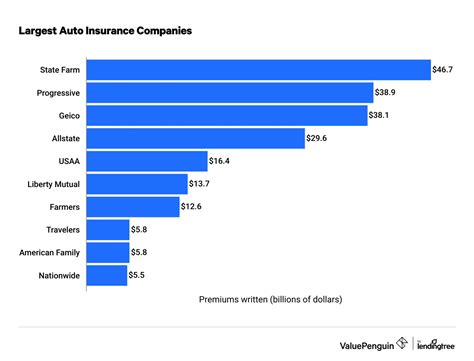

Companies For Auto Insurance

In the vast landscape of insurance providers, the search for the ideal auto insurance company can be a daunting task. With numerous options available, it's essential to navigate the market wisely to find a company that not only offers competitive rates but also provides comprehensive coverage tailored to your specific needs. This article aims to shed light on some of the leading auto insurance companies, highlighting their unique features, coverage options, and customer experiences to assist you in making an informed decision.

Understanding the Auto Insurance Landscape

The auto insurance industry is a highly competitive market, with various companies vying for your business. Understanding the unique selling points of each provider is crucial to making an informed choice. From established legacy insurers to innovative digital-first startups, the options are diverse, catering to a wide range of consumer preferences and requirements.

Key Factors to Consider

When evaluating auto insurance companies, several critical factors come into play. These include the range of coverage options offered, the flexibility of policy customization, the company’s financial stability, and its reputation for customer service and claims handling. Additionally, the digital services and tools provided can greatly enhance the customer experience, making policy management more efficient and convenient.

Exploring Top Auto Insurance Companies

In this section, we delve into some of the industry’s leading auto insurance providers, analyzing their unique value propositions and how they cater to the diverse needs of consumers.

State Farm

State Farm, one of the largest auto insurance companies in the United States, boasts a strong reputation for its comprehensive coverage options and customer-centric approach. With a wide range of policies tailored to individual needs, State Farm offers flexible payment plans and excellent customer service, making it a popular choice among many drivers.

Key Features:

- Comprehensive Coverage Options: State Farm provides coverage for a wide range of scenarios, including liability, collision, comprehensive, personal injury protection, and uninsured/underinsured motorist coverage.

- Discounts: They offer various discounts, such as safe driver, multiple vehicle, and good student discounts, helping policyholders save on their premiums.

- Digital Tools: State Farm provides a user-friendly mobile app and online platform for policy management, claims tracking, and roadside assistance services.

| Coverage Type | Policy Options |

|---|---|

| Liability | Offers various liability limits to cater to different risk profiles and budget needs. |

| Collision | Provides coverage for vehicle repairs or replacement after an accident, with optional deductible options. |

| Comprehensive | Covers non-collision related incidents like theft, vandalism, and natural disasters. |

Geico

Geico, known for its catchy advertisements and digital-first approach, has become a go-to choice for many modern drivers. With a focus on convenience and affordability, Geico offers a seamless online experience for policyholders, making it an attractive option for those seeking efficient and cost-effective coverage.

Key Features:

- Competitive Rates: Geico is renowned for offering some of the most competitive auto insurance rates in the market, making it an affordable choice for many drivers.

- Digital Services: The company provides an intuitive mobile app and online platform for policy management, claims reporting, and roadside assistance, enhancing the overall customer experience.

- Discounts: Geico offers a range of discounts, including multi-policy, good student, and safe driver discounts, helping policyholders save on their premiums.

| Coverage Type | Policy Options |

|---|---|

| Liability | Provides liability coverage with customizable limits to suit different risk profiles. |

| Collision and Comprehensive | Offers coverage for vehicle repairs or replacement after an accident, as well as protection against non-collision related incidents. |

| Medical Payments | Covers medical expenses for the policyholder and passengers after an accident, regardless of fault. |

Progressive

Progressive is a well-known name in the auto insurance industry, renowned for its innovative products and services. With a customer-centric approach, Progressive offers a wide range of coverage options and tools to help policyholders make informed decisions about their insurance needs.

Key Features:

- Customizable Coverage: Progressive allows policyholders to tailor their coverage to their specific needs, offering a range of optional add-ons and endorsements to enhance their policies.

- Name Your Price Tool: This unique feature lets customers enter their budget and preferred coverage, and Progressive suggests a policy that fits within those parameters.

