Comparison House Insurance

Securing your home and its contents is a vital step in protecting your financial well-being and peace of mind. With a diverse range of home insurance policies available, it can be challenging to navigate the market and make an informed decision. This article aims to provide a comprehensive guide to understanding and comparing house insurance options, ensuring you find the best coverage tailored to your specific needs.

Understanding the Basics of House Insurance

At its core, house insurance, also known as homeowners insurance or home insurance, is a contractual agreement between an insurance provider and a homeowner. This contract outlines the coverage and financial protection offered by the insurer in the event of specific incidents or losses. It is a safeguard against the financial burden that can arise from unexpected events, such as natural disasters, theft, or accidental damage.

House insurance typically covers two main areas: the structure of the house and its contents. The structure includes the physical building, any permanent fixtures, and attached structures like garages or sheds. Contents, on the other hand, refer to personal belongings inside the home, such as furniture, appliances, clothing, and electronics. It's important to note that standard policies may have limitations on certain high-value items, like jewelry or artwork, and additional coverage may be required for these items.

Furthermore, house insurance often includes liability coverage, which protects homeowners from financial losses due to accidents or injuries that occur on their property. This coverage is essential, as it can safeguard homeowners from potentially devastating financial consequences if a visitor is injured on their property and pursues legal action.

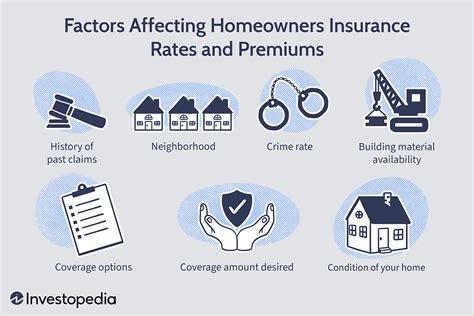

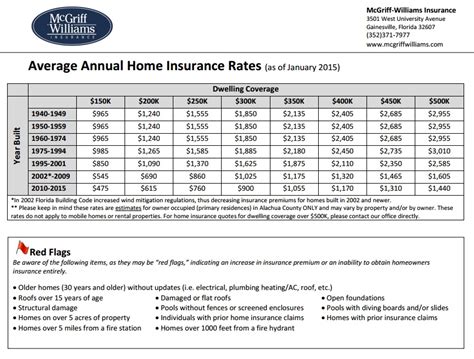

The cost of house insurance, commonly referred to as the premium, is determined by various factors. These include the location of the property, its value, the level of coverage required, and the homeowner's claims history. Premiums can be paid annually, semi-annually, or monthly, with some insurers offering discounts for longer-term commitments or bundling with other insurance policies.

It's crucial for homeowners to understand that house insurance policies are not one-size-fits-all. Different policies offer varying levels of coverage, and it's essential to carefully review and compare these to ensure the chosen policy adequately protects the home and its contents.

Key Factors to Consider When Comparing House Insurance

When embarking on the process of comparing house insurance options, several critical factors should be taken into consideration. These factors will help homeowners make an informed decision that aligns with their specific needs and circumstances.

Coverage Limits and Deductibles

Coverage limits refer to the maximum amount an insurance company will pay out for a covered loss. It’s essential to choose a policy with coverage limits that adequately reflect the replacement cost of your home and its contents. Insufficient coverage limits can leave homeowners financially vulnerable in the event of a significant loss.

Deductibles, on the other hand, are the amount the homeowner must pay out of pocket before the insurance coverage kicks in. Higher deductibles typically result in lower premiums, but it's crucial to choose a deductible amount that is manageable and won't cause financial strain in the event of a claim.

Types of Coverage

House insurance policies offer various types of coverage, and it’s important to understand the differences. HO-3 policies, for instance, are the most common and provide coverage for the structure of the home and its contents against a wide range of perils, including fire, theft, and vandalism. HO-4 policies, often referred to as renters insurance, cover personal belongings and liability but do not include coverage for the structure of the home.

Additionally, there are HO-5 policies, which provide broader coverage than HO-3 policies, including protection against a wider range of perils and often cover high-value items without the need for additional endorsements. HO-6 policies, also known as condominium insurance, cover the interior of the unit and personal belongings, as well as provide liability coverage.

Additional Coverages and Endorsements

Many house insurance policies offer additional coverages and endorsements that can be added to the base policy to provide more comprehensive protection. These may include coverage for specific perils, such as flood or earthquake, which are typically not covered by standard policies. Other endorsements might cover high-value items, such as jewelry or fine art, which often have sub-limits on standard policies.

Insurance Provider’s Reputation and Financial Strength

Choosing a reputable and financially stable insurance provider is crucial. A company with a strong financial rating can provide peace of mind, ensuring they will be able to pay out claims even in the event of widespread disasters. It’s advisable to research and compare the financial strength and reputation of different insurers before making a decision.

Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact the homeowner’s experience. It’s essential to choose an insurer with a track record of prompt and fair claims processing. Online reviews and ratings can provide valuable insights into the insurer’s customer service standards.

Discounts and Bundling Options

Many insurance providers offer discounts for various reasons, such as loyalty, safety features in the home, or bundling multiple policies together. Bundling home insurance with other policies, like auto insurance, can often result in significant savings. It’s worth exploring these options to reduce the overall cost of insurance.

Real-Life Examples and Case Studies

To illustrate the importance of comparing house insurance options, let’s consider a few real-life scenarios. In one instance, a homeowner who had only basic coverage found themselves inadequately protected when their home was damaged in a severe storm. The policy’s coverage limits were not sufficient to cover the full cost of repairs, leaving the homeowner with a significant financial burden.

In another case, a homeowner who had meticulously compared policies and chosen one with broader coverage and higher limits was able to fully recover after a fire. The insurance company promptly processed the claim, and the homeowner was able to rebuild their home without incurring additional costs.

