Commercial General Liability Insurance

In the realm of business operations, understanding and securing adequate insurance coverage is paramount. Among the various types of insurance, Commercial General Liability (CGL) insurance stands out as a fundamental protection measure for businesses of all sizes and industries. This comprehensive insurance policy safeguards businesses from a wide range of potential liabilities, providing financial security and peace of mind. In this in-depth exploration, we delve into the intricacies of CGL insurance, examining its coverage, importance, and the critical role it plays in ensuring the longevity and stability of businesses.

Understanding Commercial General Liability Insurance

Commercial General Liability Insurance, often referred to as CGL, is a vital component of any business’s risk management strategy. It serves as a safety net, protecting businesses from financial losses resulting from a variety of common liability claims. These claims can arise from accidents, injuries, property damage, or other incidents that occur during the course of business operations.

The primary purpose of CGL insurance is to provide coverage for bodily injury, property damage, personal and advertising injury, and medical expenses that may be incurred by third parties. It also offers protection against legal costs and settlements that may arise from such incidents. This broad coverage ensures that businesses are not financially devastated by unexpected events that can occur in the normal course of doing business.

Key Coverage Areas

- Bodily Injury: Covers medical expenses, pain and suffering, and lost wages resulting from accidents or injuries caused by the insured business’s operations.

- Property Damage: Provides compensation for damage to or loss of third-party property, including buildings, vehicles, and personal possessions.

- Personal and Advertising Injury: Protects against claims of libel, slander, copyright infringement, and other forms of personal injury caused by the business’s products, services, or advertising.

- Medical Payments: Offers immediate coverage for medical expenses incurred by injured parties, regardless of fault.

- Legal Defense: Pays for the cost of defending the insured business against liability claims, even if the claims are groundless.

CGL insurance is designed to be flexible and adaptable, offering different levels of coverage to suit the unique needs of each business. Policies can be customized to include specific endorsements or exclusions based on the nature of the business and its associated risks.

The Importance of CGL Insurance

The significance of Commercial General Liability Insurance cannot be overstated. It is a cornerstone of any comprehensive risk management strategy, providing several critical benefits that contribute to the long-term success and stability of businesses.

Financial Protection and Peace of Mind

One of the most significant advantages of CGL insurance is the financial protection it affords. In the event of a liability claim, the insurance policy steps in to cover the associated costs, including medical expenses, property repairs, legal fees, and potential settlements. This financial safety net is particularly crucial for small and medium-sized businesses, which may not have the resources to absorb substantial losses.

Furthermore, CGL insurance provides businesses with peace of mind, knowing that they are protected against a wide range of potential liabilities. This assurance allows business owners and managers to focus on growth and innovation, rather than worrying about unforeseen events that could threaten the financial viability of their operations.

Risk Management and Prevention

CGL insurance is not just about responding to liabilities after they occur; it also plays a proactive role in risk management. Insurance carriers often provide resources and guidance to help businesses identify and mitigate potential risks. This can involve implementing safety protocols, improving workplace conditions, or enhancing product safety measures.

By working closely with insurance providers, businesses can develop a comprehensive risk management plan that minimizes the likelihood of incidents and claims. This proactive approach not only reduces the need for insurance payouts but also enhances the overall safety and efficiency of business operations.

Attracting Clients and Partners

In many industries, having adequate insurance coverage is a prerequisite for doing business. Clients, particularly those in high-risk sectors, often require their service providers or contractors to have CGL insurance as a condition of engagement. Similarly, business partners and suppliers may also prefer or require that their associates carry appropriate insurance coverage.

By obtaining CGL insurance, businesses signal their commitment to professional conduct and financial responsibility. This can enhance their reputation and credibility, making them more attractive to potential clients and partners. It demonstrates a willingness to take responsibility for their actions and a commitment to protecting the interests of those they work with.

Real-World Examples of CGL Claims

Understanding the practical applications of CGL insurance can provide valuable insights into its importance and coverage. Here are some real-world scenarios where CGL insurance has proven to be crucial:

Slip and Fall Accidents

A customer slips and falls on a wet floor in a retail store, sustaining injuries. The store’s CGL insurance policy covers the medical expenses and potential compensation for the customer’s injuries, as well as the legal costs associated with defending the claim.

Product Liability

A manufacturing company discovers a defect in one of its products, leading to a recall. The CGL policy steps in to cover the costs of the recall, including the replacement of defective products and any legal fees associated with defending against potential lawsuits from affected customers.

Advertising Disputes

A business is sued for copyright infringement after using an image in its advertising campaign without permission. The CGL policy provides coverage for the legal costs and potential settlement, helping the business navigate the dispute and protect its reputation.