- Digital Services: Progressive provides a comprehensive suite of digital tools, including a mobile app for policy management and claims tracking, and online resources for educational purposes.

| Coverage Type | Policy Options |

|---|---|

| Liability | Offers customizable liability limits to cater to different risk profiles and budget constraints. |

| Collision and Comprehensive | Provides coverage for vehicle repairs or replacement after an accident, as well as protection against non-collision related incidents like theft and natural disasters. |

| Medical Payments | Covers medical expenses for the policyholder and passengers after an accident, regardless of fault. |

Allstate

Allstate is a trusted name in the insurance industry, offering a wide range of auto insurance policies to cater to diverse consumer needs. With a focus on personalized service and a strong agent network, Allstate provides comprehensive coverage options and a seamless claims process.

Key Features:

- Personalized Coverage: Allstate offers customizable coverage options, allowing policyholders to tailor their policies to their specific needs and preferences.

- Discounts: The company provides various discounts, including safe driver, multiple policy, and good student discounts, helping policyholders save on their premiums.

- Digital Tools: Allstate offers a user-friendly mobile app and online platform for policy management, claims tracking, and access to a range of educational resources.

| Coverage Type | Policy Options |

|---|---|

| Liability | Offers customizable liability limits to cater to different risk profiles and budget constraints. |

| Collision and Comprehensive | Provides coverage for vehicle repairs or replacement after an accident, as well as protection against non-collision related incidents like theft and natural disasters. |

| Uninsured/Underinsured Motorist | Covers policyholders in the event of an accident with an uninsured or underinsured driver. |

USAA

USAA is a unique auto insurance provider, offering its services exclusively to active military members, veterans, and their families. With a strong focus on serving the military community, USAA provides comprehensive coverage options and excellent customer service, tailored to the unique needs of its policyholders.

Key Features:

- Military-Focused: USAA's policies are designed with the specific needs and circumstances of military members and their families in mind, offering flexible coverage options and discounts.

- Discounts: The company provides various discounts, including safe driver, multiple policy, and loyalty discounts, helping policyholders save on their premiums.

- Digital Services: USAA offers a user-friendly mobile app and online platform for policy management, claims tracking, and access to a range of financial services tailored to military members.

| Coverage Type | Policy Options |

|---|---|

| Liability | Offers customizable liability limits to cater to different risk profiles and budget constraints. |

| Collision and Comprehensive | Provides coverage for vehicle repairs or replacement after an accident, as well as protection against non-collision related incidents like theft and natural disasters. |

| Rental Car Coverage | Covers the cost of a rental car if the policyholder's vehicle is in the shop for repairs. |

Making an Informed Decision

Choosing the right auto insurance company is a critical decision that can significantly impact your financial security and peace of mind. By understanding the unique features and coverage options offered by each provider, you can make an informed choice that aligns with your specific needs and budget.

It's important to carefully evaluate your insurance requirements, research the companies' reputations and financial stability, and seek recommendations from trusted sources. Remember, the best auto insurance company for you is the one that provides the coverage you need at a price you can afford, with excellent customer service and a seamless claims process.

Key Takeaways

- Evaluate your insurance needs and budget to determine the coverage and policy options that best suit your requirements.

- Research the companies’ financial stability, customer service reputation, and claims handling processes to ensure a reliable and trustworthy provider.

- Explore the digital services and tools offered by each company to enhance your overall insurance experience and convenience.

- Seek recommendations from trusted sources, such as friends, family, or online communities, to gain valuable insights into each company’s performance and customer satisfaction.

How do I choose the right auto insurance company for my needs?

+Consider your specific insurance needs, budget, and preferences. Research the companies’ coverage options, discounts, customer service, and digital tools to find the best fit for you.

What are the key factors to consider when evaluating auto insurance companies?

+Key factors include coverage options, policy customization, financial stability, customer service, claims handling, and digital services. These aspects can greatly impact your insurance experience and value.

Are there any discounts available with auto insurance policies?

+Yes, many auto insurance companies offer a range of discounts, such as safe driver, multiple policy, good student, and loyalty discounts. These can significantly reduce your insurance premiums.

How important is the digital experience when choosing an auto insurance company?

+The digital experience is crucial as it can greatly enhance your insurance journey. A user-friendly mobile app and online platform can simplify policy management, claims tracking, and access to educational resources, making the entire process more efficient and convenient.