These examples highlight the significance of carefully reviewing and comparing house insurance options to ensure adequate coverage. It's a decision that can have a profound impact on a homeowner's financial security and peace of mind.

The Future of House Insurance: Trends and Innovations

The house insurance industry is evolving, driven by technological advancements and changing consumer needs. Here are some key trends and innovations shaping the future of house insurance:

Digital Transformation and InsurTech

The rise of InsurTech, or insurance technology, is revolutionizing the way house insurance is purchased and managed. Insurers are increasingly leveraging digital platforms and mobile apps to streamline the insurance process, from quoting and purchasing to claims filing and policy management. This digital transformation enhances convenience, efficiency, and customer experience.

Personalized Insurance

Insurers are now able to offer more personalized insurance policies thanks to advancements in data analytics and machine learning. By analyzing a homeowner’s specific circumstances, such as their home’s location, construction, and risk factors, insurers can tailor policies to provide the most appropriate coverage and pricing. This level of personalization ensures that homeowners receive the coverage they need without overpaying for unnecessary protections.

Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-go or pay-per-mile insurance, is gaining traction in the house insurance market. This innovative model allows homeowners to pay for insurance based on their actual usage or the risk factors they face. For example, a homeowner might pay a lower premium if their home is equipped with advanced security features or if they implement energy-efficient upgrades that reduce the risk of fire.

Smart Home Integration

The integration of smart home technology with house insurance is another exciting development. Smart home devices, such as security cameras, smoke detectors, and water leak sensors, can provide real-time data to insurers, allowing them to offer more accurate and personalized coverage. Additionally, these devices can help prevent losses and reduce the severity of claims, benefiting both homeowners and insurers.

Disaster Resilience and Sustainability

With the increasing frequency and severity of natural disasters, insurers are focusing on disaster resilience and sustainability. Many are offering incentives and discounts to homeowners who take steps to make their homes more resilient to natural disasters, such as reinforcing roofs, installing storm shutters, or implementing water-saving measures. This not only helps protect homeowners but also aligns with broader sustainability goals.

Blockchain and Data Security

Blockchain technology is being explored by insurers to enhance data security and streamline processes. By leveraging blockchain, insurers can securely store and share policy information, claims data, and other sensitive details. This technology can also facilitate faster and more efficient claims processing, as well as reduce the risk of fraud.

Expert Insights and Tips for Choosing the Right House Insurance

Navigating the complex world of house insurance can be challenging, but with the right guidance, homeowners can make informed decisions. Here are some expert insights and tips to help you choose the right house insurance coverage:

Understand Your Risks: Start by assessing the specific risks your home faces. Consider factors like your location (e.g., flood zones, earthquake-prone areas), the age and condition of your home, and any unique circumstances (e.g., high-value art collection, antique furniture). Understanding these risks will help you tailor your insurance coverage accordingly.

Compare Multiple Quotes: Obtain quotes from several insurers to compare coverage and prices. Be sure to ask about any discounts or bundling options that could lower your premium. Online comparison tools can be a convenient way to gather multiple quotes quickly.

Review Coverage Limits and Deductibles: Carefully review the coverage limits and deductibles offered by each policy. Ensure that the limits are sufficient to cover the replacement cost of your home and its contents. Also, choose a deductible that you can comfortably afford to pay in the event of a claim.

Consider Additional Coverages: Evaluate your needs and consider adding optional coverages or endorsements to your policy. For example, if you have valuable jewelry or artwork, you may need to add a personal articles floater to your policy to ensure these items are adequately covered.

Check the Insurer's Reputation: Research the financial stability and reputation of the insurance company. Look for reviews and ratings from independent sources to ensure the insurer is reliable and capable of paying out claims.

Understand the Claims Process: Familiarize yourself with the insurer's claims process and policy regarding claims handling. Ensure that the process is straightforward and that the insurer has a good track record of prompt and fair claims settlement.

Review Policy Exclusions: Carefully review the policy exclusions to understand what is not covered. This can help you identify any gaps in coverage and decide if you need to adjust your policy or consider additional coverages.

Consider Bundling Options: If you have multiple insurance needs, such as auto and home insurance, consider bundling your policies with the same insurer. Bundling can often lead to significant savings and streamlined policy management.

Stay Informed and Review Annually: Keep yourself informed about changes in the insurance market and your personal circumstances. Review your house insurance policy annually to ensure it still meets your needs and that you're not overpaying for unnecessary coverage.

| Insurance Provider | Policy Type | Coverage Limits | Deductible Options |

|---|---|---|---|

| Provider A | HO-3 | $500,000 Dwelling, $250,000 Personal Property | $500, $1,000, $2,500 |

| Provider B | HO-5 | $1,000,000 Dwelling, $500,000 Personal Property | $1,000, $2,500, $5,000 |

| Provider C | HO-6 | $250,000 Unit Interior, $100,000 Personal Property | $250, $500, $1,000 |

What is the average cost of house insurance?

+

The average cost of house insurance varies depending on factors like location, home value, and coverage limits. According to industry data, the average annual premium for homeowners insurance in the United States is around $1,200. However, it’s important to note that this can range widely based on individual circumstances.

Are there any discounts available for house insurance?

+

Yes, many insurers offer discounts for various reasons. Common discounts include multi-policy discounts (when you bundle house insurance with other policies like auto insurance), loyalty discounts for long-term customers, and safety discounts for homes with certain security features or disaster-resistant upgrades.

How often should I review my house insurance policy?

+

It’s recommended to review your house insurance policy annually or whenever there are significant changes to your home or personal circumstances. This ensures that your coverage remains adequate and that you’re not paying for unnecessary protections.