Compare Motor Insurance Quotes

Welcome to a comprehensive guide on comparing motor insurance quotes, designed to empower you with the knowledge and tools to make informed decisions. In today's market, navigating the world of motor insurance can be complex, with a multitude of options and varying coverage levels. This article aims to provide an in-depth analysis, offering practical tips and insights to ensure you get the best value for your money while securing adequate protection for your vehicle.

Understanding Motor Insurance Quotes

Motor insurance quotes are tailored assessments of the costs and coverage you can expect from an insurance provider. These quotes are influenced by a range of factors, including your personal details, the type of vehicle you own, and the specific coverage options you choose. Understanding how these quotes are calculated and what they entail is crucial to making an informed decision.

Factors Affecting Motor Insurance Quotes

Numerous elements come into play when insurance companies generate quotes. These include:

- Vehicle Type and Age: Newer and more expensive vehicles generally attract higher insurance premiums. Additionally, certain makes and models are considered higher risk, impacting the quote.

- Personal Information: Your age, gender, driving record, and location can significantly influence the quote. For instance, younger drivers and those with a history of accidents may face higher premiums.

- Coverage Options: The level of coverage you choose plays a vital role. Comprehensive coverage, which includes collision and comprehensive protection, typically costs more than liability-only coverage.

- Deductibles: Opting for a higher deductible can lower your premium, but it means you’ll pay more out of pocket if you need to make a claim.

- Discounts: Many insurance companies offer discounts for various reasons, such as having multiple policies with the same insurer, being a safe driver, or having certain safety features in your vehicle.

Analyzing Coverage Options

When comparing motor insurance quotes, it’s essential to look beyond the price tag and scrutinize the coverage offered. Here’s a breakdown of common coverage options:

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers damages you cause to others’ property or injuries you cause to others in an accident. |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. |

| Comprehensive Coverage | Covers damage to your vehicle due to non-collision incidents like theft, vandalism, or natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses for you and your passengers, regardless of fault. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage. |

The Process of Comparing Quotes

Comparing motor insurance quotes effectively involves a systematic approach. Here’s a step-by-step guide to help you through the process:

Step 1: Identify Your Needs

Before you begin comparing quotes, it’s crucial to assess your specific needs. Consider factors such as the value of your vehicle, your budget, and the level of risk you’re comfortable with. This initial assessment will guide your choices and help you prioritize certain coverage options over others.

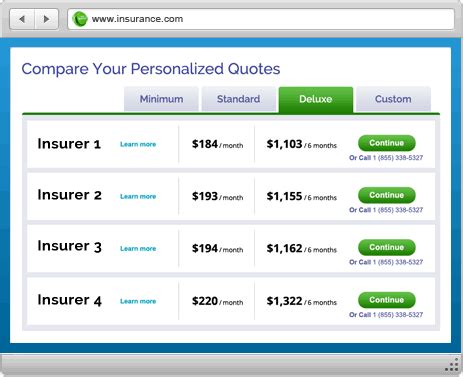

Step 2: Gather Multiple Quotes

Don’t settle for the first quote you receive. Reach out to multiple insurance providers or use online comparison tools to gather a range of quotes. This ensures you have a diverse pool of options to choose from, increasing the likelihood of finding the best deal.

Step 3: Analyze the Quotes

Once you have a collection of quotes, it’s time to delve into the details. Compare the coverage options, deductibles, and premiums side by side. Look for any exclusions or limitations that might impact your coverage. Also, consider the reputation and financial stability of the insurance company, as this can affect the quality of service you receive.

Step 4: Negotiate and Ask Questions

Don’t hesitate to negotiate with insurance providers. You can often get a better deal by discussing your specific needs and circumstances. Additionally, ask plenty of questions to clarify any doubts or uncertainties you may have about the coverage or the quote itself.

Step 5: Make an Informed Decision

With all the information at hand, it’s time to make a decision. Choose the quote that best aligns with your needs and budget, offering the most comprehensive coverage without breaking the bank. Remember, it’s not just about the price; the quality of the coverage and the reliability of the insurance company are equally important.

Maximizing Your Motor Insurance Experience

Beyond comparing quotes, there are several strategies you can employ to enhance your motor insurance experience and potentially reduce costs:

Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. This not only simplifies your insurance management but can also lead to significant savings.

Safe Driving Practices

Maintaining a clean driving record can result in lower insurance premiums. Additionally, consider taking a defensive driving course, which can not only improve your skills but may also qualify you for insurance discounts.

Utilizing Telematics

Some insurance companies offer telematics programs, where they install a device in your vehicle to track your driving behavior. Safe driving habits, as tracked by this device, can lead to reduced premiums over time.

Regular Policy Reviews

It’s a good practice to review your motor insurance policy annually. This allows you to stay updated with any changes in your coverage needs and ensures you’re not overpaying for unnecessary coverage.

The Future of Motor Insurance

The motor insurance landscape is evolving, with technological advancements and changing consumer needs driving innovation. Here’s a glimpse into the future of motor insurance:

Digitalization and Convenience

The rise of digital platforms and mobile apps is transforming the way we interact with insurance providers. Expect more streamlined processes, instant quotes, and easier claim procedures in the future.

Personalized Coverage

With advancements in data analytics, insurance companies are moving towards more personalized coverage options. This means policies tailored to your specific needs and driving behavior, offering better value and more accurate pricing.

Autonomous Vehicles and Insurance

As autonomous vehicles become more prevalent, the insurance industry will need to adapt. The liability landscape may shift, with more focus on product liability and less on individual driver responsibility. This could lead to new coverage options and potentially lower premiums for autonomous vehicle owners.

Conclusion

Comparing motor insurance quotes is an essential step in ensuring you get the right coverage at the best price. By understanding the factors that influence quotes and taking a systematic approach to comparison, you can make an informed decision that protects your vehicle and your wallet. Remember, the key to a successful motor insurance experience is staying proactive, informed, and open to the evolving landscape of the industry.

What is the average cost of motor insurance?

+The average cost of motor insurance varies greatly depending on factors like your location, driving record, and the type of vehicle you own. As of [most recent data available], the national average for auto insurance premiums is around [average cost per year]. However, this can range from as low as [low-end estimate] to as high as $[high-end estimate] depending on individual circumstances.

Are there any ways to get cheaper motor insurance quotes?

+Yes, there are several strategies to potentially reduce your motor insurance premiums. These include maintaining a clean driving record, increasing your deductible, taking advantage of discounts (such as safe driver or multi-policy discounts), and shopping around for the best rates. Additionally, considering alternative coverage options, like usage-based insurance or telematics programs, can also lead to savings.

How often should I review my motor insurance policy?

+It’s recommended to review your motor insurance policy at least once a year. This allows you to stay updated with any changes in your coverage needs, ensure you’re getting the best value for your money, and make necessary adjustments. Life circumstances, such as a change in marital status, a new vehicle, or a move to a different location, can all impact your insurance needs and premiums.