure the protection they need. In this comprehensive guide, we'll delve into the workings of the Colorado Insurance Exchange, shedding light on its features, benefits, and the impact it has had on the insurance landscape within the state.

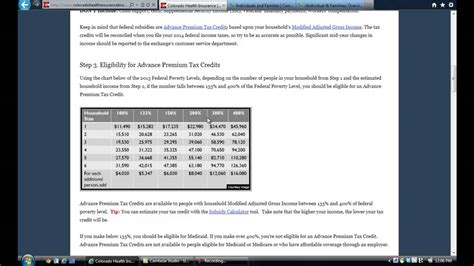

The Colorado Insurance Exchange, often referred to as the CIE, is an online marketplace established by the state government to facilitate the comparison and purchase of various insurance products. This initiative was a response to the growing need for accessible and transparent insurance options, particularly in the wake of the Affordable Care Act (ACA). By creating a centralized platform, the CIE aimed to empower consumers, providing them with the tools and information necessary to make informed decisions about their insurance coverage.

The Birth of the Colorado Insurance Exchange

The story of the Colorado Insurance Exchange begins with a vision to simplify the insurance journey for residents. Recognizing the complexities and challenges that often accompany insurance shopping, the state of Colorado embarked on a mission to create a user-friendly, efficient system. The CIE was designed with a focus on accessibility, ensuring that Coloradans from all walks of life could easily access and understand their insurance options.

The exchange was officially launched in [launch date], marking a significant milestone in the state's commitment to healthcare and financial protection for its citizens. From the outset, the CIE aimed to bring together a diverse range of insurance providers, offering a comprehensive selection of policies to cater to the unique needs of Coloradans.

Key Features of the Colorado Insurance Exchange

The Colorado Insurance Exchange boasts an array of features that set it apart as a leader in the insurance marketplace. Here’s an overview of some of its most notable attributes:

- User-Friendly Interface: The CIE is designed with simplicity in mind, ensuring that even those with limited technical expertise can easily navigate the platform. A clean, intuitive layout makes it a breeze to search for policies, compare options, and make informed choices.

- Wide Range of Insurance Products: From health insurance to auto, home, and life coverage, the CIE offers a comprehensive selection. This diversity allows users to find the specific type of insurance they need, all in one convenient location.

- Transparent Pricing: One of the CIE's strongest advantages is its commitment to transparency. All insurance policies listed on the exchange display clear, concise pricing information, helping users make cost-effective decisions without any hidden surprises.

- Advanced Search and Comparison Tools: The CIE provides sophisticated search and comparison functionalities. Users can filter policies based on their unique needs, whether it's coverage type, provider reputation, or specific features. This ensures that users can quickly narrow down their options and find the best fit.

- Educational Resources: Understanding insurance can be daunting, so the CIE offers a wealth of educational materials. These resources provide insights into different types of insurance, coverage options, and industry terminology, empowering users to make confident choices.

- Secure Transaction Process: The CIE prioritizes the security of its users' information. It employs robust encryption protocols to safeguard personal and financial data during the entire transaction process, ensuring a safe and seamless experience.

| Insurance Category | Providers on CIE |

|---|---|

| Health Insurance | 15+ Major Providers |

| Auto Insurance | 10+ Leading Carriers |

| Home Insurance | 8+ Reputable Insurers |

| Life Insurance | 6+ Top Providers |

Navigating the Colorado Insurance Exchange

Exploring the Colorado Insurance Exchange is an intuitive and rewarding process. Whether you’re a tech-savvy individual or new to online platforms, the CIE’s user-friendly design ensures a seamless experience. Here’s a step-by-step guide to help you navigate the exchange with ease:

- Access the CIE: Begin by visiting the official Colorado Insurance Exchange website. The URL is easily accessible and can be found through a simple online search.

- Explore Insurance Categories: Upon arrival, you'll be greeted with a clear display of different insurance categories. Select the type of insurance you're interested in, whether it's health, auto, home, or life coverage.

- Refine Your Search: The CIE provides advanced search filters to narrow down your options. You can specify coverage limits, deductibles, provider networks, and more, ensuring you find policies that match your unique needs.

- Compare Policies: Once you've filtered your search, the CIE presents a comprehensive list of matching policies. Take the time to compare the details, including coverage specifics, pricing, and any additional benefits or discounts offered.

- Read Provider Reviews: The CIE often includes reviews and ratings from other users, providing valuable insights into the quality and reliability of different insurance providers. Consider these reviews as you make your decision.