Property Damage

A contractor accidentally damages a client’s property during a renovation project. The client’s CGL insurance policy covers the cost of repairing the damage, ensuring that the client is not financially burdened by the incident.

| Scenario | Coverage Provided |

|---|---|

| Slip and Fall | Medical Expenses, Legal Defense, Settlement |

| Product Recall | Recall Costs, Legal Fees |

| Advertising Dispute | Legal Costs, Settlement |

| Property Damage | Repair Costs |

Choosing the Right CGL Policy

Selecting the appropriate CGL policy involves careful consideration of several factors. Business owners should evaluate their unique risks and exposures, taking into account the nature of their operations, the products or services they offer, and the locations where they operate.

Assessing Risks and Exposures

A thorough risk assessment is essential in determining the appropriate level of CGL coverage. This involves identifying potential hazards and liabilities associated with the business, such as accidents, property damage, product defects, or professional negligence. By understanding these risks, businesses can tailor their insurance policies to provide adequate protection.

Customizing Coverage

CGL insurance policies can be customized to meet the specific needs of each business. This customization allows for the inclusion of endorsements or riders that address unique risks or exposures. For example, a business operating in an area prone to natural disasters may choose to add an endorsement for flood or earthquake coverage.

Working with Insurance Brokers

Engaging the services of a knowledgeable insurance broker can be invaluable in selecting the right CGL policy. Brokers have extensive experience in assessing risks and matching them with appropriate insurance coverage. They can guide businesses through the process, explaining the nuances of different policies and helping to identify areas where additional coverage may be beneficial.

Comparing Insurance Carriers

It is important to compare different insurance carriers to ensure the best coverage and value. While price is a consideration, it should not be the sole factor. Business owners should also evaluate the financial stability and reputation of the carriers, as well as the breadth of their coverage and the quality of their claims handling processes.

The Future of CGL Insurance

As the business landscape continues to evolve, so too does the nature of risks and liabilities. The future of CGL insurance will likely involve adapting to emerging trends and technologies, as well as addressing new and complex risks.

Emerging Risks and Liabilities

With the rise of new technologies and business models, such as e-commerce and remote work, new risks and liabilities are emerging. CGL insurance policies will need to evolve to address these changes, providing coverage for cyber-attacks, data breaches, and other digital threats. Additionally, as businesses expand their global reach, CGL policies may need to offer more comprehensive international coverage.

Environmental Concerns

Environmental sustainability is becoming an increasingly important consideration for businesses. CGL insurance policies may need to address environmental liabilities, such as pollution or waste management, to ensure that businesses are protected against potential environmental claims.

Changing Regulatory Landscape

Regulatory changes can have a significant impact on CGL insurance. As laws and regulations evolve, insurance policies may need to adapt to provide coverage for new compliance requirements. For example, with the increasing focus on data privacy, CGL policies may need to offer more robust protection against data breaches and privacy violations.

Conclusion

Commercial General Liability Insurance is an indispensable component of any business’s risk management strategy. It provides financial protection, peace of mind, and a foundation for long-term stability. By understanding the importance of CGL insurance, business owners can make informed decisions to protect their operations and secure their future success.

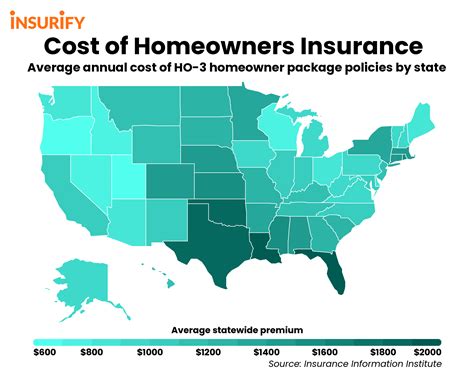

How much does CGL insurance typically cost?

+The cost of CGL insurance can vary significantly depending on several factors, including the size and nature of the business, the industry it operates in, the level of coverage required, and the insurance carrier. On average, small businesses can expect to pay between 500 and 1,000 per year for a basic CGL policy, while larger businesses may pay several thousand dollars annually for more comprehensive coverage.

What are some common exclusions in CGL policies?

+Common exclusions in CGL policies include intentional acts, contract disputes, pollution, employment-related issues, and professional services. It’s important to review the policy’s exclusions carefully to ensure that the coverage aligns with the business’s unique needs and risks.

How can businesses reduce their CGL insurance premiums?

+Businesses can take several steps to reduce their CGL insurance premiums. These include implementing robust risk management practices, maintaining a good safety record, and bundling their insurance policies with the same carrier. Additionally, businesses can work with their insurance broker to explore options for discounts or alternative policies that may be more cost-effective.