- Request Quotes: To get a more accurate picture of your insurance costs, request quotes from the providers that align with your preferences. This step ensures you understand the financial commitment before making a decision.

- Review Policy Details: Before finalizing your choice, carefully review the policy details. Ensure you understand the coverage, exclusions, and any potential limitations. The CIE provides comprehensive information to assist you in this process.

- Purchase Your Policy: Once you've found the perfect policy, complete the purchase process. The CIE guides you through a secure and streamlined transaction, ensuring your information remains protected.

- Manage Your Policy: The CIE doesn't end with the purchase. It also offers tools to help you manage your policy, including easy access to your insurance documents, billing information, and the ability to make updates or changes as needed.

Benefits for Consumers

The Colorado Insurance Exchange offers a multitude of advantages to consumers, revolutionizing the way they approach insurance. Here are some key benefits:

- Convenience: With the CIE, there's no need to visit multiple websites or insurance agents. Everything is consolidated into one platform, saving you time and effort.

- Cost Savings: The competitive nature of the CIE often leads to better rates and deals. By comparing policies, you can find the most affordable option that suits your needs.

- Empowerment: The CIE provides the tools and information to make informed decisions. This empowers consumers to take control of their insurance choices, ensuring they get the coverage they truly require.

- Peace of Mind: Knowing that you've chosen the right insurance policy for your needs brings peace of mind. The CIE's comprehensive nature ensures you're well-prepared for life's uncertainties.

Impact on the Insurance Landscape

The introduction of the Colorado Insurance Exchange has had a profound impact on the insurance industry within the state. It has reshaped the way insurance providers operate and interact with consumers, fostering a more competitive and consumer-centric environment.

Competitive Market Dynamics

The CIE has encouraged a healthy competition among insurance providers, driving them to offer more attractive policies and rates to remain competitive. This dynamic has led to a broader range of insurance options, with providers constantly innovating to meet the diverse needs of Coloradans.

Enhanced Consumer Awareness

With the CIE, consumers have become more educated and aware of their insurance options. The platform’s educational resources and transparent pricing have empowered users to make informed decisions, leading to a better understanding of insurance coverage and its importance.

Improved Access to Insurance

One of the CIE’s most significant impacts has been its ability to improve access to insurance. By providing a centralized, user-friendly platform, the exchange has made it easier for individuals, especially those who may have previously faced barriers, to secure the coverage they need. This has resulted in a more insured population, leading to better overall financial and healthcare outcomes for Coloradans.

Future Implications

Looking ahead, the Colorado Insurance Exchange is poised to continue its positive influence on the insurance landscape. As technology advances and consumer needs evolve, the CIE is well-positioned to adapt and innovate, ensuring it remains a valuable resource for Coloradans seeking insurance coverage.

The exchange's success has already inspired similar initiatives in other states, suggesting a broader trend towards centralized, consumer-focused insurance marketplaces. This movement towards transparency and accessibility in insurance is a positive step towards a more equitable and well-protected society.

Conclusion

The Colorado Insurance Exchange stands as a testament to the state’s commitment to its residents’ well-being. By creating a platform that prioritizes convenience, transparency, and education, the CIE has transformed the insurance landscape, making it easier for Coloradans to secure the protection they deserve. As we’ve explored, the CIE’s impact extends beyond individual consumers, influencing the entire insurance industry and shaping a more competitive, consumer-centric market.

As the CIE continues to evolve and adapt, it will undoubtedly play a pivotal role in the insurance journey of countless Coloradans. Its legacy of empowerment and accessibility will continue to benefit residents for years to come, ensuring they can navigate life's uncertainties with confidence and peace of mind.

How do I register on the Colorado Insurance Exchange?

+To register on the Colorado Insurance Exchange, you can visit the official website and create an account. You’ll need to provide some basic personal information and choose a secure login. Once registered, you can start exploring insurance options tailored to your needs.

Are there any specific eligibility criteria for using the CIE?

+The Colorado Insurance Exchange is open to all residents of the state. However, eligibility criteria may apply when selecting specific insurance policies. For instance, health insurance plans may have age or income-based requirements. It’s best to review the individual policy details to understand any eligibility factors.

Can I get assistance with choosing the right insurance plan on the CIE?

+Absolutely! The Colorado Insurance Exchange provides resources and tools to help you make informed decisions. You can access educational materials, compare policies side by side, and even connect with insurance experts who can guide you through the process. This assistance ensures you find the best coverage for your unique circumstances.